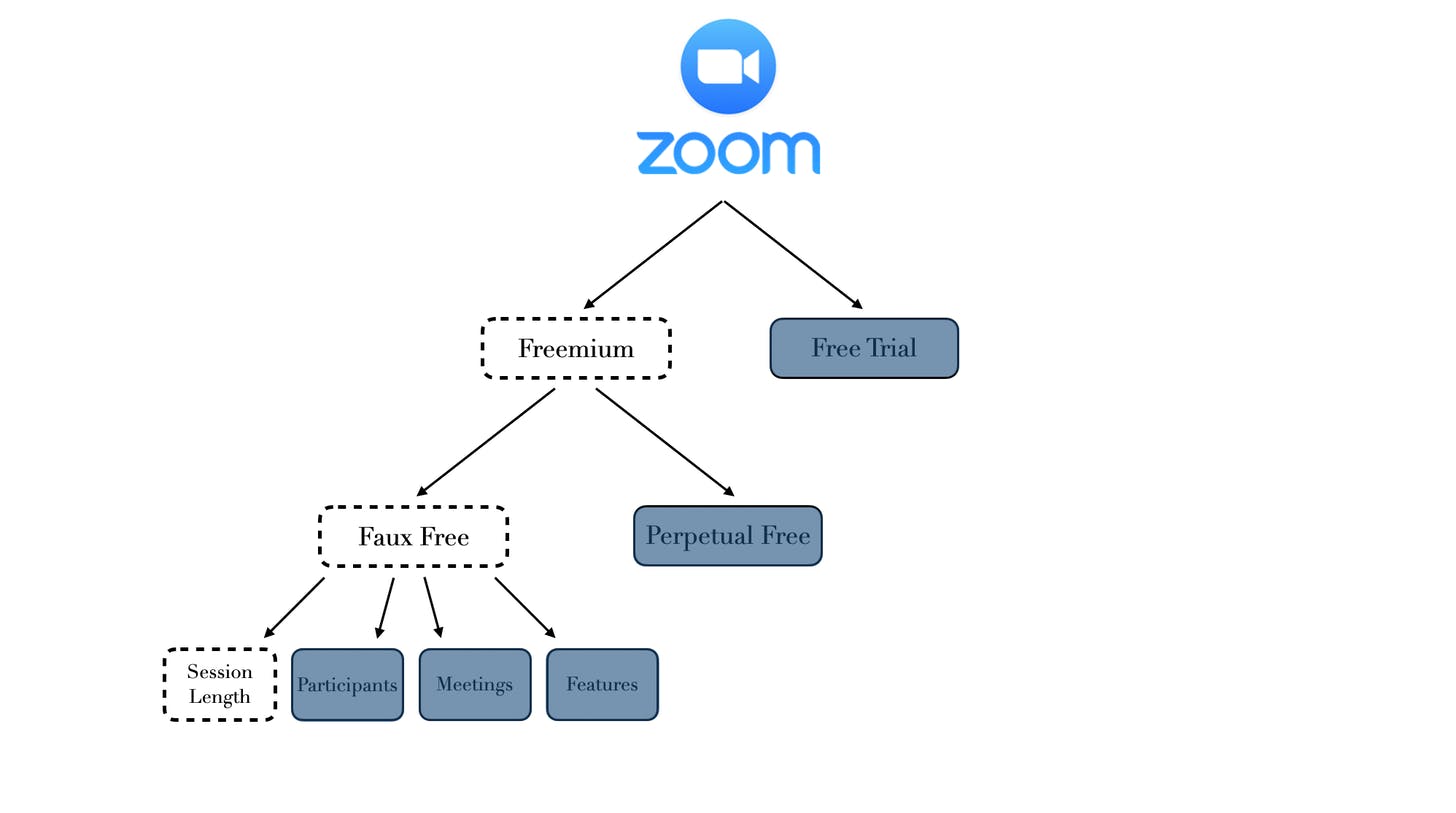

Zoom's freemium decision tree

By now, we’re all familiar with Zoom. Perhaps too familiar...

