This article is the third of four installments in our new series, How Fintech Companies Can Simplify Their Funding Strategy. Read part 1 on Choosing the Right Funding Structure here. Read part 2 on Trade-offs Across Terms here.

In this series, we have explored a variety of funding options for startups looking to launch a new financial product as well as terms to consider when negotiating your first warehouse facility.

At this point, your company has decided to raise debt or at least would like to explore the option… where do you start?

If this is your first time embarking on a debt raise, it can be a daunting task, particularly given the sheer number of options, structures to consider, resources required, and ever-evolving debt provider landscape. Successfully getting a facility in place takes time and effort, but the more prepared you are and the more you can stick to a timeline, the easier (and more efficient) your process will be.

While no company’s experience will be exactly the same, the key steps are consistent, and in this article, we aim to demystify the debt-raising process at large and navigate you through it. We’ll do this by outlining lender outreach preparations, the process timeline for corporate versus asset-backed debt, and the key considerations you should take into account for both. By understanding this process, you’ll hopefully be in a position to secure debt term sheets and determine the optimal funding path for your specific circumstance. Let’s get started.

Prep and Outreach

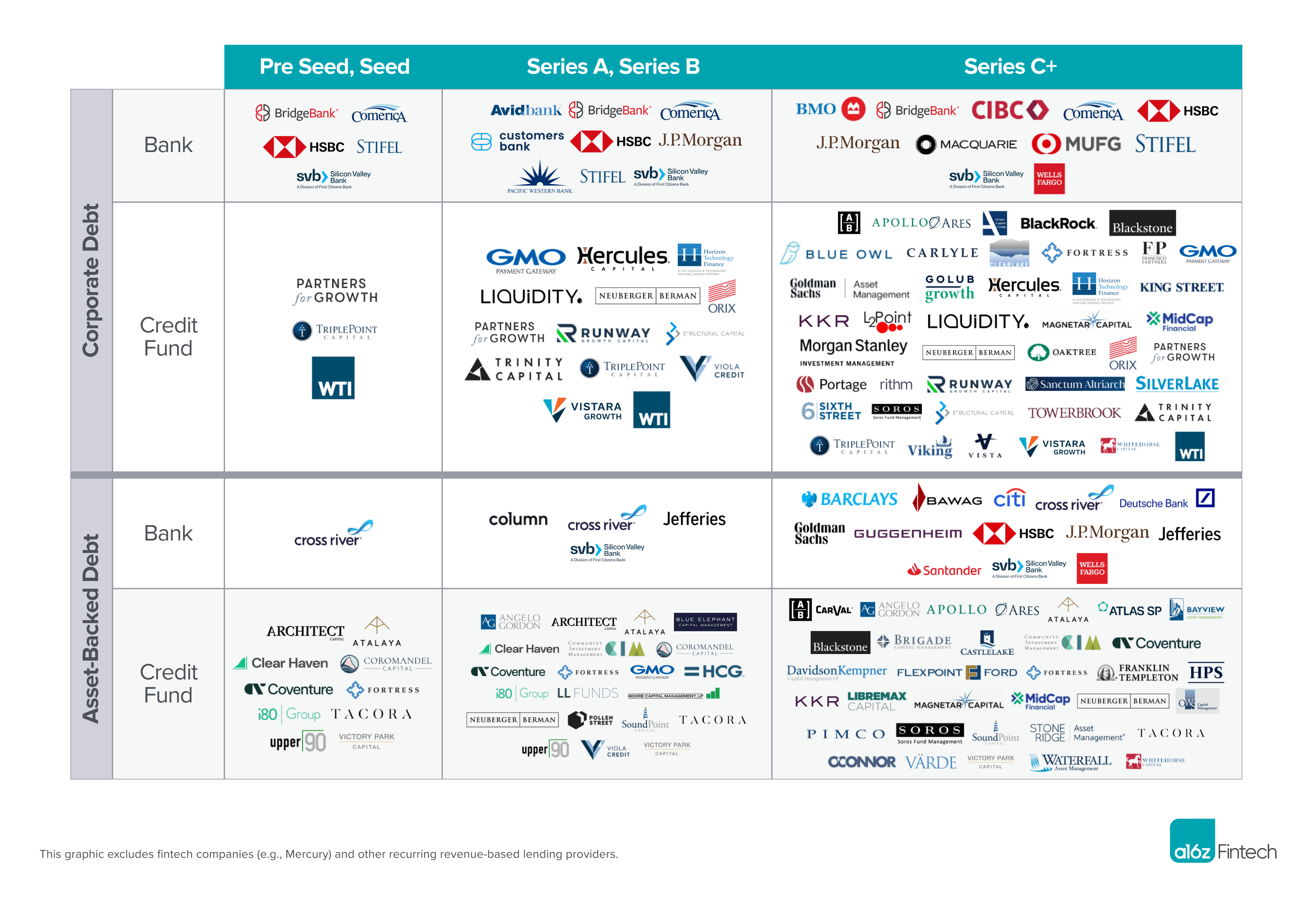

The lender universe is large and ever-evolving, as evidenced by the acquisitions of both SVB and First Republic earlier this year. Given the shifting landscape, it’s helpful for you as a CEO and/or founder—or for your finance and capital markets teams, if you have those hires to help you through this process—to know who the key players are at each stage so you can spend your time and energy speaking to the right firms.

From our experience, companies who have successfully raised debt typically reach out to roughly 10 potential lenders (banks and credit funds) when setting up their initial discussions—though some ultimately decide to go even broader with 15 to 20. By having more lenders, you can create a sense of competitive tension, though the benefits of having multiple options may not be worth the sacrifice to your time (and hit to your work streams).

Depending on the stage of the company, certain lenders may be more of a fit than others. To start the outreach process, many companies may choose to contact lenders they’ve previously met through fielding inbounds or at conferences. However, if a company has backing from a venture capital firm, we would recommend that they meet with their venture firms first to review the firm’s existing relationships and/or to get recommendations for lenders based on the company’s stage and preference. Leveraging your VC’s relationships can help with initial warm conversations. As you move through the process, stay organized and build your list of lenders with your venture firm and others who can be helpful in making connections. Once you have finalized your list, start setting up introductory 30-minute conversations with lenders.

Next, let’s discuss what you as a company will need to prepare and have ready to share.

Corporate Debt

There are multiple debt structures that companies can raise. Two that we have focused on previously in this series include corporate debt and asset-backed debt. It’s important to know that these two have different processes including timelines, players, and diligence. As you consider potential funding options, you may determine that corporate debt is a more appropriate option to start.

