At 16 years and $1.6B ARR, Zendesk today gets 14% of new business from startups. That’s a pretty significant part of the growth of their company. On top of that, if you look at their top accounts globally, 33 of the top 50 customers by ARR are startups.

During SaaStr Annual, Zendesk Sr. Director Brad Bowery and Andy Zhuhai, Director of Business Development at Crosslink Capital, shared how to:

- Craft an offer

- Establish your GTM strategy

- Build your VC channel

Crafting An Offer

As you think about going to market and startups, specifically, keep in mind that this particular audience is a bit more used to getting discounts and sometimes even perks through accelerator programs or startup credits. You have to think about how you will differentiate and craft your offers from the rest of your marketing.

Some things to think about as you craft your offer are:

- Does it align with your sales motion? You don’t want conflict with the sales team.

- How do you leverage that offer to develop relationships with partners?

Being able to differentiate your offer is really important. A few different ways Zendesk did this include:

- The 12-month discount. This is where they started, but startups weren’t adopting the product as much with a discount, and there was a lot of conflict with the sales team.

- Credits. Next, they moved to credits, which are very popular, with AWS and Google Cloud being great examples of companies that are always giving credits out to startups. Ultimately, it was a little too complex for Zendesk to implement at the time.

- A free term. At Zendesk, startups got six months free. This drove adoption for those six months, leading to more startups coming out of the program and 60% graduating into paying customers.

The only challenge with a free term is there’s nowhere else to go. You can’t keep giving software away for free, so you have to get creative with other features and services.

Establishing Your GTM Strategy

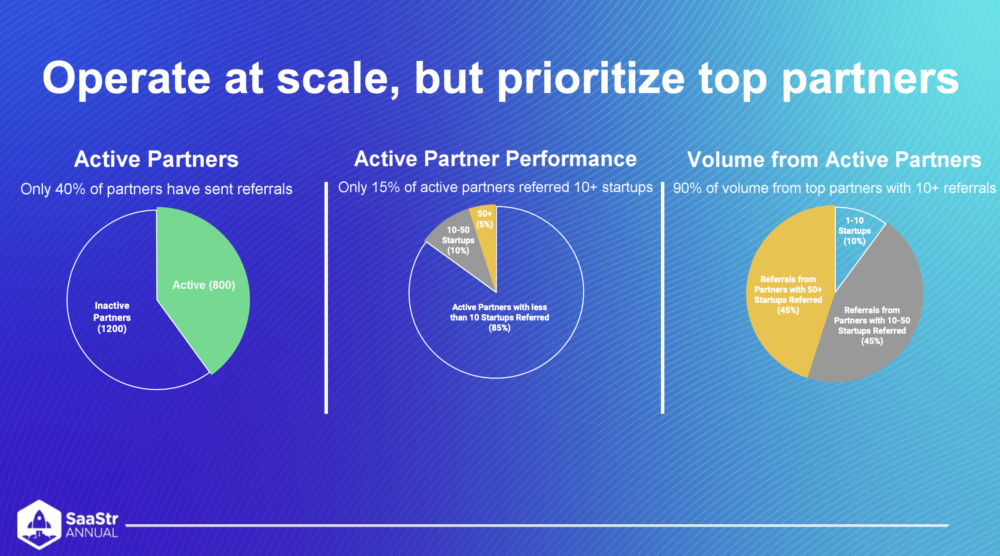

Looking back at 2020, most of Zendesk’s customer funnel came in organically through their website, some paid, and a small percentage through partnerships. Today, 50% comes from partnerships, and it’s been an important part of growth in the last few years. As you think about building out a partnership program, remember that you need to be able to operate at scale but prioritize your top partners.

At Zendesk, they spent a lot of time onboarding new partners, but only a small percentage were actually sending startups to them. It amounted in a lot of wasted time.

So, they flipped it and made it easy to onboard partners as seamlessly as possible, and as they got into the program, Zendesk tracked who was sending them startups and prioritized those partnerships.

Today, 15% of active partners have referred 10+ startups to Zendesk. Looking at the program overall, 90% of the volume they get comes from those 15% of active partners.

Different types of partners have differing needs and things they’re looking for. Three types of partners include:

- VCs

- Accelerators

- Ecosystem partners

Accelerators are often packaging your offer with their benefits. VCs want to make sure startups are getting off on the right foot. And ecosystem partners want to get out in front of startups. While ecosystem partners tend to refer a lot of startups, the majority of ARR for Zendesk’s partner program often comes from VCs. You want to reach startups through VC firms, and it starts with understanding the structure and role of the firm.

Building Your VC Channel

First, understand if you’re starting a net-new relationship with a VC Firm, you’ll want to spend most of your time focusing on non-investing roles like LP relations, CFOs, and the platform. Investing roles are focused on finding new investments for the firm, and while they can be champions and influencers down the road, they’re more focused on finding new partners, not bolstering existing portfolio companies.

