For any Cloud and SaaS Founders or execs seeking practical strategies and inspiration to stay ahead of the curve, this session’s for you. At the SaaStr Annual, Kiren Sekar, Samsara’s Chief Strategy Officer and founding chief Product Officer shared five lessons he learned along the way from scaling six products to $100M+. The six products/companies Kiren helped scale to $100M that he’ll reference in this playbook include: Bill, Cloudflare, Crowdstrike, Samsara, Snowflake, and Zscaler.

His five lessons are:

- A single metric that helps guide decisions of when to pivot, when to iterate, and when to pivot.

- Discovering the entire market and mapping out all potential verticals early in the process.

- The incredible power and value of the mid-market segment.

- Building customer feedback into the DNA of your product team and products.

- Going multi-product early.

Let’s take a closer look at these learnings.

Lesson 1 — The Magic “Scale or Pivot” Metric

With so many different SaaS metrics out there, which metric can really steer a business? Of course, ARR growth and cash burn are the most important. If you can grow ARR without running out of money, you’ll do alright.

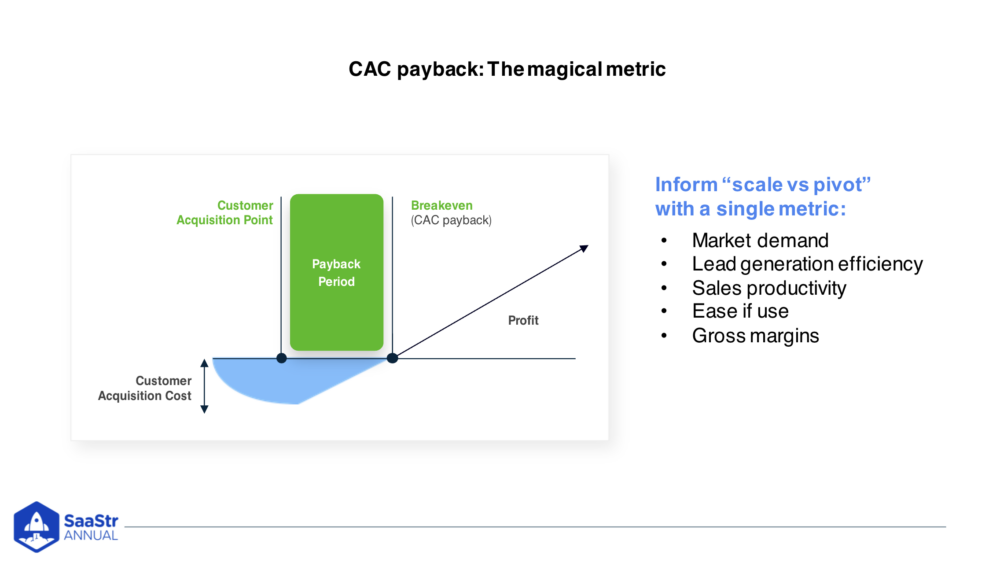

But there’s a single metric that can reflect market demand, product market fit, how well a GTM engine is executing, and the quality of the product- and that is the CAC (customer acquisition cost) payback period. As most in SaaS know, you incur significant costs acquiring customers before they even pay you a dollar. This spend is your lead gen, marketing, SDRs, and sales team salary and commission. Eventually, they pay back that cost, and the time between acquiring and payback is the CAC payback period, typically measured in months.

This metric tells us so much about

- The physics of the business

- How you should be scaling

- Market demand

If you have a product that resonates with end customers and solves a burning pain for them, they’ll be coming to you, and you won’t have to spend as much time explaining the product.

CAC payback leads to:

- Spending less time on leads

- Reps who can attain higher quota

- A shallower trough to dig yourself out of

Conversely, if what you’re doing isn’t solving real customer pain, you’ll have to spend a lot more resources to onboard each customer. The CAC payback metric tells a lot about the effectiveness of your execution — generating high-quality leads, whether you’re following up on and converting them quickly, and whether sales reps are properly enabled and managed well. If you achieve all of the above, you can shrink the CAC payback period.

If you have a complex product requiring a lot of configurations and customizations for every customer, it’ll increase the cost to acquire a customer and take longer to recoup costs. If the CAC payback is too long, you want to slow down and figure out which is the drag factor and then improve it before accelerating.