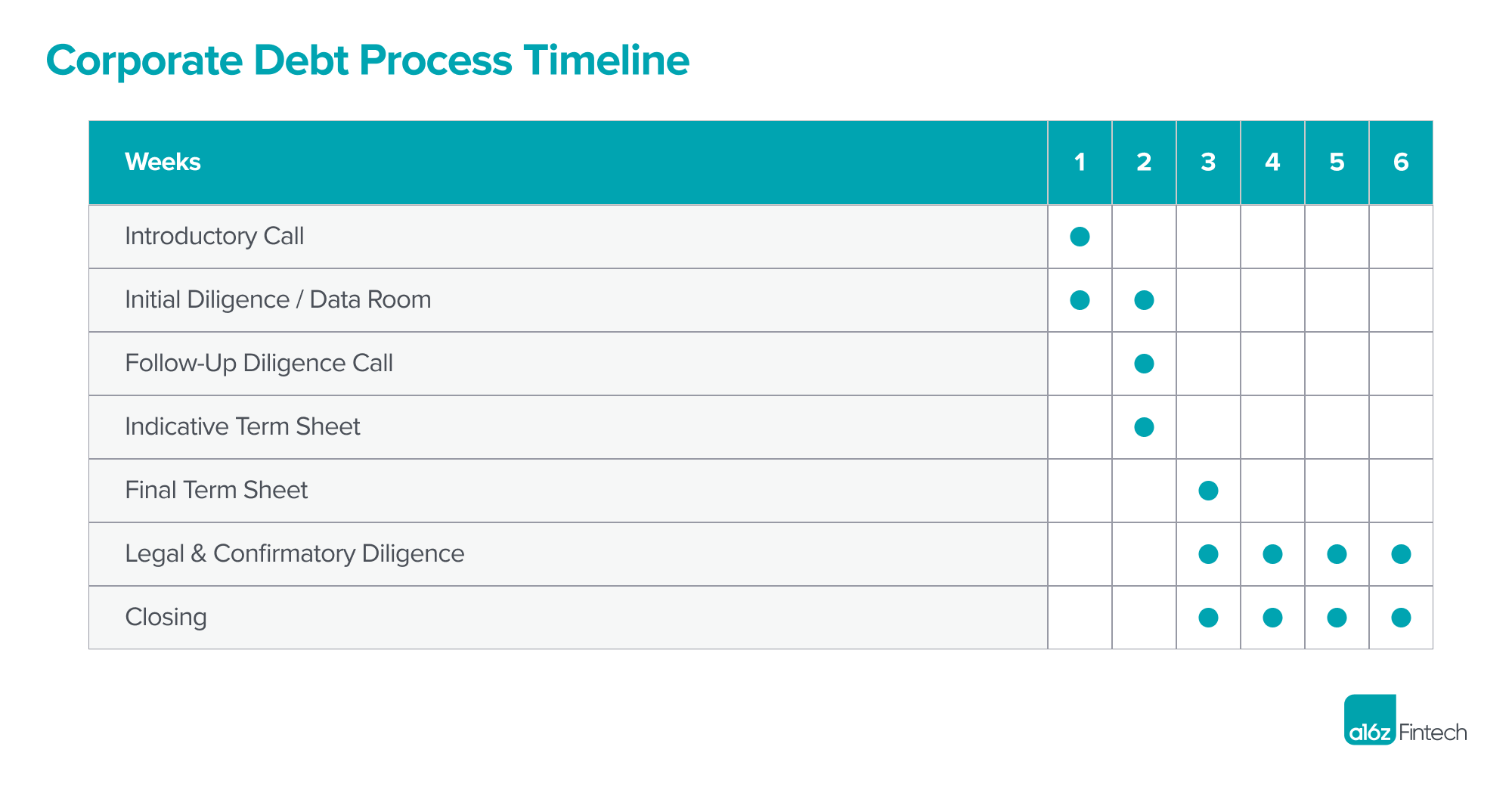

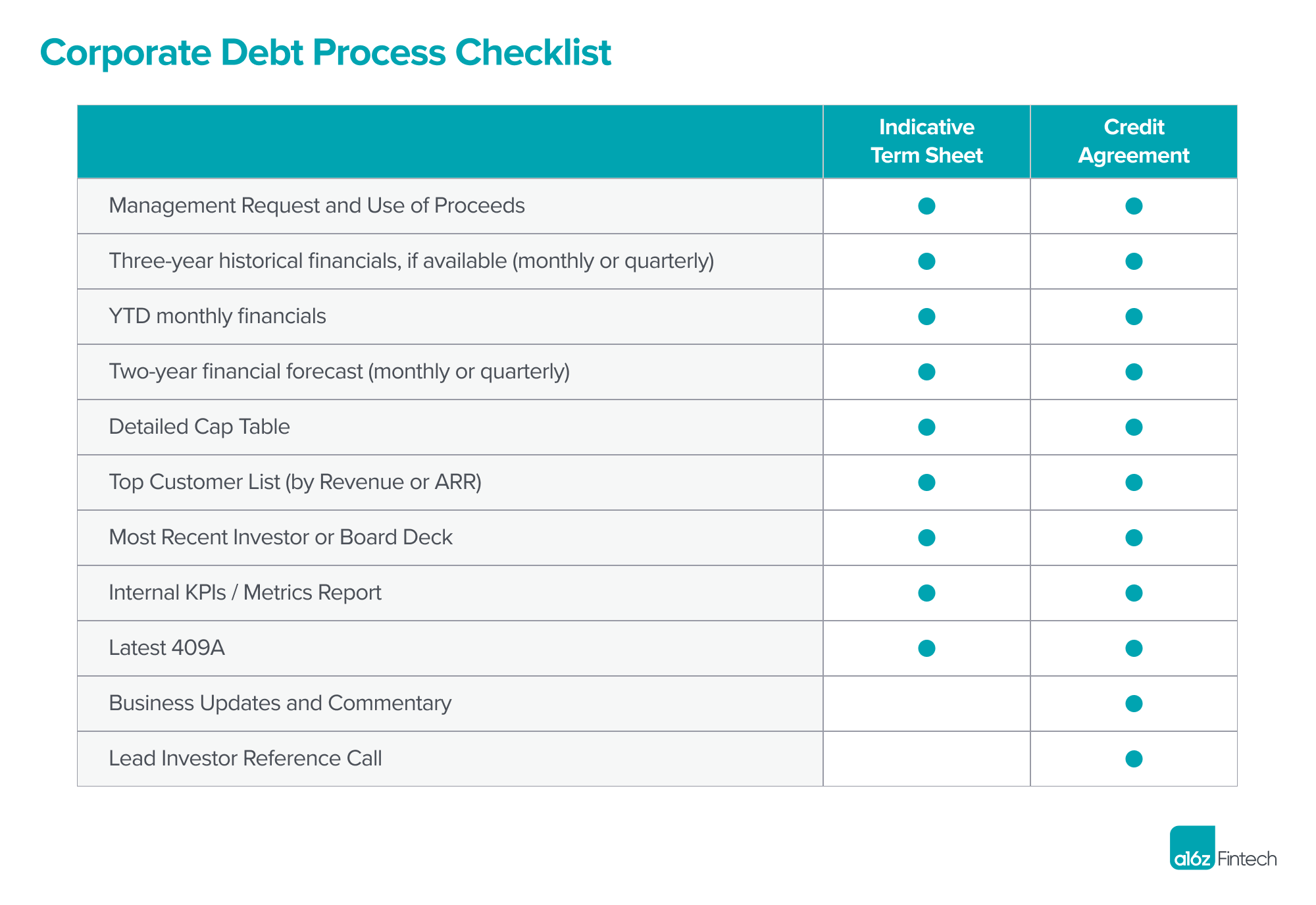

When raising corporate debt, companies should plan for a 4-6 week timeline from introductory call to closing. Introductory calls usually start with the lender seeking out information about, at a minimum: the company’s business overview, market opportunity and revenue model, funding history, valuation of last round, and what the company is looking to achieve with this debt raise.

Following the introductory call, the lender will request additional financial information that may include: historical monthly and/or quarterly financials (ideally with a balance sheet); updated forecasts, including cash forecast and burn; detailed cap tables; the company’s latest 409A; a top-customers list by revenue or ARR; the most recent investor or board deck (with the company overview, value proposition, market segmentation, and TAM overview); and if not already in the investor deck, key business KPIs (customer churn and retention, CAC and LTV, etc.). These diligence items are hopefully off the shelf (in a data room, usually coming off an equity raise) and lenders should sign an NDA to gain access to them.

After reviewing the diligence materials, lenders will look to schedule a follow-up call to go through deeper questions and provide initial thoughts on structure, as appropriate. Timing from introductory call to initial indication is typically 7-10 days. Once that indication has been agreed upon with the company, the lender will meet with their credit committee to obtain initial approval for indicative terms, while working towards a formal term sheet.