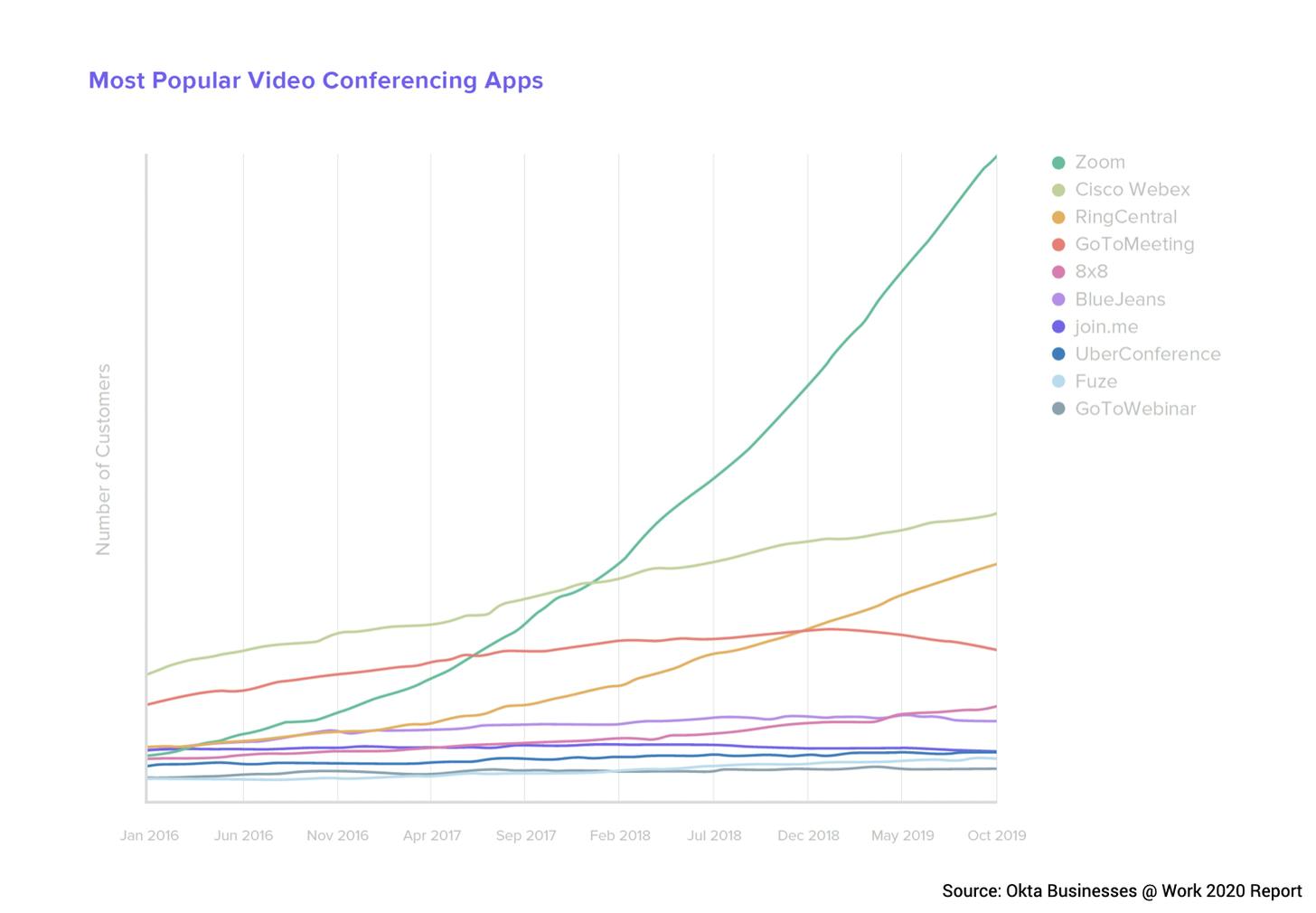

While their path to video-conferencing dominance has been well-documented, I want to hone in on the acquisition strategy that got them into the game.

