The 6 Most Common Mistakes Founders Make When They Are Just Starting to Scale Revenue

SaaStr

MARCH 30, 2024

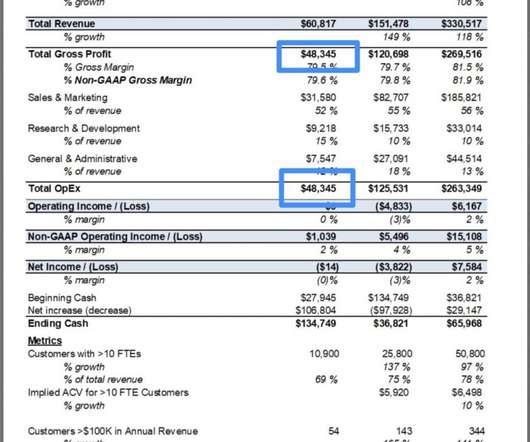

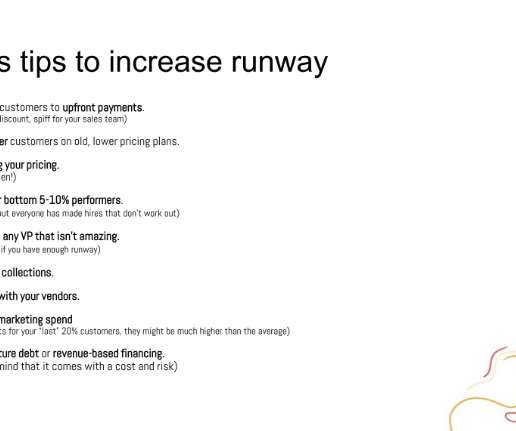

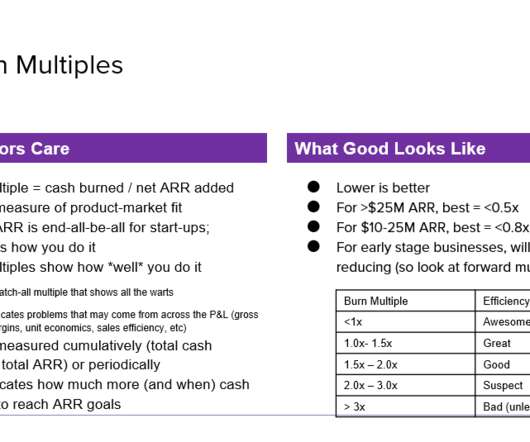

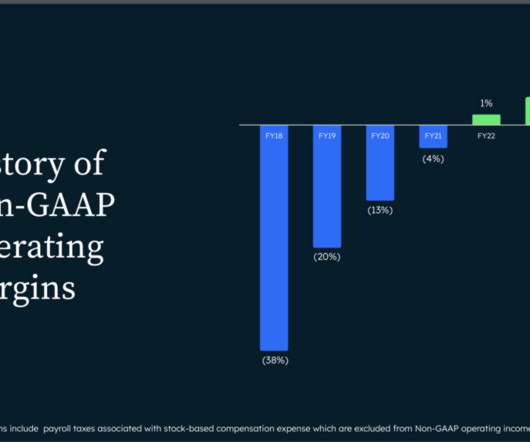

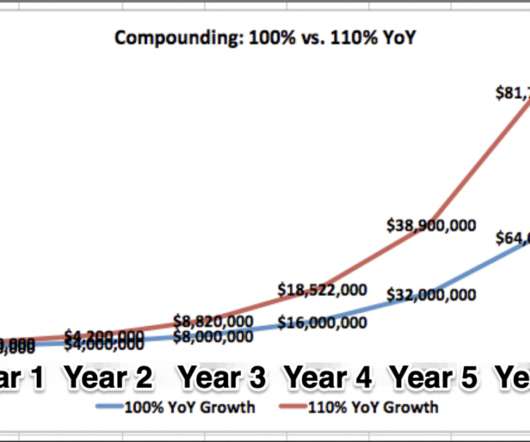

Bad operational model / misunderstanding the burn rate. If you don’t model it properly (and often for the first time) — your burn can creep up on you, no matter how carefully you think you are managing expenses. Getting too comfortable with yourself because of your High Win Rates. Or at least, maybe $10m-$20m ARR.

Let's personalize your content