PayPal for Enterprise: Building Solutions Across the Funnel

Neil Patel

JANUARY 11, 2023

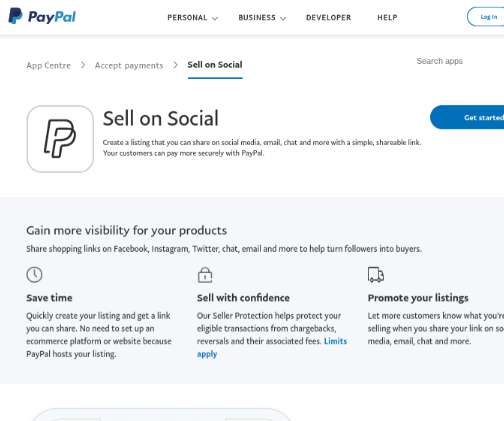

Article sponsored by PayPal. Contactless payment methods are tapping into the future of commerce. International Data Corporation (IDC) predicts that 80% of retailers will offer contactless payment and app-based scan-and-pay systems in-store by 2023. Solutions include: ● Omnichannel payments. Customer insights.

Let's personalize your content