Choosing the right SaaS accounting software can be daunting, but it’s essential for any successful SaaS business. The sooner you retire those Excel spreadsheets, the better.

Otherwise, you may struggle to execute complex accounting procedures or accurately forecast future cash flow. But with so many options on the market, how do you know which one is the right fit for your business?

In this blog post, we’ll guide you through the process of choosing the right accounting software for your SaaS business. We’ll show you the features it’s essential for your software to have, what you should consider before choosing a solution, and five of the best SaaS accounting solutions on the market. We’ll even demonstrate how you can use Chargebee to simplify SaaS accounting.

Table of Contents

SaaS Accounting: An Introduction to Financial Management

SaaS accounting is the process of recording, evaluating, and reporting financial data for your SaaS company. It requires a specialized approach to accounting because the subscription-based model used by most SaaS companies fundamentally differs from traditional business models.

Rather than a one-off initial payment for the product or service followed by additional charges for things like implementation and support, SaaS businesses roll everything into a single monthly fee. That means they thrive on recurring revenue.

This makes cash flow dynamics more complex, which means COGS is lower and creates higher gross margins. It also means SaaS businesses face various accounting issues due to their subscription-based income.

While the subscription business model results in reasonably consistent annual income, monthly cash receipts can change drastically depending on what portion of your customers pay monthly or annually.

This issue can make recognizing revenue far more tricky for SaaS businesses than for other companies. Let’s take a second to explain why.

There are two types of SaaS accounting methods companies can use. The first, called cash-basis accounting, recognizes revenue and expenses when money is received or paid.

The second, accrual accounting, is much more common. It records revenue and expenses when they are earned, regardless of whether cash gets deposited in the future. The advantage of this method is that companies can defer revenue reporting on tax returns.

Unfortunately, accrual accounting for SaaS businesses is made even more complicated because revenue is subject to routine changes — customers can upgrade, downgrade, or cancel their plans month to month.

The problem with revenue recognition is that it makes it harder for SaaS businesses to follow Generally Accepted Accountancy Principles (GAAP). While it’s not mandatory for SaaS businesses, doing so will increase the transparency and consistency of your financial reporting.

What’s more, the vast majority of investors will require GAAP compliance. If you are publicly traded or have to abide by the Government or industry regulations, GAAP compliance will also be mandatory.

If you follow GAAP, then you will also need to follow ASC 606, which states revenue should only be recognized when services have been provided — not when income is received. SaaS businesses following GAAP will, therefore, have to spread out revenue rather than cashing in immediately.

In cases where revenue is collected upfront, such as an annual payment, you must recognize revenue over the lifetime of the contract. In most cases, that will be achieved by dividing the contract value by 12 (for each month of the year) and recognizing that value each month.

If it was a two-year commitment, then you would have to divide the contract value by 24 to get the monthly revenue recognition amount.

Key Considerations Before Choosing SaaS Accounting Software

If you’re in the market for SaaS accounting software, we recommend you consider the following four factors when making your choice.

Company Size

Different-sized companies have different accounting needs. Larger businesses will have more complex accounting needs and will require far more charts, reports, and features than smaller startups.

At the same time, consider the people using the software. In small teams, the CFO or another senior financial figure may handle accounting. In this case, more specialized software may be appropriate. In larger teams, the job may fall to less experienced employees or those without a technical background. In this case, prioritize intuitive software above all else.

Budget

Few SaaS accounting software platforms are prohibitively expensive for most businesses, but your budget should still be an important consideration.

It’s not just the monthly cost of the software or the number of users you need to pay for that you should consider. You should evaluate the system’s total cost, which includes installing the software, paying for support and training, and transferring data to the new tool. Different providers offer different levels of training and support. Some may even offer a white glove service that handles everything.

Business Model

The biggest accounting tools will be suitable for every kind of business. However, smaller providers may specialize their software to meet specific needs. You can find accounting software that focuses on e-commerce stores, for instance, or B2B software providers.

It can make sense to choose a platform that closely matches your business model, particularly if you have no plans to expand your product offering. But in most cases, a comprehensive solution will be the most sensible bet.

Future Growth

Your revenue levels won’t stay the same forever. As your business grows, accounting workflows can get much more complicated. Nothing is worse than transitioning from one SaaS accounting software provider to another.

