Dear SaaStr: How Can I Convince My Investor We’ll Double Their Investment By The Next Round?

SaaStr

MARCH 22, 2024

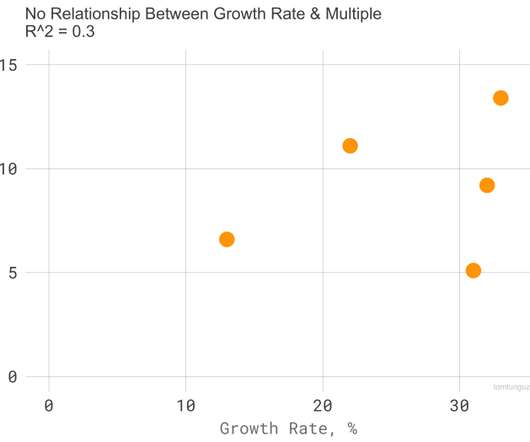

Dear SaaStr: How Can I Convince My Investor We’ll Double Their Investment By The Next Round? If you are a VC / private investor, there’s a key meta question: why invest now ? Because, at the same price … later is always better. This is really the reason most very early-stage investments get done.

Let's personalize your content