Once the lender issues a formal term sheet, the company usually engages in some negotiation to discuss outstanding items. These final negotiations to iron out key points usually take a week or two to close.

After the company signs the term sheet, the lender will begin legal documentation and work with their counsel on clearing conflicts to get a full loan agreement drafted. This usually takes about a week. Concurrently, the lender should request updated diligence items for their internal closing memo, which will primarily consist of confirmatory diligence and any items that have changed since the initial committee discussion.

For early stage companies, lenders are mostly underwriting based on existing investor support; with later-stage companies, they are underwriting to enterprise value and are more focused on company KPIs, churn, and related metrics. A key step in the confirmatory diligence process is when the lender does a reference call with the company’s lead investor; this allows them to better understand the investor’s investment thesis, the level of support the company is receiving, the capital the investor has invested to date and reserves for the future, as well as any other key areas of concern. This step is important, because once debt is drawn, a lender’s ability to recoup their principal will be primarily driven by future equity funding going into the business, either from existing or new investors. As such, lenders focus mostly on underwriting to key growth drivers or metrics tracked by equity investors.

Ideally, lenders look for 12+ months of starting cash runway prior to need for debt, but that can vary on a case-by-case basis depending on factors such as debt size, lender risk tolerance, capital invested to date, and the scale/growth of the business.

The closing process typically takes about 4 weeks, which allows for legal documentation negotiation, account opening (if the lender is a bank), and the completion of all necessary compliance documents. For corporate debt, normal venture counsel (e.g., Cooley, Goodwin, Gunderson Dettmer, or Wilson, etc.) should be sufficient in helping to identify issues and negotiate any outstanding points.

Asset-Backed Debt

The process of raising asset-backed debt takes longer and is more complex compared to raising corporate debt. It’s therefore critical for companies to retain experienced counsel early on, as the legal undertaking and documentation for the former will be much more drastic. We recommend working with law firms who have dedicated structured credit practices or professionals and ideally specialize in the fintech lending market (Paul Hastings is one example), as opposed to law firms who serve the VC market. It’s also worth noting that bank and credit fund processes for an asset-backed facility will differ. For now, we’ll define lenders in this section to include both banks and credit funds.

