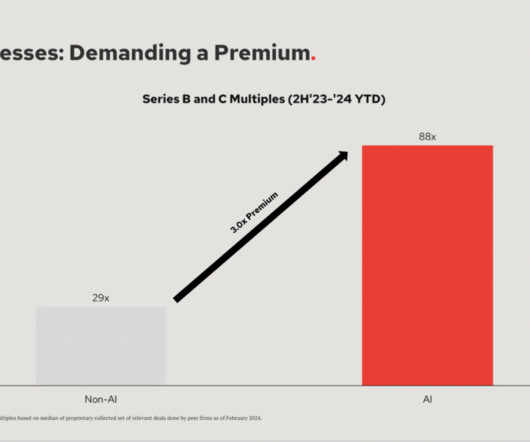

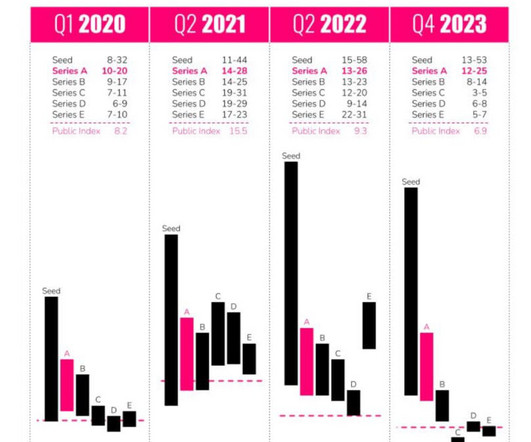

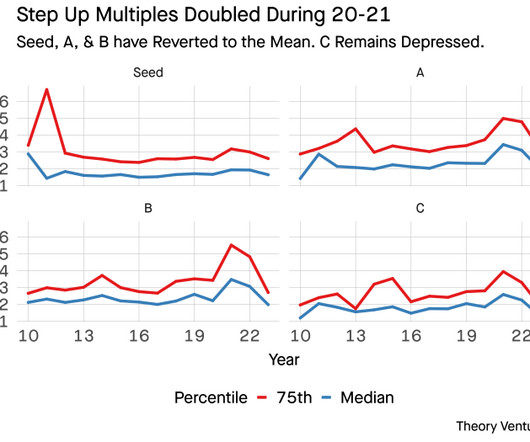

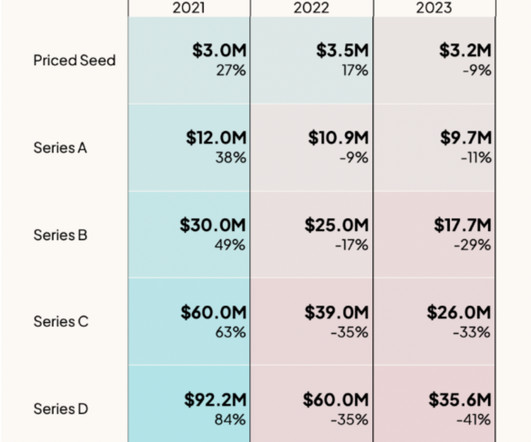

Redpoint: Seed May Still Be Strong, But There’s No Bounce Back at Series A. And the AI Premium is 3x.

SaaStr

MARCH 22, 2024

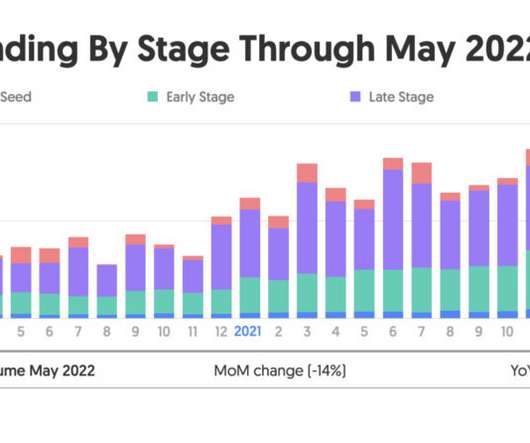

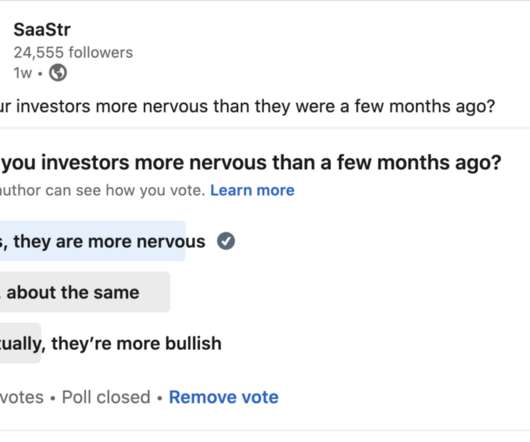

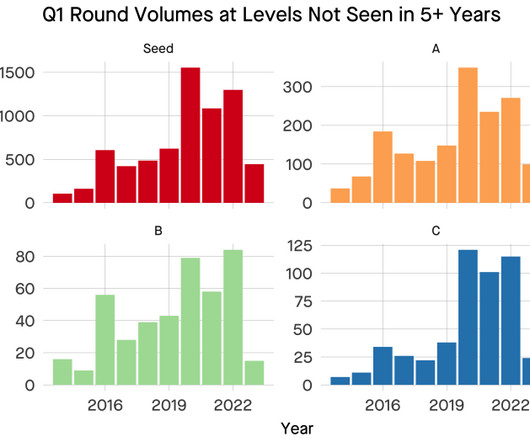

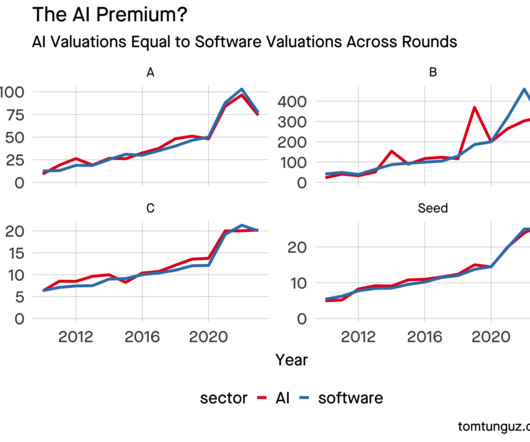

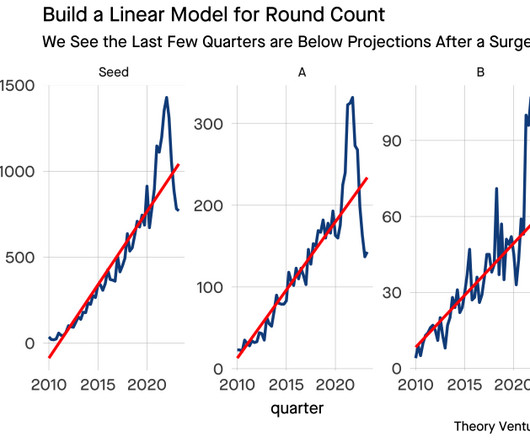

And what it says is that even though Seed stage investing remains arguably as strong as ever … Series A hasn’t bounced back. What’s most important is after a seed round … how hard is it to raise another round? the growth. There’s no free lunch. And the AI Premium is 3x. appeared first on SaaStr.

Let's personalize your content