Dear SaaStr: How Do I Craft a Winning Investor Deck for an Early-Stage Startup?

SaaStr

APRIL 22, 2024

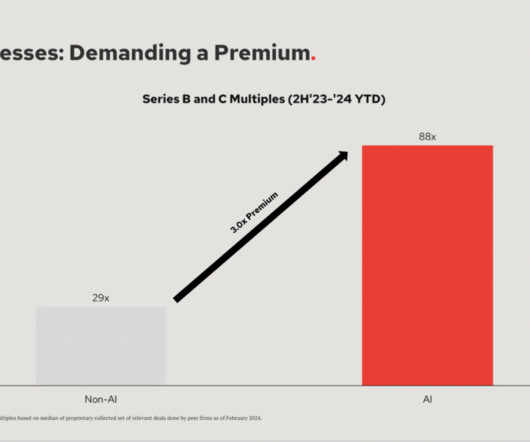

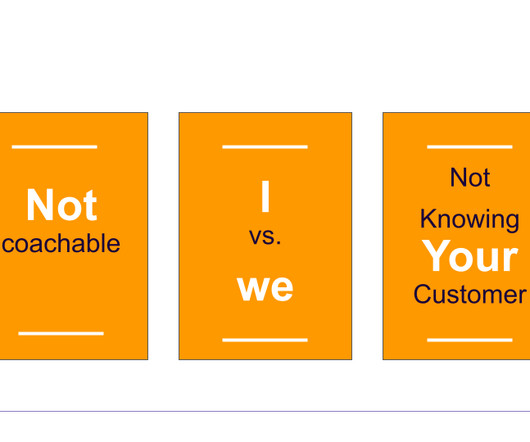

Dear SaaStr: How Do I Craft a Winning Investor Deck for an Early-Stage Startup? Here’s my #1 piece of advice: Get it all down to One Slide. "How to Create a Compelling Investor Deck: The Power of the First Slide" pic.twitter.com/AyyS7lHATz — SaaStr (@saastr) March 22, 2024 With 6-7 points on that slide.

Let's personalize your content