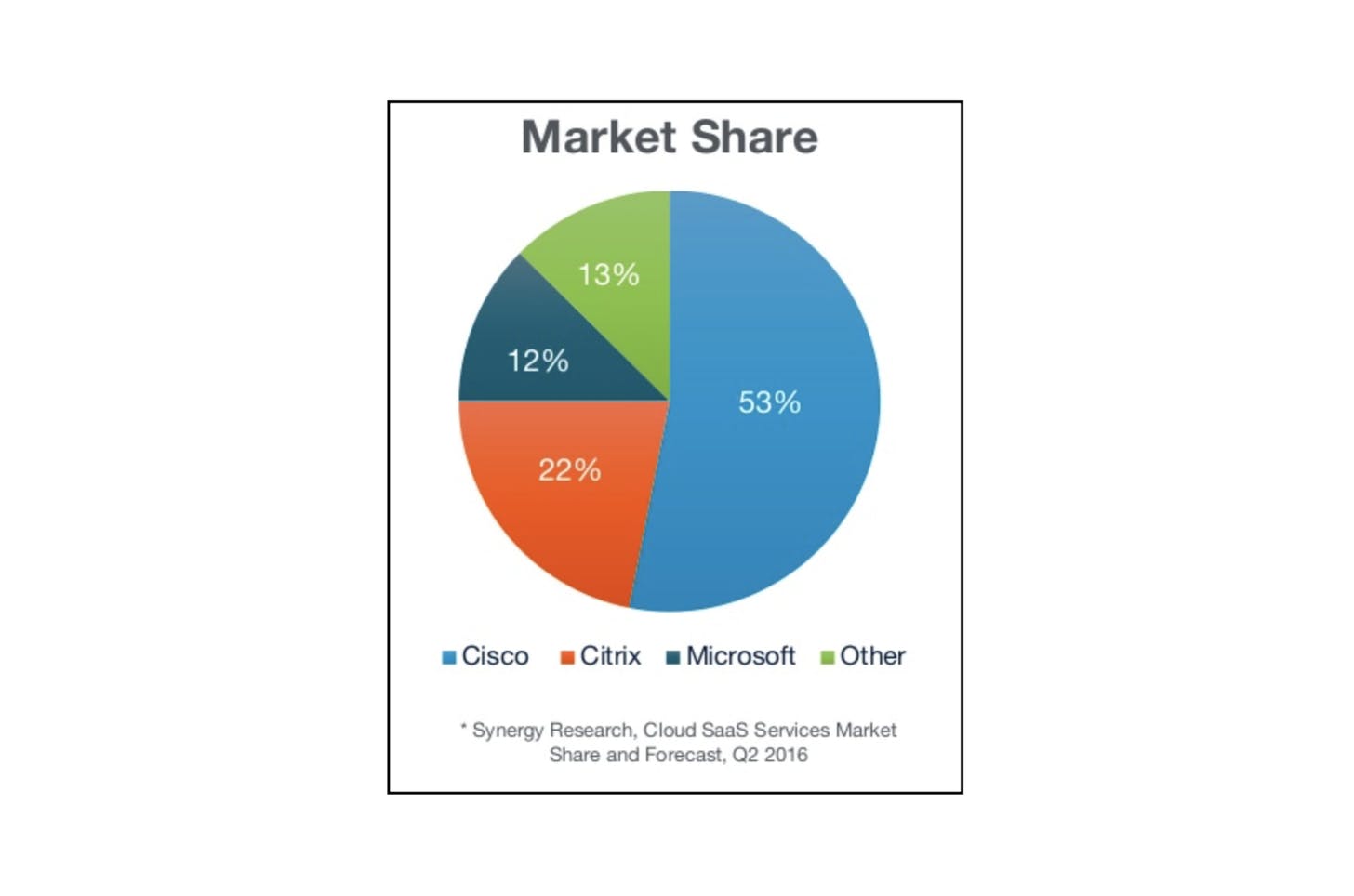

Let's go back to Summer '16, which is when I first started hearing the word that has since become interchangeable with video-conferencing. Even back then, video-conferencing was a competitive market with big-name players.

While Zoom’s quick ascent to market-leader has a lot to do with the quality of their product, there was still the issue of discovery. Simply put, how could they get people to try a new product amid such powerful, entrenched competitors?

Before going live with a free product, Zoom had some decisions to make...