All asset-backed lenders will require an introductory call to the company. The introductory call is similar at a high level for both corporate and asset-backed debt, though the latter includes a more detailed discussion on the funding mechanics for the product being financed and backed by underlying collateral or originated assets (e.g., small business loans for their customers). A founder/CEO’s presence may also be necessary in helping lay out the full story. Lenders are likely to utilize a discovery template of 15-20 questions to help with their evaluation. Topics of discussion will include company overview, background of the management team (i.e., character assessment and expertise in scaling a capital program), competitive landscape and market dynamics, equity funding history and backers, cash position and runway expectations (including projected burn), planned future equity raises, go-to-market strategy, as well as details on sourcing new customers and channels for customer acquisition.

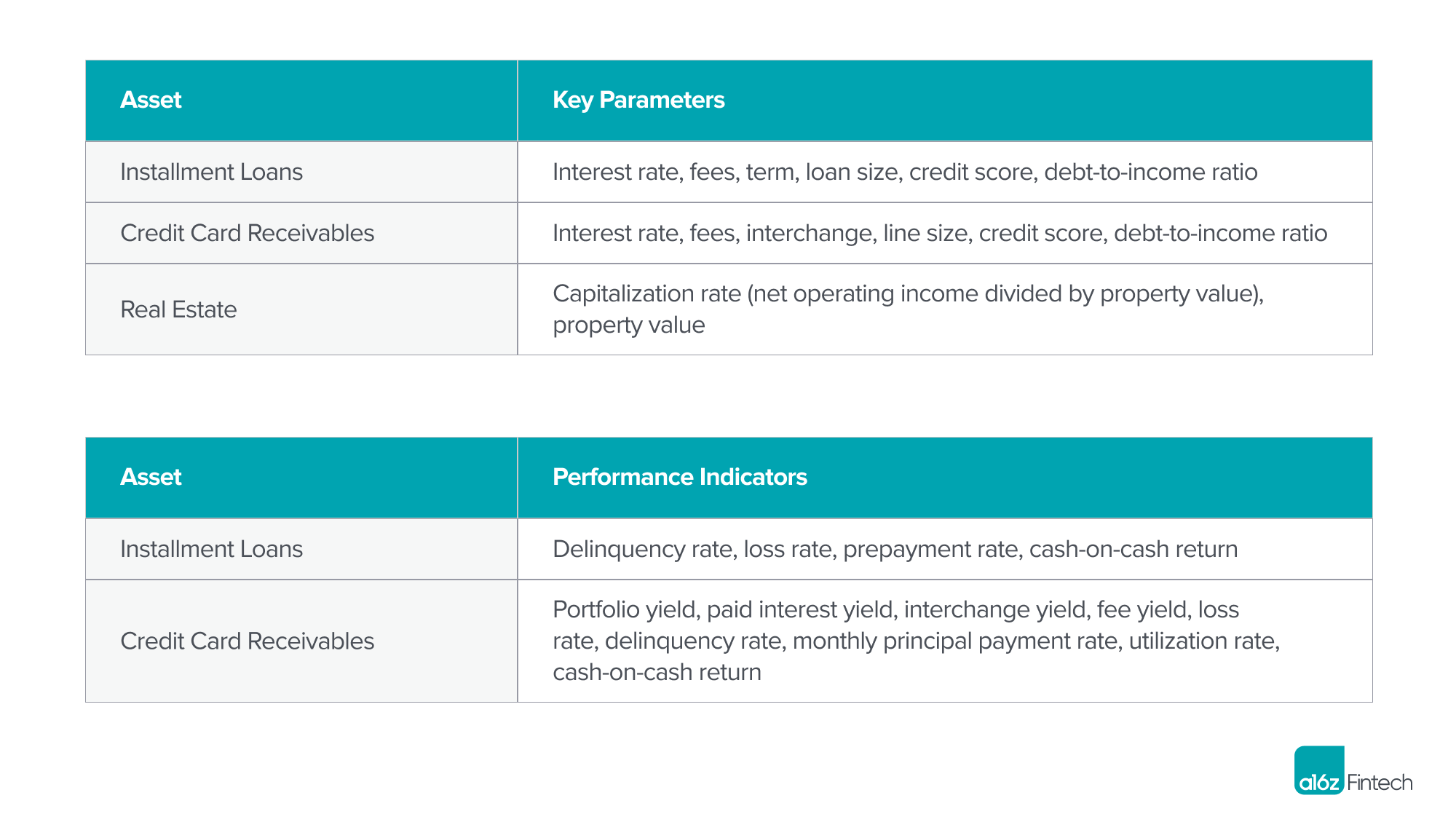

It’s also important for companies to walk through their business model and demonstrate how they make money. For example, an unsecured consumer loan originator can make money via net interest margin, origination fees, and/or loan sales. Whereas a credit card receivable originator makes money via net interest margin, balance transfer fees, and/or interchange fees. A real estate company makes money via leases and/or asset management fees.

