This article is the final installment in our series, How Fintech Companies Can Simplify Their Funding Strategy. Read part 1 on Choosing the Right Funding Structure here. Read part 2 on Trade-offs Across Terms here. Read part 3 on Executing a Debt Raise here.

Congratulations! After weeks (or months) of negotiating, you’ve finally closed on your facility. If you’ve drawn on a line from your venture debt facility, money has been wired to your business banking account. Or if you’ve raised a warehouse, you can now fund and originate loans that will be repaid by a financing partner.

What happens now?

Throughout this series, we have provided many resources to prepare you for this stage of your business journey. We’d like to wrap up by focusing on how to manage debt post-closing.

Given that lender-negotiated key terms impact origination parameters and limit certain business operations, what tools and which best practices should you leverage to ensure you stay compliant while managing your business efficiently against those covenants? With the combination of diligence solutions (e.g., third-party calculation agents and paying agents) and demands set by lenders, how should you best manage your facility to meet these ongoing requirements?

For this article, we interviewed multiple lenders to glean their guidance and insights. We also sought the advice of several software providers who work with fintech borrowers to get their best approaches to managing one or more debt facilities.

Armed with these considerations and guidance around invaluable tools — many often not mentioned as part of the debt raise process — you’ll hopefully stay on top of all your contractually required reporting, tracking, and much more.

Credit Agreement and Funding Mechanics

The credit agreement, that lengthy document dedicated to formalizing your credit arrangement with the lender, outlines many of the key terms and ratios necessary for compliance. Reporting, in line with the terms of the agreement, will be necessary once the arrangement has been finalized.

For asset-backed debt, at a bare minimum, lenders will likely ask for monthly reporting packages consisting of loan tape metrics, consolidated (sometimes audited) financial statements, and accounts payable and receivable within 30 days of month’s end. Certain data points can put a company in default, so it’s absolutely critical that companies make sure they are compliant at all times, stay within their concentration limits, and calculate their borrowing base accurately. Similarly for venture debt, monthly financials will be shared as part of reporting requirements.

Certain workflows, such as calculations and borrowing base reporting, will need to be set upfront to assist with the maintenance of ongoing funding requests. Depending on the underlying asset class and sophistication of the borrower, there may be additional requirements specified by the lender.

We encourage fintech companies to work with lenders on their requirements and to have open discussions on what needs to be reported. Some fintech companies may even begin to set up automated tools before the facility is put in place. This should alleviate some of the stress post-closing and set companies up for immediate success.

Next, let’s review some of the relevant concepts from negotiating your first facility that relate to funding mechanics.

Eligibility criteria are the requirements that need to be met in order to originate an asset within the facility. Examples can include things like minimum FICO scores for consumer loans or minimum time-in-business or debt-service coverage ratios (DSCR) for small businesses. Note you can still originate “ineligible” assets, but you’ll need to use your own capital to fund them.

Criteria to originate an asset within the facility may also include concentration limits — which cap the percentage of portfolio concentration in any given geography, industry, risk bucket, etc. — or set min/max bounds on the interest rate for products you originate as well as overall gross yields expected in the portfolio.

The eligibility criteria will help define and outline the credit box (i.e., acceptable funding parameters and risk metrics) by using upfront, non-performance driven data such as revenue, time in business, and minimum FICO. Separately, there are performance criteria you will need to monitor and track against over time.

