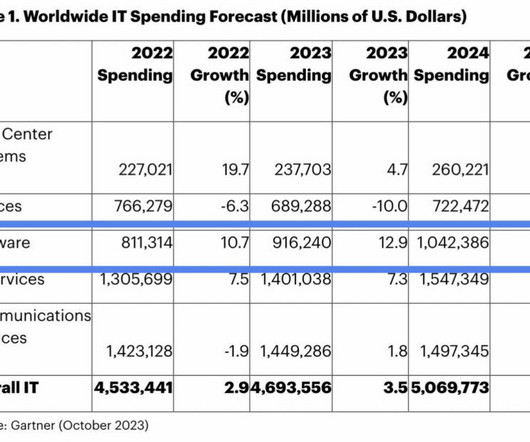

We End the Year at All-Time Lows for SaaS Growth. A Buying Signal — Or The End of an Era?

SaaStr

DECEMBER 28, 2023

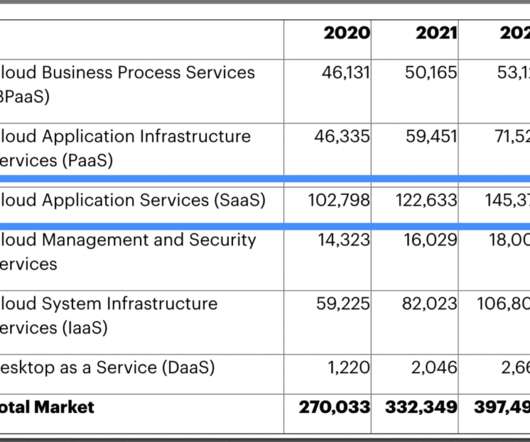

And broader Cloud players had great years too, from MongoDB to Cloudflare to Azure, if not quite as crazy as at the peak of 2021. Shopify, Canva, Monday and tons of other SaaS leaders less focused on tech and startups had big years.

Let's personalize your content