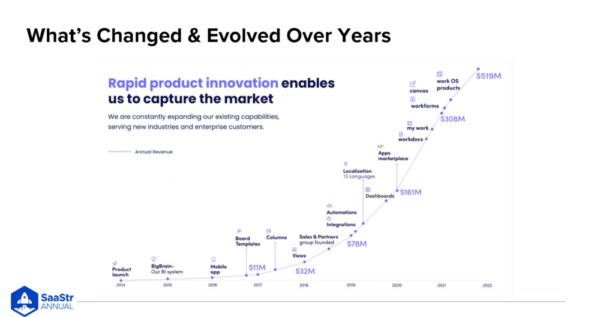

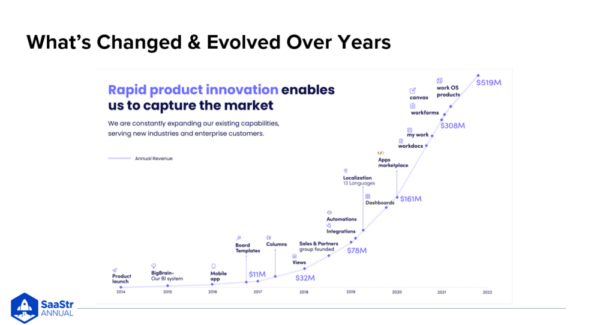

Monday has gone from $7m in 2017 to over $700m in revenue today, showcasing the sheer power of compounding revenue. Did monday.com’s founders feel like they’d be 100x bigger in just six years since that first SaaStr conference they attended?

Eran Zimman, monday.com’s co-founder and co-CEO, shares his secrets to scaling and growth in an unpredictable market.

monday hasn’t missed a beat, but before we dive into their secrets, let’s first learn where it all started and what they do today.

monday’s Hypergrowth Journey

From day one, monday built a platform. It’s a very flexible software that allows everyone to build their own solution.

The first use case was project management, and it’s what many people think monday is.

Why project management?

Because nobody went on Google and searched “flexible software to manage my business.” They searched project management or CRM.

You have to understand:

- what people are searching for

- what their intent is

- what the product is that you’re building

It’s a marrying of company vision and go to market.

Monday has always been a platform, and now it’s transitioned into multi-product with monday CRM and monday Dev.

How to Communicate Multiple Products Without Overwhelming Customers

When you have something as rich as monday’s platform, especially when many of the customers are SMBs, you have to be able to share your product without overwhelming.

How is that possible?

“You don’t need to tell the whole story from the beginning, especially when you sell to SMBs,” shares Zinman.

Focus on giving people value as soon as possible. Serve customers a CRM or project management first, and as they scale and use it more, they’re exposed to more features.

Zinman calls this a gradual discovery. You don’t want to overwhelm SMB customers, and Monday made this a focus from day one.

Measuring Usage Since Day One

Since the beginning, monday.com built and has used a BI tool called Big Brain — a major investment for that size of company. But they refused to fly blind.

Big Brain was an internal tool to track revenue, marketing expenses, and usage of the product. It’s still a major part of the company.

Since starting the company in 2014, there wasn’t a lot of money you could raise in a startup. Their first round was $1.4m.

Money wasn’t in abundance, so they had to measure and track everything, and it stuck with them.

The 10x Feature That Set monday Apart From The Rest

Initially, monday.com’s database was the 10x feature. Every time they made a lift in terms of features, it wasn’t because of customer feedback. Instead, it was a major lift from things they didn’t expect.

Automation was a huge driver of growth, and not many customers asked for it. Of course, automating manual work is common now, but it wasn’t then.

What Converted Customers In The Early Days

Both co-founders of monday are unique because they’re both engineers. There wasn’t a “business person,” like many startups have.

Since day one, they didn’t like selling to customers. It wasn’t their skill. So, they were forced to build a product that automatically converts. They wanted customers to become paying customers without talking to anyone.

And it worked.

How did it work?

They put so much focus on the user experience, and A/B tested everything to make it as easy as possible to get started. It’s a great way to build a company if your focus is on PLG. In retrospect, if they had an amazing salesperson that could sell a mediocre product, they might have got the wrong signal. But because people convert by themselves, it creates a healthy product market fit.

