Clouded Judgement 5.10.24 - Software Weakness Across the Board

Clouded Judgement

MAY 10, 2024

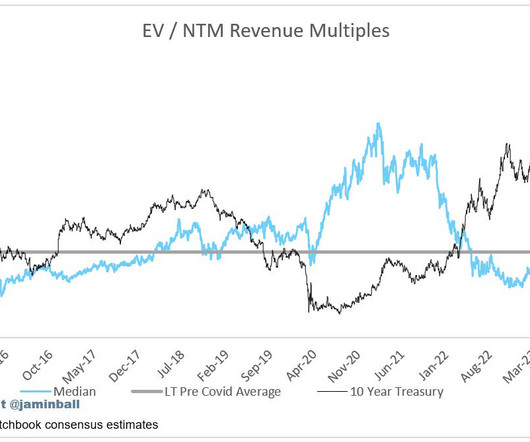

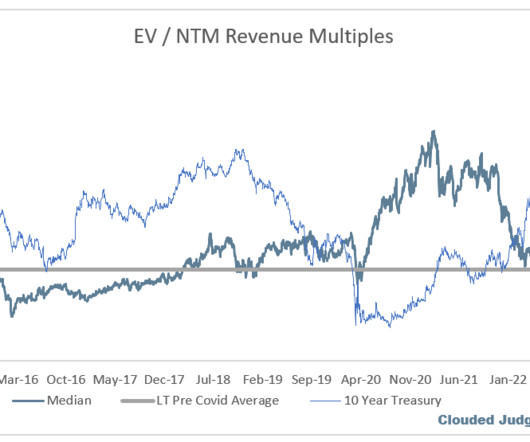

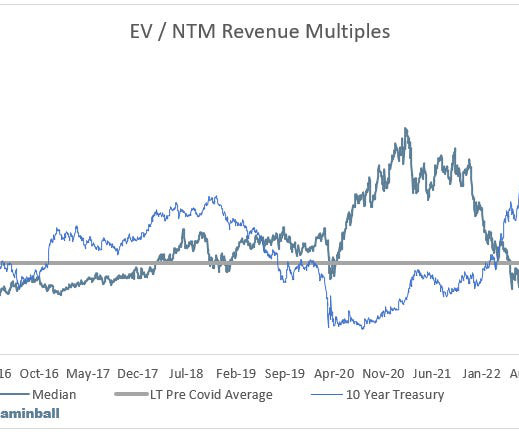

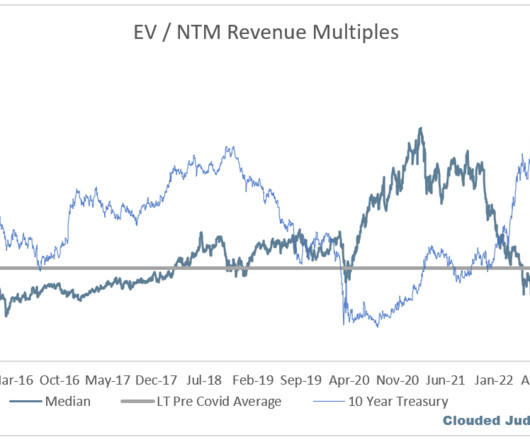

And no one raised full year guide >2% The median “beat” (Q1 revenue over Q1 consensus estimates) was 1.5%, which is the lowest it’s been in the last 4 years Overall, it’s been a TOUGH quarter for software companies. Revenue multiples are a shorthand valuation framework. Overall Stats: Overall Median: 5.7x

Let's personalize your content