SaaS businesses have a unique set of needs and challenges when it comes to payment processing. From creating a user-friendly checkout experience to collecting recurring payments and following tax laws in dozens of jurisdictions across the globe, it’s a lot to handle.

That’s why having a payment gateway that works seamlessly is so essential. It’s just one piece of the SaaS payment puzzle, but everything becomes much easier if you have a gateway that works for your business.

In this article, we’ll take a deep dive into SaaS payment processing systems, highlight some of the challenges your business could face, and help you build a great SaaS payment setup. We’ll even give you a breakdown of popular payment gateways to help you get started.

Saas Payment Processing: An Overview

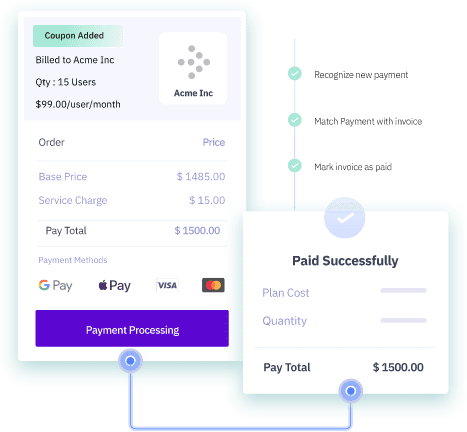

SaaS payment processing is a multi-step process. Multiple systems need to work together for your company to successfully collect payments — whether a one-off fee or a recurring subscription.

There are three core systems every SaaS payment solution needs:

- A payment gateway

- A subscription management solution

- A billing user interface

A payment gateway is how customers make payments. It is the first thing they see when they choose to buy your product, and it is the software that charges their card and sends the money to your bank.

SaaS businesses often use a subscription management solution to manage ongoing payments. It will automatically charge subscribers without them having to reenter their billing information, support price changes, and generate invoices for the SaaS business. This tool will also handle things like discounts, downgrades, and cancellations.

A billing user interface is the front-end area where customers interact with your SaaS brand. It lets them view pricing, subscribe to plans, update their credit cards, and generate invoices.

Those are just the core pieces of the SaaS payment processing puzzle. Most businesses will also require a dunning system to collect failed payments, reporting and analytics functionality to optimize their billing processes, and tax and accounting features to record and submit transactions to multiple local authorities.

With so many moving parts, most SaaS businesses buy a solution rather than build one.

What Makes SaaS Payment Processing Difficult?

The biggest difference between SaaS payments and other businesses is the reliance on recurring payments. This presents several challenges that your payment gateway needs to help you overcome.

Managing Recurring Automatic Payments

One of the biggest challenges of SaaS payment processing is managing recurring SaaS payments. Unlike traditional businesses, where customers make one-time purchases, SaaS companies rely on recurring revenue from subscriptions. This means they need robust subscription management systems to ensure customers are billed correctly and on time.

That seems manageable when customers are charged the same amount each month. But what happens when subscriptions are based on usage limits or when users switch plans more than once a year? Even canceling subscriptions can be a challenge.

It’s why a payment gateway alone isn’t enough. SaaS businesses must use recurring billing software to handle the heavy lifting.

Failed Payments

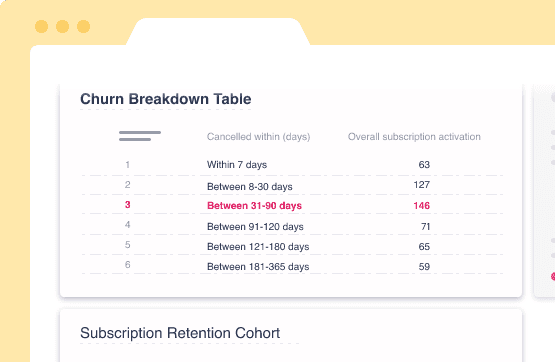

Failed payments occur when a customer’s credit card is out of date or declined or there are insufficient funds in their account. Failed payments are a significant problem for SaaS brands. Not only are they one of the biggest causes of involuntary churn — as much as 10% of your revenue could be at risk — but it also impacts a SaaS business’ cash flow.

To combat this, SaaS companies need to have a revenue recovery process in place. This can be an accounts team that communicates regularly with customers, or businesses can choose to automate revenue recovery processes.

Handling International Payments

The beauty of a software business is that companies across the globe can use it. While that’s great for your bottom line, handling international payments can be a significant issue. Not only do SaaS brands need to have a payment gateway capable of accepting payments in local currencies, but they also need to follow local tax laws and regulations.

That’s why working with a payment gateway that supports multi-currency payments and has a robust reporting system is vital. Your subscription management platform will also need to be able to handle multiple currencies.

Accounting and Financial Reporting

When you accept payments from across the globe, you’ll also be responsible for reporting those payments to the relevant authorities. That might be manageable in-house when you sell in one or two locations, but it quickly becomes unsustainable.

As a result, SaaS businesses need to work with payment gateways and subscription billing platforms that simplify SaaS accounting operations and automate the process of reporting revenue and tax payments. Integration with bookkeeping and accounting software is also essential.

What Should Subscription Companies Look for in Payment Gateways?

SaaS brands should look for the following features when choosing a payment gateway:

Multiple Payment Methods

Increase conversion rates by letting customers pay using their preferred payment method. That includes:

- Credit cards

- Debit cards

- Direct Debit

- Digital Wallets

- Crypto

It should also be possible to make recurring payments using several of the methods listed above.

Secure Transactions

Security is paramount for both SaaS brands and consumers. Any payment gateway you consider should be PCI DSS-compliant as standard. Additional security features like 3d secure 2.0 authorization are also recommended.

Fraud Prevention Features

Choose a payment gateway with built-in fraud prevention features. Common methods are an Address Verification Service (AVS), Card Verification Value (CVV), risk scoring, and lockout mechanisms.

Low Transaction Fees

Payment gateways generate revenue by taking a percentage of each transaction. While you want to choose a payment gateway with all of the features above, you should also be mindful of choosing one with low transaction fees — especially if a payment gateway is just one part of your overall payment system.

Top Payment Gateways and Processors for SaaS Businesses

Below are the top payment gateways and processors for SaaS businesses. Find out more about them, or use our comparison tool to find the best solution.

Stripe

Stripe is a powerful and flexible payment gateway. For instance, you can use Stripe Checkout, the platform’s hosted payment gateway, or create a customized API-based solution that integrates with your site. Stripe handles over 135 currencies and dozens of payment methods and is trusted by brands including DocuSign, Amazon, and Shopify.

Other important features include machine learning-based fraud prevention, authorization optimization, and a suite of other payment-related products.

Stripe integrates with Chargebee to automate recurring subscriptions.

Stripe Pricing

Stripe offers simple pay-as-you-go pricing at a rate of 2.9% + $0.30 per transaction. There are no setup or monthly fees.

Braintree

Braintree, which is part of the PayPal network of companies, offers both hosted and integrated payment gateway solutions. It offers a global service that allows customers to pay with credit cards, digital wallets, and other payment methods. It also offers subscription and buy now, pay later functionality. The platform is Level 1 PCI compliant and provides advanced fraud protection that reduces false positives and minimizes chargebacks. One integration is all you need to join brands like Uber and Casper accepting payments with Braintree.

You can combine Braintree and Chargebee to automate recurring payments.

Braintree Pricing

Braintree charges businesses 2.59% + $0.49 per transaction for cards and digital wallets. ACH Direct Debit payments incur a 0.75% fee and Venmo payments cost 3.49% + $0.49 per transaction.

Checkout

Checkout is an integrated payment gateway used by leading brands like Patreon, Shein, and Sony. It offers a range of API and developer-friendly tools, making it easy to add Checkout to your website. With over 150 currencies and local payment methods (on top of debit and credit cards), accepting international payments is also a breeze. Other features include smart fraud detection, PCI DSS compliance, and 3D secure customer authentication. If that wasn’t enough, Checkout also gives users access to granular payment data to improve processes.

Checkout integrates with Chargebee to help you scale subscription payments.

Checkout Pricing

Check out tailors’ pricing based on your needs. It offers a flat rate with no setup or account maintenance fees.

GoCardless

GoCardless is the preferred payment gateway for over 75,000 businesses worldwide. It offers both a managed and integrated payment gateway solution, complete with customizable payment pages. You can collect payments from over 30 countries without needing a local bank account, and customers can pay in various methods. GoCardless integrates with over 350 other tools, including Salesforce, Xero, and Sage, and allows you to manage payments through its intuitive dashboard or via a third party. GoCardless can also handle subscription payments via direct debit.

GoCardless integrates with Chargebee to scale recurring billing.

GoCardless Pricing

GoCardless charges businesses 1% + $0.25 per transaction up to a maximum of $2.50. International payments incur a higher fee of 2% + $0.25. There’s no contract and no setup fee.

Paypal

Payflow Payment Gateway by PayPal is a comprehensive payment gateway offering that offers both integrated and managed solutions. The checkout page is hosted by PayPal when using the Payflow link and self-hosted when using Payflow Pro. With Payflow, you can accept transactions in over 200 countries using 25 different currencies. It integrates with all major shopping carts and virtually every processor. PayPal can also provide a merchant account if you don’t have one.

Unlike other payment gateways, Payflow offers a range of other features like recurring billing, buyer authentication, and fraud protection services at an additional cost.

PayPal integrates with Chargebee for easy recurring payments.

PayPal Payflow Pricing

Pricing depends on which of the two payment gateway options you choose. Payflow Link incurs no monthly fees, while PayPal Pro costs $25 per month. Neither gateway charges a setup fee, and both charge the same transaction fee of $0.10.

Bluesnap

Bluesnap offers an all-in-one payment platform that provides most businesses with everything they need to accept payments. Customers can use a wide range of payment methods, including all major credit and debit cards, as well as eWallets like Apple Pay. Bluesnap’s payment gateway is PCI compliant and integrates with several leading shopping carts, including WooCommerce, Magento, and BigCommerce. Bluesnap also offers a managed fraud prevention service and the option to host your checkout page with themselves or integrate their platform into your own site via API.

