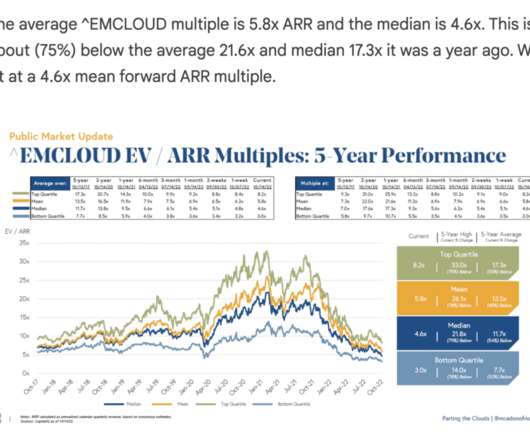

Cloud Stocks May Be Down. But the Cloud Remains on Fire. That Matters More.

SaaStr

MAY 16, 2022

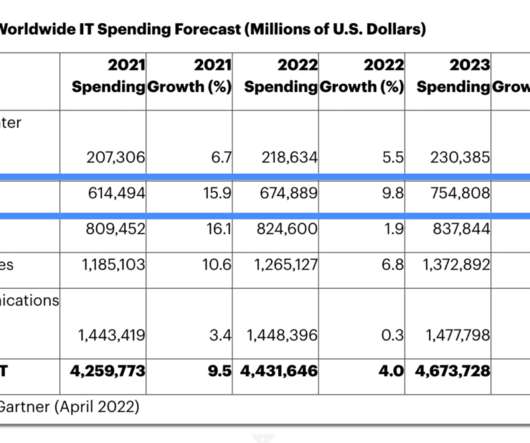

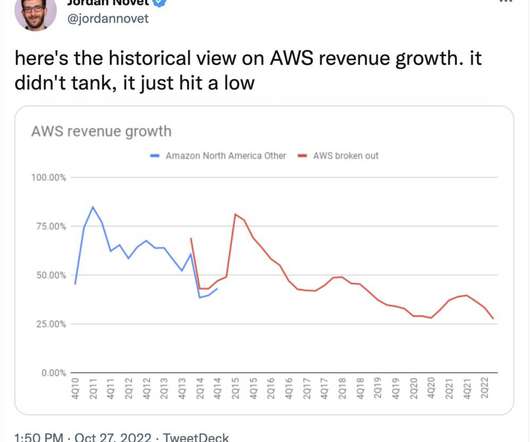

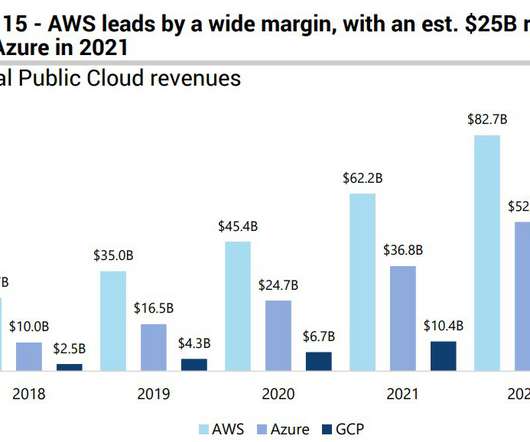

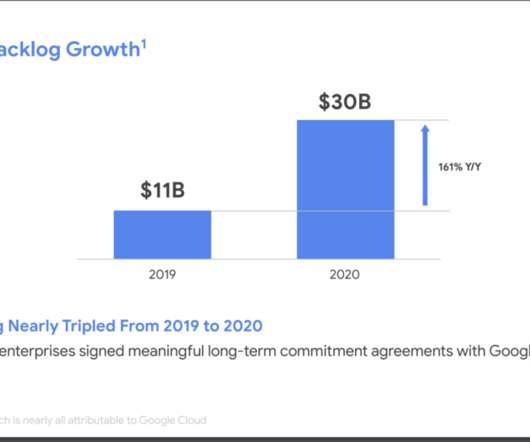

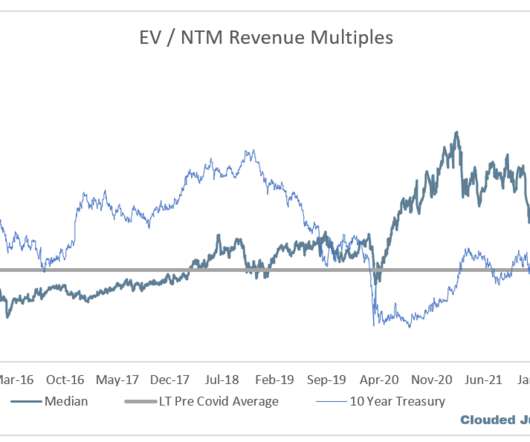

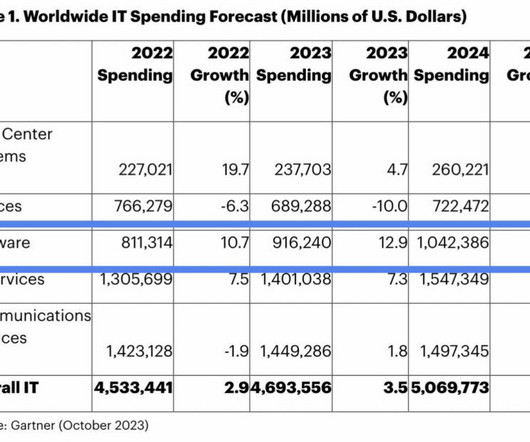

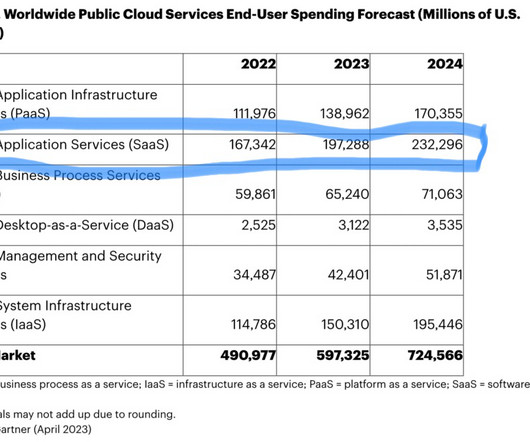

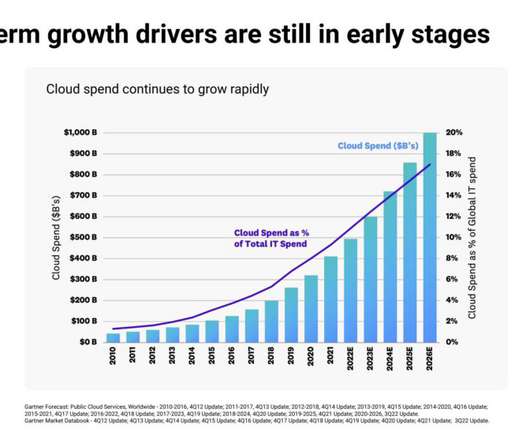