That’s why you need to choose a platform that can scale with your business and meet your needs in the future.

If you’re looking to raise capital or sell your business in the future, you’ll want to choose an accounting platform with accurate GAAP and IFRS financial statements. Investors (or buyers) will also want to see other metrics that the right SaaS accounting software will be able to generate. These metrics could include bookings, average contract value, committed MMR, and EBITDA.

Features to Look for in SaaS Accounting Software

SaaS companies have specific needs for accounting software and should look for tools with the following features.

Automation

SaaS accounting is complicated enough without users being overwhelmed with repetitive manual tasks. By choosing SaaS accounting software that automates core tasks, employees are less likely to make errors and have more time to focus on high-level work like generating reports and making sure accounting practices stay compliant.

There is a range of tasks that SaaS accounting software can automate. The most common is data entry. Many accounting tools integrate with third-party data sources like payment providers and e-commerce platforms, meaning employees don’t have to manually transfer data from one source to another.

SaaS accounting software can also automate more complicated tasks, like calculating sales tax. The U.S. has particularly complicated rules on which state gets to charge sales tax, so using an automated solution can streamline the entire process and reduce the risk of costly errors. What’s more, the task can also integrate with invoicing and billing functionalities, so the correct sales tax is automatically added.

Scalability

As your SaaS company grows, its accounting needs will get more complex.

Want to raise funding? You’ll need to create a raft of reports and become GAAP compliant. Need to handle payroll for thousands of staff? You’ll need accounting software capable of doing so.

What about your plans to expand internationally? In most cases, that will mean accepting payments in a range of different currencies — and your SaaS accounting tool will have to be able to accept them. Each country will also have its own accounting and financial reporting best practices. Once again, any tool you choose should be able to function effectively in future international markets.

At the same time, you don’t want to suddenly find yourself paying a monthly subscription that has skyrocketed. That’s why it’s important to check that any potential SaaS accounting software has the features you need in the future and will supply them at an affordable price.

Integrations

The last thing you want is for a piece of mission-critical software like your SaaS accounting software to be isolated from the rest of your tech stack. It needs to be connected to your CRM, sales tax tools, subscription management software, and other tools if you’re serious about streamlining operations and growing your business.

That’s why it’s vital to assess the integration capabilities of any SaaS accountancy platform. There are certain things you should look for, in particular.

Payment integration is the first and, arguably, most important. There’s absolutely no reason you should be manually copying payment information into your SaaS accounting software. Payment integrations also enable real-time cash flow and MMR analysis.

An integration to calculate sales tax is also vital. Sales tax should be calculated at the point of checkout and automated on all future invoices. In the vast majority of cases, this will require a third-party integration like Chargebee or Avalara.

Your CRM should also integrate with your accounting platform. This is particularly relevant if you offer customized quotes to prospective customers, where that process is handled by your sales team in your CRM. A CRM integration also provides better customer data, allowing you to create more in-depth reports and run better analyses to identify churn risks and opportunities to grow revenue.

Finally, you should also choose a platform that makes it easy to migrate data from your current solution — whether that’s spreadsheets or another SaaS accounting tool.

Reporting and Analytics

Accounting software needs to provide reports and insights. It’s vital your SaaS tool gives you a real-time overview of your business’s financial situation. For example, you’ll need to generate the following reports every month to follow GAAP guidelines.

- A Profit & Loss or income statement

- A Balance Sheet

- A Cash flow statement

Many SaaS accounting platforms will provide that level of reporting, but few will let you track key SaaS metrics like:

- Bookings: the dollar amount of a signed contract

- Billings: produced when companies send a bill

- MRR: monthly recurring revenue (and this should be recognized revenue)

- Churn rate and CLV

Best SaaS Accounting Software Solutions

Below, we have provided a review of five of the best SaaS accounting software solutions. We cover their core features, what makes them practical for SaaS businesses, how well they integrate with the rest of your tech stack, and, of course, the price of each tool.

Quickbooks

Quickbooks by Intuit is one of the best-known cloud-based accountancy platforms in the world. It is a generalist accounting software, but it is a viable option for smaller SaaS businesses.

Automation is a core feature of Quickbooks’ platform. The software’s open API means you can connect any other application directly to the platform and automatically input data without the need for manual data entry.