The first decision: freemium vs free trial

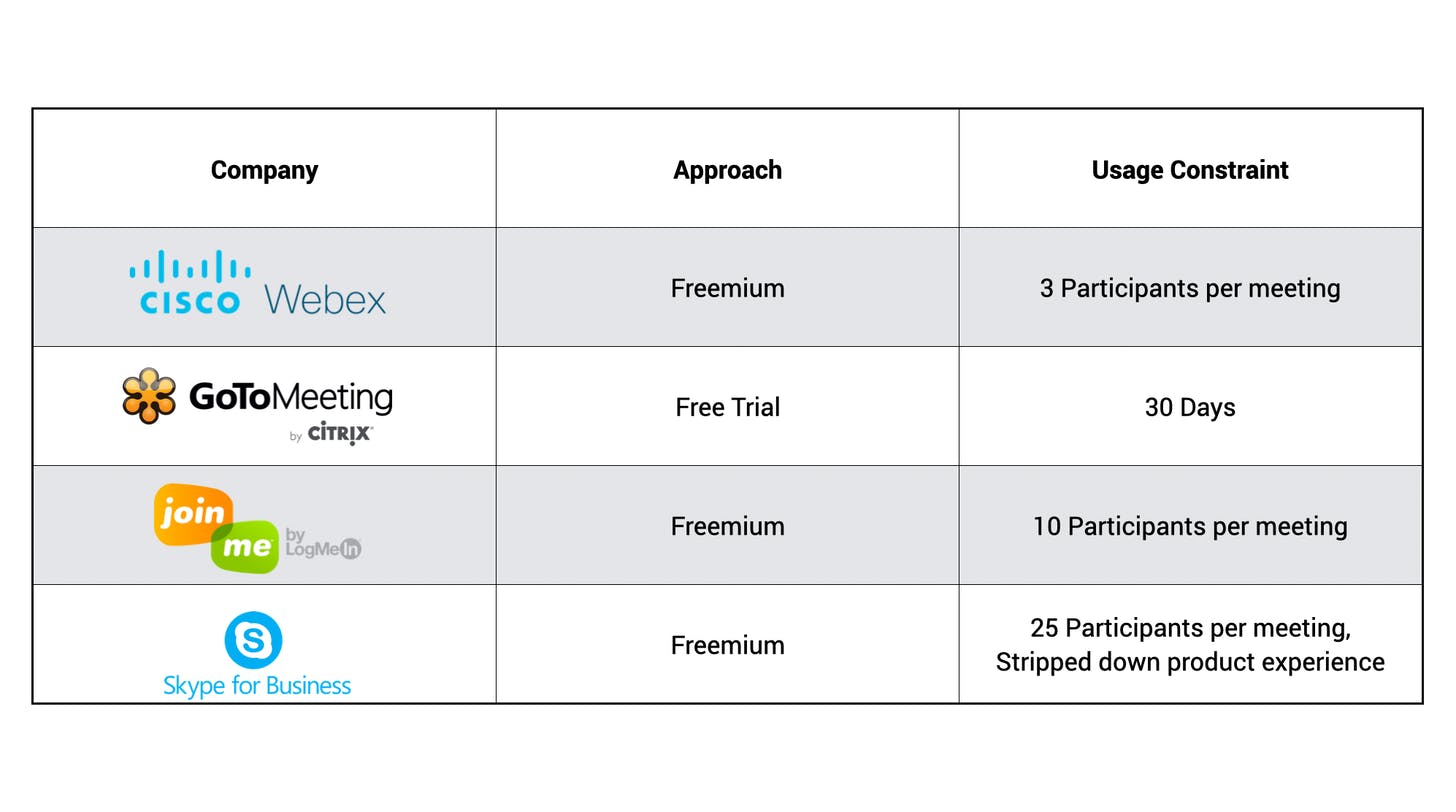

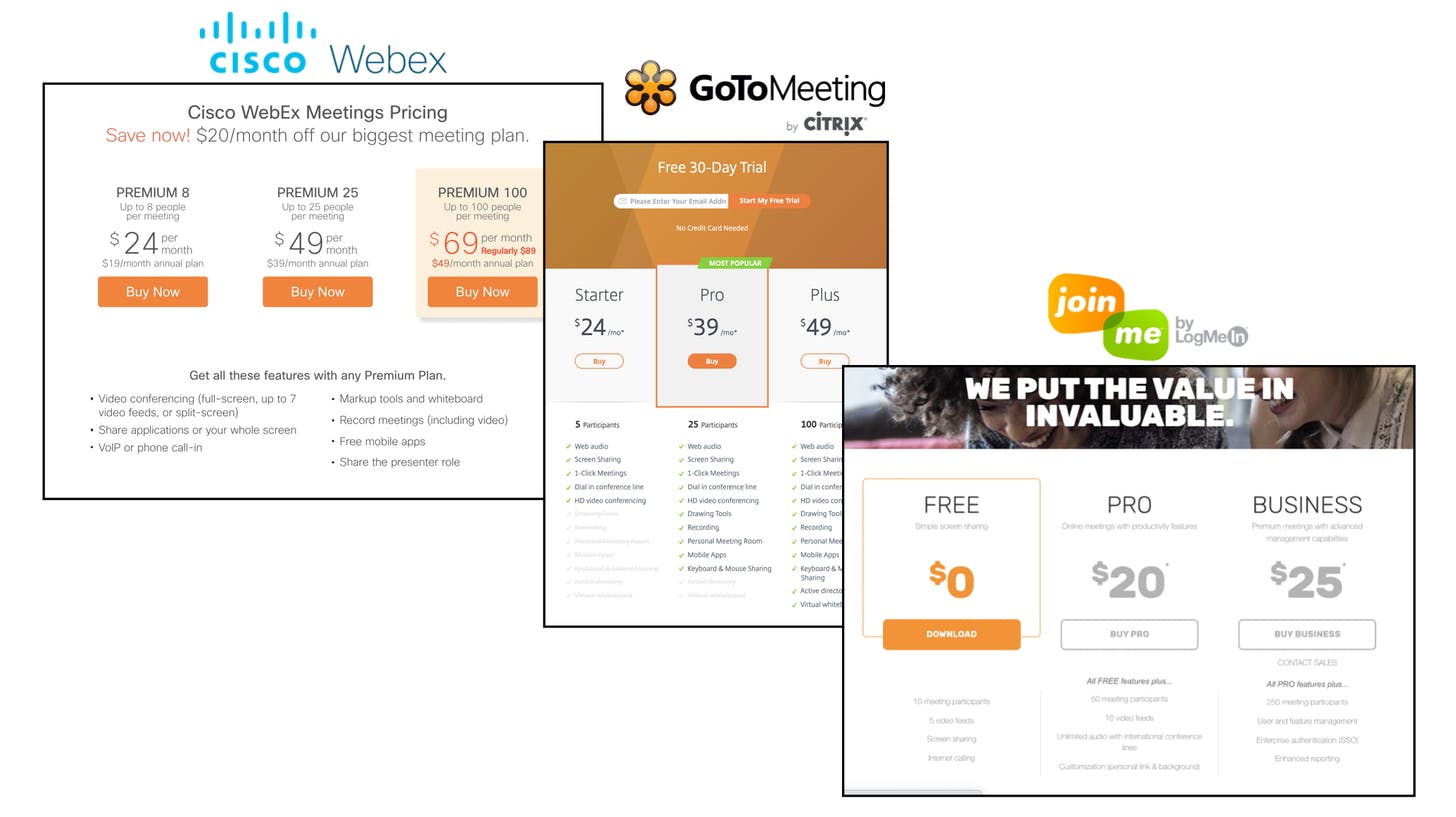

In determining how to go to market with a free product, Zoom first had to decide between Freemium and a Free Trial. At the time, both Freemium options and Free Trials were available on the market. Let’s take a look at the key players at the time:

While choosing between Free Trial and Freemium isn't always straightforward, one thing that makes the decision easier is the concept of loss aversion. A free trial can be especially powerful for sticky solutions that users don’t want to lose access to at the end of the trial period.

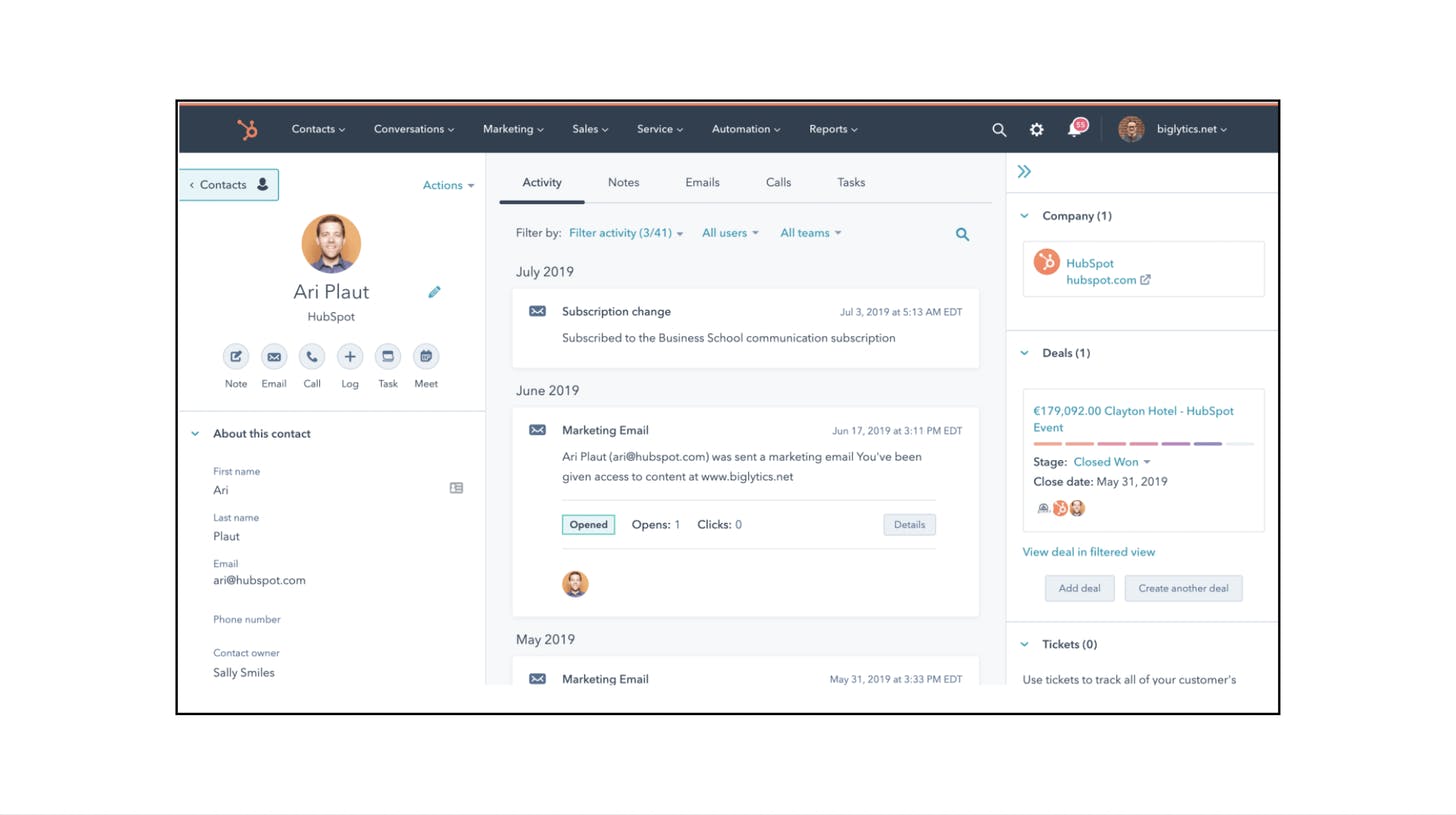

I think back to my time at HubSpot and the free trial sales motion for the marketing suite. When prospects uploaded their email database, implemented the tracking code, and started to see a 360-degree view of their leads and opportunities, they wouldn’t want to give it up after 30 days.

Video-conferencing is different. You don’t lose anything when you switch providers, and it’s not hard to learn a new solution. Over the past five years, I’ve switched between GoToMeeting, Webex, UberConference, and Zoom and the learning curve has never taken more than a day. Video-conferencing is more or less a commodity in that sense.

Zoom understood this dynamic and decided to go the Freemium route. The next step was determining which type of Freemium play made the most sense.

The second decision: perpetual free vs faux free

Broadly, there are two types of Freemium: Perpetual Free and Faux Free.

With a Perpetual Free plan, core functionality is given away for free and value-added services and products are monetized separately. Think about Notion’s recent update to their Personal plan where they eliminated usage constraints and monetized collaboration features in upgraded tiers.

With Faux Free, a limited edition of the product is available for free and usage is capped in some way. A classic example of this is Mailchimp, which you can use for free until you reach 2,000 email subscribers.

