5 Key Data Points about the Early Venture Market in Q1 2022

Tom Tunguz

MAY 4, 2022

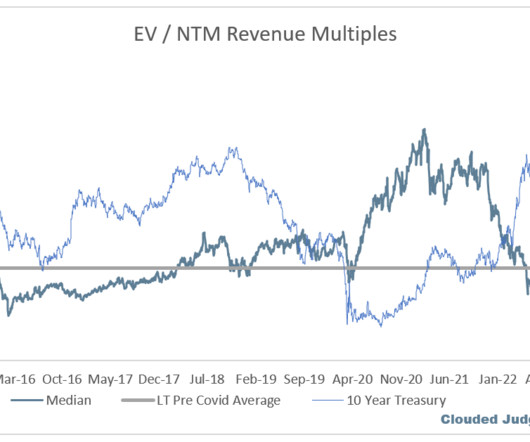

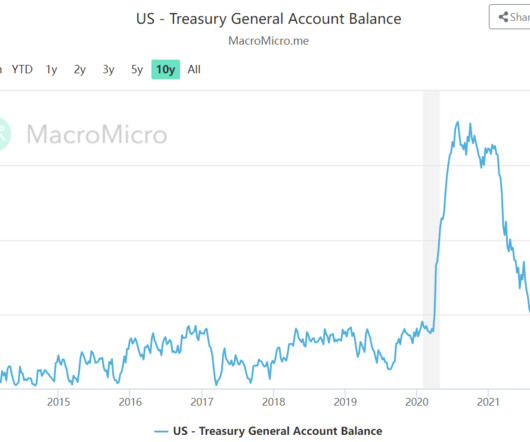

The term sheets signed in November and December closed in Q1, which may buoy these figures. 100m post is consistent with what I’ve seen in the market for the most sought-after investments. Web3 deals represented more than 11% of investments, the largest share, superseding fintech and healthcare. Seed has become the new A.

Let's personalize your content