SaaS Capital: Across 1,500 SaaS Startups, Yearly Contracts Don’t Actually Increase NRR

SaaStr

MAY 12, 2023

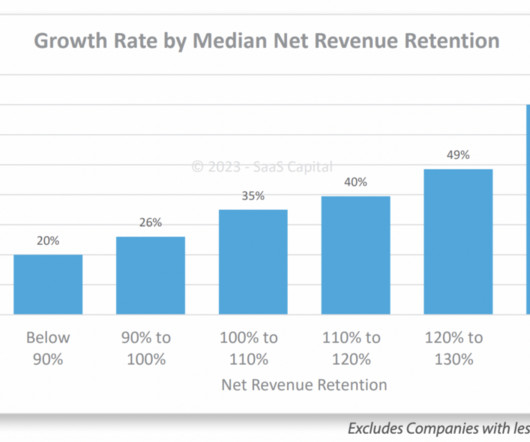

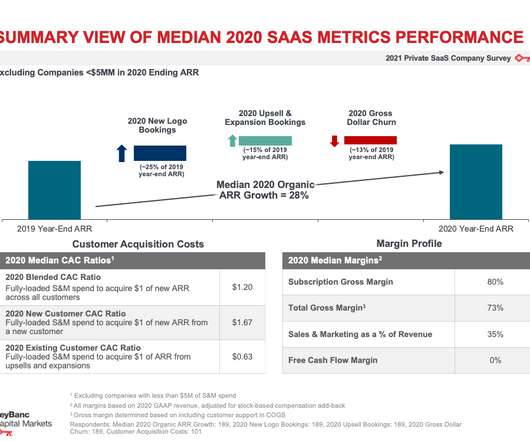

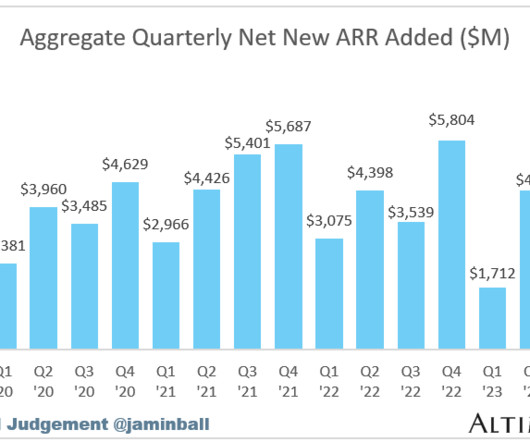

So SaaS Capital put out its latest report on SaaS retention and NRR after having surveyed over 1,500 SaaS companies and professionals. Median NRR is 102% across all SaaS companies, Media Gross Retention is 91%. You can download it here. And as time goes on, that doesn’t really help you much. This data confirms that.

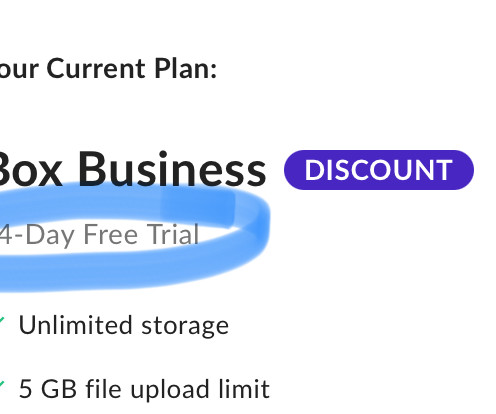

Let's personalize your content