What I Learned Selling My Company for $130M with Harry Glaser of Periscope Data and ModelBit

SaaStr

APRIL 17, 2024

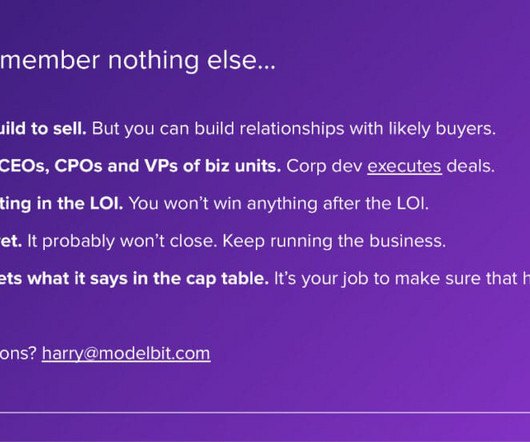

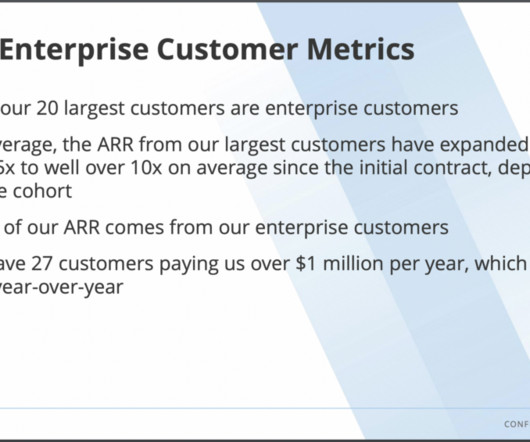

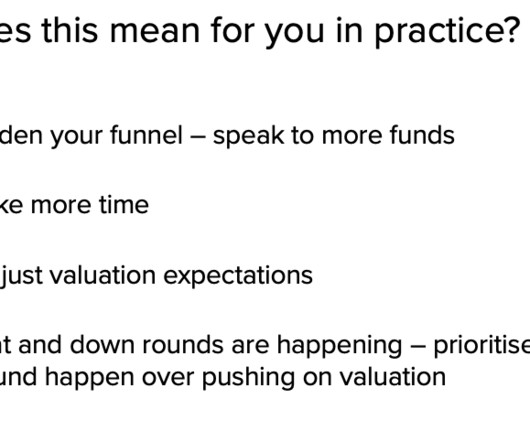

A few years ago, Harry Glaser sold his company, Periscope Data, for $130M. It was a difficult, punishing, and rewarding experience. At a recent SaaStr Workshop Wednesday, he shared a behind-the-scenes look into what this process looks like and five key takeaways for other founders who are want an inside look the process. The Journey of Selling Your Startup Harry was the co-founder and CEO of Periscope Data, which raised a seed round before finding customers, yet didn’t run out of money before b

Let's personalize your content