Why are things in SaaS so different in 2023 than in 2022?

And extremely different than 2021?

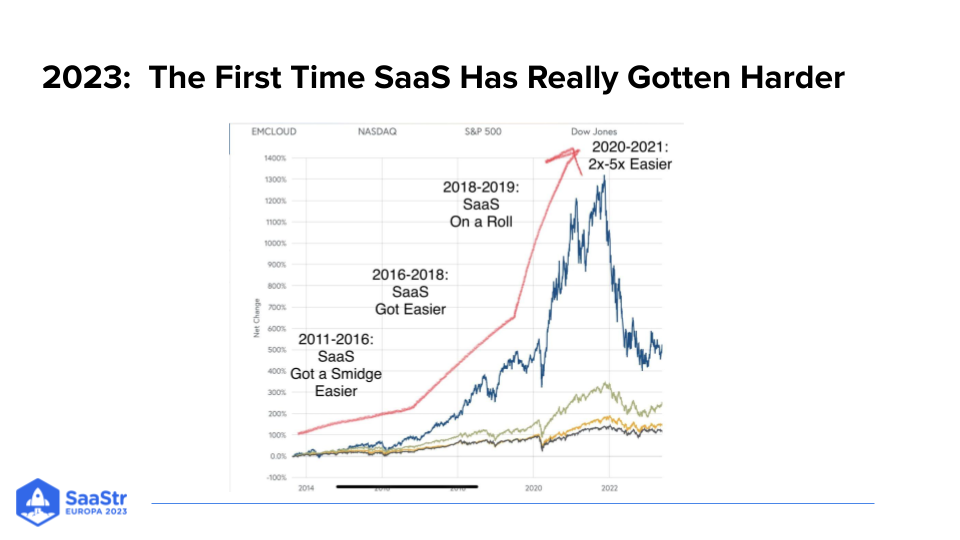

“I think for most of us during the crazy lockdown era, it was just nuts,” Lemkin explains. “And this is, I know this sounds obvious, or maybe it doesn’t, but as someone’s been doing SaaS since 2005, this is the first time in the last 10 years that SaaS has gotten harder.”

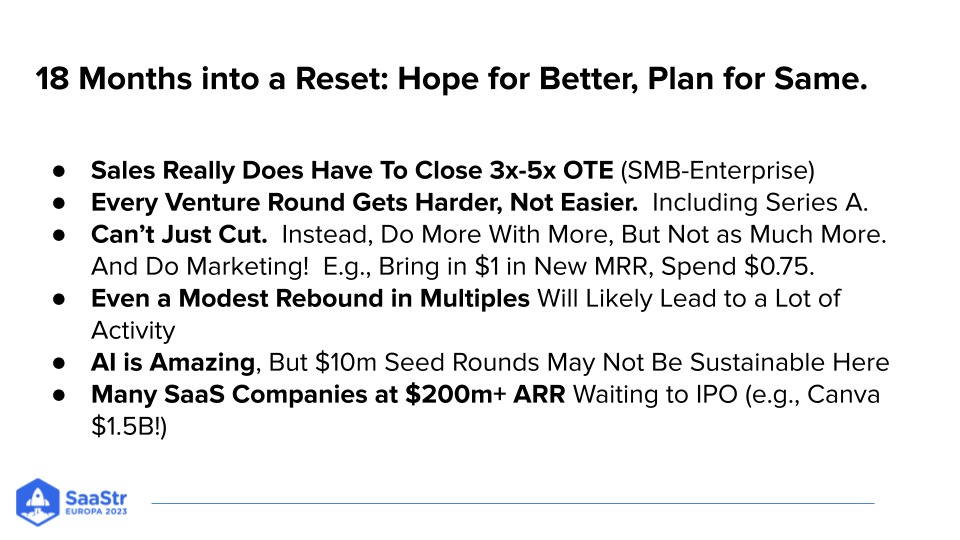

What’s Different in SaaS in 2023:

Looking at the BVP Cloud Index below and the overall growth of the markets, notice how on the top one, which indicates all the public cloud stocks and their stock prices – there were a few noticeable bumps, and if you look closely, you’ll also see where there have been some downturns.