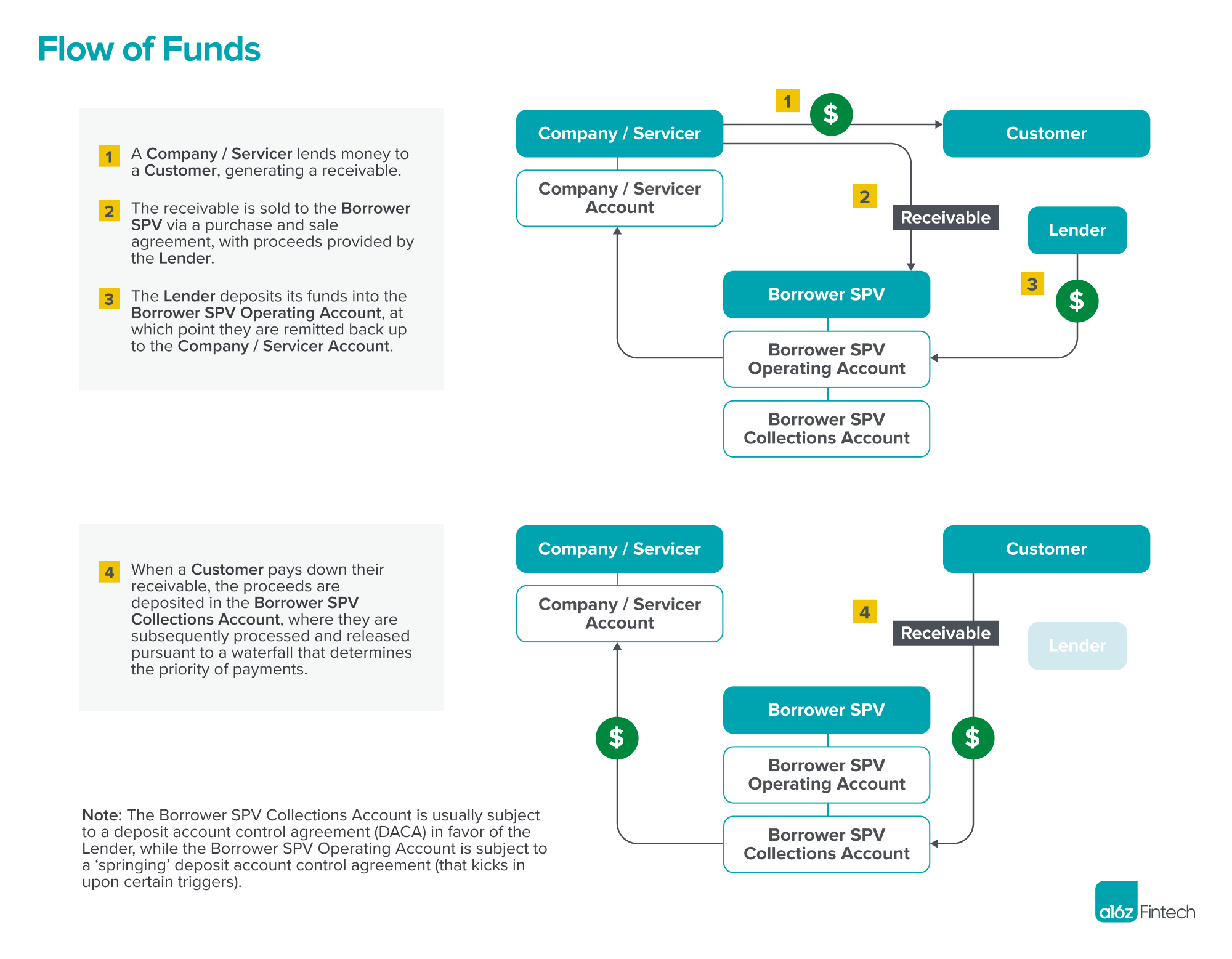

Using a small business borrower as one example: an end customer will go through a front-end loan application to make sure it complies with all the relevant criteria and fits within the credit box. If the application is approved, then the loan amount (minus an origination fee) would be funded to the customer. The loan would then be originated and recorded on the borrower’s balance sheet before being “sold off” to the lender.

Historically, originating a loan involves completing a number of tedious tasks including: organizing the data, assigning a loan ID, uploading all required documentation dictated in eligibility criteria, and working with a third party who acts as a diligence agent to validate the assets and perform an independent review. If no disqualifying criteria exist, the loans are pooled together, in batch, over the course of a week (or longer) and sent off to the lender. The lender would then wire money back through a separate bank account.

In some cases, a company will retain loans for 2 to 7 days to season them and establish itself as the lender of record, for regulatory purposes. Once these loans are seasoned, they are sold to the SPV / warehouse vehicle. However, since the SPV / warehouse vehicle is often consolidated to the company’s financials, the company must continue to report these assets on its books for financial statement purposes.

Having a tool to automate all the granular tasks involved in funding can save companies both time and money (i.e., equity tied up in a loan) — more on this below.

Servicing, Verification, and Reporting

Lenders we spoke to highlighted 3 key workflows pertaining to facility management: servicing, verification, and front-end analytics and reporting. Certain software and services providers have the ability to do all 3; other times the roles are divided.

Loan servicers are responsible for collections, where they auto debit gross principal and interest payments from a bank account and wire them to the lender. Lenders take gross principal and interest payments from the loan tape provided by the servicer, transpose that loan file into a master Excel sheet, and analyze portfolio performance from the repayment history. The portfolio performance is then compared to the parameters outlined in the credit agreement to ensure no covenants (i.e. max delinquency / default rates) were tripped. Companies often use a third-party servicer or in cases where they service the loans themselves, lenders typically require a back-up servicer who can step in and manage the portfolio if the company goes out of business.

For verification, lenders must approve assets in order to classify eligibility. Making sure that assets fit all the criteria can be manual and done in batch, or they can be done continuously.

Another key part of managing a facility is having a dashboard for front-end analytics reporting. Workflow tools (such as Setpoint, Vaas, and Finley) offer solutions for detailed loan information-enabling companies to track and stay compliant within their agreement terms.

