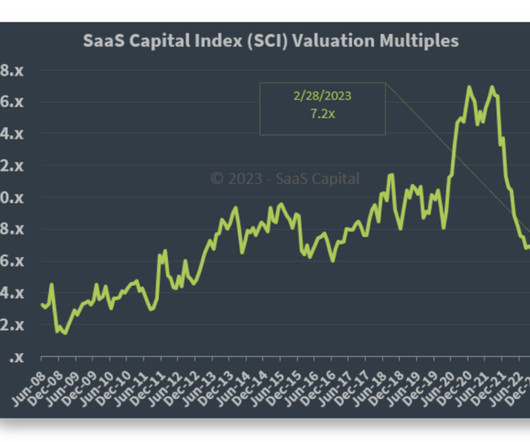

The Three Valuation Lows in SaaS: 2013, 2016, and 2022

SaaStr

MARCH 10, 2023

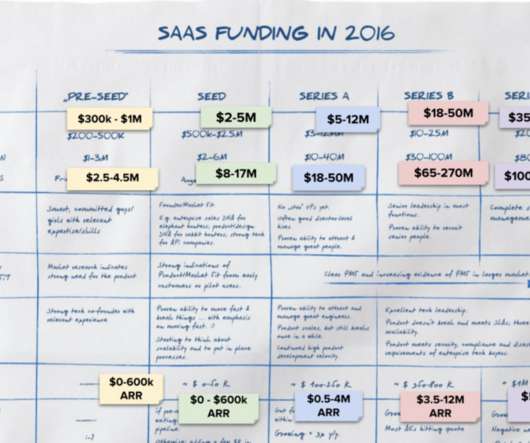

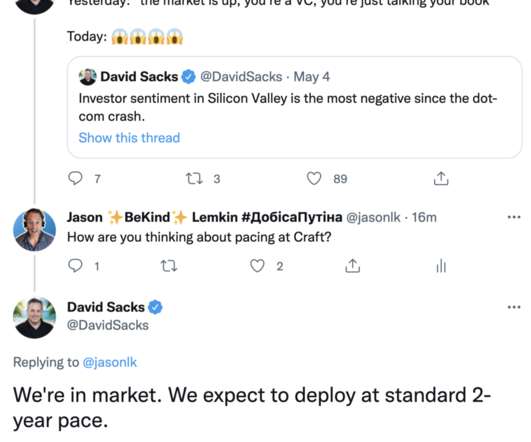

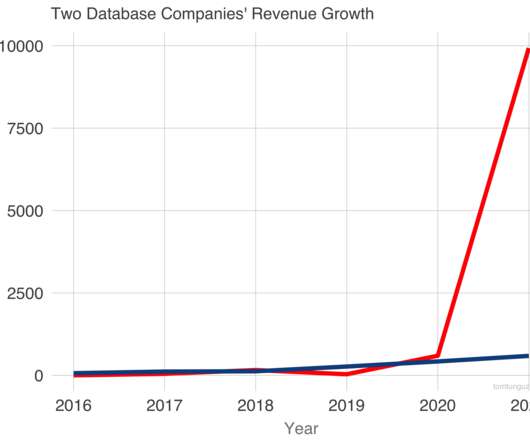

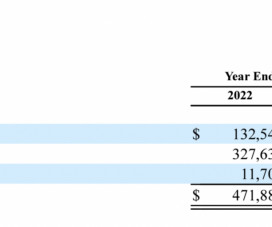

And then the “Flash Crash” of 2016 came, our first big hit. I did a deeper dive on SaaS multiples, and what that means for founders and SaaS execs, below at SaaStr APAC: The post The Three Valuation Lows in SaaS: 2013, 2016, and 2022 appeared first on SaaStr. It was just too hard to make money at 4x ARR.

Let's personalize your content