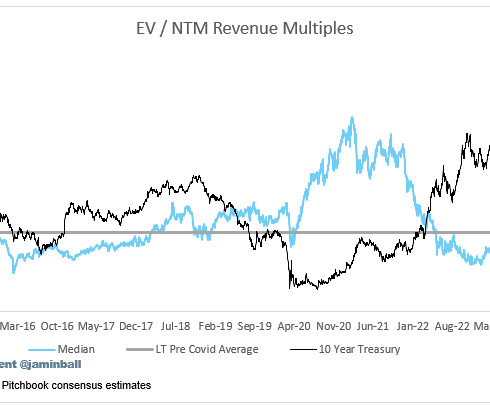

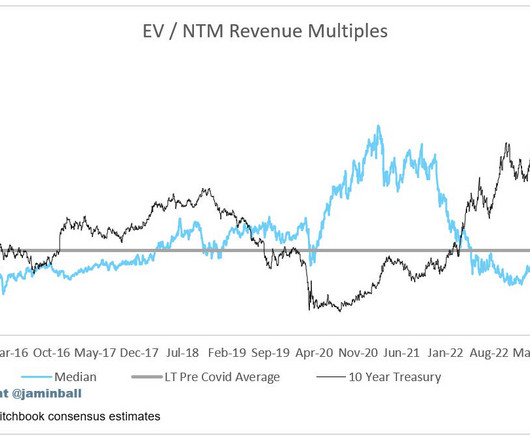

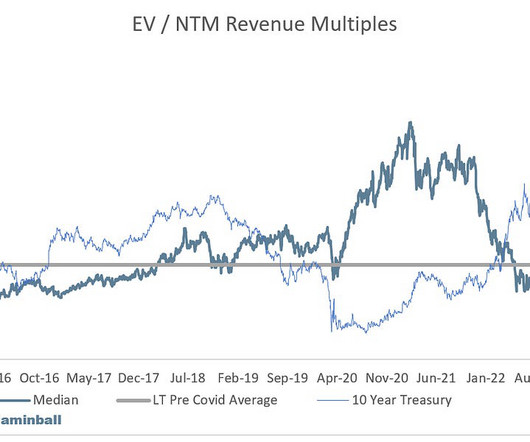

Clouded Judgement 2.29.24 - Shades of 2021

Clouded Judgement

MARCH 1, 2024

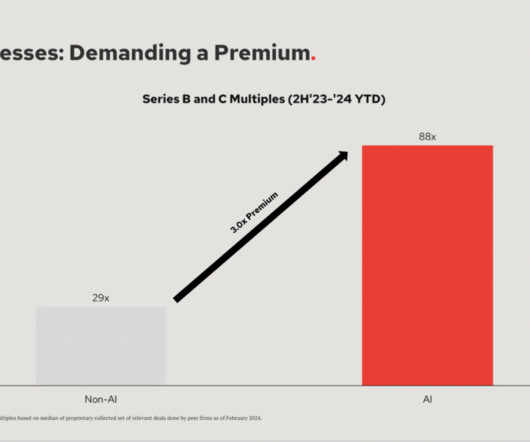

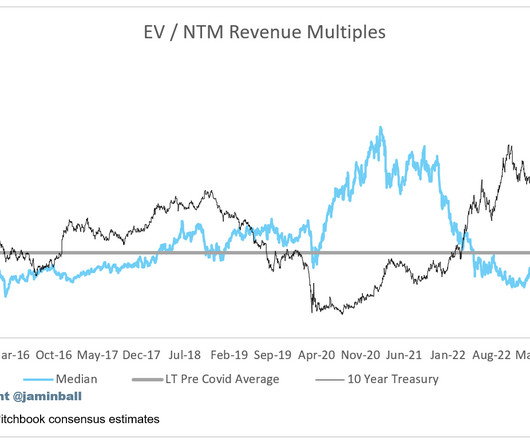

” I heard that a lot in 2021, and unfortunately not many call options hit… It’s hard to invest at 100x ARR and exit at 10x and make a return VCs aim for. Even a DCF is riddled with long term assumptions. Everything getting pre-empted. The volume of pre-empted rounds is skyrocketing. This is a more recent phenomenon.

Let's personalize your content