Finally, lenders will want to dig into everything feeding into the asset piece of the equation. What type of asset is the company creating? Examples could include installment loans, credit card receivables, or invoices. How much volume has the company originated to date and what’s the company’s projections for origination volume in the next 12 months? What is the background of the company’s Head of Risk? How does the company underwrite and service assets? Does the company self-service or is it reliant on any third-parties or other vendors? How are these loan products regulated? What partners or licenses are required? Lenders will want to evaluate the key product parameters of the assets, as well as understand historical performance and future projections. Companies should make sure to be upfront about any challenges they’ve encountered with the product to date, such as changes in performance (if there is actual data).

Appetite and comfort around funding may also vary across situations. For example, some companies may have several existing products but require funding for a de novo product with minimal data. In such cases, lenders might look to other factors (e.g., has the company recently raised VC funding, are there a number of customers who are in existing similar products?) for consideration. Other companies may only have seed funding but are able to share enough origination data to demonstrate cash flows and performance.

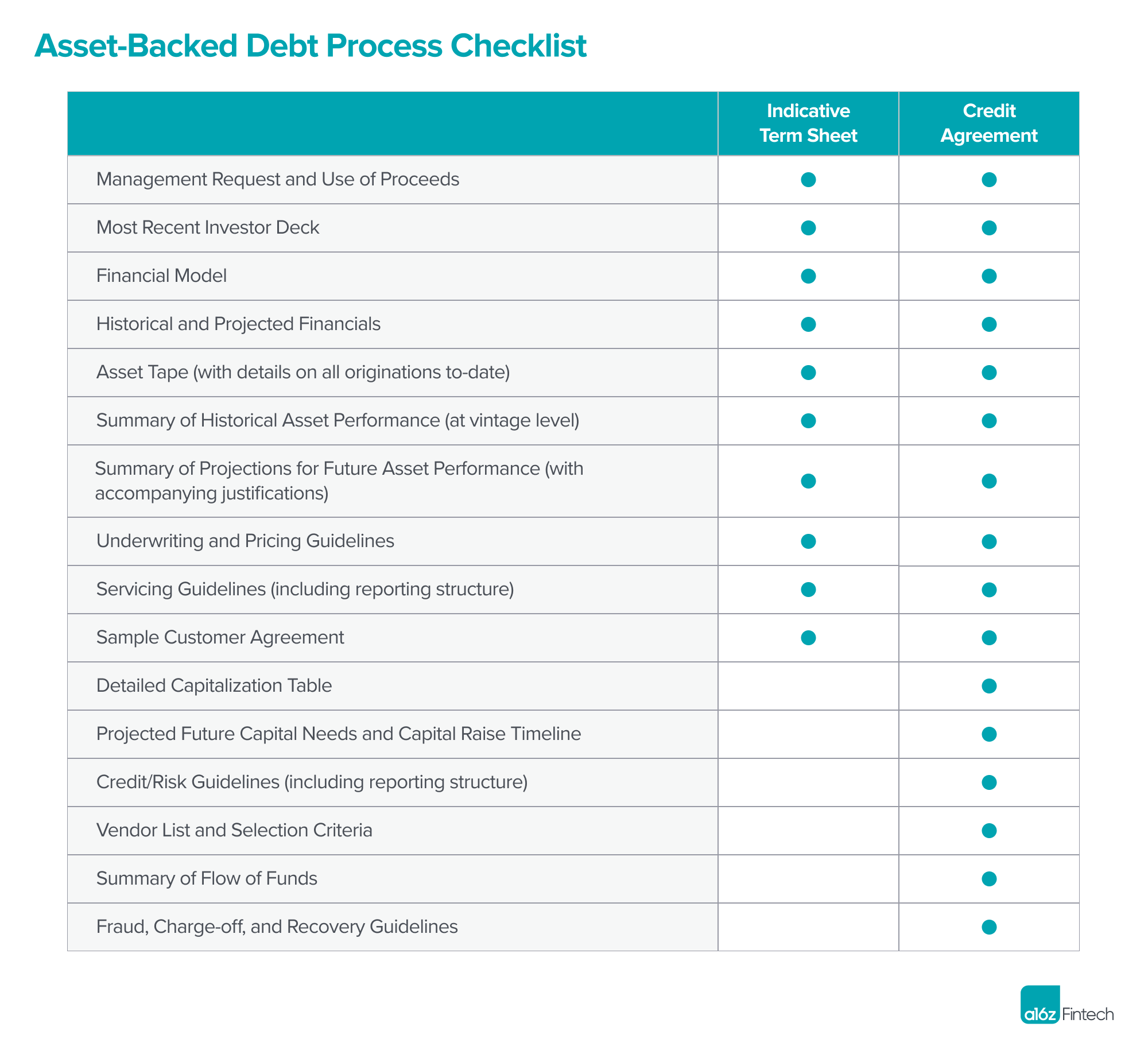

Most companies will organize a virtual data room for all the diligence items required, including company overview, financials, legal form agreement for the asset/funding, servicing and collections policy, collections waterfall (part of servicing), loan tapes, funding history, and investors (who they are and why they invested). Even if the loan tape is small, it can be helpful to share monthly data. As time goes on, companies build up a track record and sometimes daily performance can show enough to get lenders comfortable.

As lenders review diligence materials, they will perform extensive work on the underwriting policies that the company has in place. This includes assessments into loan tape (i.e., loan amount, loan duration, expected pay back, rate, etc.), asset pricing, factors that go into deciding yields, flow of funds, debt servicing, key vendors (i.e., outsourced servicers), and so on. These help determine considerations around sizing, advance rate, margin, and overall structure.

