Discover Bessemer Venture Partners’s annual State of the Cloud report, going through trends, benchmarks, and metrics that underpin the Cloud economy.

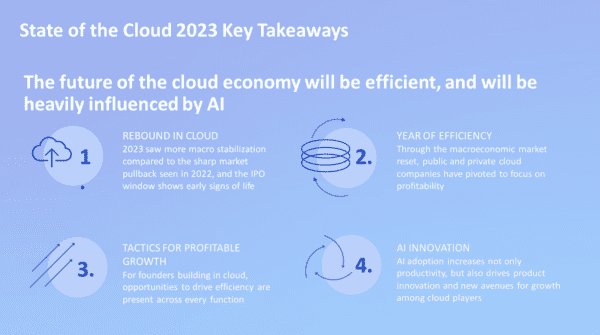

The past twelve months have been relatively turbulent for Cloud founders. SVB collapsed, market multiples are down, yet the IPO window is re-opening, and we have a platform shift to AI that’s exciting everybody.

What does this mean for Cloud companies?

Let’s find out.

The Macro Impact On Public Cloud Software Over The Past Year

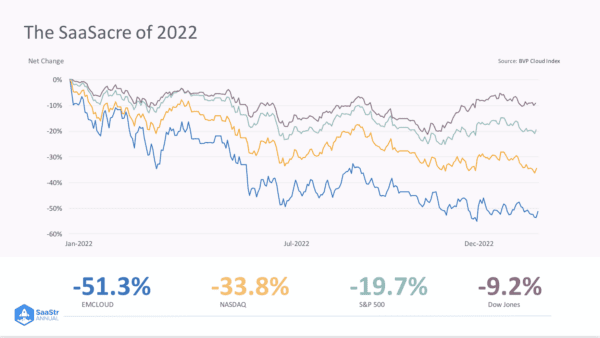

Cloud stocks dropped in 2022 in a severe market pullback event that Bessemer Venture Partners call The SaaSacre.

Within the year, the BVP Cloud Index slid over 50%.

The main reason for the pullback was due to the external shock of hiking interest rates. Within a year, we moved out of a hyper-low interest rate environment at record-breaking speed, which led to multiple compression and macro uncertainty.

By the end of the year, valuation multiples for Cloud companies hadn’t just fallen below the 10-year trailing average but below the pre-pandemic long-term average we were used to seeing.

Beyond multiples, many Cloud companies faced a deluge of headwinds that impacted business fundamentals…

- Lengthening sales cycles

- Tightening customer budgets

It was no surprise that SaaS IPOs came to a screeching halt.

On the M&A front, things slowed but remained robust for a couple of reasons.

- It was a record year for private equity-sponsored deals.

- Announcements of several blockbuster acquisitions, most notably from Adobe acquiring Figma, which was the highest valuation multiple offered in an acquisition for any software company at scale.

While that deal has yet to close, it demonstrates that best-in-class Cloud companies can derive a valuation premium, even in an extremely tough environment.

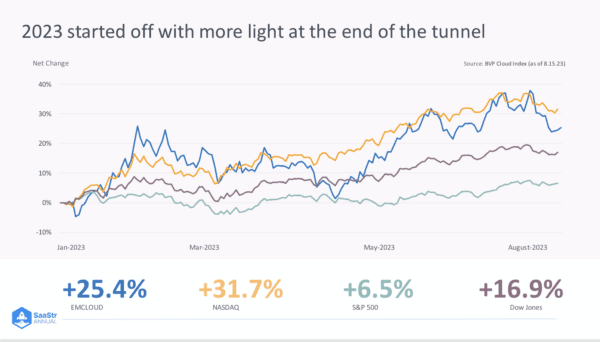

While 2022 was a gloomy year, the skies are parting in 2023.

The BVP Cloud Index is up 25%, indicating a light at the end of the tunnel.

A lot of the uncertainty of 2022 stemmed from changing macro conditions, and now 2023 is seeing more stabilization. Inflation is slowing, and the CBOE Volatility Index has remained healthier this year.

While we’re still a ways from the high valuations of 2021, we are seeing valuation multiples normalize closer to the range of what we saw for long-term pre-pandemic averages.

Consequently, with more stabilization, IPO windows are showing more signs of life.

Klaviyo has just IPO’d at an almost $10 Billion valuation, marking the first pure SaaS company to file to go public in a 2-year draught in SaaS IPOs.

Bessemer believes the top private Cloud companies will follow suit.

A Pivot From Growth At All Costs To Driving Profitability

The Cloud model of recurring revenue, low marginal distribution costs, and strong net dollar retention dynamics is possibly one of the best and most resilient business models ever invented.

