Effectively monetizing any new technology is a race to capture market share while still giving yourself room to grow your business. But the stakes are much higher with generative AI: though it promises to deliver unprecedented value to businesses, it can also be very expensive to serve to each incremental customer. At the growth stages in particular, founders need to be mindful of their unit economics and margins. We often hear these founders ask: how can I capture the value created by genAI? Should I eat the cost of my genAI features, or pass it along to customers? Will my customers actually be willing to pay for genAI and if so, how much?

We’re in the very early days of genAI and until adoption curves and costs stabilize, there won’t be any tried-and-true pricing or packaging frameworks. That said, we’ve outlined how we’re thinking about pricing and packaging in a part of the market that’s debating how to monetize their new genAI feature—B2B SaaS and prosumer companies—and how we’re seeing other companies approach the same question so you can better understand where your strategy fits in today.

Triangulate early usage, customer personas, and product mission

As with any pricing and packaging exercise, the best place to start is to understand:

- How much value your feature delivers and to whom, and

- How much serving that feature costs

Then, square those findings with how core you think genAI will be to your overall product offering.

Some of this will be more art than science, since founders are still figuring out what value genAI delivers to customers and how much it costs. That said, your early usage and customer personas can give you insight into both of these vectors.

Beta and early usage

For beta and early usage, you want to understand which customers are using your product, how often, how much it costs you to serve them, and how much they’re willing to pay for a genAI feature. For instance, it’s important to dig into the following:

- Does it increase your TAM? (e.g., were you previously serving 10 customers and can now serve 100?)

- Does your genAI feature increase conversion from a free to a paid tier, or a higher paid tier?

- Does your product have a base of power users who account for the majority of the feature’s use? If so, how are they impacting your COGS?

Customer personas

For customer personas, you want to figure out which personas are willing to pay and which aren’t. Do all your customers realize value from the genAI feature, or just some?

A good way to learn more about your customer personas and segments is through interviews, surveys, and sales team data.

- Interviews. If you have a small number of customers, interviewing them can give you a better signal into who’s interested in buying your product and what products they might be interested in in the future.

- Surveys. If you have a larger number, you can survey them about what potential new features are most important to them, then tie that information back to their company industry or function.

- Sales team data. Your sales team talks to customers day in and day out, which means they usually have a great read on what features different types of customers need in order to be successful with your product.

One note here: be wary of “AI tourists”—or customers who sign up for your product because they either have a company-wide mandate to experiment with genAI (B2B) or because they’re excited to try a new genAI feature themselves (prosumer). These users can be difficult to retain, even in cases where they’re willing to pay to try your product. (That said, we are seeing more enterprise companies reallocate genAI spend from innovation lines to standard software lines, which indicates that genAI is evolving into a key part of many enterprises.)

Product vision

This is where your vision as a founder comes in. Maybe only a subset of your customers are excited about generative AI right now, but you believe that generative AI will eventually reshape the customer experience of your product and present a much richer value prop. Or maybe you’re still determining how generative AI will benefit your customers, and right now it’s a nice-to-have for certain users. This part of the exercise is qualitative and vision-oriented, and it’s up to you to decide how central genAI will be to your product roadmap and value prop going forward.

Once you have both a good sense of the value and cost of your genAI feature, and a working hypothesis for how generative AI figures into your current product offering and future roadmap, you can start thinking about packaging and pricing concretely.

Packaging: core, upgrade, or add-on?

