Demystifying Credit Card Interchange Fees: What You Need to Know [2024 Rates and Updates]

Stax

DECEMBER 20, 2023

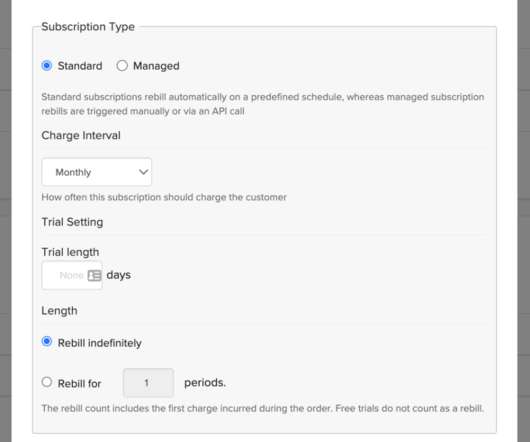

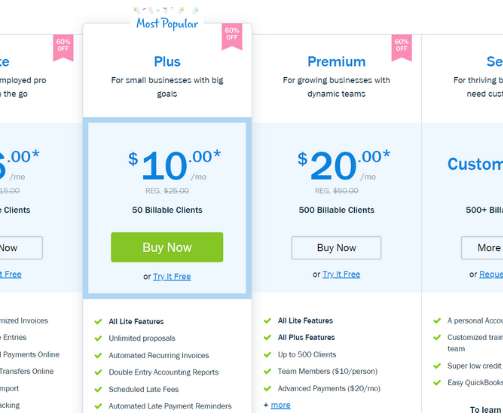

Set rate processing Subscription rate processing TL;DR Interchange fees are not collected by your payment processor or bank; they go directly to the card-issuing banks. Interchange fees vary significantly depending on the card issuer, the issuing bank, type of transaction and/or merchant type.

Let's personalize your content