Tooling for Asset-Backed Debt

Along with educating operators on what to expect in managing and reporting on a facility, we also wanted to shed light on companies who are providing automated tooling.

Unsurprisingly, a significant portion of today’s capital markets workflows (both internal and external) remains manual and error-prone, dominated by Excel files and email. Manually managing these processes can significantly inhibit growth, impact equity efficiency, and lead to a higher cost of capital. In the worst case, errors can result in an inability to extend or access debt capital entirely. To avoid this, management should carefully consider the internal infrastructure around their capital markets workflows and ways of automating key tasks.

Though there may be a bias towards building in-house, there can be significant benefits to partnering with solution providers who have a broad product offering and deep institutional capital markets knowledge. Not only can it be more scalable and cost-effective, these tools also free up expensive human resources from tedious, minute tasks to focus more on core revenue drivers, helping strengthen a company’s competitive positioning and strategic initiatives.

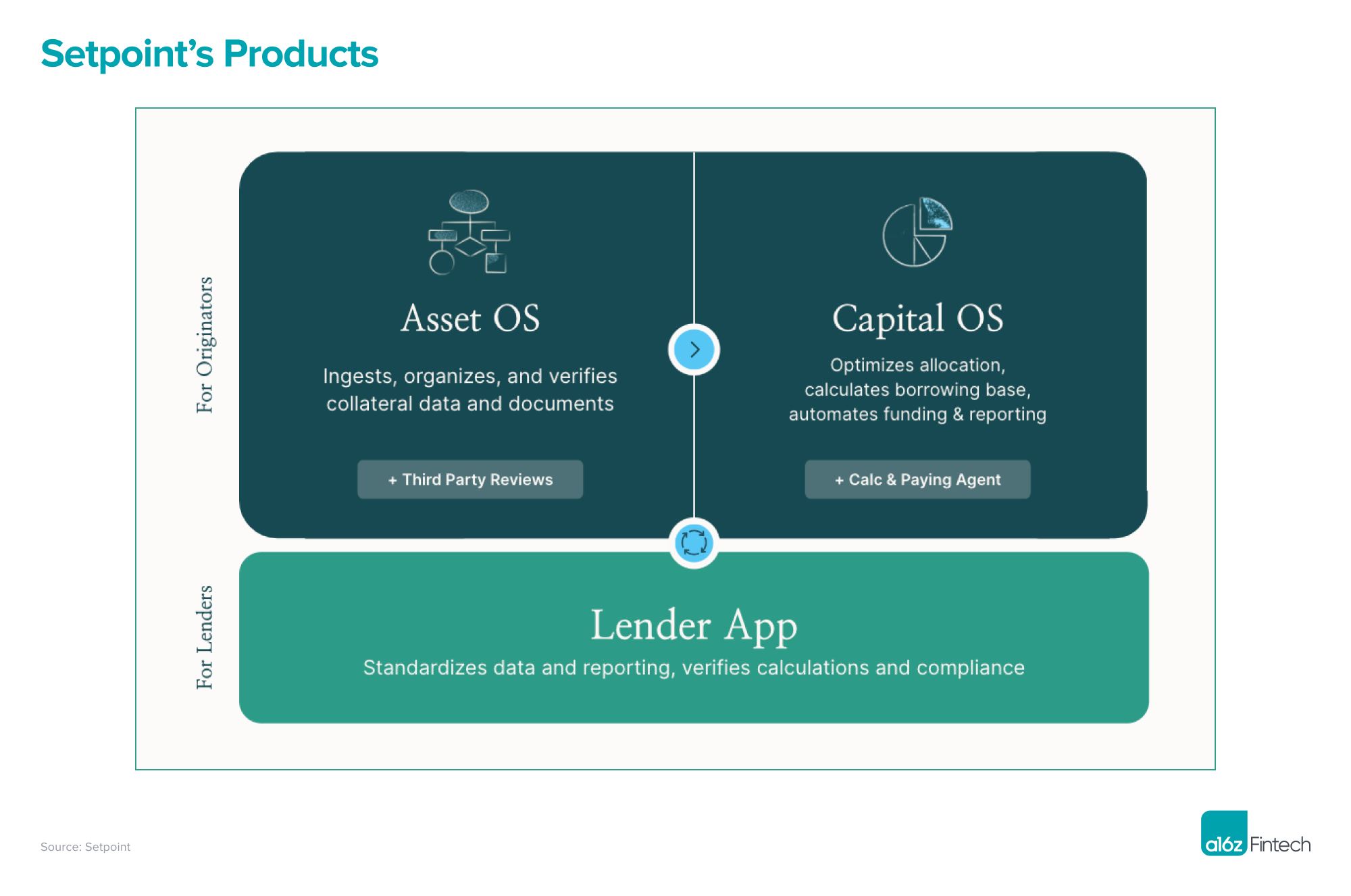

One company seeking to modernize these processes and provide a better solution is Setpoint, one of a16z’s portfolio companies.