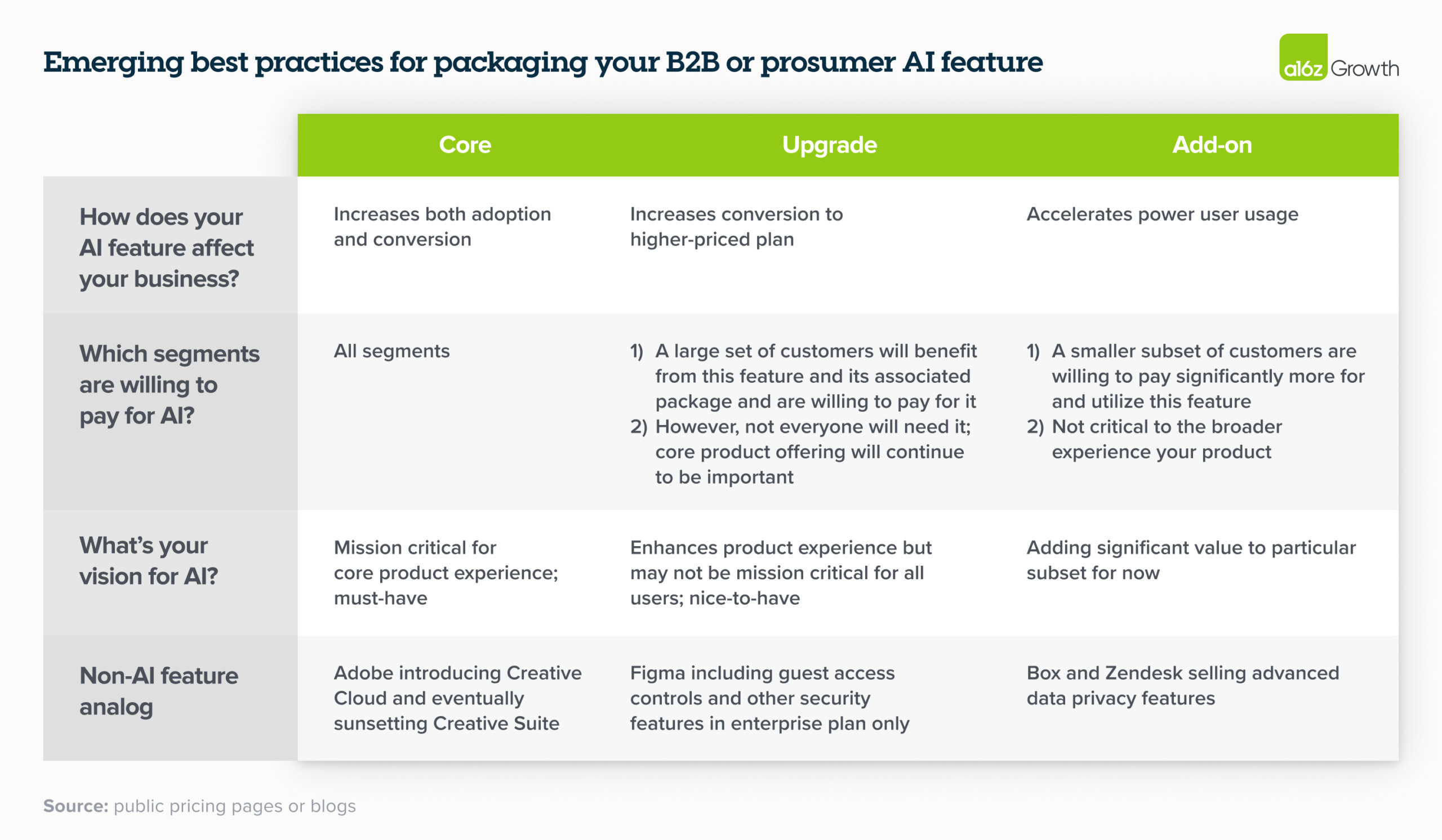

We generally see B2B and prosumer genAI features fall into 3 buckets: as a core offering, as part of an upgrade tier, or as an add-on. Many of the best practices for packaging non-genAI prosumer and B2B SaaS still apply in the genAI era at this point, so it can also be helpful to reference how companies have packaged their new non-genAI features in the past.

Core

If all your customers are excited and willing to pay for your genAI feature, early usage data shows that it significantly increases adoption and conversion, and genAI is mission-critical to your value prop, it can be smart to include it as part of your core offering. In this case, you might not need to directly monetize your genAI feature because it has significant downstream effects on your TAM and conversion. The example we cited earlier applies here: maybe you could serve 10 customers with your existing product and now you can serve 100 thanks to your genAI feature.

Since we’re in the “land grab” phase of generative AI adoption, including your generative AI feature in your core offering can also make your product more appealing than offerings from incumbents and other startups. Because there’s demand for this feature across all segments, however, we imagine that some companies will eventually increase the total price of their core package to better account for the cost of serving the feature.

Upgrade

Packaging your genAI feature as an upgrade works when it’s a nice-to-have feature that can act as an upsell lever for the majority of your customers. The feature doesn’t radically change the way customers use your product, but it can help most of them unlock more value. Some genAI companies might offer more data sets in an upgrade feature, for instance. Or take Mailchimp as an example. Most of their users might not need a genAI feature in the core offering—they likely just want to be able to build and serve an email list—but genAI-generated email copy, segmentation, and analytics could enhance most users’ experience of the product. We’ve also seen some companies use their genAI feature as an upsell lever to increase conversion to a higher pricing tier or cover part of the cost of serving genAI.