90% of VC firms have some kind of platform role, and platform folks have a lot of different titles, so you may to need to do additional research for the firm you’re targeting. But their overall focus will be on adding value to the portfolio, overcoming obstacles, moving faster, and connecting to support and resources. These are the folks who will be most receptive to companies coming to them with an offer for a VC’s portfolio companies.

There are three areas of the ecosystem you should focus on in terms of building GTM with VCs to their startups:

- Focus on your target segment.

- Align benefits with current priorities.

- Back it up with powerful testimonials.

Focus on Your Target Segment

Too many startups come to VCs and aren’t clear who their ideal customer is. Focus on who your ICP is.

- What is the size of the company?

- Do they have a CRO in place?

- How much funding do they have?

- What are their sectors, geos, etc.?

Find companies with those attributes and use them to see which VC firms invest there, and follow those firms for your partnerships.

Align Benefits with Current Priorities

Align benefits with what’s happening in the ecosystem right now. Everybody sees what’s happening in the macro. Everyone is doing more with fewer people, extending runway, cutting costs, consolidating tools, retaining customers, and growing faster. If the benefits aren’t lining up, you’re a nice-to-have. You don’t want to be a nice-to-have.

Back up your offer with customer testimonials. People aren’t going to remember the attributes of your product or your features. They’ll remember the anecdotes and stories. Those travel so fast from venture teams straight to founders, boards, and other VC funds. For example, a vendor extended the runway of a portfolio company by eight months. Another consolidated three tools into one. Those stories spread like wildfire.

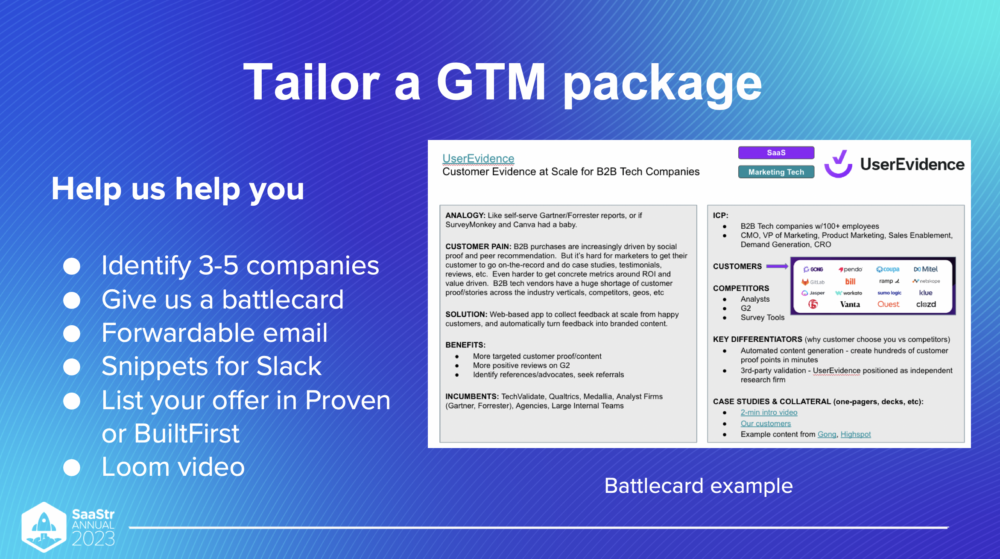

Tailor a GTM Package for Investors to Share

Learn the VC tech stack. They all have a unique stack they use to get in touch with portfolio companies. Crosslink Capital for instance uses Proven for people to host offers and discounts, Notion, Slack, and email. It’s key to find out what their stack is and create a GTM package tailored to each firm. Make it easy for them to share it with their portfolio companies so they don’t have to try and write an email explaining why you’re so great.

Choose three to five companies within their portfolio to target. You have to make it compelling enough for the non-investor persona to share to their portfolio companies in the hopes that it will help them succeed and scale faster. But investors aren’t just going to blindly spray-and-pray their entire portfolio. Write out the email they can send — again, make it easy and give them the whole package.

Lastly, you’ll want to stand out. The bad news is there are a lot of companies developing VC partnership functions. The good news is that many aren’t doing anything to stand out. This is where you can be really effective and come up with a unique value proposition to make your solution stand out to others.

Zendesk does a great job of this with a Slack community containing the largest concentration of customer experience leaders and top startups. VCs will want all of their portfolio companies to have access to that.

Think beyond your solution and how you can give back and create community.

Key Takeaways

- You want to invest in your GTM approach for startups. It’s a really important segment.

- Be creative! It’s not just an offer. A lot of benefits you provide go beyond the discount.

- Make it easy for your VCs to work with you.

- Results take time and require a sustained effort.