Lesson 2 — Discover the Entire Market

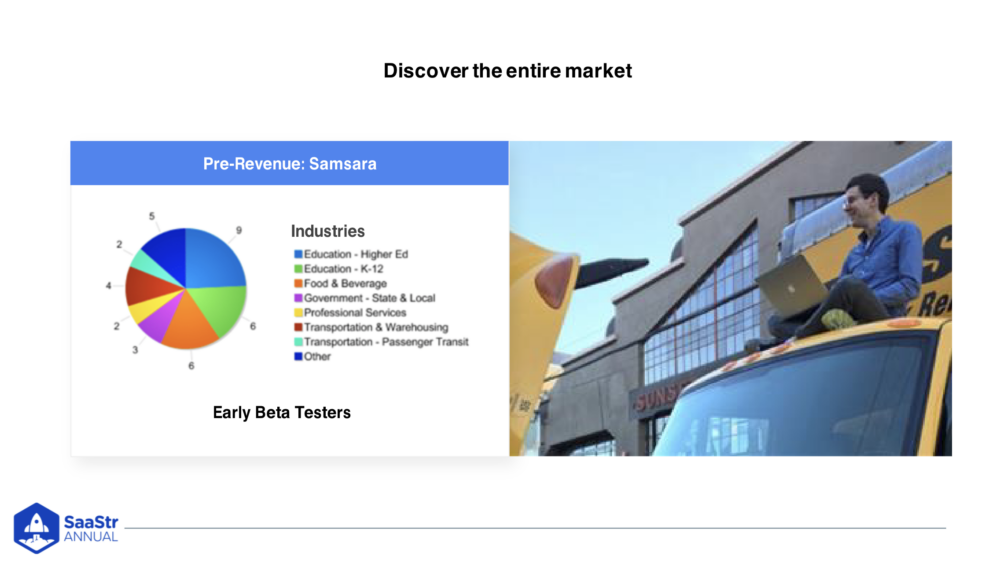

At Samsara, they had competitors narrowly focused on specific segments of the market. They also had legacy competitors who only focused on long-haul trucking. So, they engaged with the entire market very early and understood the common needs across verticals.

The above image was from a pre-revenue deck when Samsara was still getting feedback. The pie chart shows the different industries customers were in — schools, local government, food, transportation, etc. They tracked this systematically from the early days and avoided going too deep into something too niche. Instead, they focused on the common threads.

Fast forward to $10M ARR, and you’ll see that a lot of the industries are the same as in the early days and quite diverse. Setting these seeds early and allowing them to scale is beneficial and can impact long-term outcomes.

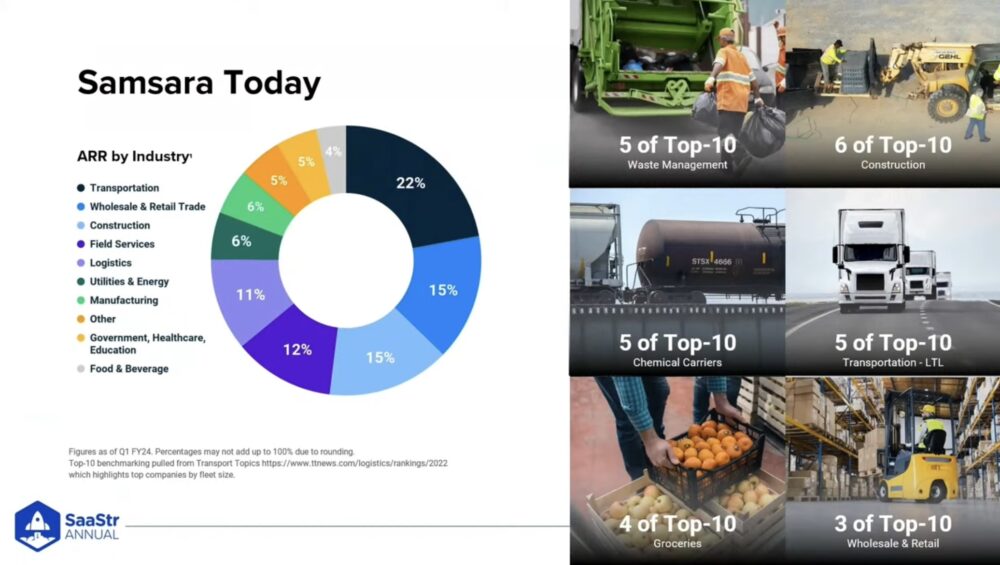

Now, at nearly a billion in ARR, they have a nicely distributed pie chart of industry verticals.

There was a surprising benefit beyond the ability to scale revenue…

They got interesting ideas from specific verticals. They’d then take those ideas to other verticals and ask if that would be useful for them, too. It ended up making the product better for everyone.

