So AppFolio is a big vertical SaaS+ success story I frankly don’t know as much about as I should. There are several big leaders in property management software, and AppFolio is one of them.

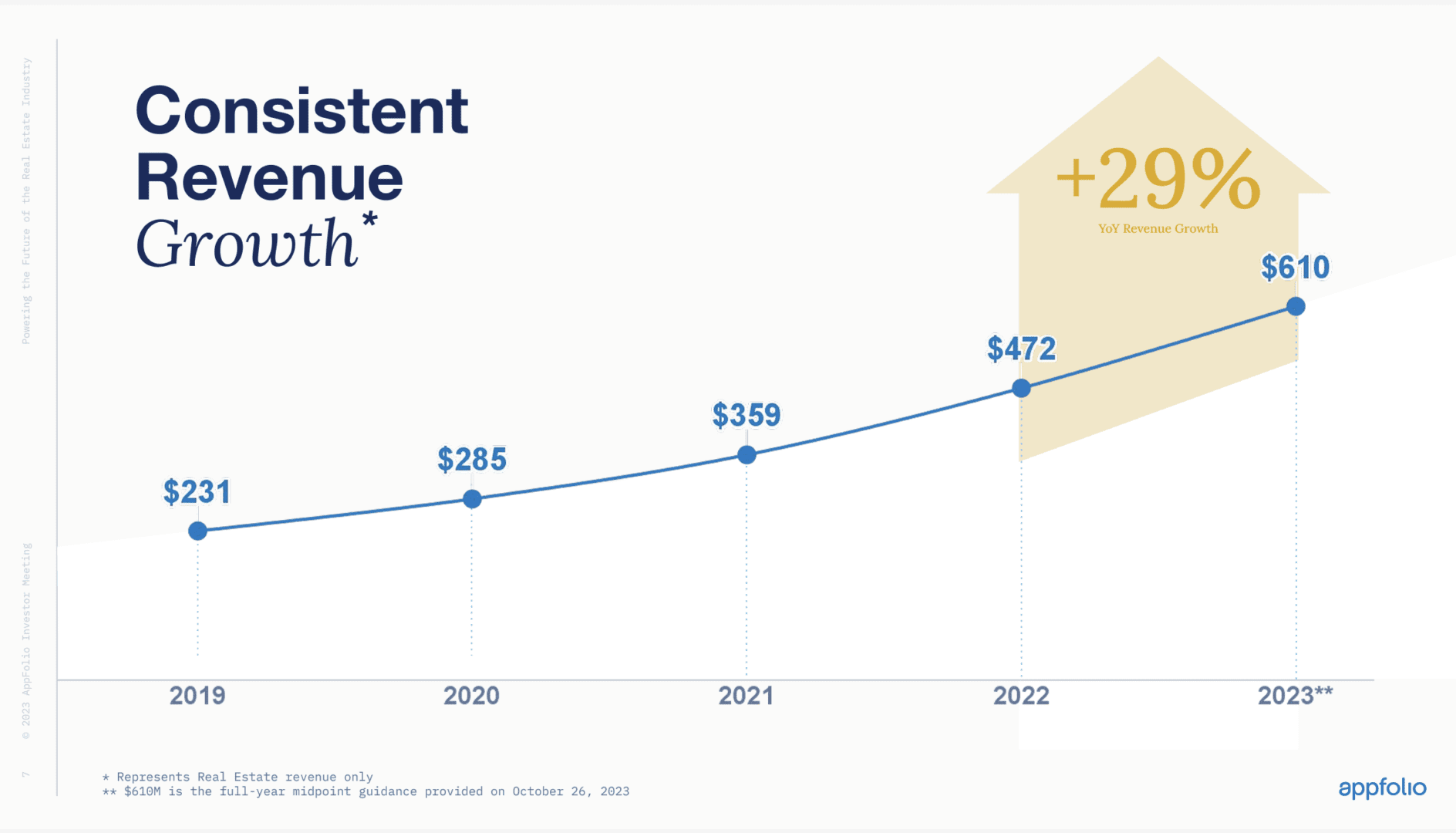

It’s doing well, especially in today’s markets. At $660m in “ARR” (a lot of that isn’t software, as we’ll see below), it’s trading at a $7.2 Billion market cap, even with lower than standard gross margins. That’s pretty healthy. Growth is strong if not crazy, at +29% at $660m in “ARR”. Importantly, it’s efficient growth as we’ll see.