If you can start with a true self-service motion, your product will be better.

Picking Your Core Verticals and Selling Outside of “Tech”

70% of Monday’s customers are non-tech — real estate, banking, construction, and even churches.

So, how did two engineers get out of tech?

When starting the company, they wanted to sell a product that wasn’t just for tech companies. Expanding to non-tech industries, especially in today’s market, is a major benefit.

From day one, 70% of their customers weren’t in tech. They were in the real world with real businesses serving regular people. That’s one of the things that made Monday resilient. Those overly exposed to tech companies took a big hit in the last 18 months, and the fact that monday is so flexible possibly allowed them to enter into verticals they had no experience in.

Was this strategic?

In the beginning, it was random.

The co-founders ran a bunch of Facebook ads, and the original banner was “Manage your startup.” Surprisingly, churches and construction companies signed up. They weren’t startups, but they were using the platform, so monday strategically chose that path based on what people were doing with the platform. The more traditional companies were easier to reach on Facebook and sometimes easier to convert, so they ran with it.

monday’s Learnings Through This Macro Of The Last 24 Months

Not everything has been easy for monday.com over the last two years, but if you look back at their growth, it’s remained strong. For monday, they still felt what happened in the last year and a half, but to a lesser extent.

And for a few reasons…

- Some things you can and can’t control. The fact that monday isn’t 100% tech-focused was a big thing. A lot of non-tech companies weren’t affected by the economy. So, if you can sell into non-tech companies, that’s helpful.

- monday has done performance marketing to great success. What Zinman had seen when the economy changed was a lot of companies cut performance marketing entirely because it’s the easiest thing to reduce.

“In my opinion, that’s a big mistake,” says Zinman.

They kept doing it after the economy changed, and they also scaled it. They’re seeing the lowest bids ever as a company because everyone has pulled back and reduced spend while they remain more aggressive than ever. monday has Big Brain, which means they have the confidence that everything they’re spending money on will bring in good results.

If you want to build confidence in your performance marketing spend…

- Do it right now. It’s cheap.

- Try to measure how each campaign affects ARR.

It’s not complicated and will give you the confidence and ability to scale.

Why monday.com Grew So Fast

A combination of things has helped monday grow super quickly.

- Performance marketing

- A lot of verticals

- Product

Performance marketing is efficient and works. Big Brain gives them the confidence that it works.

Going multi-vertical means you can bid in each industry and be very efficient.

When you only have one vertical, you eventually exhaust inventory, so every incremental dollar you put toward it isn’t as efficient as the first.

And product is another reason monday has blown up.

They allow customers to use it, and they don’t have a lot of feature requests because the team gives them the ability to customize the product to their needs.

Going Multi-Vertical

Right now, monday has scaled their many verticals. At one point, each vertical might have had its own team.

Now, they have monday Sales CRM, a complete organization within the company.

Each vertical was born, however, because they saw their customers using it in a certain way, and so they packaged that into a product.

How did monday verticalize?

They verticalized based on usage, not on the customers or industry.

You might have churches fundraising or managing things a certain way, which becomes a use case for that company.

So, they packaged products for use cases.

Nobody Measures Cash, But They Should

For folks who don’t have to worry about operating margins or free cash flow, this chart is night and day. In Q2 of ‘22, monday was growing at hyperspeed.

They were burning cash, but growth was incredible.

In four or five quarters, they went from unprofitable to wildly profitable. Before, they burned $.16 for each dollar coming in, which is a pretty low burn multiple, and now $.26 of every dollar is going to cash flow.

How is that possible?

“There’s something misleading about how we measure SaaS companies. All the metrics we’re using — LTV to CAC, CAC return rate — don’t take cash into account. ARR is not cash. CAC is not cash,” says Zinman.

Today, monday has over $1B in cash. That’s more cash in the bank than they ever raised from VCs or the public market.

The point is…

Nobody measures cash. But they should.

What is measuring cash?

When they started the company, they were religious about seeing the cash return.

They’d spend money on Facebook, YouTube, and Google and then measure when the cash literally left the bank. And then measure when the cash came back into the bank from those customers.

Imagine you have $5m in the bank…

One way to think is that you can spend $5m on performance marketing because that’s what you have in the bank.

monday would spend $25m on performance marketing when they had $5m in the bank.

