Clouded Judgement 3.22.24 - ERR vs ARR and the Conundrum of AI Revenue Streams Today

Clouded Judgement

MARCH 22, 2024

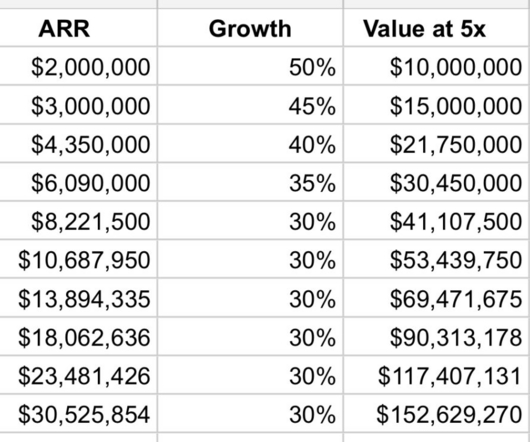

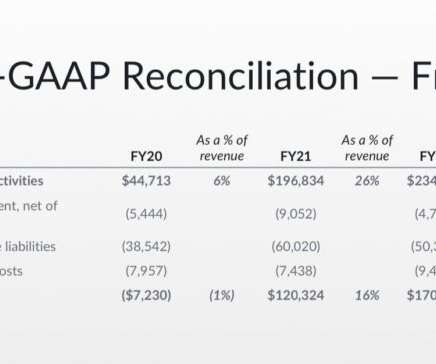

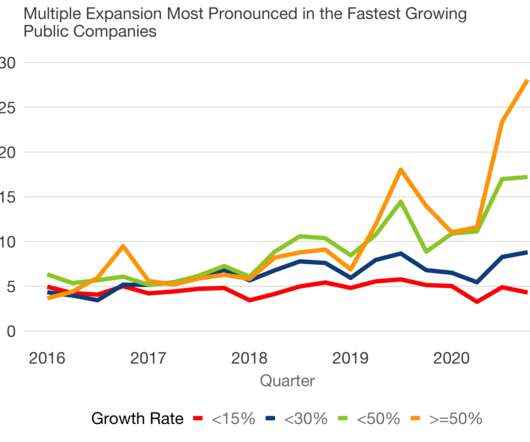

Subscribe now ARR (Annual Recurring Revenue) vs ERR (Experimental Runrate Revenue) ARR (Annual Recurring Revenue) is one of the most popular SaaS (Non-GAAP) metrics. Many investors laugh (and some rightly so) at the fact that software companies’ valuations are often described as a multiple of revenue.

Let's personalize your content