How Much Should You Expect Your Startup to Slow in 2022?

Tom Tunguz

JULY 28, 2022

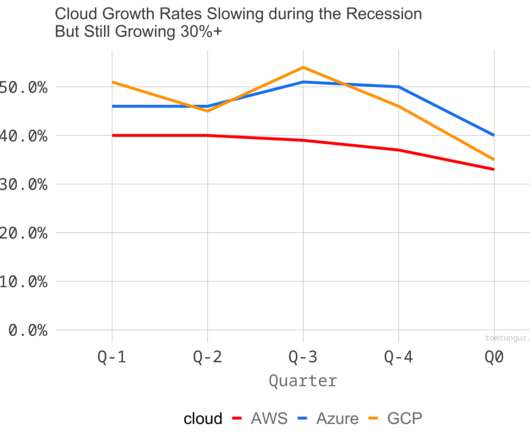

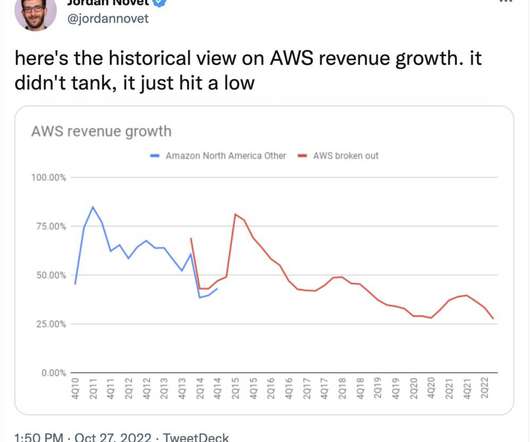

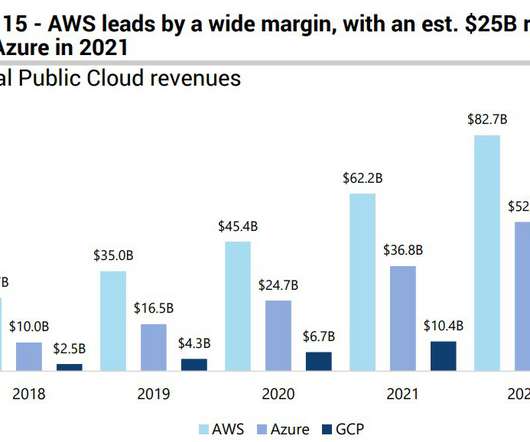

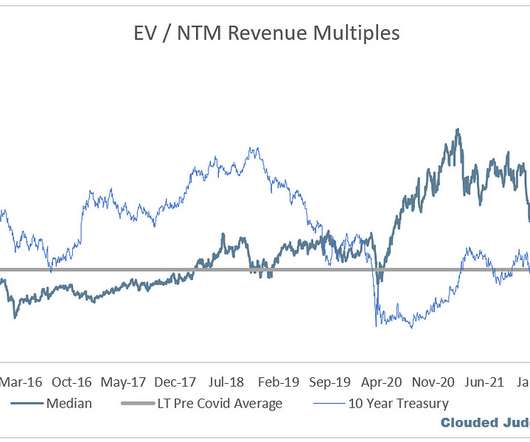

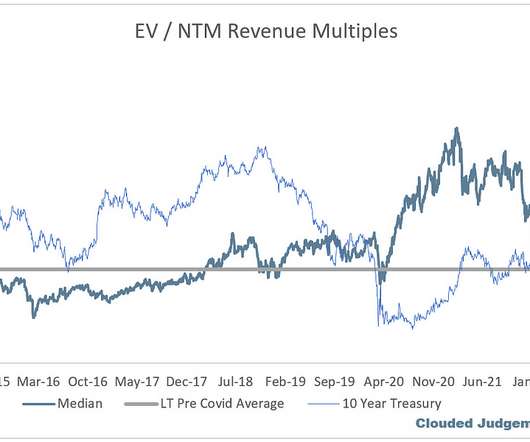

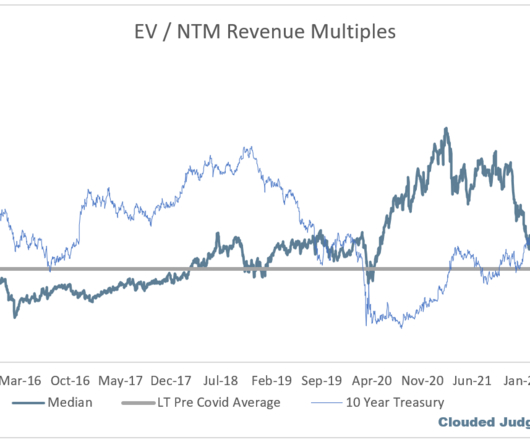

The 21% decline should provide founders an input into their forecasts for the remaining two quarters of 2022, especially infrastructure startups. Larger businesses face more daunting challenges sustaining higher growth rates, so AWS numbers are expected. GCP reported 37% growth & Microsoft 40%. Q/Q Growth Rate Change.

Let's personalize your content