Adding Payments and Fintech to SaaS Can Be Great. But You Gotta Watch the Margins.

SaaStr

AUGUST 11, 2022

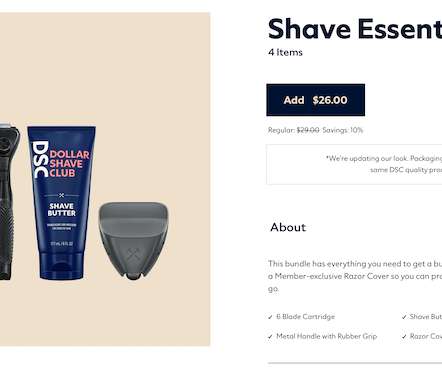

So in the Boom Times of later 2020 and 2021, almost every VC pushed SaaS companies to at least become a little bit of a fintech. It seemed such an easy way to bolt on more revenue to an underlying SaaS platform. Shopify now gets 2x the revenue from payments and merchant services than it does from SaaS subcriptions.

Let's personalize your content