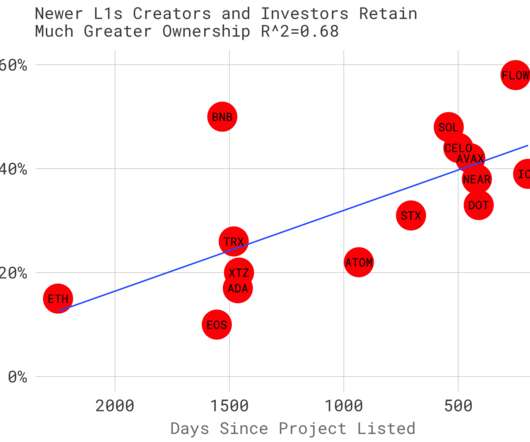

Crypto Companies Insider Ownership is Approaching that of Classic Startups

Tom Tunguz

OCTOBER 2, 2021

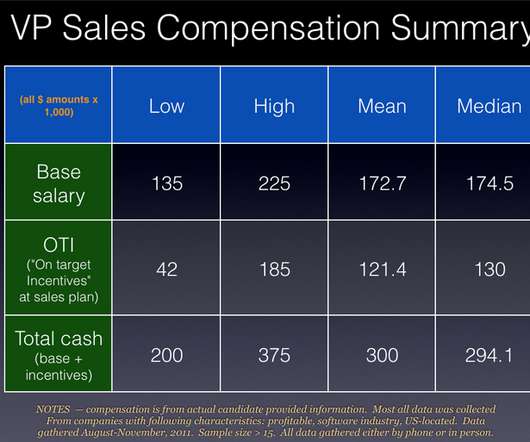

Unlike equity-only startups, crypto startups maintain two capitalization tables. The first is the equity cap table, just the same as non-crypto startup. The second is the token cap table: who owns how many tokens. Market Cap Rank. Second, insider ownership correlates to market cap, slightly.

Let's personalize your content