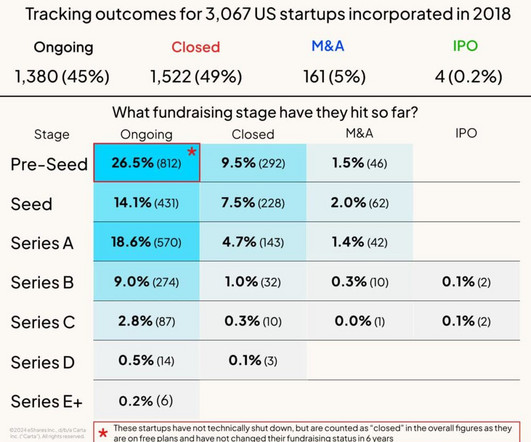

What Are The Odds You Get Acquired Within 5 Years for a Good Price? Around 1%-1.5%

SaaStr

MARCH 19, 2024

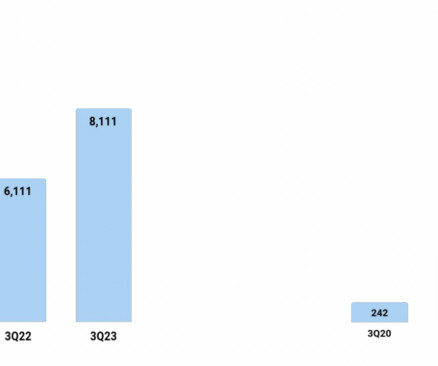

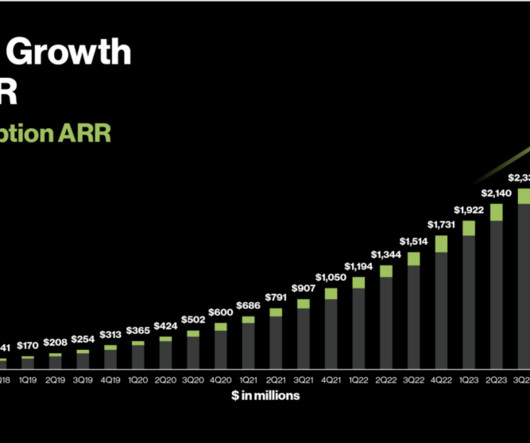

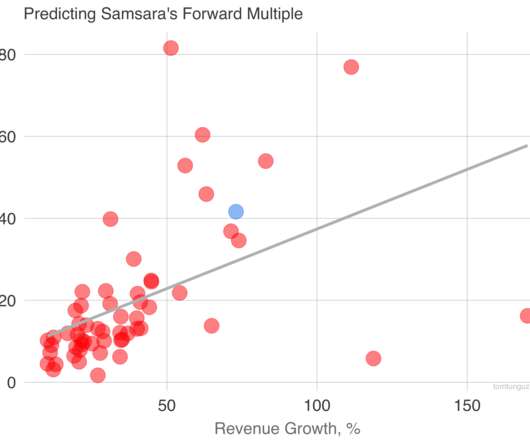

So Carta put out some recent data I found very useful on how many startups raise another round, and how many sort of quietly wind down, in the first 5 years or so after being founded (from 2018 to early 2024): Almost none IPO’d in the first 5 years, but that just makes sense. That sounds about right to me.

Let's personalize your content