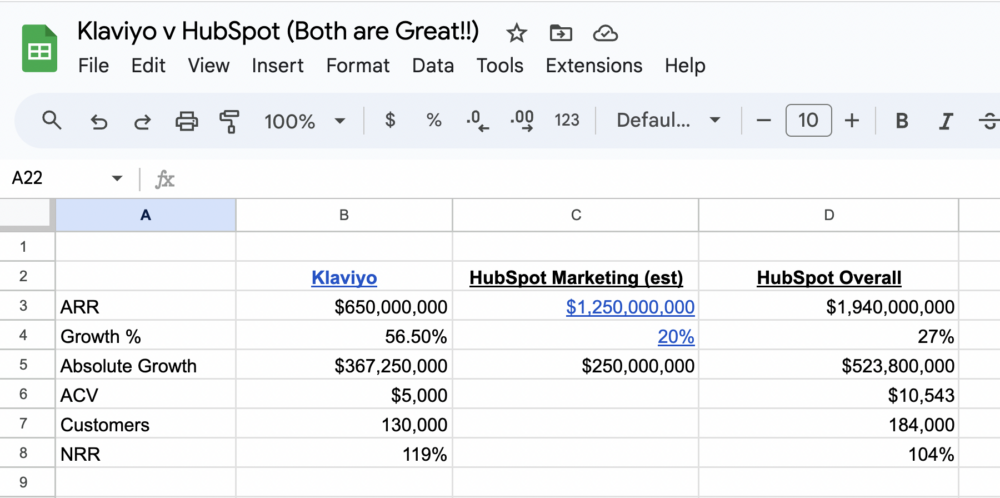

Klaviyo overall is probably growing faster than HubSpot Marketing:

Klaviyo:

– $650,000,00 ARR

– Growing 56%

– Adding ~$360m in new bookingsHubSpot Marketing:

– $1,200,000,000 ARR (est — of $2B total)

– Growing 20%

– Adding ~$240m in new bookingsHubSpot overall is much…

— Jason ✨Be Kind✨ Lemkin (@jasonlk) October 2, 2023

So there’s no question HubSpot overall is far bigger than recently IPO’d Klaviyo, at an impressive $2B in ARR, growing an epic 27%.

