Money on Autopilot: The Future of AI x Personal Finance

Andreessen Horowitz

JULY 27, 2023

Seventy-seven percent of Americans report feeling financially stressed , making consumer personal finance an attractive market for new builders.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

money-finance

money-finance

Andreessen Horowitz

JULY 27, 2023

Seventy-seven percent of Americans report feeling financially stressed , making consumer personal finance an attractive market for new builders.

SaaStr

APRIL 25, 2024

This will make you more money as a shareholder, no? If you don’t ask for anymore money — the CEO’s job is a lot safer. They usually only push when they feel they have no choice, and when there’s a lot of money already into the company. OK you probably agree with both in theory. You give it 110%.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

SaaStr

MARCH 4, 2024

Raising a high-priced round, just to raise it Raising a lot of extra money on SAFEs Raising too much “non-dilutive” capital Used right, these tools all can work well. SAFEs Aren’t “Free” Money. Non-Dilutive Financing and Venture Debt Do Have Their Place, But They Have Their Risks, Too. What seems free, when times are good?

SaaStr

MARCH 20, 2024

With personal experience from EchoSign and other high-growth companies, he was spoiled when it came to those companies raising money from exceptional VCs. But it didn’t matter because of how they were deploying money then. In 2021 and 2022, the money was a net negative, and what GTM organizations did was twofold.

SaaStr

JANUARY 25, 2024

But as a rule: Top engineers will all be given retention packages, extra money / RSUs / options designed to keep them for 2-4 years. Then, either: They’ll want to keep everyone for a while; or They won’t see the value in keeping much of sales, marketing, finance, etc. All engineers and product people will want to be kept.

SaaStr

JANUARY 23, 2023

Unicorns that looked like sure things a year ago are now running out of money. And there are too many founders looking for bridge financing, and not enough bridge financing to go around, And yet, these are still very good times to raise a seed round. Third, VCs believe they can still make money in seed.

SaaStr

SEPTEMBER 4, 2023

Dear SaaStr: What Happens When You Can’t Meet The Expectations From the Valuation of Your VC Financing? The more money that goes in, the bigger the stakes, the bigger the drama here. It varies e based on the situation. So the issue is solved there, in a sense. They get it. Unless — they’ve invested a lot ?

SaaStr

JANUARY 24, 2022

Take a read if you are still running finance yourself, or just have an part-time outsourced resource. In the old days, we didn’t have to worry about finance too much. SaaS accounting and finance has gotten pretty complicated, and the impacts of getting it wrong have gone up substantially. Accounting and Finance.

SaaStr

JULY 25, 2023

Dear SaaStr: We sold 30% of our Company Pre-Money During our Friends and Family Round. What VCs will want to make sure is that: The founders are adequately incented going forward The angels before them, as a group, don’t have control or blocking rights over future financings. Will VCs Care? Will VCs Care?

SaaStr

SEPTEMBER 3, 2023

SaaStr Founder and CEO Jason Lemkin and Partner at QED Investors Amias Gerety chat on the Fintech Beat podstream about all things SaaS, money, and what makes a great founder. Controls Around How You Spend Money And Grow Without question, the proper controls for startups and scaleups have gotten worse over the last 8-10 years.

Tom Tunguz

DECEMBER 13, 2022

In the 2000s, when capital was scarcer, founders & VCs would derive round size by debating the quantum of money required to achieve Series B milestones. As the pendulum swings to a higher-cost-of-capital-environment, milestone-based financing may return. When capital is scarce, it’s rationed. Let me explain : Era.

SaaStr

JANUARY 30, 2024

That they had to get to cash-flow positive, because no more money was coming. They’re at $2m-$20m ARR or so, sometimes more, aren’t losing money, and have 90%-100%+ NRR and relatively stable GRR and logo retention. The customer financing is there. Everyone had to cut, cut, cut — and was told to cut, cut, cut. Is that you?

SaaStr

AUGUST 14, 2023

The traditional practice is that VC funds have the startup pay both their fees and the VC’s legal fees in the financing. So the money to pay these legal fees doesn’t come out of the corporate bank account in many cases. Dear SaaStr: Does The VC Fund Pay for Legal Fees After The Term Sheet is Signed? It doesn’t matter in the end.