Add-on

Packaging a genAI feature as an add-on is wise if your genAI feature delivers significant value to a small set of customers willing to pay a premium and you want to directly manage your margins when serving the feature. Packaging as an add-on can:

- Monetize your innovation directly, which leads to more sustainable margins over the short term. (If you believe AI will become a core differentiating factor for your product over the long term, however, you may need to transition to a different packaging model.)

- Increase your TAM: you can charge more for the customers who are willing to pay more while also maintaining customers at your existing price point.

- Offer a way to beta test your feature with an audience that’s excited about the product and willing to give feedback on it.

We think of the add-on as the “power user package”—companies can charge a premium for their products because a set of power users will disproportionately benefit from that feature. That said, we have seen some other companies who package their add-on genAI features sell the add-on to the entire company when doing enterprise deals to prevent users from sharing logins, even if only a few individual users want it. This might cover costs in the short-term, but be aware that buyers might not always want to buy software packages with this mandate.

One note: we’ve seen some companies include basic genAI features in a core or lower-paid tier and gate better-performing genAI features or more genAI usage in a higher tier. In these cases, the logic of segmenting for value remains the same. If a genAI feature can expand the number of users you can serve, for instance, consider offering it as a core feature. If your other, more high-powered genAI feature enables your power users, you could gate that feature and charge more for it.

Pricing: subscription or hybrid?

Because most B2B SaaS and prosumer companies sell software-to-human products, it makes sense to monetize through subscriptions instead of usage—no customer wants to estimate “how much” genAI they’ll use. But subscription pricing in the genAI era can exaggerate the gap between how much your customers use your product and how much revenue you actually bring in. In fact, selling seats for your genAI feature can actually put you in the position of hoping your customers don’t use your products. Power users pay the same flat fee as customers who barely use your product, which means your most important customers can eat into your margins.

So how can you better align your incentives with your customers’? Because we’re still in the early phase of genAI adoption, it remains an open question.

When we take a look at the current landscape, however, we see core and upgrade packaging priced by seat by default. GenAI is either part of a base product or an added feature in an existing subscription tier. That said, some companies are experimenting with hybrid subscription–consumption models when pricing their add-on features in order to better cover costs and monetize power users. These hybrid approaches include credit drawdown approaches (like Box) or flat-rate seats with credits for incremental levels of consumption (like Adobe Creative Cloud). (When adding a usage-based element to an existing subscription motion, consider how to provide predictability to customers and handle overconsumption.)