The platform has a built-in sales tax tool that automatically tracks thousands of tax laws, calculates the correct nexus for your sale, adds the right amount of sales tax to invoices, and correctly categorizes your product from state to state.

It provides a range of reporting features, helps you manage tax deductions, and can even run payroll. Some of the advanced reports we discuss above may require third-party integrations.

Quickbooks offers a highly scalable solution with different features and levels of support that change as your business grows. For example, the company offers QuickBooks Priority Circle, which is a VIP service for the company’s advanced offering that connects you with a dedicated account manager, training, and 24/7 support.

Quickbooks integrates with over 750 business apps, including payment providers, CRMs, and a range of third-party applications that help you do even more with the platform — like Chargebee.

Quickbooks offers a 30-day free trial. Most SaaS businesses will require the Advanced plan, which costs $200 per month.

Xero

Xero is a New Zealand-based cloud accounting platform that boasts 3.5 million subscribers worldwide. It isn’t a specialist tool by any means, but it has one of the most comprehensive feature offerings of any platform in this list.

Those include all the standard features you would expect from accountancy software, including the ability to invoice clients, claim expenses, connect to your bank accounts, accept payments, make payroll, and reconcile bank accounts.

Xero’s reporting capabilities will be of particular interest to SaaS executives. The platform makes it easy to get a real-time view of your accounts, view a range of reports (Balance Sheet, Profit & Loss, etc.), and create customized reports specifically for your SaaS accounting needs.

Xero is also well suited to SaaS businesses that accept payment in multiple currencies. You can currently use over 160 currencies to make and receive payments in Xero, have Xero instantly convert currencies on your behalf, and create reports in any currency, too.

The Xero App Store offers integrations for hundreds of third-party add-ons and well-known apps. This includes integrations with payment providers like Square and Stripe, Payroll platforms like Gusto, CRMs like Salesforce and HubSpot, and subscription management platforms like Chargebee.

Xero offers a 30-day free trial. Most SaaS businesses will need the company’s Established plan, which costs $70 per month.

Sage Intacct

Sage Intacct is an American cloud accounting software provider. It has an incredibly advanced offering that makes it perfect for startups and established companies. In particular, it has a dedicated offering to SaaS and subscription billing companies, which automates many SaaS accounting processes. This includes data entry, revenue recognition, subscription billing, and forecasting.

Sage Intacct’s financial reporting features are second to none. Get real-time insights into core SaaS metrics like accounts payable and receivable, billings, and MRR. Customizable reports are also available so you can see your General Ledger, Profit & Loss, and other key reports. There are over 200 investor-grade reports in total.

Sage Intacct makes support a priority. As well as access to the platform, monthly membership also provides access to Member Masterclass, where you can learn more about SaaS accounting processes, a range of learning and certification courses, and a robust community of fellow users.

If that weren’t enough, the Sage Intacct Marketplace allows you to integrate the software with over 300 other applications. These include business management tools to help you better analyze your accounting data, CRMs so that you can automatically upload data, payroll software, inventory management tools, tax management systems, and subscription management platforms like Chargebee.

Sage Intacct offers custom pricing options. Get in touch with their team for a personalized quote.

Freshbooks

Freshbooks is a cloud-based accounting platform used by over 30 million business owners. While it is primarily aimed at small business owners, it has many tools that SaaS companies need to perform the complex accounting procedures synonymous with their industry.

Freshbooks offers all the standard features you would expect, including invoicing, online payments, expenses, and reporting. The platform also allows you to manage projects and access data using your smartphone with the Freshbooks app.

That being said, some of the more advanced accounting reports may require third-party applications or may not be available at all using the platform.

Support is always on hand. The company has over 100 support staff across North America and Europe. It also handles migration to the platform and will take care of manual data entry from any accounting system or bookkeeping software, including spreadsheets and Word documents.

Freshbooks offers built-in integrations with over 100 popular apps. These include third-party add-ons like Income Importer, which lets you automatically upload payment data from platforms like Stripe and Square, and established businesses like HubSpot and WordPress.

Freshbooks offers a 30-day free trial. Most SaaS businesses will require the company’s Premium plan, which costs $27.50 per month.

Zoho Books

Zoho Books is a cloud-based accounting program that is ideal for startups and small businesses — especially those already using Zoho’s suite of tools.