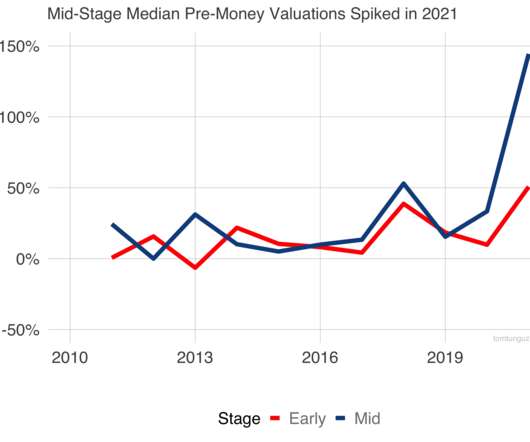

Tom Tunguz

FEBRUARY 22, 2022

PitchBook surmises non-traditional VC (aka hot money) comprises 78% of venture dollars invested in 2021. Across Series A to Series E rounds in the US, hedge funds participated in 63% of startup financings worth more than $200B in 2021. of Series As and Bs received hedge fund money - effectively zero. A paltry 1.3%

SaaStr

MARCH 12, 2024

3 Be Financially Viable The more money you raise, the fewer options you have for an acquisition. You only make money after your investors get their money back. Going through your finances and cleaning your books during a process is an easy way to slow down a process. It’s ok to leave money on the table.

SaaStr

OCTOBER 29, 2022

So I’ve seen a trend among many startups these days which is to sort of have a VP or Director of Business Ops instead of a VP / Director of Finance. They handle the cash too, but also go deep on the business in a way a “finance person” usually simply can’t. True finance folks (e.g., In fact, they usually don’t know how.

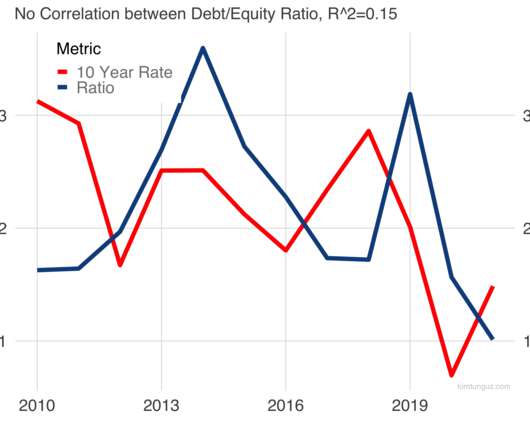

Tom Tunguz

FEBRUARY 14, 2022

In 1968, Milton Friedman argued “ In the Price of Money, ” that higher interest rates don’t mean less borrowing. We’ve established that interest rates are uncorrelated to startup financing over the last twenty years. He would echo this sentiment in an article Reviving Japan. After the U.S. After the U.S.

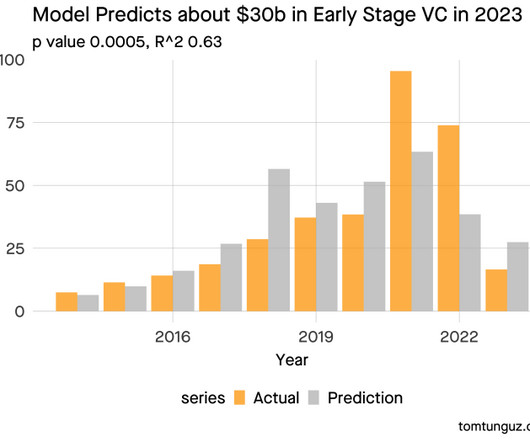

Tom Tunguz

APRIL 16, 2023

But it might be a bit less since the most competitive financings particularly in AI have been clearing at 2021 valuations, & the mountain of dry powder (more than $500b raised for early venture in the last 3 years) will buoy valuations through competition. A number between $30b-55b would imply 30%-60% reduction in the early stage market.

SaaStr

JULY 7, 2021

And forget about most bank-style debt financing if your VCs aren’t 100% supportive. Even if they don’t, the acquirer will generally require close to 100% shareholder support to close a deal no matter what the financing documents or law say. The second key is not to ask for more money from your VCs, and not expect it.

SaaStr

APRIL 14, 2022

I think at a minimum you should have a real experienced finance lead at $2m ARR, a real VP Finance once you raise $20m, and a CFO once you are at $20m+ ARR. Most startups just wait way too long to get finance right: They wait too long to get collections right, and have to write off a lot of bookings. jasonlk) April 12, 2022.