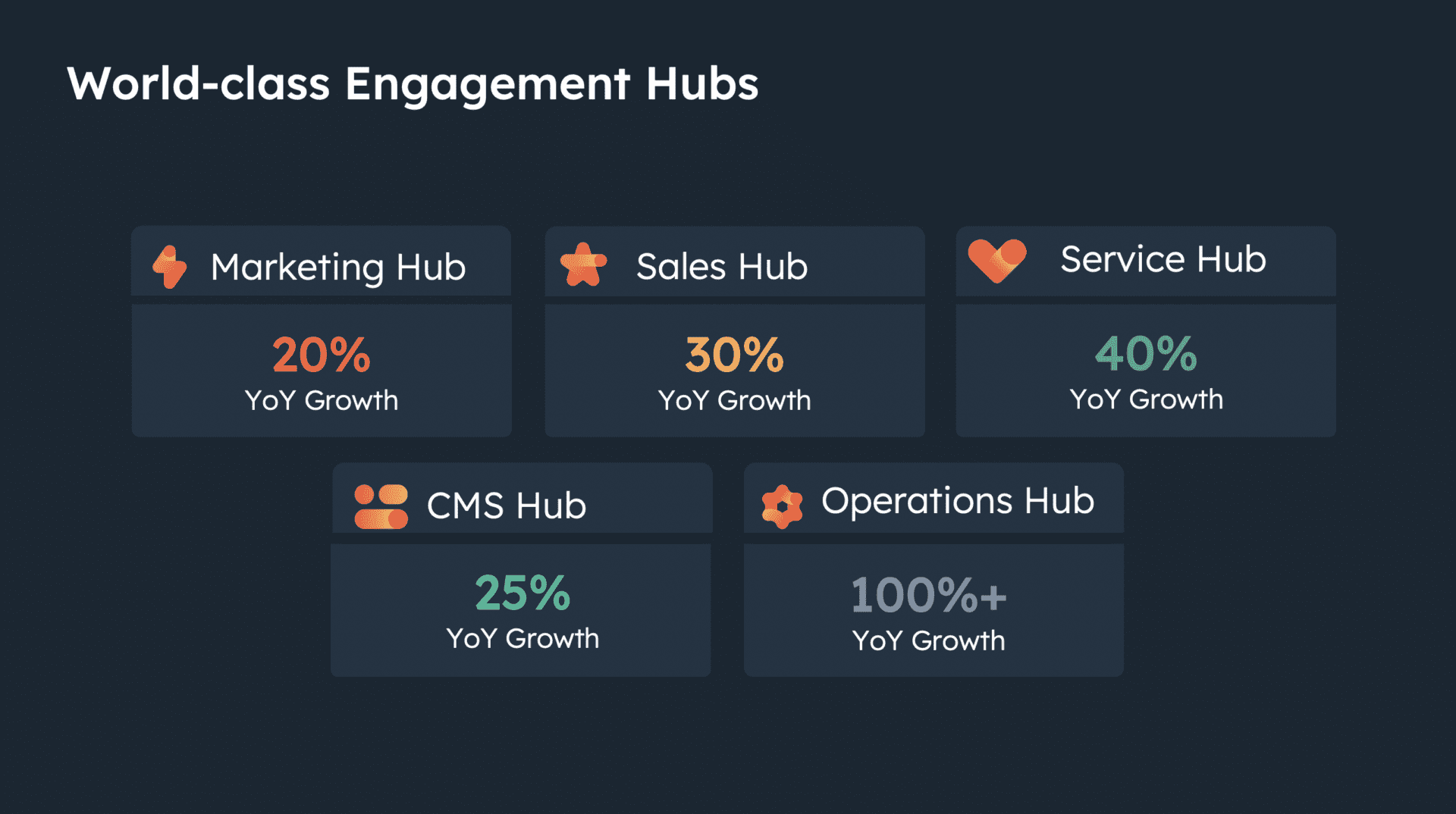

But HubSpot is a platform today, from Marketing to Sales to Service to CMS — a true Customer Platform:

Its first product is the most mature — its Marketing Hub is growing 20%, vs CRM at 30% and Service at 40%.

HubSpot used to break out the revenue by Hub, I’m not sure it does today but guessing based on prior estimates, Marketing is probably around $1.2B of the $2B total ARR for HubSpot.

Now let’s compare that to its Marketing-Only (for now), eCommerce almost entirely (for now), neighbor in Boston, Klaviyo:

What we can see is that while Klaviyo’s epic business — $650m ARR, growing 57% and profitable — may never catch HubSpot overall, it just might catch HubSpot’s Marketing Hub business on its own. It’s now adding more new bookings than HubSpot Marketing Hub.

It’s more than halfway there, it’s growing much faster, and importantly, its new bookings appear to be higher than HubSpot’s Marketing Hub.

Both are incredible winners that huge industries rely on — but Klaviyo is much more a vertical play, and HubSpot far more horizontal.

It’s interesting to compare and contrast their paths. HubSpot diversified into Multiple Hubs, and its Marketing Hub is now quite mature. Klaviyo is just beginning its expansion outside of Marketing as a product and importantly eCommerce as a vertical (almost all its revenue is from eComm) at almost $700m ARR.

So far, both strategies seem to have performed incredibly well. And are quite different. Klaviyo has truly owned its niche (Shopify marketing automation), and HubSpot is one of the most impressive multi-product expansions ever, after owning general SMB marketing automation.

WIll be fascinating to see where both end up in a few years.

And a related post on Klaviyo here: