Do I have a churn problem? How do I know?

How do I tell if I have a churn problem in my subscription business?

We get this question a lot from our prospects and customers - what is a normal churn rate? How do I know it’s time to start testing and optimizing my cancel experience for churn?

In a way it’s a funny question to ask. Very few companies would question the value of optimizing acquisition metrics. Entire marketing teams are often organized around optimizing metrics like ROAS, AOV, and RPU.

The truth is that, if you are a subscription business, churn rate, save rate, and deflection rate are all metrics that you should be optimizing in the same way you optimize retention. Churn isn’t a problem looking for a quick-fix, it’s a funnel that can be improved over time.

What we have found; though, is that companies wait too long to start thinking about churn and the cancellation funnel and only act on churn when it’s painfully obvious in other business metrics. Here are a few unavoidable signs that you might need some help with churn.

Acquisition is no longer outpacing cancellation: A declining subscriber base is often a sign that you need to get a tackle on churn rates to continue with growth.

You have over-tapped your current market: It’s difficult to continue to grow your subscriber base without spending large amounts on acquisition - basically, your customers who churned aren’t happy with the product and you’ve run out of new prospects to sell to.

You have more than 10k subscribers and haven’t focused on churn reduction/deflection: At a certain point, your subscriber base is large enough that a focus on churn makes sense for any business. We’ve found that companies that start to test churn improve deflection by 50% in 1-year (link).

Customer subscriptions expire with credit card changes or moves: Involuntary churn, or cancellation due to customer inaction on events like change of address or credit card expiration has well-known mitigation steps. Your billing provider (if it’s not chargebee) should be helping you reduce involuntary churn with advanced dunning techniques.

Unless you’ve spent large amounts of time and energy optimizing your cancellation flow and billing systems, it’s likely that the business is sub-optimized for retention. Retention increases have an outsized impact on profit, according to a Bain and HBS Study:

A 5% increase in customer retention increases profits by 25-95%

Churn Rates vary by industry and stage of business

Benchmarks for churn show large variability based on both segment and AOV for subscription orders. It’s entirely possible that your churn rate seems low, but is not optimal for your specific vertical.

How does your business measure up? Recurly did a study on Churn for their customers.

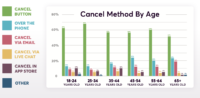

We also see that deflection varies markedly by vertical within eCommerce. If your business has a deflection rate that is significantly below that in your vertical, it’s likely that you could use some optimization of your deflection funnel!

A focus on churn can improve offer save and deflect rates 50% in 12 months

A review of key customers in the eCommerce vertical shows the power of focusing on churn. If you’d like to read their success stories, follow these links: