Did you know there is a “LinkedIn for Doctors”? That is doing $450,000,000 in ARR … growing a fairly mature 18%, but at an insane profitabilty level with a 43% (!) adjusted EBIDTA margin?

Well, there is.

It’s called Doximity and it’s worth $6.5 Billion Dollars. That’s 12x ARR even with fairly mature growth. Why? Profits. Lots and lots of profits.

5 Interesting Learnings:

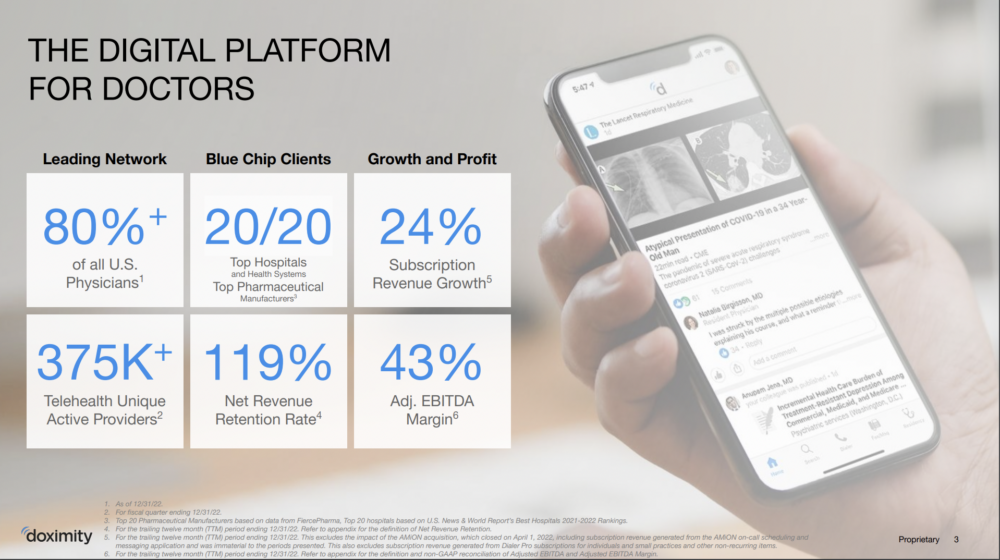

#1. 80% of All U.S. Physicians in Their Network. This turbocharged Doximity’s growth, but truly hitting 80% of your ecosystem has lead to slowing growth as they approach $500m in ARR.

