5 Best Paddle Alternatives in 2024

FastSpring

APRIL 23, 2024

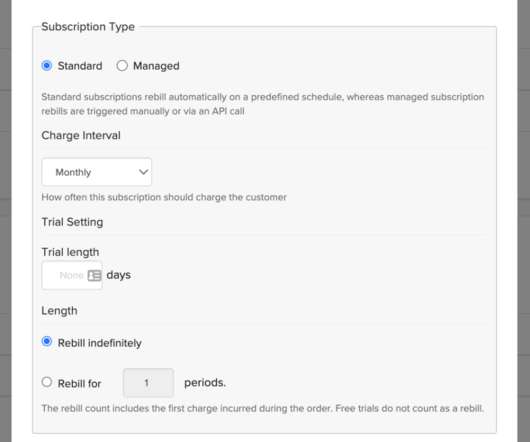

Braintree by PayPal. FastSpring includes global payment processing and recurring revenue management, of course, but the platform also takes care of the end-to-end checkout process, including optimization of your checkout flow, collecting and remitting sales tax and VAT, localization, fraud prevention, global compliance, and more.

Let's personalize your content