So AppFolio is a quiet member of the 10x ARR club

– SaaS for property management

– $660m run-rate, $7.2B market cap (11x)

– Growing 29% a year — efficiently

– Only 30% of revenue from software, rest payments + services

– 20% Free Cash Flow, 16% non-GAAP margins

– Frozen… pic.twitter.com/8PLvYP1JRz— Jason ✨Be Kind✨ Lemkin 🇮🇱 (@jasonlk) November 15, 2023

And its stock is up 87% this year! AppFolio is what the markets want in a software+ company, at least in 2023.

Let’s dig in.

5 Interesting Learnings:

#1. Steady, Strong Growth — Since 2006

Appfolio was founded way back in 2006, and they never quit. 10 years later, they hit $100m ARR in 2016 and growth just compounded from there. Today, at a $660m run-rate, they are growing 29% a year, with substantial free-cash flow.

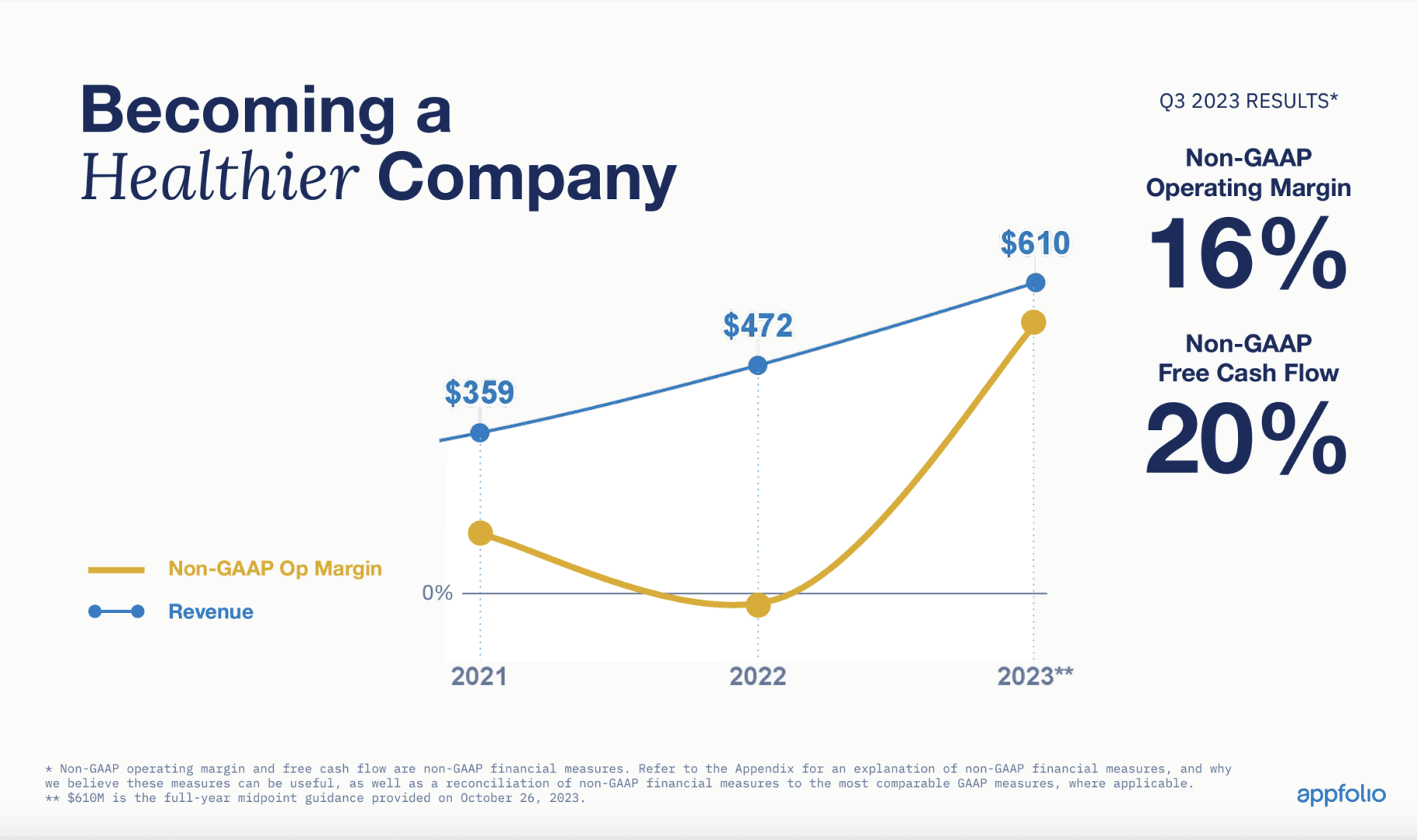

#2. Gotta Radically More Efficient in 2023

This is really the theme of the year in SaaS and Cloud. As you can see below, while non-GAAP operating margins dipped in 2022, they came roaring back in 2023, with 20% free cash flow and a huge gain in operating margins.

