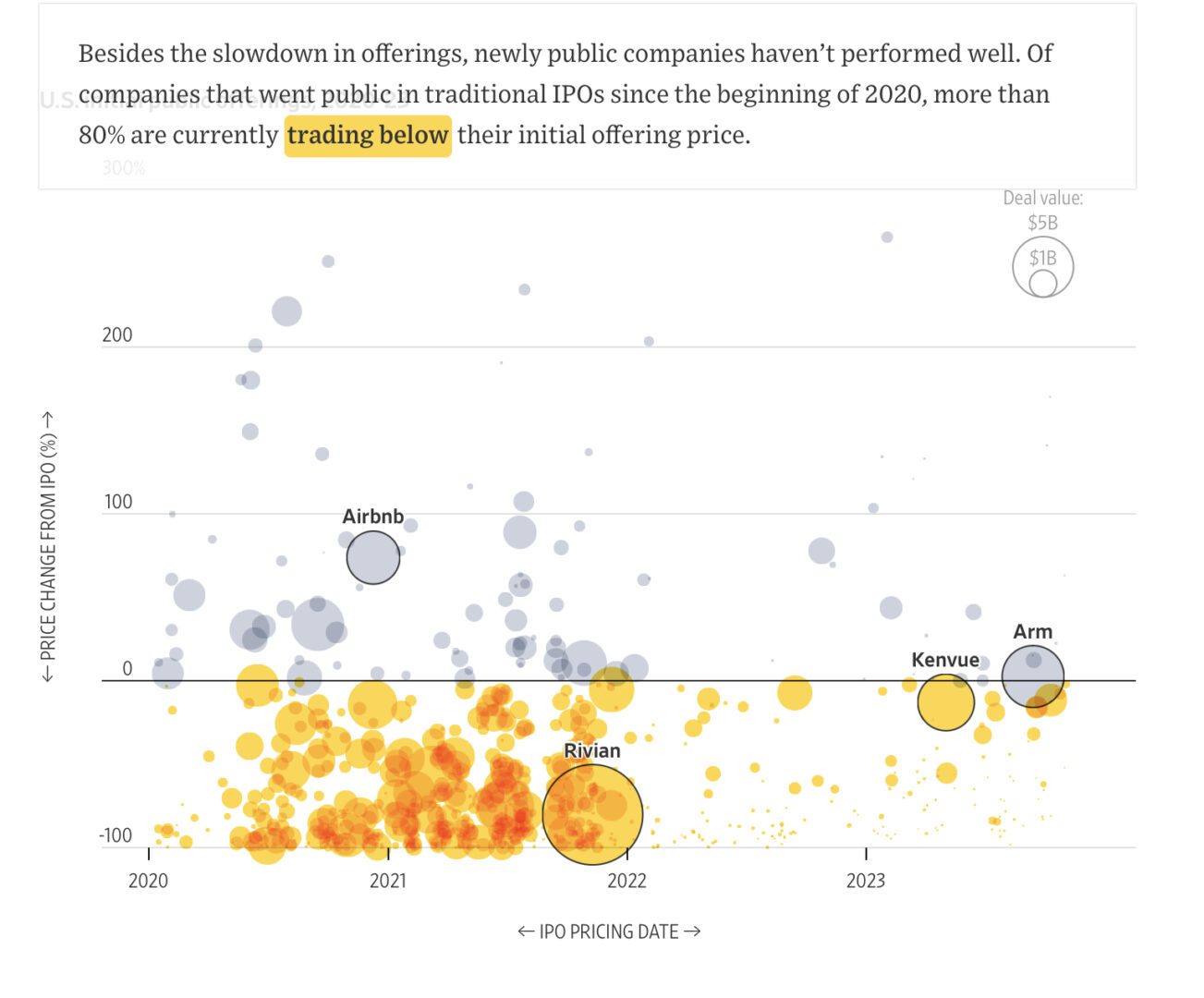

So the Wall Street Journal did a great job slicing and dicing IPO data recently. To me, the most jarring statistic was this one: 80% of IPOs since 2020 are trading below their IPO price, or “broken”:

So what, you might think? Buyer beware? Hooray for “efficient IPOs” that don’t leave money on the table, some say?

Perhaps. But the problem is this — when folks don’t make money off startups, everything gums up and slows down.

Most VC investments do need to make money. Not every one, but on balance, most do. This is even true at seed stage. There, even if most “logos” don’t make money, most of the dollars invested do need to make money. Most.

The 50% line is a big deal at every stage of investing, at least from seed to IPO. Most of your investing dollars do need to make money. Not all, but most.

But right now, 80%+ of IPOs aren’t making money, including the most recent “triumvirate” of 2023 IPOs that tried to re-open the markets: Klaviyo, Instacart and ARM. All A+ companies.

Pricing can fix this, and re-pricing in general is in process all across tech. The best can always IPO, it’s just a question of price. But it takes time and a lot of pain. IPO’ing at 4x-5x ARR isn’t appealing to most break-out leaders.

If the IPO market is in its second year of not really functioning, that creates stress up and down the startup stack.

A related post here: