“Seed is Broken But There is More Seed Funding That Ever”: The Latest Deep Dive with Harry Stebbings and Jason Lemkin

SaaStr

MAY 27, 2024

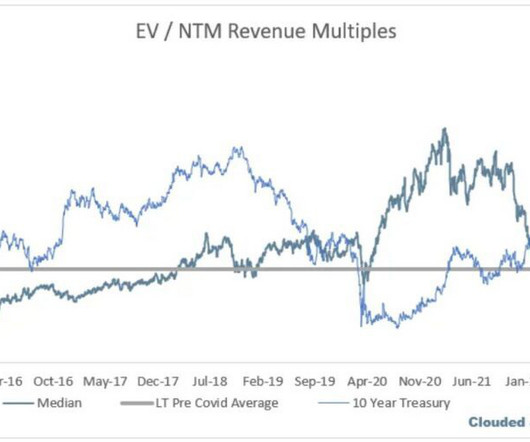

Ok the title here is a bit dramatic, but certainly seed investing is in an odd place in 2024. Harry and Jason did a deep dive on this and so much more here: Intro (00:00:00) Seed investing is broken due to limited founders capable of triple-digit growth. The best investments grow from $1 million to $10 million in 5 quarters or less.

Let's personalize your content