As time presses on, a world of paperless transactions catches up with the world everyday. Over time the world has seen a speedy decline with paper checks. Paper checks usually cost around $4 to $20 and fluctuates due to certain companies and how they function. The reason why they can be so expensive is that overtime additional expenses go into paper checks like the costs of labor charges, working hours dedicated to making the check, material costs, and other charges levied by banks. For example, It is estimated that around $13k is spent monthly on labor costs to process an average of 5000 checks a month. If it’s a large enterprise with thousands of checks, the cost of labor can be mammoth size pricing. A strategically designed way can help relieve this load and cost on the company and utilize its working hours for other productive works. And this is including the accounting software into this expense of paper checks. With a large scale company needing checks to be processed and done, the expense of materials is very high.

A business organization needs envelopes, stamps, check paper, printer, and ink for printing the checks. Take for example, about 5,000 checks going out a month, that will likely run up a price of $3.5k. But now banks are in the equation on the costly process of checks; Banks use the details like the MICR (Magnetic Ink Character Recognition) line on check to process the checks electronically. But they charge fees for all these. Banks’ major fees are imaging fees, paid check fees, positive pay fees, check reconciliation fees, and more. Fees like these alone can reach up to $4k a month. And that’s not even including bounce checks and return checks. Which will most definitely increase this mammoth sized total. With these three expenses, this could add up to the total resulting in $20.5k a month to process at least 5,000 checks.

Usio over the year of 2023 has disbursed approximately 870,260 cards. Saving businesses over millions of dollars with card distribution. With businesses coming in all different avenues, the Akimbo card has a lot of adaptability when it comes to multiple uses. But when it comes to multiple uses, businesses will use Akimbo cards for business situations such as to control employee expenses because it’s easier for them. The easy use of it is what brings people to the product of the Akimbo card. Digital disbursements offer several benefits over traditional payment methods, such as checks or cash. The Akimbo Card can keep things digitally.

ACH (Automated Clearing House) is a payment processing network that’s used to send money electronically between banks in the United States. It allows for automated, electronic debiting and crediting of both checking and savings accounts and Usio offers businesses the services of ACH. Businesses prefer ACH because an ACH payment can be either a credit (adding money) or debit (withdrawing money), direct deposit is always an ACH credit payment. Some people might say why would you do an ACH transaction over a wire transfer? Well that’s because of cost. For example, the median cost of a paper check transaction is $3.00, whereas an ACH can range anywhere from $0.26 to $0.50. Plus ACH covers many different grounds of transactions, such as business to business (B2B), government transactions, and consumer transactions. Scan to pay, is also in many ways that Usio utilizes quick and easy payments for businesses to customers so they don’t have to go and scramble to a website and have to look for the bill they have to pay. Simply a business will send a customer a designated QR code through the mail made by Usio and a customer will use their mobile device to scan and it will take them right to the branded payment section eliminating any use of having the customer to navigate a confusing website. Usio offers multiple options to ease the burden of disbursements including Usio prepaid card issuing, ACH and Scan to Pay.

Here are some of the key advantages of digital disbursements:

- Speed: Digital disbursements can be processed and delivered much faster than traditional methods. This can be especially beneficial for urgent or time-sensitive payments. A fast paced digital world is where things are trending towards and people who own businesses are always seeking ways to help bookkeep more efficiently. The Akimbo Card can do just that and adapt as the world evolves. Usio ACH makes online transactions quick and easy for when people need to do instant payments or consumer transactions.

- Cost-Effectiveness: Digital disbursements can be more cost-effective than issuing paper checks, which require printing, postage, and manual processing. Akimbo Cards only charge less than the cost of a stamp. Usio utilizes its very own ACH, digital disbursement aka Akimbo card and scan to pay so businesses who come to Usio in need of services will be satisfied with everything Usio has to offer with the very affordable services Usio has to offer.

- Convenience: Recipients can receive digital disbursements directly into their bank account or mobile wallet, eliminating the need to visit a bank or check-cashing location. With a digital world on the horizon, being a convenience is something the Akimbo Card strives to be, and always keeps the wheel spinning. Usio ACH brings increased efficiency and timeliness for whenever a user is needing such services at any time of the day.