Setpoint

Setpoint is a finance management system that seeks to improve the interaction between borrowers and lenders, and markets itself as a solution to manage all operational aspects of the secured debt capital markets. Its software allows borrowers to grow from an initial warehouse or asset-backed facility into a capital markets-funded issuer by giving them access to the most efficient capital across securitization, whole-loan buyers, banks, and private credit funds.

Lenders can use Setpoint’s products to streamline reporting verification, portfolio analytics, and third-party validation of collateral. According to Setpoint, they currently manage in excess of $18 billion in debt facilities and annual transactions across asset-backed securities (ABS) and asset-based lending (ABL) asset classes, including consumer loans, residential mortgages and properties, SMB, factoring, supply chain finance, and equipment finance.

Setpoint helps companies that rely on access to debt capital set up the appropriate infrastructure and processes to help them meet the zero-defect requirements of capital markets. Such automated products help eliminate the need for manually managing capital markets operations across workstreams, which is not sustainable, scalable, or error-proof.

According to Setpoint, its product suite has materially improved the efficiency and error rate of processes related to collateral management and reporting reviews. Verification of borrowing base reports has been cut from hours to minutes, and collateral review processes have been shortened by days while reducing error rates by 17%. More importantly, its optimal allocation algorithm has driven a material reduction in the cost of capital, as much as 65 bps, by helping borrowers determine the optimal allocation of assets across their funding sources.

