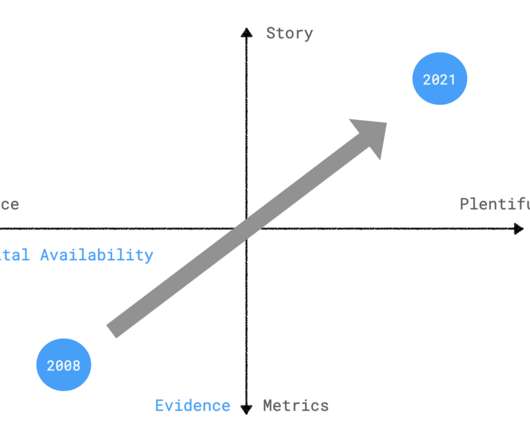

Product-Market Fit in Different Capital Environments

Tom Tunguz

MAY 2, 2022

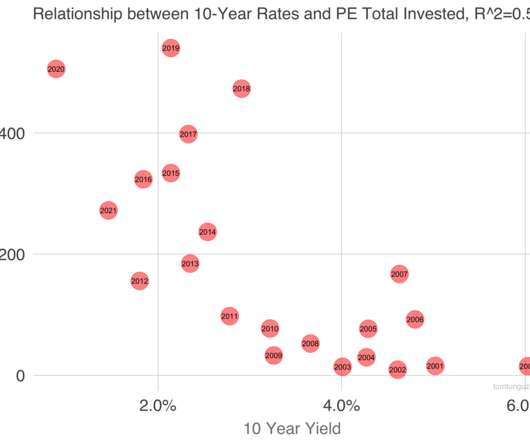

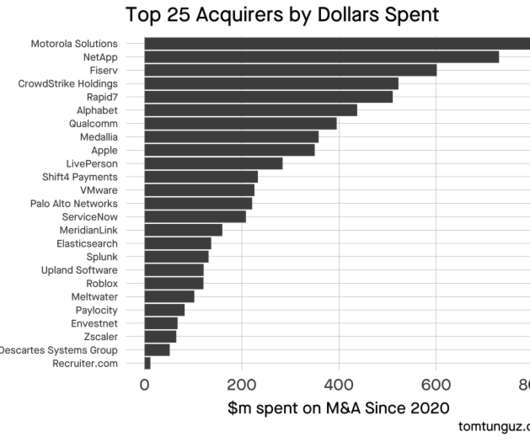

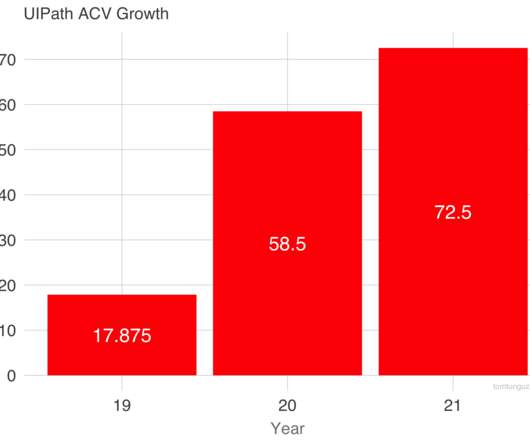

Charting sales efficiency by year of IPO would be revealing if this is the case: good idea for a future post.). In addition, along the way, investors and founders began to explore more capital intensive businesses: direct-to-consumer ecommerce, semiconductor companies, real estate ownership, multi-year software development.

Let's personalize your content