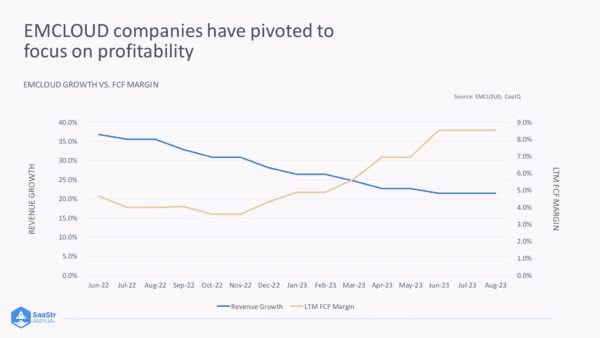

In the face of one of the toughest years for the Cloud economy, many companies adapted quickly from The Age of Excess to The Age of Efficiency.

There’s been a pivot from growth at all costs to driving profitability.

Today, the top 10 highest BVP Cloud Index companies are driving an average of 14% free cash flow, double from just a year ago for the same companies.

The efforts to drive profitability aren’t going unnoticed. They’re being rewarded.

At the peak of bull market exuberance at the end of 2021, a 1% improvement in revenue growth had the same impact on valuations as a 6% improvement in free cash flow margin.

Said another way, growth was more important than profitability by a factor of 6 at the height of bull markets.

Today, this ratio is closer to 2:1. It’s still in favor of growth, but it’s more balanced today.

A 1% improvement in revenue growth today has the same impact on valuations as a 2% improvement in free cash flow margin.

The 100 Best Private Cloud Companies In The World

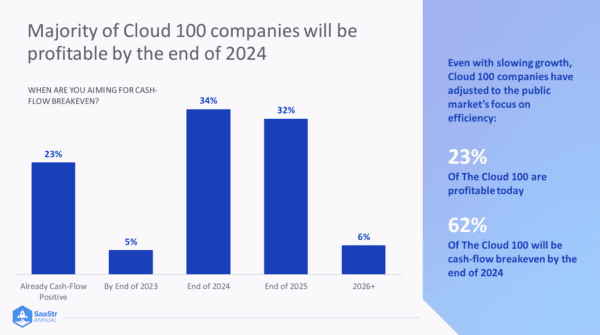

Public Cloud markets are now rewarding efficiency and profitability, so what does that mean for private Cloud companies?

Bessemer uses the Cloud100 as a proxy — Bessemer’s annual list, in partnership with Forbes and Salesforce Ventures, that represents the 100 best private Cloud companies in the world every year.

This year, for the first year, the aggregate value of Cloud100 decreased year-over-year by 11%. Still to a phenomenal $659B!

But it shows that the macro has impacted the best of the best.

Like its public peers, Cloud100 companies are focusing on efficiency.

23% of Cloud100 will be profitable by the end of this year, and ⅔ are planning to be profitable by the end of 2024.

Even for those still burning, 60% are meaningfully reducing their burn, and only 7% are meaningfully increasing it.

That’s definitely a departure from the heights of 2020 and 2021.

Why are they doing this?

Like public markets, Cloud100 growth rates have come down.

The average growth rate in Cloud100 in 2022 was 100%, and this year it fell to 55%.

If companies didn’t focus on efficiency and right-sizing P&Ls, that discrepancy in revenue would flow through the bottom line as increased burn and decreased runway.

Speaking of runway and market dynamics, market multiples have also gone down, even for the best in Cloud.

In 2021, the average multiple was 34x, decreasing to 30x in 2022, and 26x in 2023.

This is important because even though it hasn’t gone down as much as growth-adjusted public Cloud multiples. It reflects the fact that Cloud companies can’t command the same market multiples as previously.

By right-sizing P&L, focusing on efficiency and operational leverage, companies can raise when they feel like their fundamentals are strongest and can get the best valuations vs. raising to finance the business.

How To Actually Drive Efficiency Tactically

Many Cloud founders understand where they need to get to, but actually getting there is another thing.

It’s easy to say you need to transition to profitability and growth, but the devil is in the details.

So, let’s look at the tactics Bessemer Venture Partners portfolio companies have used to transition to a more efficient growth model.

The top areas of P&L for Cloud startups to drive efficient growth are:

- Gross margins

- Sales and marketing

- G&A

- R&D

- People

- Pricing and packaging

Tactic #1: Improve Code To Unlock Performance and Cost Improvements Around Cloud Hosting

Gross margin is effectively the ceiling for the profitability of a business.

A public company with less than 60% gross margins will find it structurally impossible to drive more than 20% free cash flow margins.

One tactic that is top of mind for founders is optimizing Cloud hosting costs.