At the SaaStr Annual in 2016, there was a flash crash, and it was worse than the crashes of 2008, 2009. For about four months, people just stopped buying anything in SaaS. It’s nothing like today.

It was so crazy that LinkedIn, even though they were profitable and public, panicked and sold to Microsoft. The markets panicked then, and the markets also panicked around March of 2020. But what happened then is they were short.

The nuttiness of the lockdown didn’t last. Three months later, Zoom exploded and Slack exploded. We had a tear in SaaS purchasing as we’d never seen. So even though there was a rough four weeks or eight weeks or 12 weeks, it was short.

The First Time SaaS Has Really Gotten Harder

The weird thing is now we’re in year two of a tougher cycle, whereas from 2011 to 2016, outside of that flash crash, each year SaaS got a little bit easier. People knew a little bit more about SaaS.

When Box IPO’ed back in 2015, one week before the SaaStr Annual, things were smaller. It was worth 900 million. All of a sudden, startups could be unicorns. And when it started to get easier, it all became mainstream.

Normal people went into SaaS. It wasn’t quirky people that did startups. It wasn’t crazy people that did this. It was ordinary, regular old people, and it just changed the surface air, and it just got easier. And then 2020 and ’21, it got almost too easy, not necessarily for us founders, but it became easier to cut more corners.

So then, by 2022, the market was in bad shape because it had a huge terrible overhang. The markets actually really peaked just at the end of 2021. Notably, Salesloft, a company Jason invested in almost pre-revenue was the last big acquisition that happened. They were bought for almost $2.5 billion in cash, and it closed on December 31st, 2021. Pretty good.

And Salesloft had just crossed a little over $100 million in revenue. So at the time when deals were being done at really high multiples, it was 20X, which was a decent deal for a PE workout. But it was interesting because that deal almost fell apart in December.

By the time the deal got signed, it was exciting, but by the end, investors were starting to panic.

There were questions, could we get out of the term sheet? It wasn’t quite said, but panic had already set in. And that’s when the markets just plummeted, as we know, now into 2022. It became a free fall year in the public markets.

“I personally never thought we would have two years of a public company downturn or what we are. But what are we at now? Now, we’re in what looks like a flat turn. We were up and down, but now, the public markets are flat this year. Some of them are up a bit, like Snowflake and Cloudflare, and others have actually come back from the bottom, but a few others are down,” Lemkin explains.

We’re in a world where it’s flat and multiples, what public companies are valued at as a multiple of revenue, are pretty bad. The average public SaaS company is worth five to six times the revenue.

Key Takeaway: In 2023, it’s not that SaaS has gotten hard, but think of it more as SaaS has gotten hard again. Its basically gotten as hard as it used to be, and its gotten as hard as it should be. There is not unlimited budget. CIOs, small businesses do not have unlimited money. There’s a fixed amount. And if you disrupt something, if you do something better than Salesforce or Zoom or HubSpot or Slack or even UiPath, if you do something that is 10 times better, you will get money. But it’s because you’re disrupting that budget. You’re stealing budget from one vendor to a new vendor. That will always exist even in the tougher times.