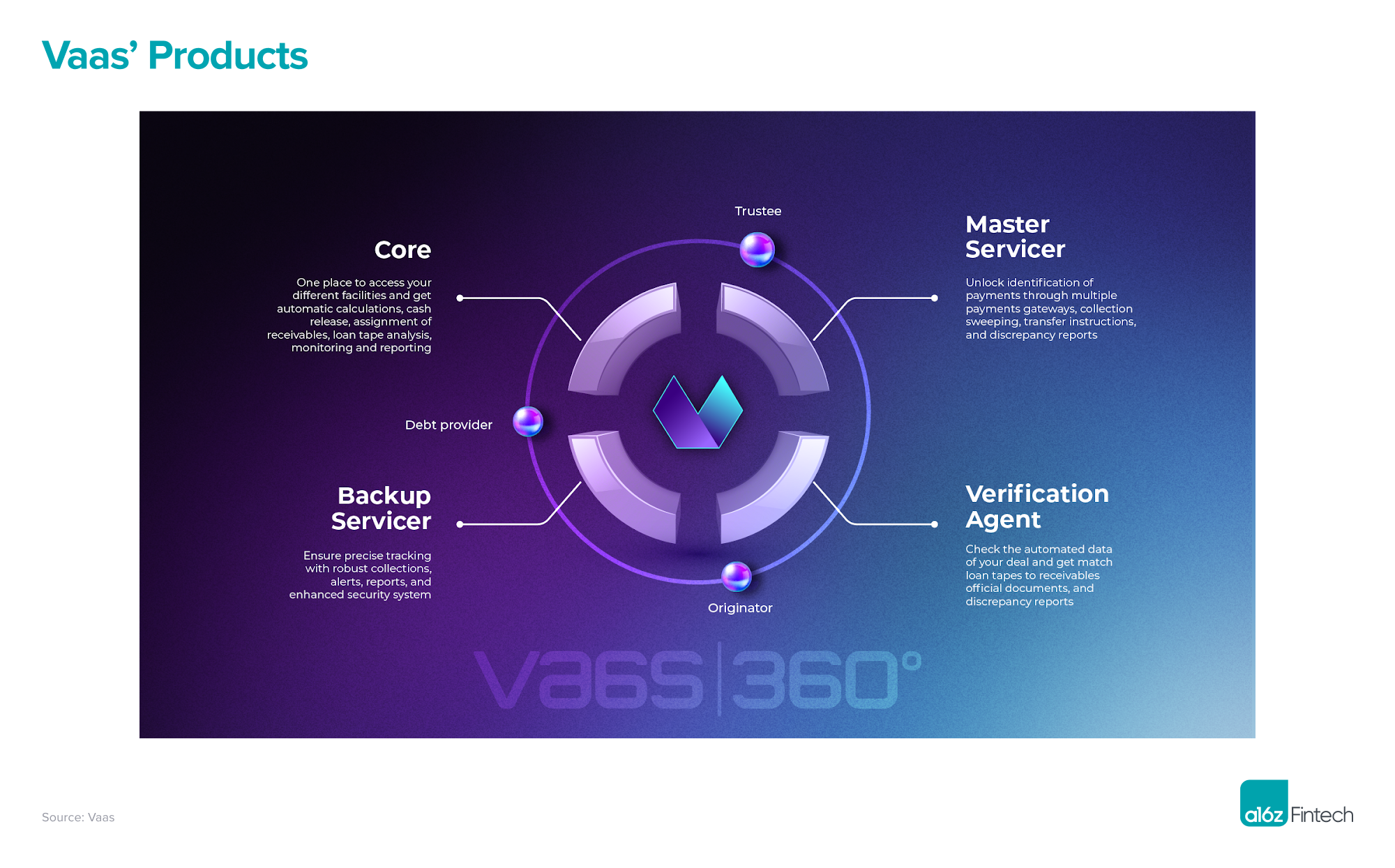

Another company from the a16z portfolio that is also looking to automate and improve processes, but with a focus on the secured debt capital markets in Latin America, is Vaas.

Vaas

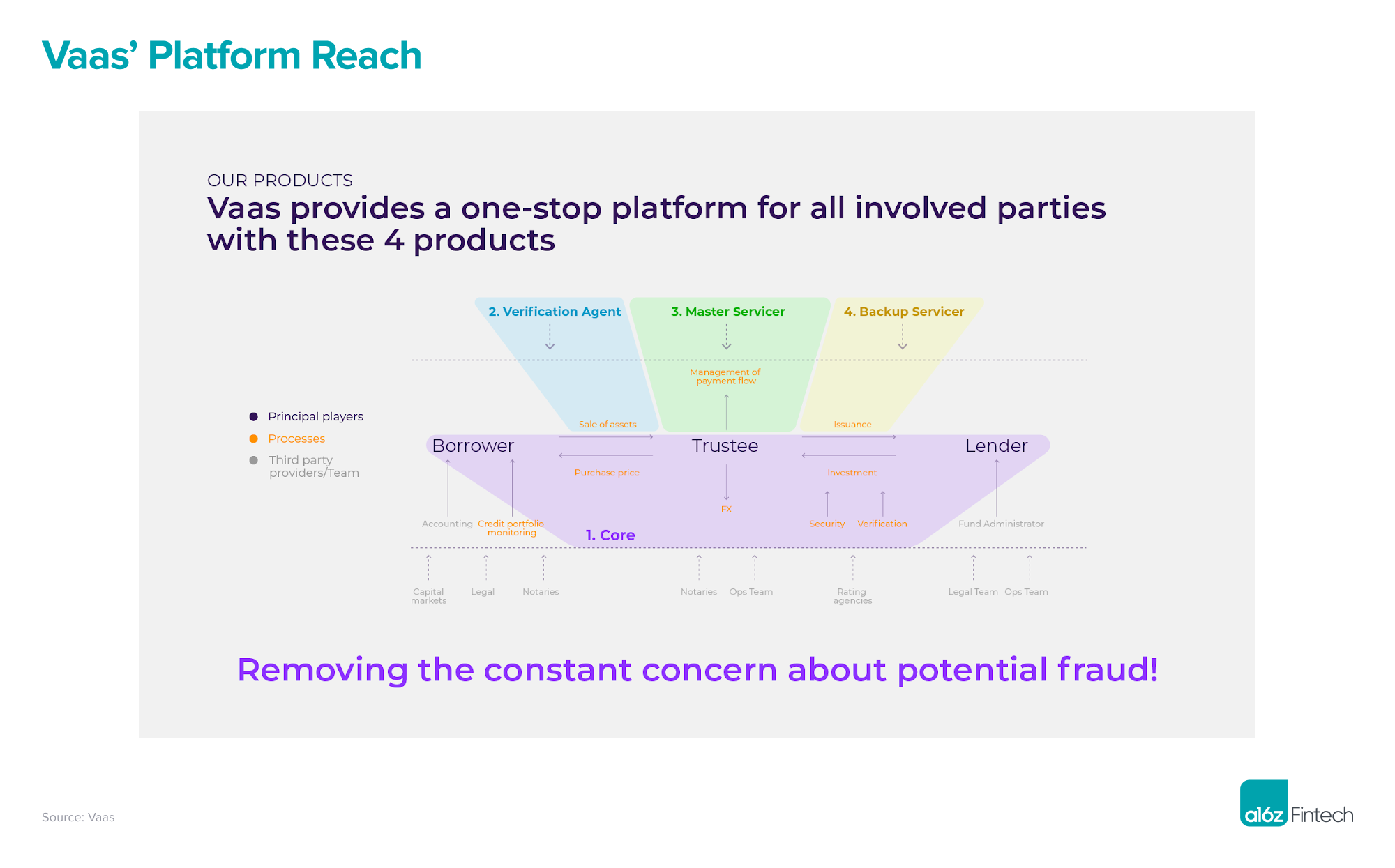

Based in Colombia and Mexico, Vaas is focused on building a developing platform for the operations of asset-based facilities in Latin America. The company houses 4 solutions to assist in streamlining day-to-day reporting and support borrower SPV / trust structures in Latin America: Vaas Core, Verification Agent, Payment Reconciliation with the Master Servicer, and Backup Servicer.