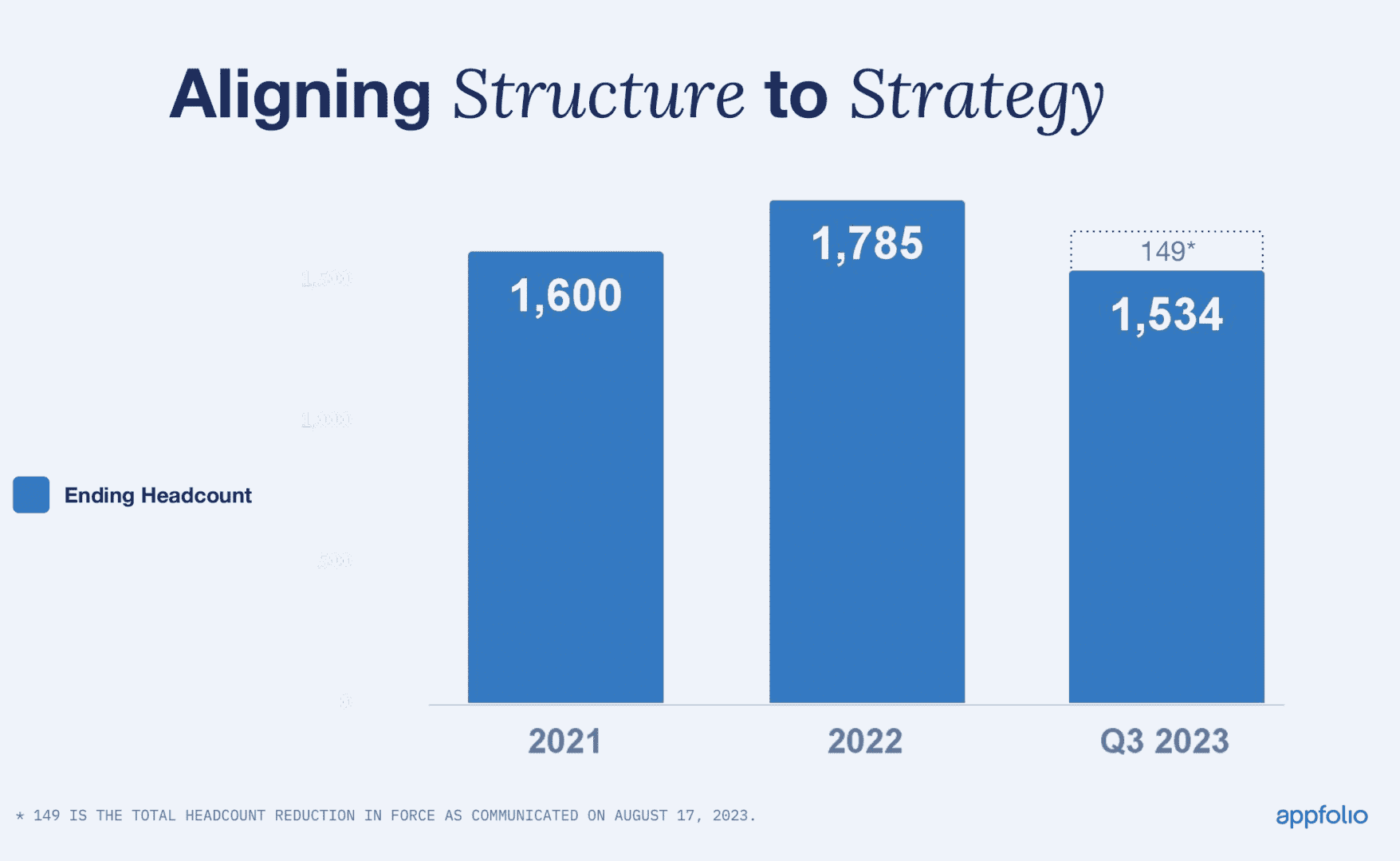

#3. Freezing Headcount is How They Got So Much More Efficient

Again, a common story. Many that did are now re-hiring, from Monday to Salesforce and more. But for now, AppFolio is staying leaner, with less headcount this year than last — despite impressive +29% growth.

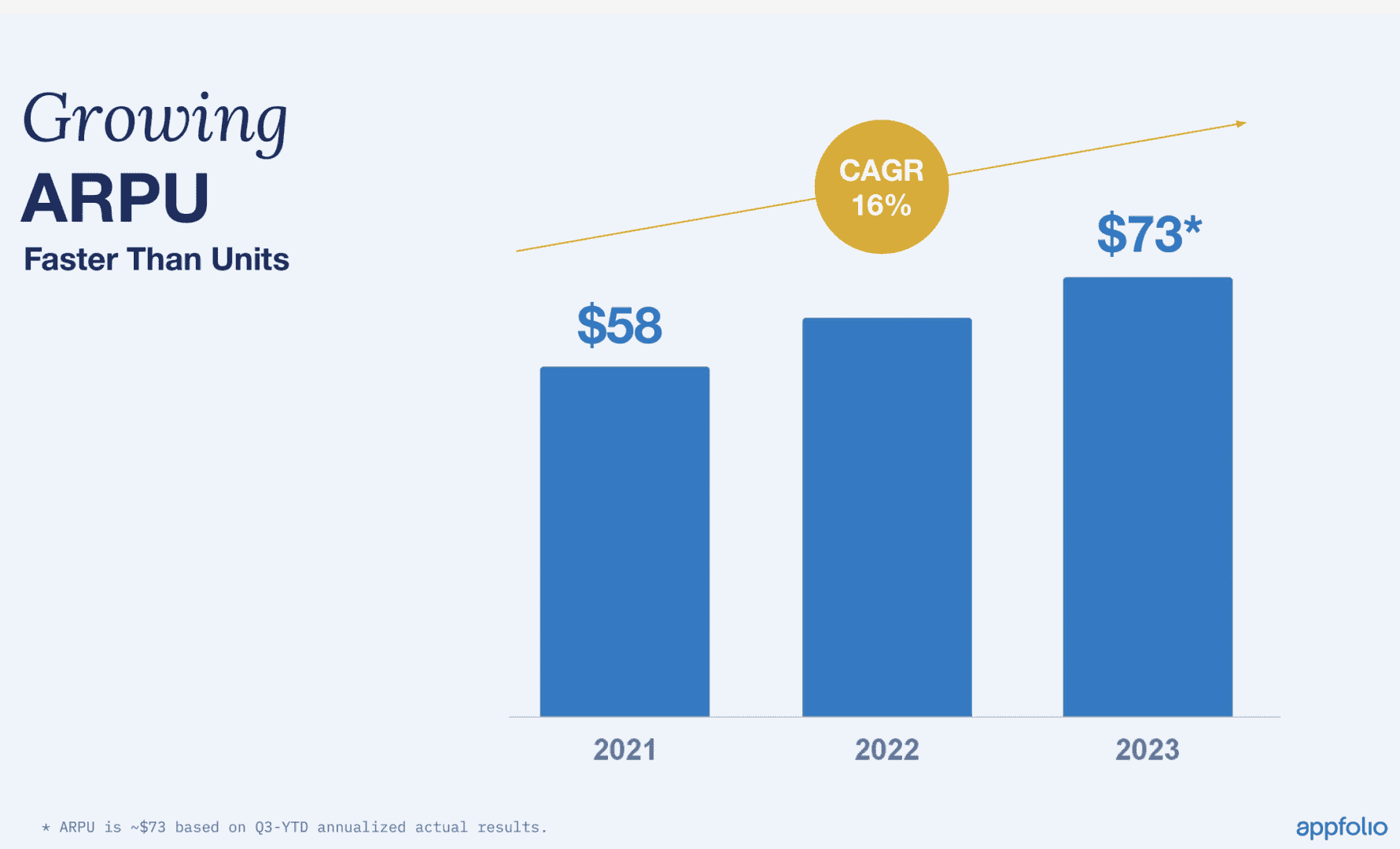

#4. About Half Growth From Expanding ARPU

With 29% overall growth and 16% ARPU growth a year, a bit more than half of their growth has come from selling more to the base — as well as raising prices. Units under management have grown 14% a year, so materially, but not enough to fuel 29% revenue growth on their own.

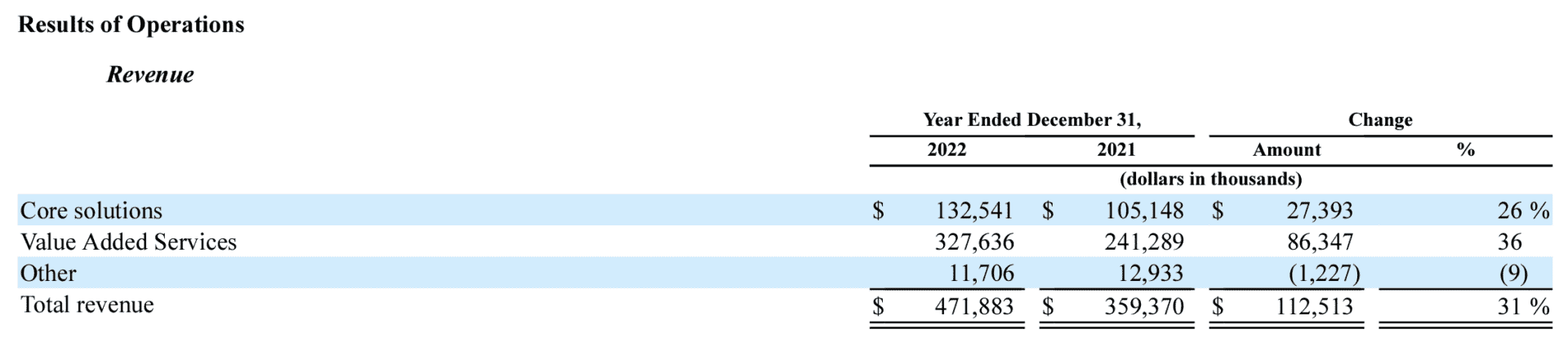

#5 Most of Their Revenue, Like Shopify and Bill, is Not From Software. And Lower Gross Margins of 62% Due to Payments and Services Revenue

A big learning. AppFolio doesn’t break out their revenues by segment as much as they used to, but as you can see below, only 30% of revenue actually comes from SaaS fees, that they call “Core solutions”. Payments and service fees make up 70%. That’s key to their top-line growth, just like it is at Shopify and other leaders. But the trade-off usually is lower margins, and that’s what we see here. At 62%. AppFolio’s revenues are higher than some that blend payments and software, but well below the traditional 75%-80% we see with pure software companies.

They’ve made up for it by being leaner, as we see above.

AppFolio, up 87% this year when many in SaaS and Cloud have struggled. Profitable (or at least, cash-flow positive and non-GAAP Operating Maring positive) leaders with good growth AND good efficiency earn higher multiples.

AppFolio is in the rare 10x+ ARR club today. A club that used to have a lot more members.