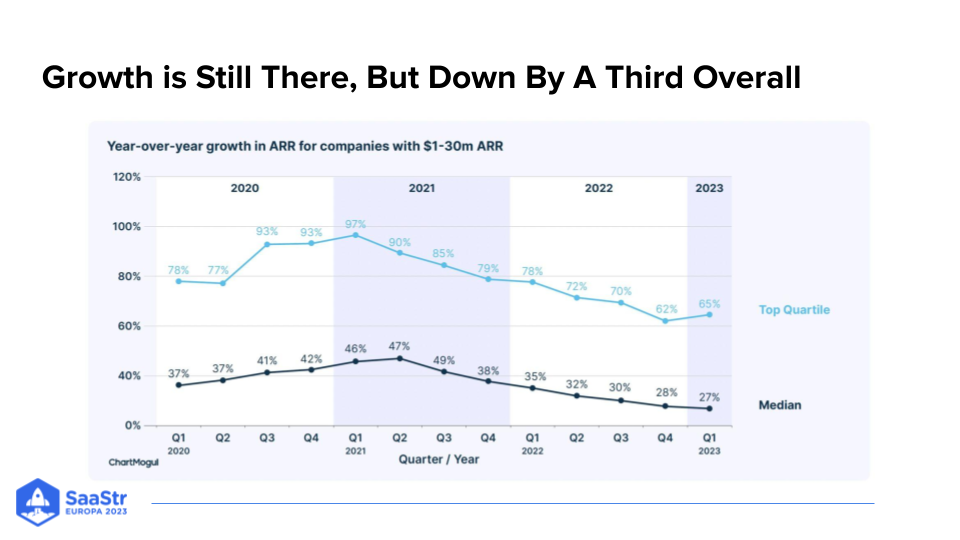

Growth Slowed Down About 33% On Average For Everyone in Q1

Jason recently wrote on SaaStr.com how two recent data analyses from ChartMogul and Altimeter across both private and public SaaS companies interestingly both showed that for the best SaaS companies, on average, growth in Q1 was down about 33% or so from a year ago.

Things are down overall by about 30%.

But growth is not down 100%. It is down by about a third from when it was easier. So everything’s 33 to 50% harder, and maybe that’s the way it should be.

But the craziest thing isn’t really the growth. The craziest thing is how necessary efficient growth has become.

Daniel Dines, CEO of UiPath shared at SaaStr how they went from losing 400 million in a year to being almost break even the next year. That was unprecedented.

Now, it’s precedented because every public company has done this and people have been wondering for 10 years if SaaS is profitable at scale. And no one knew the answer until now. Now, everyone is efficient.

Here’s an example in efficiency from HubSpot.

HubSpot: A Tale of Efficient Growth at Scale

HubSpot just crossed two billion in revenue, and all the way up to $2 billion, HubSpot has been selling to SMBs at a 10K price point. They thread a needle.

They wanted to invest in the business. They wanted to invest in sales and marketing and engineering and product, and so if you look at the left of the chart above, you can see their net margins were pretty low. They were net positive back in 2017, but it wasn’t much. They were investing almost everything back into the business.

And then over the last year, HubSpot became radically more profitable than it was a year ago, from almost nothing to 13.5% margins, and we’re seeing this everywhere.

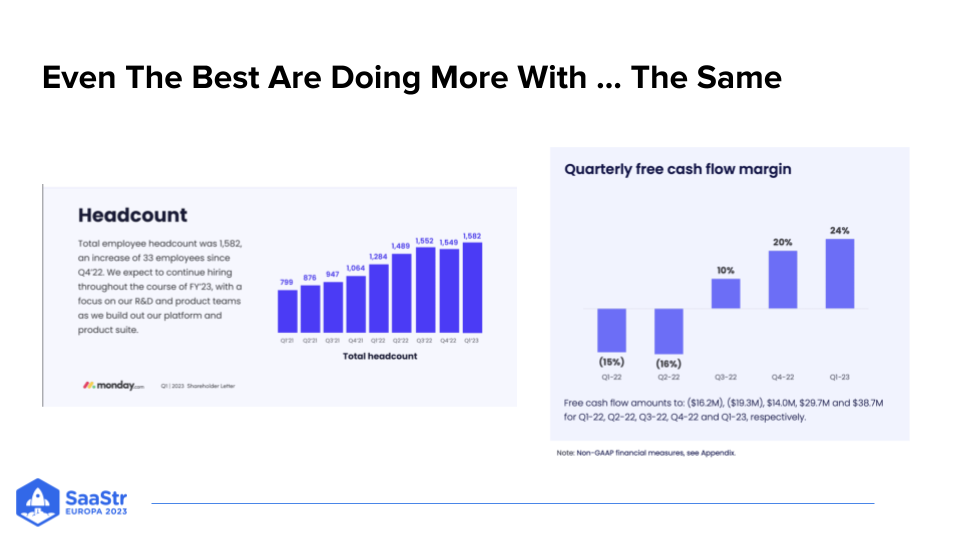

Monday.com – Achieving Profitability through Improved Margins

And here’s another fascinating example, Monday.com. It’s growing about 50% at 640 million in ARR. Pretty good, right? Especially when you consider that in less than a year, Monday.com became radically different from -16% margins to 24%.

24% is really hard to achieve.

It wasn’t luck on their part – it was strategic planning and execution. They optimized operational efficiency, cut costs, and increased profitability.

Their approach:

- Keep headcount flat for the past year

- Reduced unnecessary expenses

- Invested in technology for automation and process streamlining

- Focused on customer retention strategies

- Prioritized high-margin products or services

And it’s paid off.

For the First Time in SaaS: Efficiency Matters

The Importance of Efficient Growth in Today’s Climate

Looking at the above analysis from ChartMogul, Lemkin distilled this data down into 2 learnings:

#1 Companies that weren’t doubling in growth became unfundable over the course of this year

#2 Despite everything, the best SaaS companies still grew, just about 33% less than they did at the peak.

Lemkin explains, “Everyone already has bought 200 SaaS products, and most businesses out there work just fine. Do we need the 11000th prospecting tool or the 58,000 payroll system? We do not. The tools are okay that we have today. Build something disruptive, build something amazing that will get someone to switch and you’ll unlock the budget.”

So yes, everything in SaaS is harder, but looking at the startups and public companies that have become radically more efficient than they were a year ago shows that while things are a third harder for most of us, growth can still be achieved.

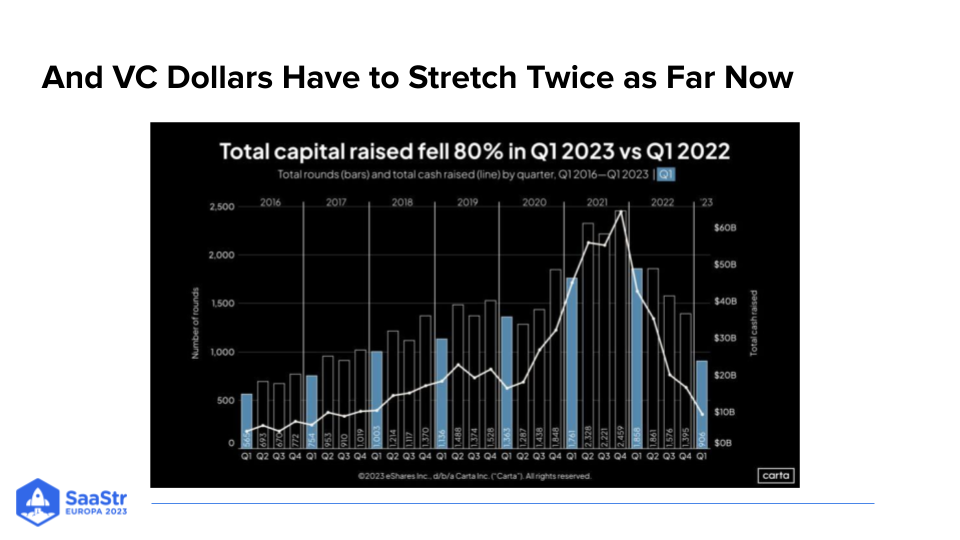

Venture Capital Markets: Toughest in 5+ Years

Lemkin explains the tough fundraising climate by distilling it down to this:

“There’s so much stress across venture today because you need to get to 100 or 200 million in ARR in seven to 10 years for venture to work. And if you’re not growing at a rate that can compound to 100 million in that journey, you simply can’t make VCs enough money for them to make money.”