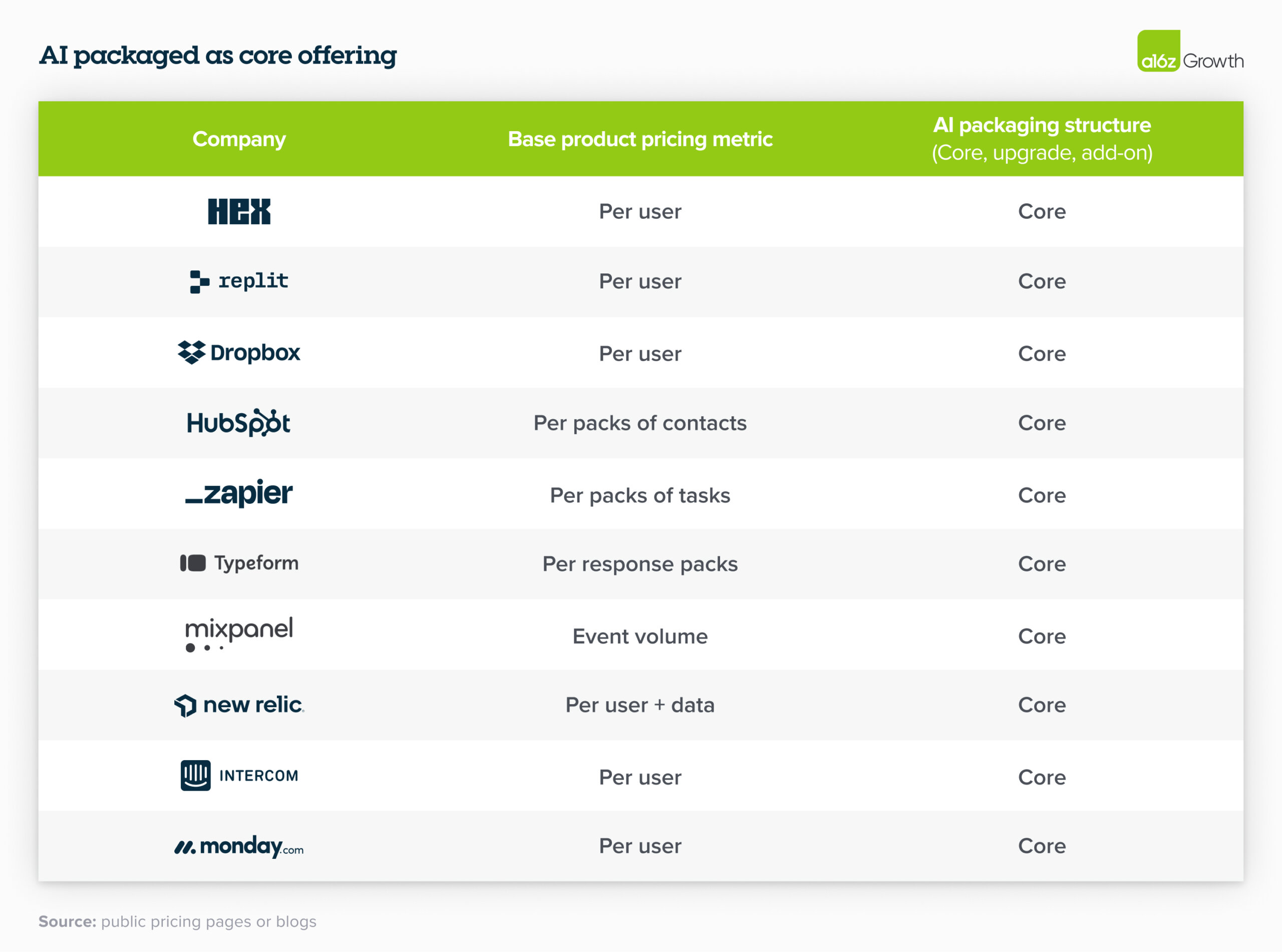

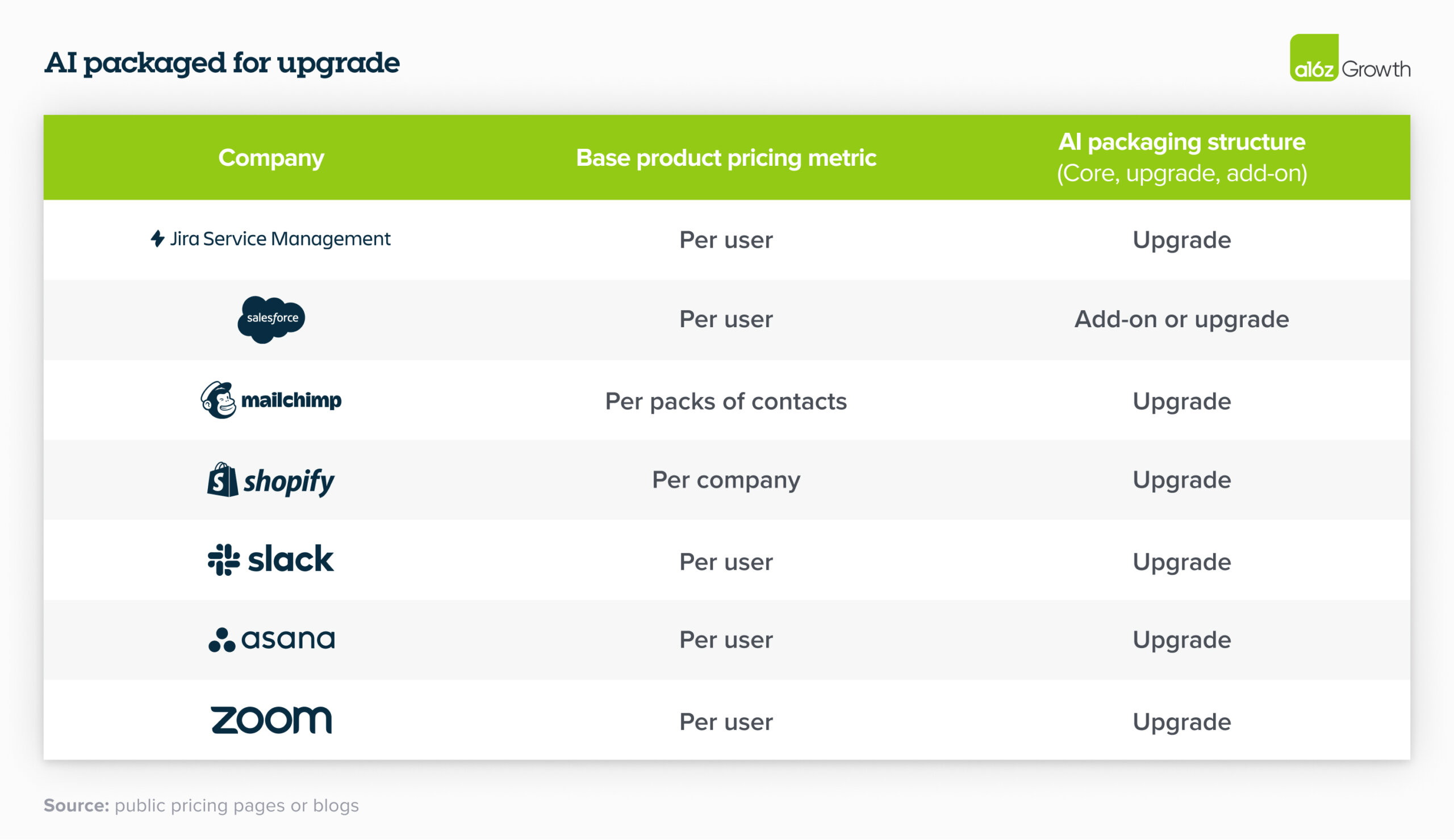

What are others doing?

We examined 31 companies with new genAI offerings to see how they’re pricing and packaging their new genAI feature. Here’s what we see in the data.

How will genAI pricing and packaging evolve?

Outcome-based pricing and other pricing metrics gain traction.

As genAI starts to offer customers significant productivity gains, some companies are thinking ahead to implementing outcome-based pricing, in which vendors charge companies for the outcomes of their software instead of for the software itself.

Outcome-based pricing is harder to get right today, since founders are still figuring out how to quantify the value genAI provides their customers. But if genAI features make companies significantly more productive down the road, it won’t make economic sense to price your offerings on a contracting user base. So we see outcome-based pricing having a potentially significant impact on companies selling a software-to-human product, like a workflow or human resources tool.

The advantage of this pricing model is getting tightly aligned with your customers’ incentives, but making sure you and your customers agree on what defines an “outcome” or “resolution” can be difficult and you’d need to trust that genAI could reliably resolve your customers’ questions. That said, we’re already seeing some companies experiment with this, like Intercom’s Fin Chat product, and we’re excited to see how this evolves.

Prepare to be nimble with your pricing.

The cost of inference is stabilizing, open source is booming, and different model providers are constantly driving down the price of their models in a bid to attract more users. Given this, companies should be ready to adapt their pricing models as model providers continue to lower the cost of APIs.

