Merchant Credit Card Fee Guide 2024: How Much Does It Cost to Process Credit Cards?

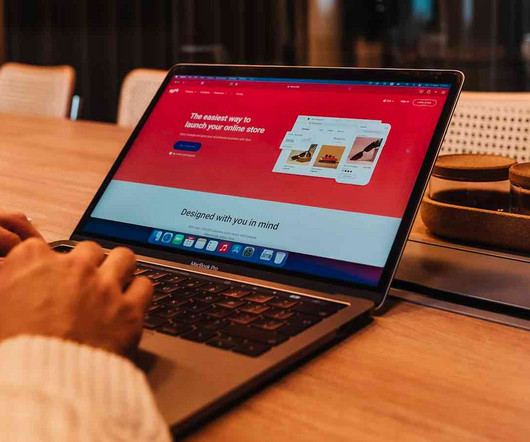

Stax

MAY 7, 2024

These fees also vary depending on the card network. Processor markup These are fees charged by the payment processor, which is the company that manages and facilitates credit card transactions. The average PCI compliance fees vary depending on various factors, such as business specifications.

Let's personalize your content