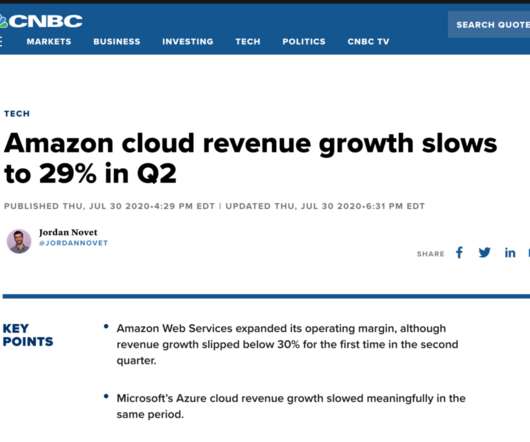

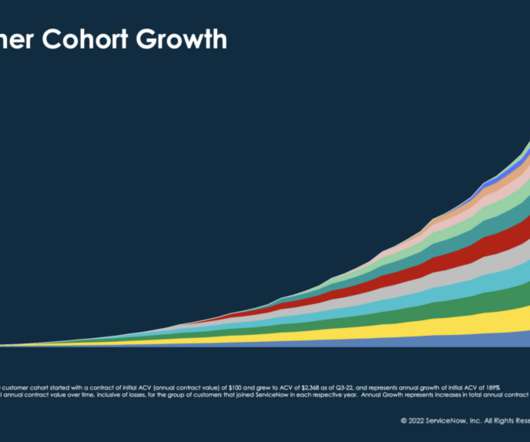

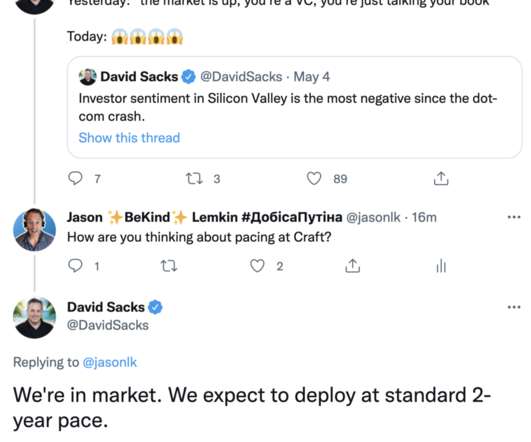

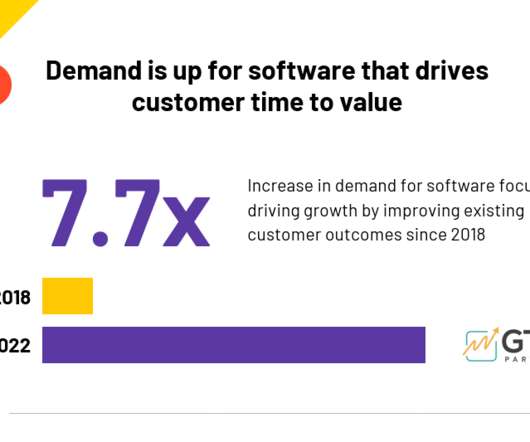

But at end of the day, in Cloud, the question is if CIO and related spend will slow down. So follow AWS, Azure and Google Cloud. So there’s much angst and even panic with so many SaaS and Cloud public stocks down 50% or more from their peaks. They are the Cloud. The post Cloud Stocks May Be Down.

Let's personalize your content