Lesson 3 — Embrace the Mid-Market

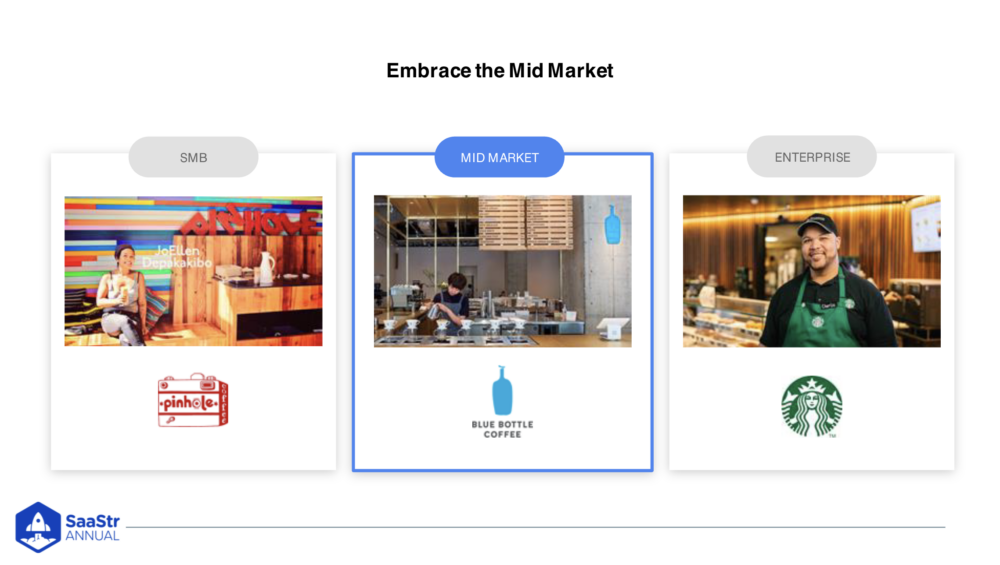

Often, people think there’s a binary choice between SMB and Enterprise. There’s a really important third segment, the mid-market, a powerful scaling element for Samsara.

Engaging mid-market early is a great way to build product market fit and repeatable sales motions. One of the beautiful things about mid-market customers is you’re engaging with professional buyers. It might be a Director of IT with the expertise and time to give considerate feedback on your product — its limitations and what it can help. Unlike Enterprise, they won’t expect it to be perfectly tailored to their business if it solves an important problem for them and they can move fast.

Mid-market has faster sales cycles, and they’ll still spend a good amount of money — $20k, $30k, $50k, and $70k deals. So, your unit economics will support a sales motion that looks like a lighter-weight, scaled-down Enterprise sales motion. If you’re talking to ten $50k opportunities in the mid-market vs. one $500k opportunity, you’ll get more signals about what’s common across customers.

The takeaway?

When you have a strong product market fit, a repeatable sales motion, and healthy CAC payback, you’re in a great position to move up-market (to Mid, then Enterprise) and scale.

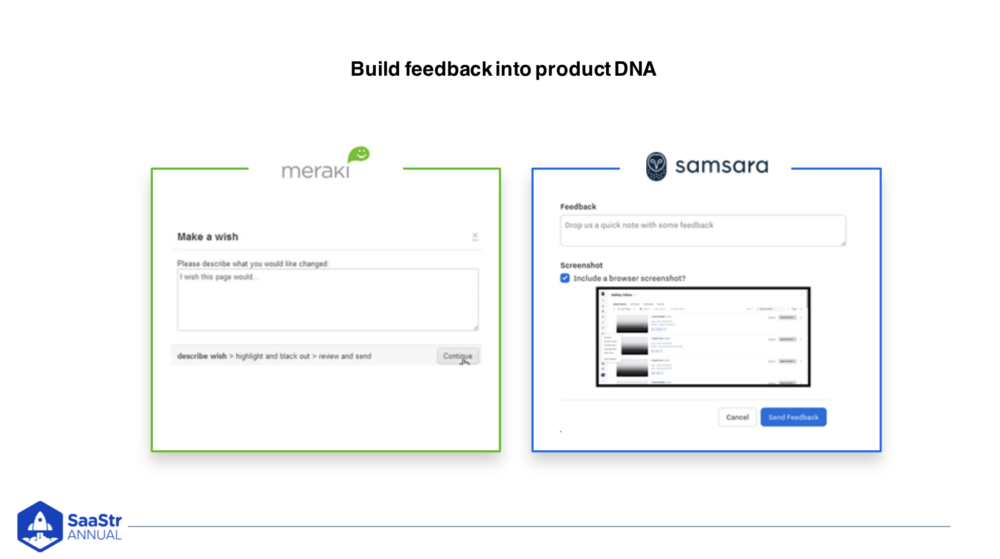

Lesson 4 — Build Feedback into Your Product DNA to Optimize the Product Roadmap

In the early days, before Samsara charged customers or had a sales team, they hired a couple of Account Development Reps to have them cold call potential customers and book demos specifically to get feedback on the product in development.

This early process allowed them to pressure test:

- Whether their product solved a problem

- If someone was willing to buy it

- How much they would pay

Once they started selling and revenue scaled from $1M to $10M, it was infeasible to be on every intro call. So, they instrumented product feedback into their CRM where an AE or sales engineer on a call could add a feature request from a customer.

This gave Samsara a data-driven understanding of the needs of various features on their roadmap. It helps ensure you’re:

- Putting your R&D resources in the right places

- Understanding what would impact the most people

- Landing the largest deals

These tools allow the sales engineers to capture feedback in a scalable way.

Samsara also builds feedback into their product DNA by adding the option to submit feedback and ideas at the bottom of every page so that anyone using the system could type a note about what they’d like to see. To take it a step further, anytime a customer submits an idea, they’re also submitting a screen grab of what they were doing on that page at the time of submission. They pipe this directly into a Slack channel so any member of the R&D team can look and see what customers want in real-time.

Of course, these techniques are scalable but aren’t a substitute for getting out and meeting customers in person. The insights are much richer face-to-face.

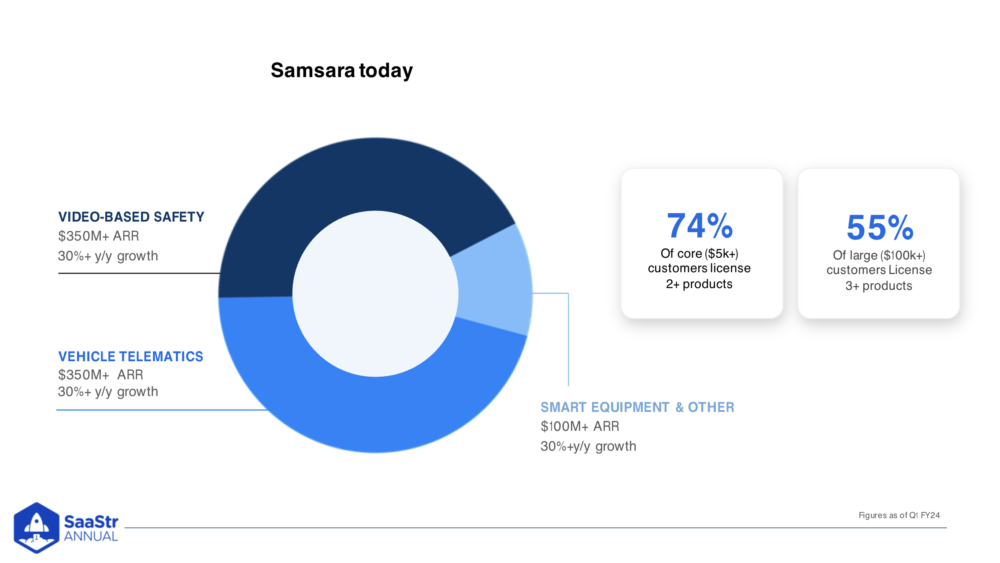

Lesson 5 — Going Multi-Product Early

Samsara had multiple products in the first couple of years that scaled to hundreds of millions and sometimes billions in sales. A couple of years in, their first product was doing really well with a multi-billion dollar addressable market. Yet, there was a lot it couldn’t do yet.

They kept investing in and improving the initial product but also took some of the team to work on new products very early.

This was beneficial because there were some customers they couldn’t get right away because they didn’t have the features. But, they traded those customers for another set of customers who could look past some gaps because the company offered them multiple products in a single platform. That’s incredibly valuable.

Going multi-product early helped develop muscles on how to engage multiple users within an organization. Customers expected that Samsara could do more for them, and it helped engineering think of solutions to support multiple applications over time. Fast forward, and you’ll see that you need a second product to scale beyond $100M ARR. Ideally, you want your second product in the market and scaling when your first is at $10M.

Key Takeaways

- Use the CAC payback period as a governor for how fast to scale your business.

- Discover the entire market across verticals.

- Mid-market customers are incredibly valuable for building product market fit and scaling.

- Build product feedback into the DNA of your business.

- Go multi-product early.