Just a few days into 2024, the U.S. Securities and Exchange Commission (SEC) announced that it would allow the trading of Bitcoin ETFs. While this change gives investors another way to bet on Bitcoin, it’s also a positive signal for merchants that accept crypto payments.

Quick catch up on Bitcoin ETFs for merchants

- The SEC has officially approved 11 spot Bitcoin ETF applications, marking a historic day for the cryptocurrency industry. This approval allows for the trading of these ETFs on various platforms, including the NYSE Arca, Chicago Board Options Exchange, and Nasdaq.

- On the first day of trading, there was significant activity among these newly-listed Bitcoin ETFs, with Grayscale Bitcoin Trust and Hashdex Bitcoin ETF initially surging, then paring gains. BlackRock and Fidelity led in trading volume among the new issuers.

- The approval and launch of these Bitcoin ETFs offer investors a wide variety of options for investing in Bitcoin in ETF form. This development is expected to attract more institutional assets into the cryptocurrency market.

Bitcoin ETFs are a positive signal for merchants - here’s why

Shortly after the SEC’s announcement, Bitcoin prices hit a two-year high. Although some hodl’ers will see this as the opportune time to stash away their coins, many of those who’ve bought at a lower price will be keen on cashing out or spending their gains.

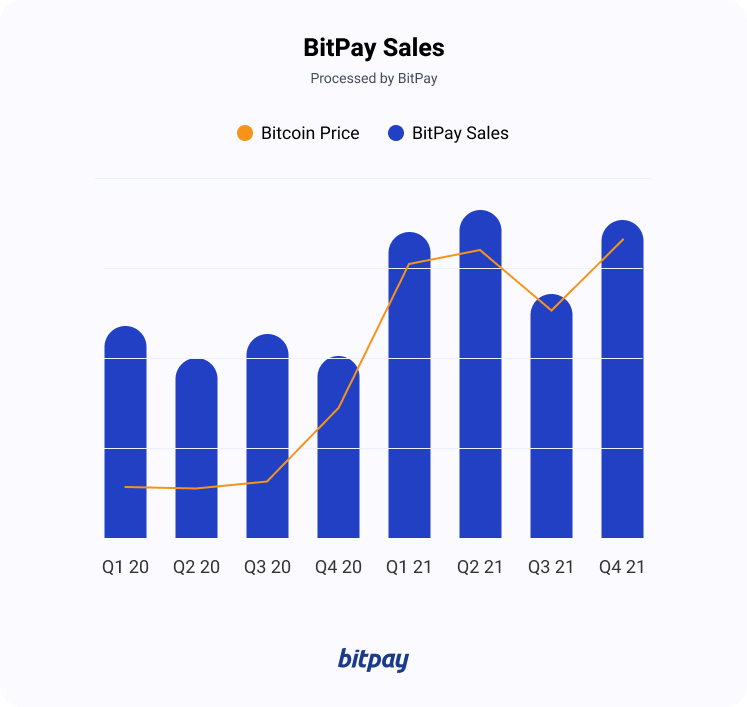

Bull runs like these can be the best time for merchants to begin accepting crypto payments. The simplest reason is the correlation between price and spending. BitPay’s internal data shows that when prices are high, crypto consumers tend to spend more.

Spending is especially prevalent in high AOV segments like Automotive, Luxury Goods, Jewelry and Watches, Travel, and Precious Metals. Crypto customers in the U.S. are known to be younger, more technologically savvy, and big spenders.

And it’s not just the approval of Bitcoin ETFs that signal positive days ahead for merchants. The Bitcoin halving, a cycle which has historically been good for crypto-enabled merchants, is expected to take place in April 2024. The combination of Bitcoin ETFs and the Bitcoin halving could make this the perfect time for merchants to integrate crypto payments into their operations.

How to start accepting crypto payments

Incorporating cryptocurrency payments into your business operations offers a significant opportunity to tap into a growing market, something that hundreds of widely-known companies are already taking advantage of. Partnering with an established cryptocurrency payments processor like BitPay can make the endeavor even easier.

Here are the steps we recommend to organizations looking to tap into the crypto consumer market:

- Choose a reliable payment processor: Partner with a trusted processor like BitPay, renowned for its ease of use and strong relationships with various coin communities.

- Integrate crypto payments: Implement this option across various platforms such as your website, email billing, or physical point-of-sale devices.

Once the integration is complete, focus on customer awareness and marketing:

- Inform customers: Clearly communicate the new payment option to your customers. This can be an integral part of your marketing strategy.

- Engage with the crypto community: Increase visibility by interacting with the Bitcoin and crypto communities, and leverage co-marketing opportunities offered by your payment processor.

BitPay stands out as a leading choice for crypto payment processing. It simplifies the process for merchants, allowing customers to pay with crypto while merchants receive settlements in their preferred fiat currency. BitPay's system ensures that merchants do not have to handle cryptocurrency directly, offering a seamless and secure payment experience for customers. BitPay merchants enjoy comprehensive support and quick setup, making the transition to crypto payments straightforward and efficient.

Interested in integrating crypto payments? Contact BitPay to get started.

Bonus: Paying your employees in cryptocurrency

Paying employees in crypto offers several key benefits and is increasingly accessible for businesses of all sizes. Integrating crypto into payroll systems, like the BitPay Send solution, allows for faster, more efficient, and cost-effective payments, including regular compensation and bonuses. This method offers lower fees compared to traditional payment methods, instant global transactions, and the ability to attract top talent interested in digital currency compensation. Additionally, it modernizes a brand's image, aligning it with the future digital economy, and provides employees with customizable benefit options.