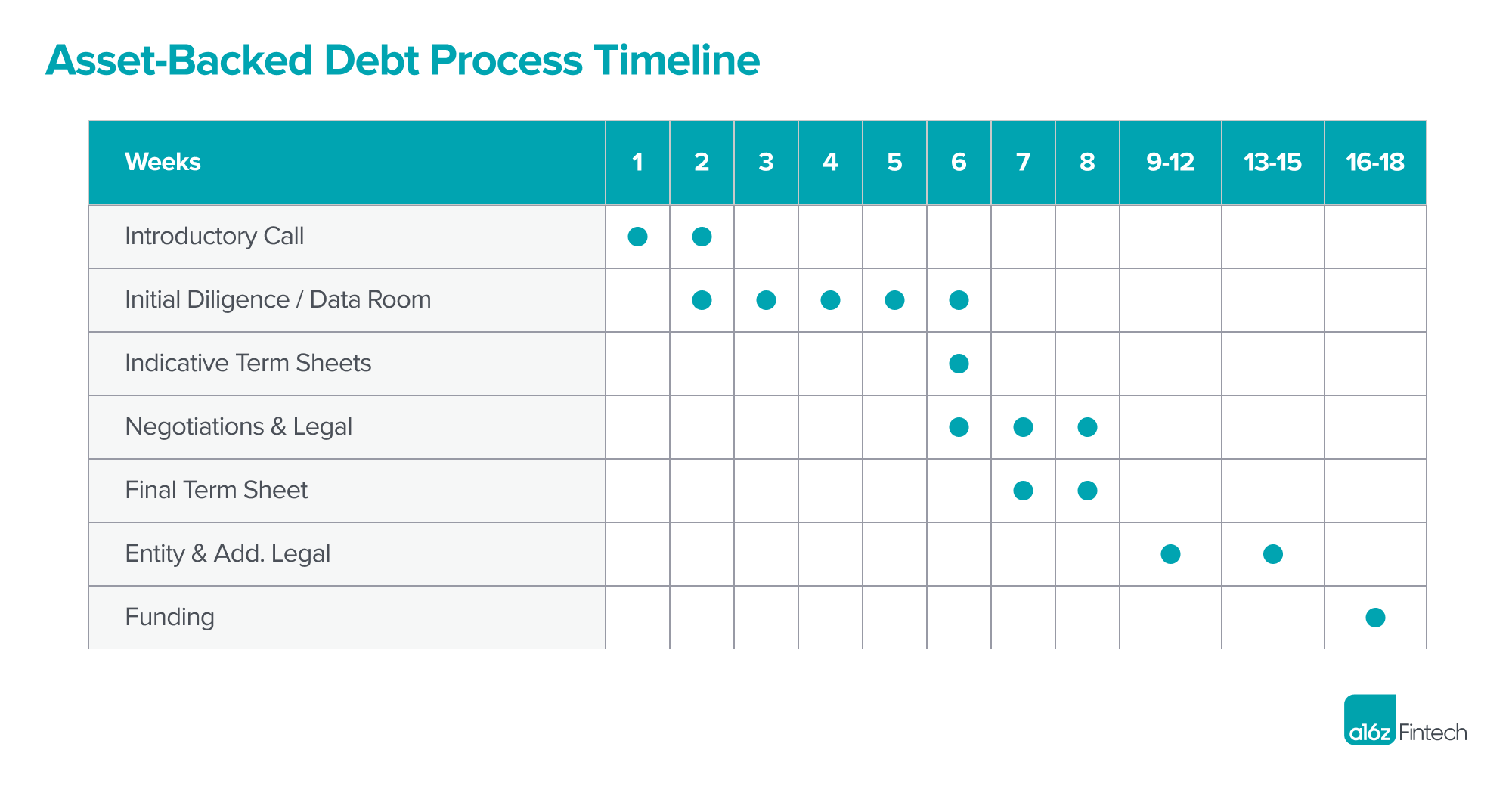

After reviewing, the lender should be able to offer a term sheet with advance rate, margin, concentration limits, etc. (Sometimes the term sheet may never get signed as some move straight into documentation.) Drafting the credit agreement will take 2-3 months and can take longer depending on counsel familiarity.

Key Considerations

Although most important points of consideration differ across corporate debt and asset-backed debt financings, there are a few common themes. First, it’s always important to have a plan and prepare well in advance of running a process. Having a good understanding of what you are seeking, who you will be speaking to, and what to expect in terms of diligence can help immensely in conserving time, resources, and money.

Lenders across both processes also put an emphasis on funding history, particularly at the early stages. Corporate debt providers want to gain insight into key investors, amount of equity raised, valuation from the most recent round, etc., while asset-backed debt providers want to understand other points such as whether you have raised enough money to create an asset or support haircut capital for the warehouse SPV arrangement (particularly at the early stage).

Timing is another key consideration across both processes. You’ll typically want to raise corporate debt coming off of an equity raise or when you still have significant cash runway. That’s compared to raising asset-backed debt, where waiting for more loan tape data can be advantageous (and potentially lead to better terms), though at the cost of the process becoming even more exhaustive and costly. Legal expenses can add up, especially for early stage companies. We’ve seen companies end up with a few hundred thousand dollars in legal bills. Aligning with your chosen counsel upfront and choosing to cap expenses at a certain level will be helpful in mitigating these situations.

There are a myriad of other points to emphasize when embarking on a process for asset-backed debt. As previously mentioned, being on the same page and speaking with debt negotiation counsel early on can help set you up for success later, particularly during the documentation phase. Working with a capital provider who you have a connection with, can be a good business partner, and understands the assets in which you are producing will pay dividends in your day-to-day post-raise. Make sure to also seek help and prepare well in advance (as opposed to building a program while running a process) with materials such as a proper, digestible model/waterfall and a clear summary of flow of funds and mechanics. These will all help better guide the conversation and hopefully lead to an optimized outcome. Refer to our prior piece for thoughts around trade-offs of key terms as you think through preparation and positioning.

For companies who are unsure and in the early stages of deciding whether they want to raise corporate or asset-backed debt, having conversations on both in parallel can often provide clarity on the best arrangement for the company at that point in time. Alternatively, there are also asset-backed lenders who are able to provide a promissory note and partner with you in advance of an eventual facility. Remember that credit structures can take multiple forms and most lenders are open to getting creative.

Conclusion

It takes time and effort to get a facility in place. It’s not always straightforward, and we highly recommend being prepared before you begin discussions and sticking to a timeline in order to run an efficient process. Any time spent focused on funding discussions will be time away from building your company.

If you’ve finally closed your facility, how do you manage it going forward? What’s the best way to report to your lender? There are nuances around reporting and various software products in the market for originators to gather required documentation/validate that the originated assets fit within the eligibility criteria set by the lenders. These solutions can also automate a lot of the ongoing portfolio performance against things like eligibility criteria/performance triggers, etc. Stay tuned for the last installment in our debt series, where we will work with a few providers to share the best way to manage your debt facility and tools to save you both time and resources.

Thank you to Len Losquadro from Cross River Bank, Ruslan Sergeyev from Stifel, and Reid Bartlett from Silo for contributing to this piece and to Atalaya, Clear Haven, Column, CoVenture, Upper90, Victory Park, and others who have shared their views.