There’s a now long-understood model of growth and how that equates to your company’s valuation that Neeraj Agrawal from Battery Ventures put together a while ago, which was triple, triple, double, double.

You’ve got to triple after one million, one to three, triple again three to nine, then nine to 18, and 18 to 36. Not everyone in SaaS quite does triple, triple, double, double, but the reason it’s such a useful heuristic is that it gets you to 100 million in seven to eight to nine to 10 years.

“That’s what it takes,” Lemkin explains. “And if you fall below that line, it doesn’t mean you’re a bad human or a bad startup or your customers don’t love you. It just means venture capitalists can’t make enough money to invest in you. Just realize your existing investors may cut you slack if growth is slowed, but new investors are just going to pass. They’re just going to pass and this is why the markets have frozen.”

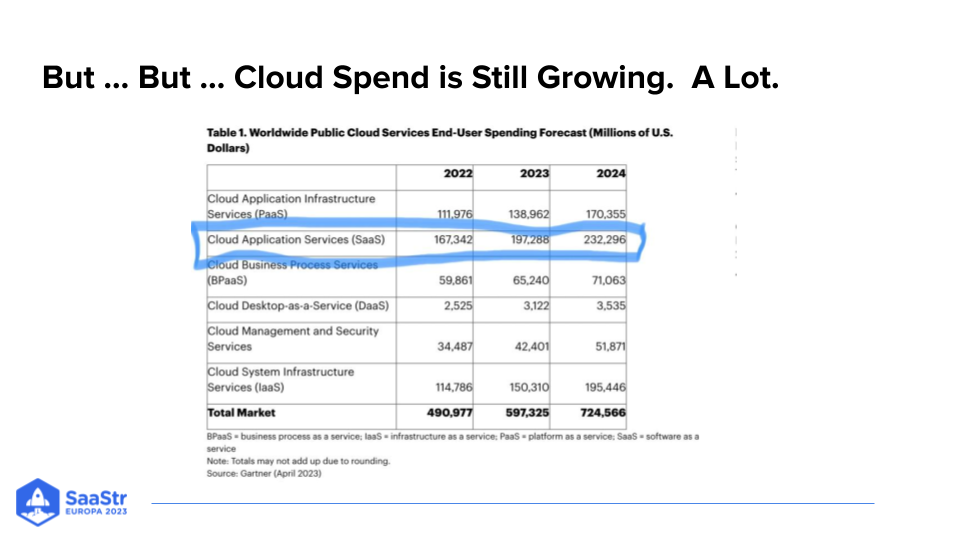

Cloud Spend Still Growing, Just with More Scrutiny

We write up a lot of the Gartner data on SaaStr as they’re constantly surveying hundreds and hundreds and hundreds of buyers. So when their numbers change a little bit, it’s always some of the most directionally correct data that we can access as founders and executives.

So what does Gartner say?

Well, SaaS is still going to grow 18% in spend this year and another 18% next year. People are still going to spend almost $200 million in the U.S. alone on SaaS just in the enterprise, $200 billion this year and $230 billion next year.

Now, a lot of that’s going to go to incumbents, price raises, and inflation, but the point is that it’s not going down year-over-year.

So overall, things are trending well for SaaS, and people are buying more and more of our products. They’re just buying differently with more scrutiny than they did 18 months ago.

“I think founders have adjusted to this, but it took them a while,” Lemkin explains. “Folks are complaining, ‘Oh my god, now the CFO has to approve my deal. Now I have more stakeholders, now I have to go through scrutiny, now I have to go through an extra layer of procurement.’ And I’m like this is the way it used to be until 2020.”

Key Takeaways:

In the end, our current climate in SaaS is more of a “reset” than a “downturn.”