USIO

JANUARY 30, 2024

Super Safe Transactions: Keeping our money safe is important. These cards have cool features like special codes, fingerprints, and tools to catch bad guys trying to steal our money. It’s like having a money superhero right in your pocket! This makes shopping way more convenient and quick. These cards are leading the way!

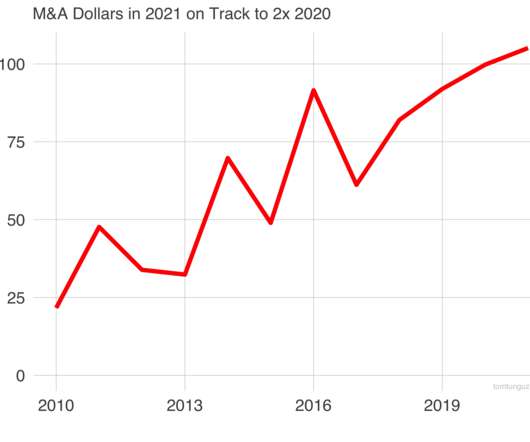

Tom Tunguz

JULY 30, 2021

I’m kidding of course, but the hyperbole illustrates the velocity of money in Startupland. There are 3-5 financings and M&A every working day. And there’s nothing more enticing to an investor to double down and move money faster than gains. I’ve never seen a dollar move faster. What’s driving this?

SaaStr

MARCH 19, 2024

1: Capital As an operator, your job is to take money and add headcount and programs to drive the growth engine for your company, You might think of capital as fundraising and budget. You want to be scrappy and figure out how to do as much as possible without deploying the capital you’ve raised and preserving that money to build a product.

SaaStr

MARCH 22, 2024

Different Pathways to CRO For Jane Kim, former CRO of CircleCl,, she used to work in finance before transitioning to SaaS. During her time in finance, she did multi-million dollar deals with 12 to 18-month deal cycles. After switching to SaaS, she started as an SMB sales leader with no prior management or SMB sales experience.

SaaStr

JUNE 18, 2022

They are the ones that often will bring you the leads for the next financing round. Perhaps one lesson we can take away from this story is that if you raise money at $45B valuation, you should try to make it your last round of financing. You want them to be SuperFans. Even, and perhaps especially, when times are a bit bumpy.

SaaStr

MARCH 28, 2023

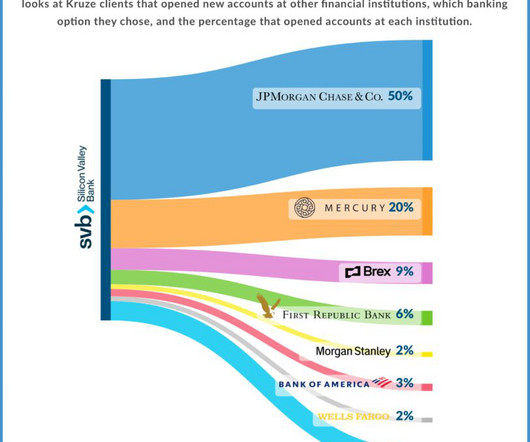

They act as trusted outsourced finance teams for 100s of startups, including some of my investments. November 23, 2008 I’m at a conference in Half Moon Bay I get a phone call from my banker at Citibank “Jason, pull all your money out. Kruze Consulting has some great data. The winner by a large margin appears to be JP Morgan Chase.

SaaStr

FEBRUARY 1, 2023

The real problem is how venture capital works in practice — the nichey, quirky way private financings and investing works: VC investment is high-ish risk and you need to know when to just walk away. When a start-up is hot, it’s insanely easy to raise more money. Only a handful of investments really make VCs big money.

SaaStr

AUGUST 7, 2023

They cared about cash in the bank — how much they spent, when they spent it, and how fast the actual money came back. The SaaS community is maturing, less money is spent on acquiring customers, and more is spent on retaining existing ARR. If it says you’ll run out of money in 12 months, you will run out of money in 12 months.

SaaStr

JANUARY 6, 2022

Even with these market wobbles, if you’re fortunate enough to be a “hot” startup in SaaS today you may find yourself oversubscribed in a fundraising round, and/or with investors that really want to invest between rounds when you don’t want or need any more money. On the one hand, it can almost feel like free money. And it can be.