Zoho may not be a dedicated cloud accounting software provider like some of the other companies on this list, but that doesn’t mean its feature offering is limited. With Zoho Books, you can process invoices, receive online payments, keep track of expenses, automate bank reconciliation, manage inventory, and run a number of reports. It’s important to note, however, that Zoho Books’ reporting functionality is slightly limited compared to other providers in this list. That means established SaaS companies may prefer to choose an alternative.

Zoho Books offers 24-hour phone and live chat support during weekdays to all paid subscribers. Premium support plans are also available from $49 per month.

Zoho Books lacks the integration capabilities of other SaaS providers. That being said, it still integrates with Zoho’s suite of business tools, as well as several major online payment gateways and Avalara AvaTax.

Zoho Books offers a 14-day free trial. Most SaaS businesses will require the Elite or Ultimate plans, which cost $100 per month and $200 per month, respectively.

Streamline SaaS Accounting with Chargebee

SaaS accounting software is just one piece of the accounting puzzle for subscription businesses. A subscription management tool like Chargebee can further streamline your accounting processes and make reporting easy.

Our platform integrates with every major accounting software (QuickBooks, Xero, Sage Intacct, etc.), allowing SaaS brands to synchronize data between platforms and eliminate manual data entry.

Chargebee also provides a range of other benefits, including automated building, subscription management, recurring payments, revenue recognition, and reporting.

Automate invoicing and billing.

Faultless revenue recognition starts with invoicing. Chargebee gives you the tools to automate the invoicing and billing process. Use the platform to create quotes to simplify the approval process, generate invoices, send payment reminders, and process payments automatically. It even accommodates special buying cycles by raising invoices in advance.

Get as granular with invoices as you need. Chargebee’s billing solution lets you track product usage and add relevant taxes and additional charges to your invoices. The same goes for discounts and product add-ons, too.

It’s all about improving the accuracy of your invoicing. The goal is to simplify incorrect revenue attainment and reconciliation efforts.

Manage subscriptions

Few Saas accounting software solutions let you manage subscriptions in the way Chargebee does. Chargebee gives you a unified view of your subscription data in one place, allowing you to discover new revenue opportunities, handle upgrades and downgrades, and create a custom cancellation process that retains as much revenue as possible.

You can roll out new pricing plans rapidly with flexible billing functionality that lets you price your product in multiple ways, including tiered pricing, volume pricing, and stair-step pricing. You can also configure smart dunning features to recover lost payments.

Handle Recurring Payments

Chargebee makes managing recurring payments as easy and as flexible as possible. It doesn’t matter how convoluted your recurring billing is, you can charge customers over whatever time frame you need — even down to the day — or by usage. And you can charge customers in over 100+ currencies.

Chargebee integrates with over 30+ leading payment providers, so you can accept payment via almost any method and from anywhere in the world. You can even create a customized PCI-compliant checkout experience that can be integrated into your website using a single line of code.

Comply with revenue recognition

Chargebee can help SaaS companies comply with revenue recognition standards by automatically calculating revenue recognition and deferred revenue schedules.

Even some of the leading SaaS accounting software providers don’t offer this level of automated revenue recognition, which means you never have to worry about staying GAAP compliant again.

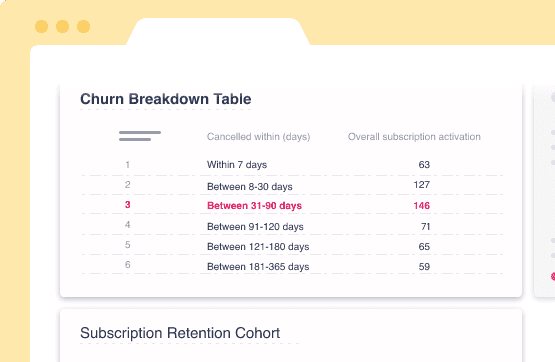

Reporting and analytics

As we’ve already discussed, financial reports are a core part of SaaS accounting, regardless of whether you’re trying to raise capital or bootstrap your business.

Chargebee provides reporting and analytics tools that can help SaaS companies monitor revenue, customer acquisition, churn, and other key performance metrics. These reports can provide insights to improve business operations.

Unlike SAAS accounting software tools, these reports are customized specifically for SaaS businesses, so you get all of the in-depth analysis you need to stay compliant and optimize your business.

Ready to simplify your SaaS accounting?