An In-Depth Guide to Subscription Billing Platforms (+ 5 Options)

FastSpring

JANUARY 17, 2023

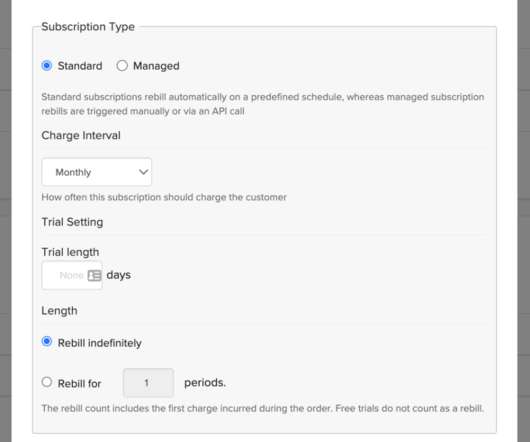

Gather metrics and view reports on monthly recurring revenue. Legal compliance. With FastSpring, B2B and B2C software companies can manage: Multiple subscription models, trials, one-time add-ons, discounts, and more. Automatically Gather Key Metrics and View Detailed Reports. Fraud prevention and chargebacks.

Let's personalize your content