Clouded Judgement 5.10.24 - Software Weakness Across the Board

Clouded Judgement

MAY 10, 2024

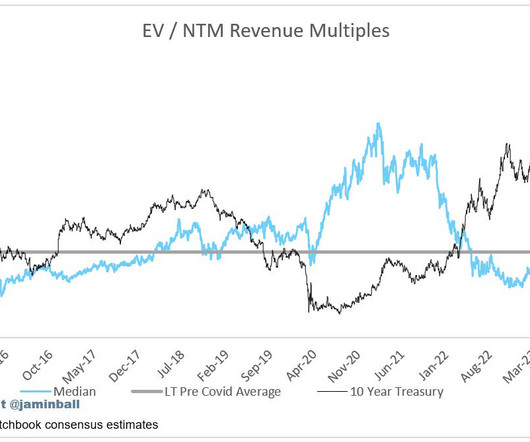

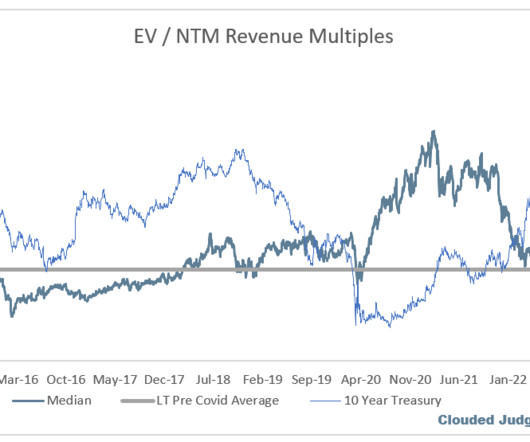

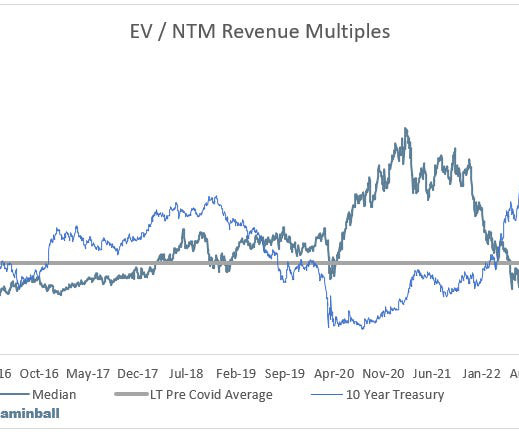

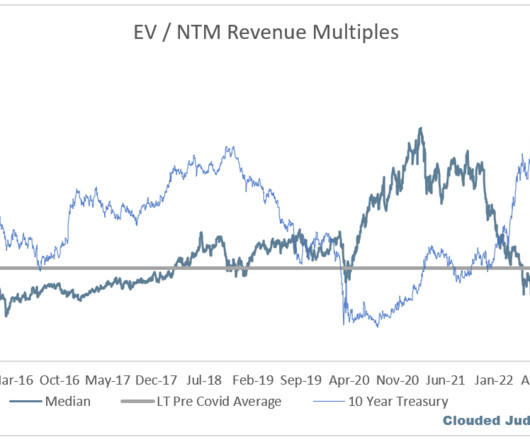

All 3 (AWS, Azure, GCP) saw positive reacceleration Quarterly Reports Summary Top 10 EV / NTM Revenue Multiples Top 10 Weekly Share Price Movement Update on Multiples SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months.

Let's personalize your content