How did they do that?

By recycling the money super quickly.

They would spend $300k on performance marketing and, after one month, saw 50% back from that campaign. Then they saw 70% back after three months.

They tracked every penny.

This is how they optimized the product and pricing.

You can think about it that way — raising money from customer usage and not just VCs.

If you focus on cash efficiency, you can make your business super efficient and scale faster as a team.

You have to be efficient from day one. Slowing hiring won’t help you over the long term, so measure for that from the beginning and make it a part of your company’s DNA.

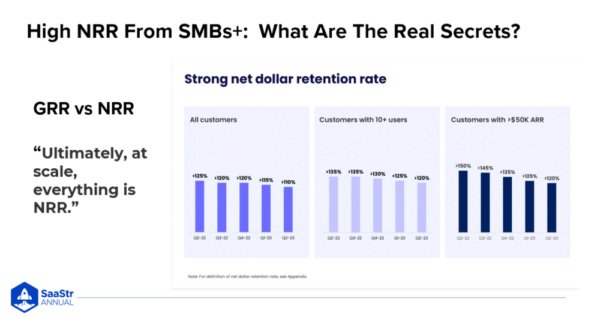

The Secret To Conquering High NRR From SMBs

monday.com went from 125 to 110 NRR, which is macro yet still epic for SMB.

How do you get over 100 for SMB?

Part of monday’s macro experience was pricing based on seats. Some companies reduced hiring, and that’s the impact they and many other SaaS companies saw.

It’s the disadvantage of having a seats model.

Companies that were more consumption-based weren’t affected, which leads Monday to consider a mixed model.

But how did they conquer high NRR for SMBS?

By optimizing for NRR, gross retention, and net retention. They measured it from day one.

Going upmarket helped NRR, and Zinman feels like they did it late in the game, around 2018.

As an engineer, he and his partner said they’ve never had a sales team.

They were wrong.

Now, they have a huge sales team because Enterprise wants a person to talk them through security issues, governance, and overall support.

Building a sales team was a great growth driver for NRR and bringing in more accounts.

The more customers you have, the more NRR is important.

If You Want To Grow 30-40%, You Do It With NRR

85-90% of monday.com’s revenue comes from existing customers who have been with them for more than a year.

How do you increase NRR?

- Measure it. A lot of companies don’t do it.

- Build a customer success team.

- Improve your product. If you create more value and sales opportunities, you’ll drive up NRR.

The majority of monday is still self-serve, but their sales-led revenue went from nothing to 30% of their revenue over 3-4 years.

As far as incorporating a sales-led motion into a PLG company, Zinman recommends starting earlier.

Their investors told them they needed a sales team, but they were patient. Hiring one was definitely a game-changer.

monday finished Q2 with a 63% year-over-year increase!

Are Sales Teams Too Lean?

For about four quarters, monday kept headcount flat and went from negative to epic cash flow.

They grew a little last quarter, so the meta-question is, did we get too efficient? Are we mortgaging futures because sales teams are too lean?

monday.com is back to hiring and intends to add another 500 people next year — going from 1800 employees to 2300.

Free cash flow will stay the same percentage if they stay stable and put that money back into hiring.

Demand wasn’t growing as expected over the last two years, so they adjusted the sales team. And, of course, Monday measures the team as well.

Now, they’re trending towards more demand and have the confidence to accelerate hiring.

Companies trimming the fat was a good thing. It improved a lot of things.

Practices That Will Remain As The Economy Bounces Back

What happened in ‘21 and ‘22 was very deceiving. If the economy is growing like crazy, it’s difficult to know what’s making you successful because “everything works!”

When everything is going up and to the right, it feels like everything works.

But when the economy changes, not everything is shiny.

So, monday focused on what was working and reduced what wasn’t.

They re-optimized quotas for salespeople, making them higher and setting new expectations. They optimized SDRS and CSMs and started measuring things they hadn’t.

Being proactive means you can optimize a lot of things. Instead of thinking you’re stuck in a bad situation, you take control.

The greatest companies are forged during a downturn.

Zinman discovered throughout the sales process that you can do more with fewer people. They started to measure that more and will never go back.