Vaas Core automates borrowers’ day-to-day capital markets operations and reporting, with the ability to manage different currencies, derivatives, multi-level approvers and signees, regulatory forms, funding requests, and borrowing base optimizations.

Verification Agent offers verifications demanded by lenders and trustees. It ensures the consistency of large document volumes and legal compliance with local jurisdictions for asset movements. Utilizing AI tools and a comprehensive data warehouse, Vaas delivers detailed reports catered to lenders’ requirements.

Payment Reconciliation and Master Servicing identifies each payment from individual customers, reconciles these payments with bank statements, and issues transfer instructions based on the legitimate ownership of the underlying assets.

Finally, Backup Servicing assumes responsibility for primary servicing and recovery efforts by establishing connections with a broad spectrum of primary servicers and collection agencies for various asset types. The service maintains control over payment directives and loan management.

By managing over $400 million in committed capital and understanding borrowers’ capital market operations, Vaas offers advice and technical expertise on compliance, legal, and financial strategies. Vaas seeks to address the critical demands of the Latin American market, while setting new standards for scalability and reliability. It also aims to empower investors of all sizes — banks, private funds, family offices, and beyond — to direct their strategies towards transparent and dependable opportunities in a dynamic and diverse region.

Both Setpoint and Vaas are addressing the problems of debt facility management by not only focusing on automating workflow and structuring data, but also taking the extra step of providing transaction diligence services, such as ensuring that a particular asset is verified.

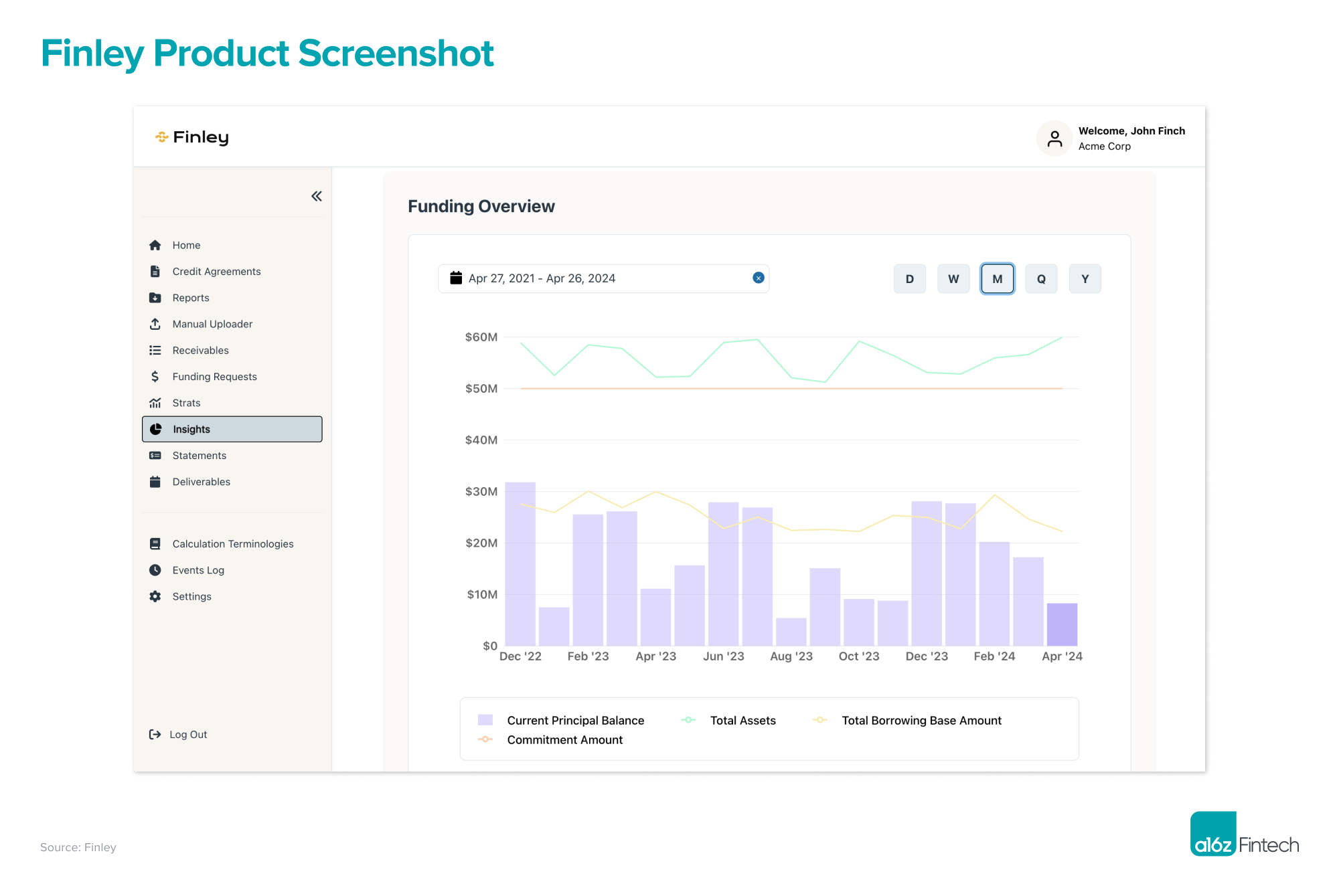

Finley

Finley is another startup that is building debt capital tools to help streamline the lender-borrower relationship. While many of Finley’s early customers were fintechs involved in specialty finance (e.g., Ramp, Navan, and Arc), the company has also launched lender-focused products in funding automation, asset and calculation verification, and portfolio management.

At its core, Finley serves as the “referee” between lenders and borrowers in debt arrangements that involve anywhere from $25 million to $2 billion in collateral-based loans. Lenders may include banks, and borrowers may be VC or non-VC backed companies.

Within the private credit space, and asset-backed loans in particular, it can be difficult for lenders and borrowers to stay on the same page when it comes to contractual obligations, consistent data and reporting formatting, loan covenant tracking, and asset performance.

The root of this problem is contractual complexity, and it is difficult to translate rules defined in credit agreements into data checks or workflows.

Finley’s software takes a 3-step approach to managing and simplifying the relationship between lenders and borrowers:

- Credit agreement digitization. Finley’s software digitizes all the unstructured information in a credit agreement and converts it into structured data, which it then feeds into a proprietary processing and automation engine. For example, if a credit agreement references a benchmark interest rate such as SOFR, Finley will map this field to a programmatic interest rate feed for real-time interest calculations.

- Data standardization and workflow automation. Finley uses customer data and credit agreement data from the previous step to automate common workflows (e.g., funding request generation) and generate alerts (e.g., deadlines or covenant threshold breaches). Historically, these tasks have been manual and error-prone.

- Advanced analysis and alerting. Finley provides continuous visibility into credit facility KPIs to make sure borrowers and lenders know how their loan performance might be changing over time. For borrowers, this might mean drilling down into daily or weekly changes in borrowing base availability. For lenders, this might mean analyzing vintage curves of loan portfolios. The capital markets function has historically been viewed as a cost center, but having real-time visibility into the business impact of capital markets operations (e.g., cash freed up on the balance sheet) can give this function the attention it deserves.

By creating a “system of record” for borrowers and lenders alike, Finley says it is giving borrowers peace of mind when it comes to capital availability, while also ensuring that lenders know exactly what’s going on across their portfolio of loans.

Tooling for Corporate Debt

Venture debt reporting is a simpler process of maintaining compliance with your lender, though there are similar high-frequency, recurring actions that need to be undertaken.

Borrowers are required to provide financials, cash balances, and other relevant information on a regular basis so that lenders can monitor the borrowers’ financial performance. Similarly, borrowers are also required to provide certificates confirming compliance with specific financial covenants or obligations outlined in the loan and security agreement. These covenants can often become complicated to track, particularly for lenders, which is why some level of automation can be extremely beneficial for all.

Lumonic is a startup building a private credit management platform, beginning with venture debt.

Lumonic

Lumonic is a private credit management platform that automates reporting and compliance for borrowers and lenders. Lumonic supports any kind of loan with one or multiple lenders and helps with tracking key metrics, loan terms, and covenants. Whereas other providers start with the borrower, Lumonic sells into the lender (credit fund / bank) and is linked to companies or borrowers once funded.

Today, there are few software solutions within private credit. Lumonic’s first product for lenders serves as a business process automation platform and is initially focused on solving the pain points of high-frequency reporting actions for borrowers.

For example, a key step that is often difficult during closing and post-closing is the signing and execution of deposit account control agreement (DACA) accounts, particularly when they’re designed for specific transactions. Because DACAs are set up in favor of lenders with specific triggers, they require significant coordination and maintenance on the parts of lenders, borrowers, and banks alike. Having a structured workflow can help significantly in easing potential turmoil for borrowers, including after a loan is paid off. Lumonic helps by connecting directly to the borrower’s bank accounts and simplifying workflows for the lender, so that various processes can be handled through the click of a few buttons.

How does it work for a lender using the platform? Lumonic onboards borrowers after loans close and provides a single source of truth per borrower and portfolio-wide, on deal-specific covenants, compliance status, and significant credit changes.

Most importantly, the biggest competition here is Microsoft’s Office suite and other outdated internal systems with little functionality beyond storing data.

Asset-backed and corporate debt tooling can be a gamechanger for businesses managing their facilities, but they also come with many considerations. How should companies strategize when to build automated internal tooling versus when to buy them? What are things to look out for when evaluating external solution providers?

Every company will have to answer these questions for their own specific circumstances. But to help you assess your situation, we asked the team at Setpoint to share some insights.

Build Versus Buy

According to Setpoint, companies should carefully consider their internal build / buy tradeoff and take into account the entire workstream as well as future growth when deciding what to do. The decision should encompass workflows for assets / collateral (e.g., data tapes, performance) as well as debt (e.g., compliance, cash flow allocation, projections). Having to manage multiple warehouses, securitizations, and future flow purchase contracts, each with unique requirements and covenants, will add significant complexity.

Additionally, while the capital markets function is an important part of your platform, your expensive in-house engineering resources should be dedicated to mission-critical disciplines and revenue drivers such as go-to-market strategy and customer-facing product development, rather than improving debt facility management.

The engineering, product development, and capital solutions teams at the various tooling providers outlined above think about nothing but streamlining and optimizing the lending process. Their products require no client engineering resources, and customers benefit from a steady stream of ever-improving innovations and enhancements. For example, Setpoint’s deep institutional knowledge of asset-backed lending and market standards can give you a leg up in ensuring your debt facilities don’t result in unintended inefficiencies and friction.

Considering Partnerships

As with outsourcing any other parts of your business, it is critical to understand the capabilities of the team and software you are dealing with.

Understand any asset class or counterparty limitations. Many providers may focus exclusively on consumer loans, residential assets, or a limited subsegment (e.g., startups only) of the market. Confirm that your particular asset class is supported, or that any future asset classes you may need can be added. Additionally, ensure that your partner understands the uniqueness of your business model. You are not a professional borrower; you have a company that is supported by your capital markets’ activity (not the other way around).

Have an eye to the future. If you only have one warehouse now, you will likely need more. This will require you to access the securitization market in the near future or consider tranching your next facility with a mezzanine lender. Can your partner’s solution support that? Does it understand those structures and can the team advise you on what each of these iterations mean for your business? Many third parties in the space can only support unitranche structures and rely upon manual or Excel-driven borrowing base calculations in the background.

Assess the stability of your partner’s platform. Just as balance sheet strength and stability form the necessary foundation for your business, your software partner should have staying power and an ability to invest in innovation. Focus on key areas such as financial strength, liquidity runway, single customer risk, nature, and size of equity investors. Consider whether your partner will be able to grow with you and serve as a long-term solution.

Get intimate with the provider’s onboarding process and expertise of its capital-solutions team. You need a partner who has been in the weeds of structuring and managing countless debt transactions and interpreted and implemented hundreds of loan agreements, both for borrowers and lenders. Ensure the provider’s capital-solutions team is involved early on in the process so that they understand the full scope of what’s required.

Conclusion

Closing a facility is far from the end of a company’s debt journey. Finalizing a debt fundraise leads to a whole new stage of operations with a myriad of considerations to track and report. It is of utmost importance to stay closely tied to the lenders’ expectations and requirements.

Hopefully, we have shown that various tools and software providers aiming to modernize outdated workflows can increasingly assist in these manual processes. The time and money saved with these tools can keep you in good standing with lenders and focused on what’s most important: building your company.

Thank you to Bart Steenbergen, Roby Farchione, and Priya Shah from Setpoint, Valentina Valencia, Juani Calivari, and Juliana Gomez from Vaas, Jeremy Tsui, Josiah Tsui, and Mary Fischetti from Finley, Kevin Hsu from Lumonic, Kwaw de Graft-Johnson from ATLAS SP Partners, Drew Pelletier from Upper90 for contributing to this piece, and to Atalaya, Stifel, Victory Park, and others who have shared their views.

- In the Vault: Turning Developers Into Clients With Marco Argenti From Goldman Sachs

- In the Vault: Finding a Single Source of AI Truth With Marty Chavez From Sixth Street

- Investing in Crux

- B2FI: Demystifying Software Sales Into Financial Institutions

- It’s Time to Raise Your Debt Facility: Execution Tactics for Founders