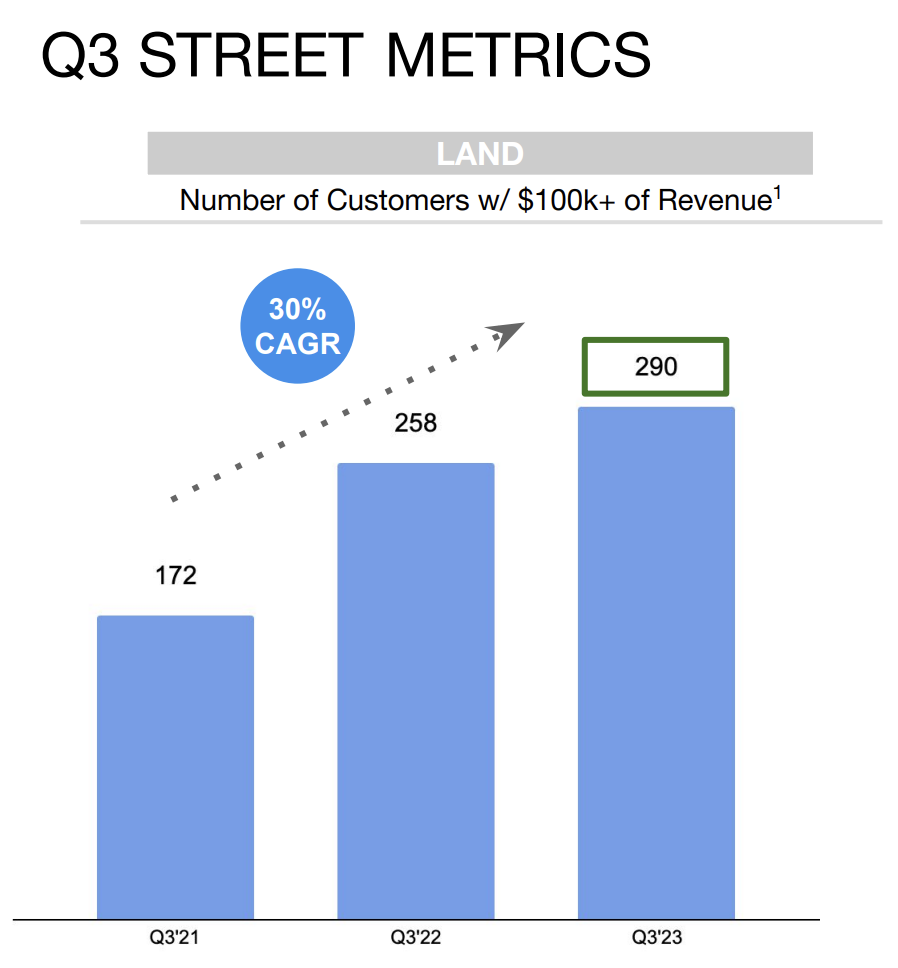

#2. 290 $100,000+ Customers. That’s how they’ve built up to something big.

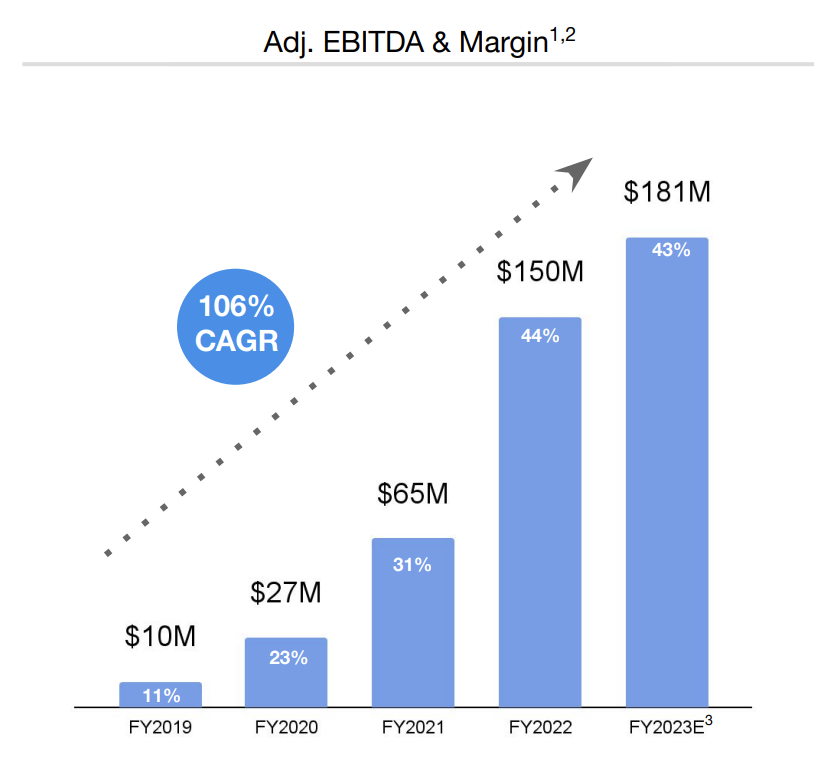

#3. Insanely Profitable — At Scale. While Doximity was EBITDA positive back in 2019, it really exploded as the business scaled. Today, it’s on track to generate $181,000,000 in EBITDA in 2023. Boom!