For now, it’s probably wise to price at a level that’s at least somewhat economical for your business in the short term while expecting the cost to service to decline over the long term (as it already has!) and drive future margin expansion. That said, if you’re banking on your genAI feature to become a core part of your business and you’re not seeing results soon, don’t hesitate to revisit your pricing and packaging structure.

Generative AI stands to deliver an unprecedented amount of value to software end users, and the goal for growth-stage founders now is to figure out how to best capture that value while maintaining stable unit economics and solid margins. With no one-size-fits-all solution, successful founders will have to take past and real-time learnings to build a clear, nimble pricing and packaging structure that communicates the value of their product roadmap.

Though best practices are still emerging, we hope these frameworks help you better navigate the pricing and packaging process for your new genAI feature.

-

Sarah Wang is a general partner on the Growth team at Andreessen Horowitz, where she focuses on enterprise technology companies.

-

Tugce Erten is a partner on the Growth team, focused on pricing and packaging.

-

Alex Immerman is a partner on the Growth team at Andreessen Horowitz, where he focuses on fintech, consumer, enterprise, and crypto/web3 companies.

- How Ecosystem-Led Growth Unlocks the Next Generation of GTM

- 16 Changes to the Way Enterprises Are Building and Buying Generative AI

- Customers Want Predictability in Usage-based Pricing. Here’s How to Help Them Get It.

- 2024 Big Ideas: Voice-First Apps, AI Moats, Never-Ending Games, and Anime Takes Off

- Usage-Based Pricing Is Popular, But Is It Right For You? Our Rule of Thumb