SendGrid, a Bessemer portfolio company, realized cogs could be minimized by looking at the entire architecture and auditing the most expensive areas from a compute, network, and storage perspective.

They found where they could drive better performance, and ended up driving a 7-figure annual cost savings.

Tactic #2: Review CAC At A Channel-by-Channel Level To Understand Which Are Performing Best And Shift Spend Accordingly

Sales and marketing comes in somewhere around 30-40% of revenue for companies.

GlossGenius is a vertical SaaS and payments company for the beauty and wellness industry.

They built a fantastic product that grew quickly and organically from the beginning.

As it scaled, they realized they needed to layer in inorganic channels of growth while keeping an eye on efficiency.

So they came up with a North Star benchmark, used it as a hurdle rate by channel, and any channels that hit that benchmark would justify a continued investment.

If a channel didn’t hit it, they’d stop investing in it and reallocate those funds into the overperforming channel.

It worked well for them.

The tactic here is to determine what might be the right hurdle rate to apply to your own channels and audit those channels accordingly.

Tactic #3: Negotiate and Optimize SaaS Vendor Spend

G&A tends to be overlooked when thinking of efficiencies in P&L because it’s only 10-15% of revenue.

That said, it’s a place to find quick wins and efficiencies without impacting the overall growth rate.

The portfolio company above, CAPMO, looked at the SaaS sprawl footprint to find areas to optimize.

They didn’t have a good idea of what software had been procured over the years. So, they conducted an audit and found inefficiencies and duplicative instances.

They were able to work with a company that negotiated about a third off of a few key contracts.

The takeaway?

Become more efficient by right-sizing G&A through fighting SaaS sprawl.

Tactic #4: Force-Rank Current Projects Based On Highest Perceived ROI To The Lowest

The most fraught bucket of OpEx is R&D.

It’s tricky because you can find short-term gains, but in the long term, it could degrade your competitive advantage.

So, how can you optimize it?

Bessemer encourages Heads of R&D to force-rank current projects based on the highest perceived ROI to the lowest. Then, cut some percent of the bottom-performing ones and reallocate to the highest ROI.

An interesting way people drive R&D efficiency is through the rise of LLMs.

Bessemer has a four-step framework when thinking of how to leverage and adopt LLMs externally for product innovation and internally for efficiencies.

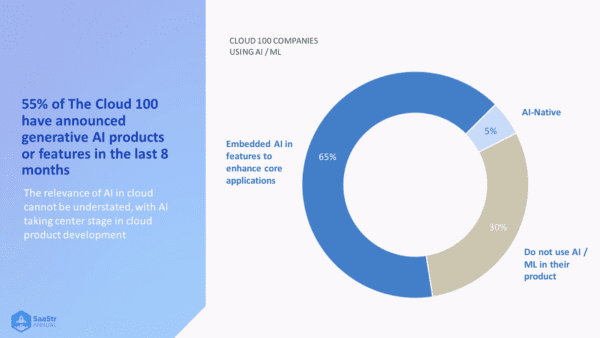

As you think about leveraging AI and optimizing R&D efficiency, it’s worthwhile to know how the best companies are doing it.

Cloud100 is moving rapidly, with 55% launching a generative AI product or feature in the last eight months alone.

Leveraging new tech and delivering the most differentiated product experience is the quickest path to success.

But how do you do it?

Three Strategies For Leveraging AI

The three strategies for leveraging AI are:

- Embedded AI

- Acquired AI

- Native AI

Embedded AI uses external AI tooling to augment product offerings, supercharging existing Cloud platforms and delivering better customer experiences.

Databricks acquired MosaicML to offer a unified platform to customers by deploying their own AI models.

Acquisition is an art and isn’t for everyone.

The final strategy is being AI native from the get-go. These companies see AI as core to their architecture from inception.

Rewrite The Product Roadmap

AI innovation is rapidly evolving, and above, you’ll find a market map of tools you could use.

You need to look at your product from first principles and rebuild your roadmap.

Some things to think about are:

- Your application — reading/writing within the app, app-specific language

- Product workflows — Predictable, repeatable sequences of workflow within your product

- Cross-product workflows — What do users write or speak after using your app (e.g., email reports)? Is your app part of a larger predictable work sequence? Will an integrated product win?

The Takeaway

Despite a turbulent few years in the Cloud ecosystem, it shows early signs of recovery. We have Klaviyo and others testing public waters.

Given the paradigm shift in how investors value companies for efficient growth rather than growth at all costs, it presents a great opportunity for Cloud founders to build durable businesses.

The dream is to be a Rule of 40 company, and companies can leverage these tactics and AI to drive efficiency and innovation.