Debt vs. Equity: The SaaS Financing Landscape

SaaSOptics

JUNE 24, 2021

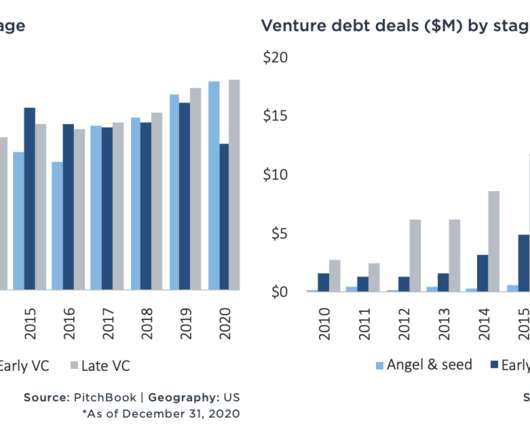

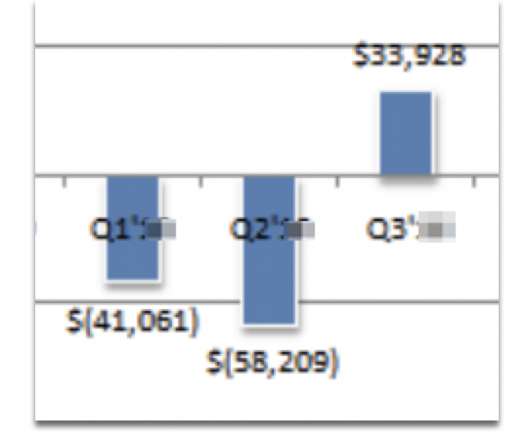

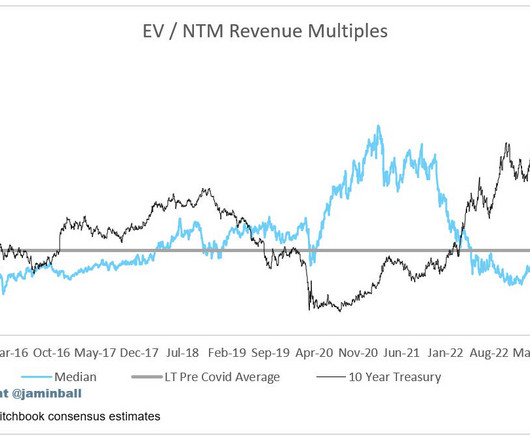

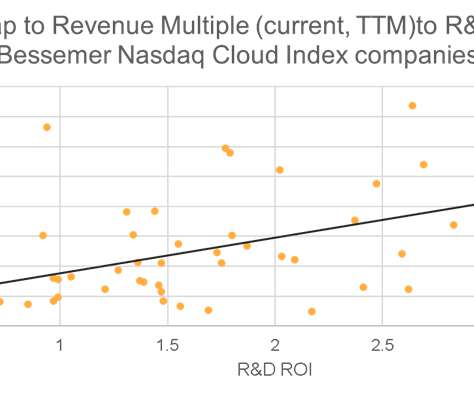

Debt vs. Equity: The SaaS Financing Landscape . Deciding between raising debt vs. equity financing? While venture capital has historically been associated with SaaS financing, the truth is it’s not suited for every business. . Debt vs. Equity: Equity-based financing.

Let's personalize your content