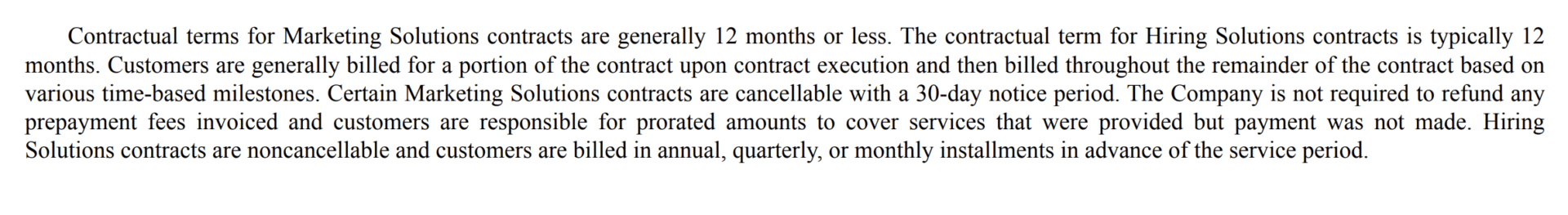

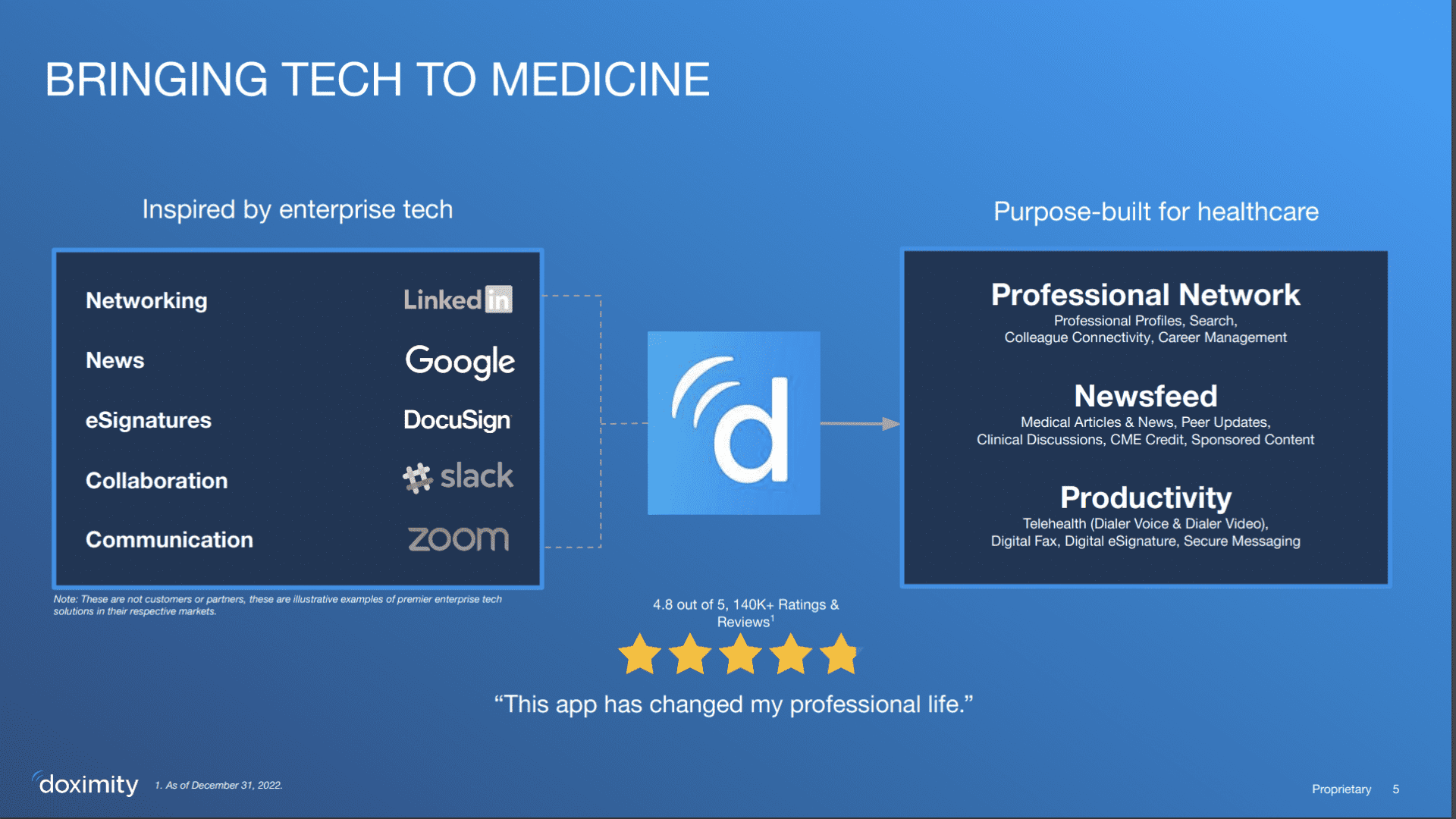

#4. The company sells Marketing Solutions and Hiring Solutions — just like LinkedIn, but just for Doctors. Marketing contracts are short, typically less than 1 year. Hiring Solutions deals are usually 1 year at a time.

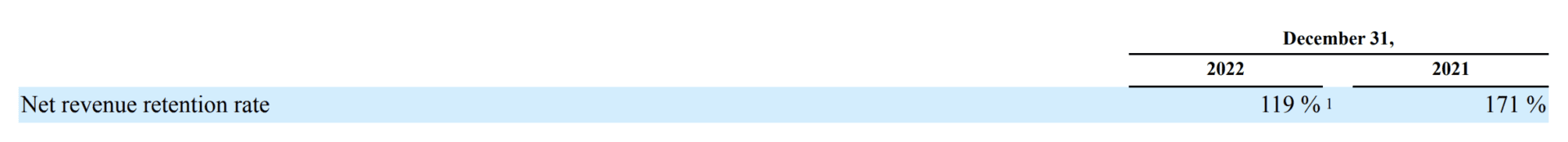

#5. NRR has Gone from Insane to Merely Very Good. NRR has dropped to a still strong 119% — from an insane 171% in 2021.

And a few extra notes:

#6. 978 employees, so over $400,000 in revenue per employee. This is much higher than the $250,000 or so we often see for public SaaS companies … hence the profitability.

