Over the past decade, India’s central bank—the Reserve Bank of India (RBI)—has become one of the most proactive regulators in the world, advancing the digitization of payments and financial services at a rapid pace. Aadhaar, the country’s pioneering digital ID system, and UPI, its real-time digital payments system, are largely regarded as models for delivering financial services and social benefits more widely and efficiently. Because Indian citizens’ digital IDs are linked to their bank accounts, for example, the government was able to electronically transfer relief funds to around 200 million beneficiaries over the course of the pandemic. Recently, a series of regulations providing more flexibility and guidelines for digital lenders, in particular, has extended fintech’s reach to a larger swath of the population.

When my co-founders and I launched Branch in 2015, our mission was to deliver world class financial services to the mobile generation. Initially, we were focused on Africa—mainly Kenya, Tanzania, and Nigeria. But around 2017, we began to develop an interest in India.

The foundation: Why is India such fertile ground for fintech?

At the time, the market seemed poised for a fintech boom for a variety of reasons.

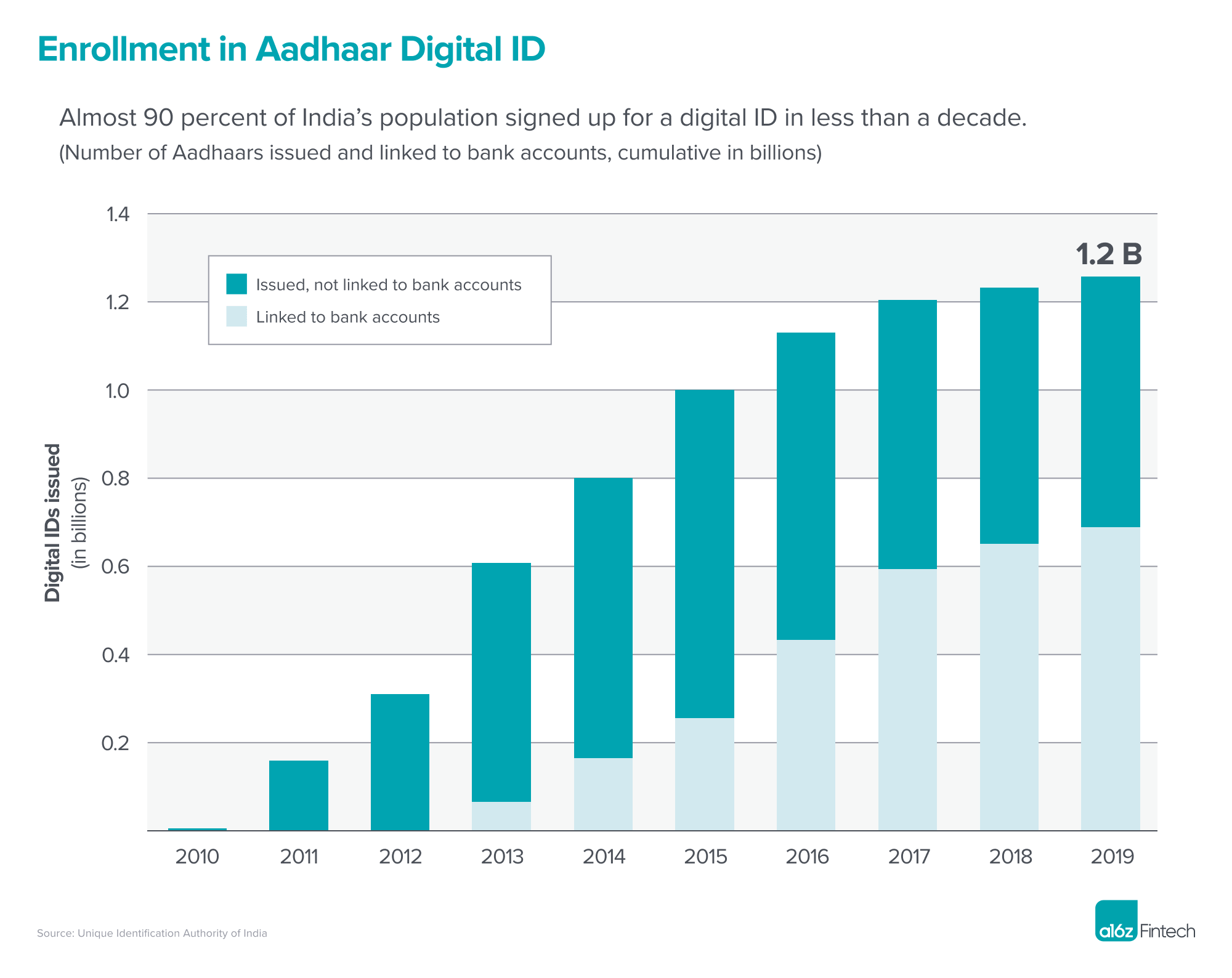

The groundwork was Aadhaar (“foundation” in Hindi), a nationwide database established by the government in 2009 to enable digital identity verification. The vision: Each Indian citizen would be given a unique, 12-digit identification number, which could be cross-referenced with biometric information (fingerprints, iris scan data, and facial photograph) and basic biographical information held in a centralized government database. By 2019, the government had issued a unique ID to nearly every adult resident in India; today, the system is used by 1.3 billion Indians, over 90% of the population. This helped with fraud and enabled smooth KYC compliance.

In addition, the government created bank accounts for nearly the entire population. Approximately 80% of Indian adults own a bank account today (although many remain dormant). This made the prospect of reaching people in rural areas—with no access to a bank branch—a real consideration.

Third, the government was actively trying to remove cash from the system. In November 2016, Prime Minister Narendra Modi announced a demonetisation initiative aimed at eradicating black money; Rs 500 and Rs 1,000 currency notes ceased to exist as legal tenders and ATM withdrawals were capped. In 2016, nearly 90% of all transactions in India were cash-based; as of 2022, cash in circulation in payment systems had declined to 20%.

Most importantly, perhaps, was the introduction of UPI in 2016—an instant, free national mobile payment system based on Aadhaar. With UPI, Indians can use an email-like address to transfer money directly from a Aadhaar-linked bank account, without needing a debit card or wallet. UPI has since become the world’s fifth largest payment network by volume, and a model for the rest of the globe.

Finally, the Indian market has historically been credit-starved. Only 11% of micro small and medium enterprises (MSMEs) in India have access to formal credit, and 60% of all credit demand is unmet. It was shockingly difficult for a low income person to access consumer credit at the time, which presented an opportunity for fintech companies like Branch to extend availability to digital lending.

India today: Regulation enables innovation

At present, the revolution is in full swing. Over the past 5+ years, RBI has enacted regulations at a rapid pace. In particular, we’ve seen several relevant developments:

Co-lending lowers the cost of capital for digital lenders

The introduction of co-lending regulations in 2018, and subsequent amendments to it, have materially lowered the cost of funds for digital lenders. Traditionally, banks have primarily served prime customers, resulting in the lowest cost of funds, while digital lenders have targeted slightly riskier segments and consequently have a higher cost of capital. Since digital lenders have a wider distribution and are better equipped to underwrite riskier segments, combining these strengths with a bank’s lower cost of capital benefits everyone in the ecosystem, including the customer. At present, Indian regulators seem most comfortable with co-lending, compared to other possible partnership models between banks and digital players.