- Security: Digital disbursements are often more secure than checks, which can be lost or stolen. They also offer encryption and other security measures to protect sensitive information. Akimbo Card is very much safe through encrypted data to multi-factor authentication, businesses can trust that their financial activities are safeguarded against cyber risks. Usio security utilizes Instant Account Validation will increase conversion rates while reducing abandonment. In seconds, Usio confirms that an account is valid including bank details, account number, routing number, balance and holder name. Receiving the highest level of security and compliance with Nacha standards. And, Usio Instant Account Validation sits outside the ACH network which means there’s no impact to transaction counts or return ratios.

- Accessibility: Digital disbursements can be more accessible to recipients who may not have access to traditional banking services, such as those in remote areas or without a bank account. Within a few clicks the Akimbo Card is accessible to the user who operates it how they would like, whether it be from payroll to employees or to real time tracking to even have control over expenditures. Users can control the Akimbo Card simply by their fingertips.

- Integration: Digital disbursement platforms can integrate with accounting and financial systems, simplifying reconciliation and reporting processes. Previous users of the Akimbo Card say it is an easy plug and play use; which is what brings people into our services Usio provides along with same-day banking with Usio ACH services.

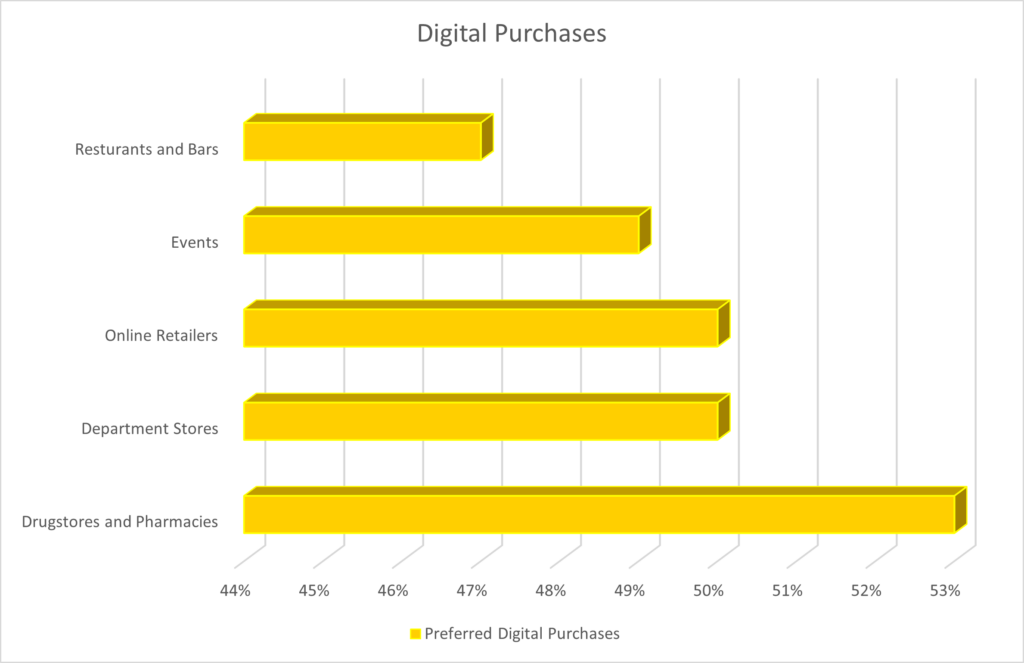

Overall, digital disbursements offer a more efficient, cost-effective, and secure way to make payments, benefiting both businesses and their recipients. With time passing on, contactless payments are becoming more and more popular. Contactless payments is a newer payment method where a device will communicate wirelessly with a point of scale (POS) instead of having a more physical interaction. Forbes ran a survey stating that respondents are equally likely to use a digital wallet for small and large purchases. This means consumers are inclined to use digital payment methods both when paying for a cup of coffee and when buying a new sofa. Trends indicate digital wallets are most frequently used for purchases from businesses in the following categories:

- – Drugstores and pharmacies (53%)

- – Department stores (50%)

- – Online retailers (50%)

- – Events (49%)

- – Restaurants and bars (47%)