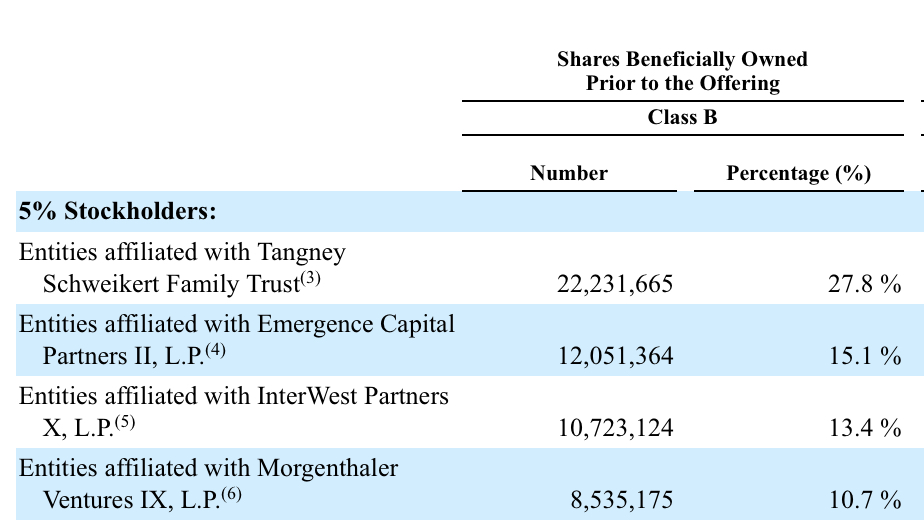

#7. Founder-CEO still owned 27.8% at IPO. Another reminder of the power of being capital efficient!

#8. Still just 3% of LinkedIn’s revenue in size. Just a side note, but LinkedIn today is doing over $15 Billion in ARR. Yup, $15 Billion. That means Doximity is just 3% of LinkedIn’s size. Not something like worth their time to truly go after.

Wow, Doximity! What a story. A bit of a marketplace, a bit of a vertical LinkedIn. And one big winner in a space a lot of folks didn’t think could quite get so big.