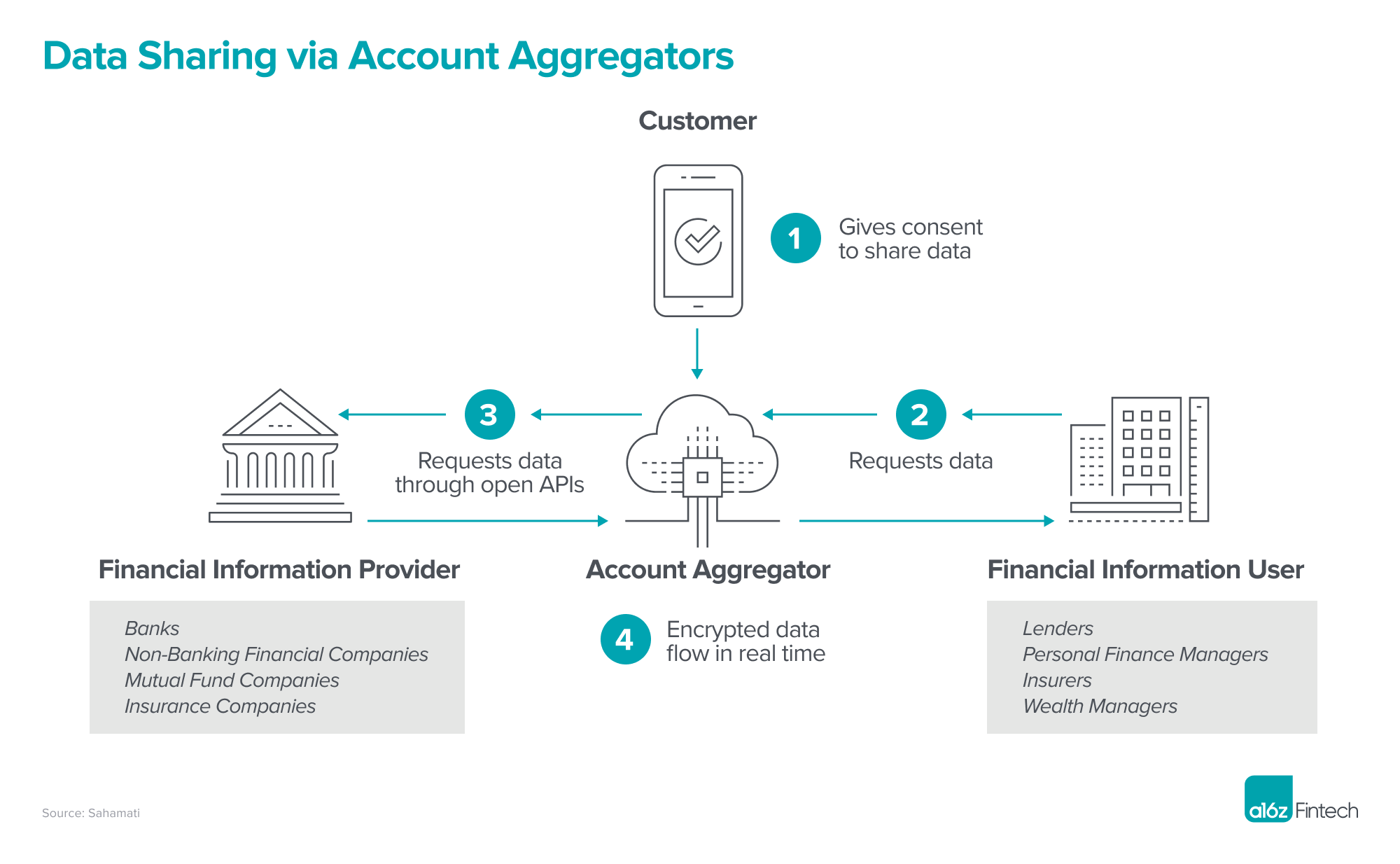

Account aggregators streamline digital underwriting

In 2016, the RBI released licensing regulations for a new kind of entity called account aggregators, which are authorized to collate all financial data (bank accounts, investments, insurance, etc.) in a single database. Digital lenders can then access this comprehensive repository, with customer consent, to assess the customer’s ability to repay. This presented a vast improvement over the previous process—in which lenders needed to request each piece of information from customers—which both eased the process of digital underwriting and reduced drop-offs in the digital application process.

OCEN digitally connects consumers, lenders, and loan service providers

The Open Credit Enablement Network (OCEN) is an open protocol which can theoretically bring all lenders and customers together under one roof. (Currently, banks representing ~80%+ of the market share are plugged into this network.) Each lender can choose to plug into this protocol. Similarly, consumer-facing platforms can connect to the protocol, thereby allowing users to access credit from the lenders who choose to lend via this protocol. This has the potential not only to expand the customer base of digital lenders, but also to allow non-lenders to offer financial products on their platforms.

Digital lending guidelines protect customers and promote trust

In August 2022, the RBI published a set of much anticipated regulations that were tailor-made for digital lenders. The guidelines put requirements in place to protect customers’ interests and established rules around fees, the use of digital signatures, data collection, and more. This both improved customer trust in digital lending and provided authorities with tools to hold errant lenders accountable.

In addition, the Indian government has been working closely with Google Play to protect consumers from unscrupulous lenders. For example, based on government directives, Google Play has been actively blacklisting illegal lending apps that abuse customer trust. India is also moving towards a whitelist approach, allowing only lending apps that are approved and maintained by a regulated entity to list on Google Play—and removing those that are not. In addition, the government is inclined to reduce the influence of apps with ties to non-friendly nations and restrict data access to such state actors. Such actions are often coordinated with law enforcement agencies, where needed.

At the moment, India is perhaps the fastest growing fintech market in the world. In fact, fintech has a chance of fully driving the economy. The country leads the world in real-time digital payments.