SaaStr

AUGUST 15, 2022

Always be sharing your Zero Cash Date, and own the implications of when you are currently running out of money. Blaming others for running out of money undermines confidence 100%. Too many finance folks create fictional models that require massive acceleration at the end of the year to tie. And your job to make sure it lasts.

SaaStr

JULY 18, 2021

This last week was full of new SaaStr video content after the incredible digital SaaStr Money sessions with the CEOs and CXOs of Chime, Square, Adyen, Plaid, Marqeta and so much more! “An IPO Mindset – How It Can Help Companies at Any Stage with Airbase” A deep dive on how to get your finances and more in better shape. #10

SaaStr

AUGUST 11, 2022

Ramp is building the next generation of finance tools – from corporate cards and expense management, to bill payments and accounting integrations – designed to save businesses time and money with every click. less and closing their books 86% faster by switching to Ramp’s finance automation platform.

SaaStr

DECEMBER 8, 2020

In both my start-ups, I was constantly worried about losing all my investors’ money. When things were rough in our first 12 months, one of the main reasons I didn’t quit was because I couldn’t bear to lose their money. So that was good, in the end, that fear of losing your investors’ money. Get it done.

SaaStr

MAY 5, 2021

This will make you more money as a shareholder, no? If you don’t ask for any more money — the CEO’s job is a lot safer. More here: 5 Things To Be Wary of In VC Financings. Second, if you don’t end up being a great CEO in the long-run, shouldn’t you be replaced when someone can do the next stage materially better than you can?

SaaStr

AUGUST 20, 2022

What I’ve seen again and again is founders that are great at bootstrapping finance just don’t intuitively understand how to spend more. They don’t scrutinize every hire and every expense as closely, because they raised the money to invest. Without intending to, or even fully realizing it. But then it compounds. Look at Klarna.

SaaStr

DECEMBER 15, 2021

But if VCs have put a lot in of money on relative basis (e.g., This typically happens when a company is doing OK, and not running out of money — but clearly could do materially better with someone else running it. A little more here: 5 Things To Be Wary of In VC Financings | SaaStr. note: an updated SaaStr Classic answer).

SaaStr

NOVEMBER 3, 2022

Embedded finance has everything to do with the flow of money. Our mission is to build powerful and secure cloud software for subscription businesses of all sizes, with a strong emphasis on good design and ease of use.

Tom Tunguz

DECEMBER 29, 2021

The Future of Money. I’m waist deep in this compendium of financial history that traces money from the first paper currency issued by Kublai Khan to modern day crypto. The Future of Money is great so far, but I’m running out of time to finish it before 2022, so it might not truly belong on this list!

SaaStr

JULY 12, 2021

We have an incredible line-up for SaaStr Money 2021 this Wednesday !! From the CEO of Chime, to the COO of Plaid, to the CMO of Marqeta, the best of Cloud and SaaS in finance and money are at SaaStr Money this Wednesday! It’s FREE so sign-up ASAP here.

SaaStr

SEPTEMBER 21, 2021

Digital Finance Today. Digital financial tools enhance the customer experience and ultimately make businesses more money. For example, since companies can save money by using fintech to streamline specific processes, they can lower prices, and so the customer saves on costs too. Fintech has evolved in stages.

SaaStr

DECEMBER 7, 2023

Obviously, the exits that we’ve made over 100 our money are incredibly exciting, but realistically, we’ve had over 35 exits, and they have all been exciting in their own way. After high school Jay moved to New Jersey to attend Rutgers University, where he studied finance & political science.

Stax

DECEMBER 4, 2023

For obvious reasons, the issue is even more pronounced for businesses in the financial services industry such as insurance companies or money services businesses. According to a UN report, money laundering activities of about $1.6 Often, it’s also used for the financing of terrorism making the world highly unsafe. of global GDP.

Andreessen Horowitz

SEPTEMBER 21, 2023

Colombia’s finance sector has historically been one of the most regulated in the world. That trend is being reinforced by advances in licensing and Open Finance, the promise of ubiquitous instant payments, and regulatory support for innovative fintech solutions. Lee este artículo en E spañol. See a16z.com/global-payments for more.

SaaStr

MARCH 14, 2020

As a rough rule, every investor that owns more than 10% will act, at least ideally, as a “lead” investor: They will “reserve”, i.e. save, some more money in case you need it and do reasonably well. They will lead a “bridge” financing if you struggling but doing well enough to perhaps earn a little more money from the existing investors.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content