Chargebee is a preferred partner of Bluesnap.

Bluesnap Pricing

Bluesnap offers pay-as-you-go pricing of 2.9% + $0.30 per successful card transaction. Customized pricing packages are available for enterprise businesses.

Mollie

Mollie provides a streamlined payment gateway solution for businesses of any size. It’s a particularly powerful solution for anyone operating in the European market, allowing you to offer every major payment method to your customers. Businesses can choose a managed or integrated payment gateway solution and begin accepting payments in as little as 15 minutes. A range of free plugins are available, as are programming packages for several languages, including Ruby and PHP.

Mollie integrates with Chargebee.

Mollie Pricing

Mollie only offers pay-per-transaction pricing, with no minimum costs or contracts. Rates start at

€0.25 + 1.8 % for Mastercard and Visa payments.

Worldpay

Worldpay by FIS is one of the most comprehensive payment gateways on the market. It supports over one million merchants worldwide and accepts over 300 different payment methods and 126 currencies. Worldpay is the trusted payment gateway of some of the world’s biggest brands, including Microsoft, Emirates, Amazon, and Lenovo, and processes over 110 million transactions on average each day.

Chargebee offers a direct integration for Worldpay

Worldpay Pricing

Worldpay charges a 1.5% transaction fee for Mastercard and Visa payments. There are no setup fees or premium charges.

What Does a Great SaaS Payment Processing Setup Look Like?

Businesses need to think carefully when choosing a payment processing setup. Once integrated, it can be difficult to change. Follow these tips to find the right solution for your SaaS business.

1. User-Friendly Checkout Experience

You don’t want to fall at the first hurdle. But that’s exactly what can happen when would-be customers are faced with an ugly or unintuitive checkout experience.

The checkout process is one of the most critical aspects of any payment processing setup. A user-friendly checkout process can significantly impact your conversion rates. With that in mind, customers should be able to complete their purchases quickly and easily without encountering any issues or complications.

To achieve this, your checkout process should be simple and intuitive. It should include clear instructions on completing the purchase, including information on the total cost, payment options available, and any applicable taxes or fees.

Letting users make payments via various methods is also essential, and payment should be localized wherever possible.

2. Tailored Payment Options to Suit the Audience

Having a well-rounded payment tech stack is crucial for any SaaS business aiming to expand globally. Your payment system should encompass various payment methods and cater to different countries, ensuring seamless transactions for your customers.

Your payment tech stack should support all major credit cards, including Visa, Mastercard, and American Express. Additionally, it should offer popular online payment methods like PayPal or Apple Pay. By providing diverse payment options through your setup, you can accommodate different customer preferences, ensuring quick and hassle-free transactions.

3. An Easy-to-Manage Billing System for Customers and Employees

When your business revolves around recurring payments, you better have a billing system in place that makes it easy for both you and your customers to handle subscriptions. In practice, customers should have access to a user-friendly front-end interface that lets them alter and cancel their subscriptions at will.

On the back end, SaaS businesses must be able to alter subscriptions for customers and receive detailed reports on payments and usage.

4. A Smart Dunning System to Recover Revenue

Whether it comes as part of your payment gateway or via your subscription management platform, SaaS businesses need a smart dunning system to recover revenue when payments fail.

Your dunning system should be automated so that it sends out reminders automatically when a customer’s subscription is about to expire when their credit card has expired, or if it’s been declined.

Chargebee’s solution takes things a step further by using an intelligent retry sequence that finds the best times to attempt recovery. That’s just the start. Once you’ve perfected your dunning process, Chargebee lets you customize the entire process from email content to timings.

5. Discount and Promotion Functionality

Offering discounts is an effective way of attracting new customers and retaining existing ones. With that in mind, your SaaS payment processing setup should include discount functionality that ensures conversion rates are as high as possible.

Creating discounts is just the start. Chargebee’s discount management platform lets you experiment with different discount types, run campaigns, and track everything to find the best offers.

6. Easy Reporting and Accounting Integration

Finally, a great SaaS payment processing setup must provide easy reporting functionality so businesses can optimize sales processes in the future. In particular, payment gateways should provide detailed insights into revenue streams and allow businesses to segment data by audience and product.

Crucially, these platforms should go beyond basic metrics like MRR and allow businesses to track more meaningful KPIs like lifetime value, average revenue per subscription, and trial-to-paid conversion rates.

Things can change in an instant with SaaS businesses, which is why alerts are key to keeping you informed when revenue dips or churn levels spike. And because every SaaS business is different, customization is key and platforms should let you build your own reports from scratch.

Make Chargebee Part of Your SaaS Payment Solution

A payment gateway is a critical part of any SaaS payment tech stack. But it’s just one part. Most payment gateways don’t have the functionality to handle recurring payments, let alone provide a user-friendly front-end interface or customer retention features.

That’s why thousands of SaaS brands choose Chargebee to manage and optimize subscription payments.