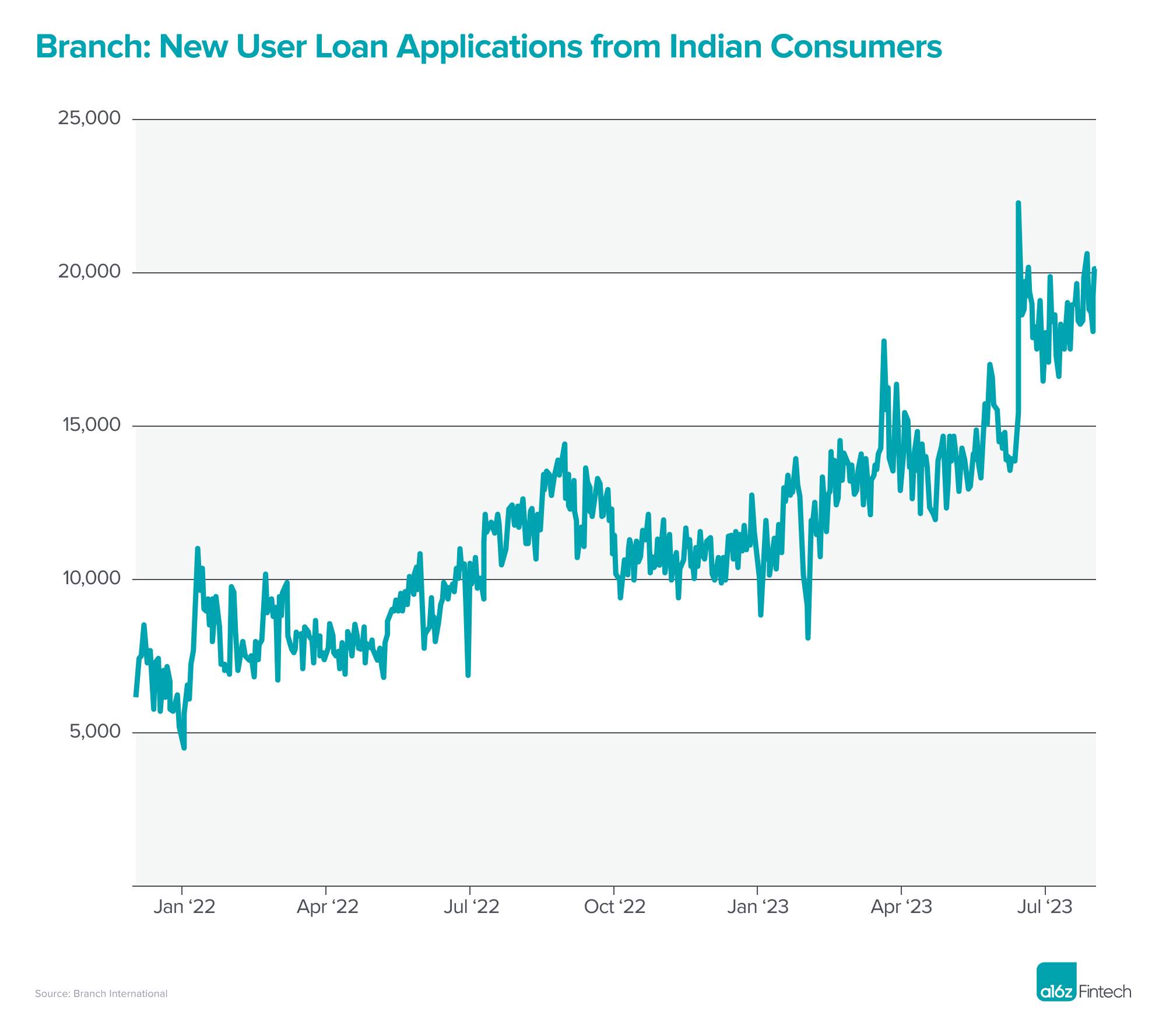

Since being granted the first-ever E-NBFC (non-banking financial company) license in 2019, Branch International’s growth has been propelled by demand in India. For context, Branch receives around 20,000 new user loan applications from Indian consumers every day. In the U.S., this kind of organic growth in fintech is unusual. In India, it’s unimpressive.

Going forward, RBI has shown an intent to support fintech innovation within well-defined guardrails.

Through proactive engagement and transparent communication, India’s central bank has demonstrated an openness to feedback and consultation with the fintech sector as it advances regulation, both at the policy formulation stage and after changes are enacted. Such pro-innovation measures make India a massive opportunity for fintech, both for founders and the country’s increasingly digital-first population.

See a16z.com/global-payments for more.