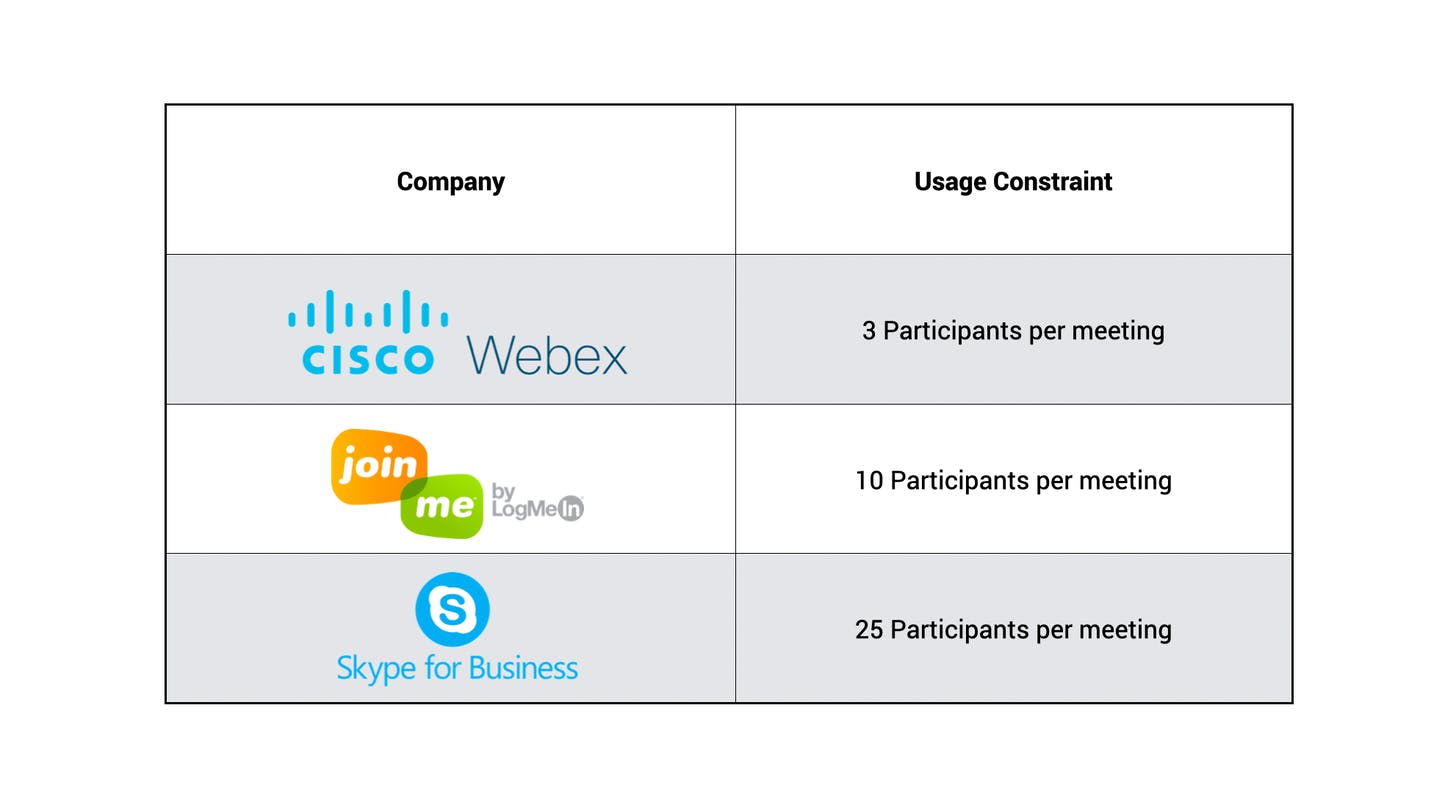

While GoToMeeting offered a free trial, the rest of the top competitors offered Faux Free Freemium plans primarily limited by the number of meeting participants. Here’s what those limits looked like:

While Zoom could have experimented with a perpetual free plan, it would have been challenging. Most organizations have simple needs from their video-conferencing solution, and giving away core functionality for free would have risked severe revenue cannibalization.

Instead, Zoom joined the competition along the Faux Free track. However, it’s within this framework that they really ventured out on their own.

The third decision: picking a usage constraint

The classic challenge with Faux Free plans is balancing customer value with revenue cannibalization.

Give away too little value and customers won’t be able to use your app sensibly. Just think about the Webex Freemium plan, which limited usage to 3 participants per meeting (really Webex? 3 people?!).

On the other hand, if you give away too much value, you risk offering a free plan that customers can use in perpetuity, cannibalizing revenue from paid tiers.

While competitors embraced meeting participants as the primary usage constraint, there are other limitations that could work for video conferencing. Here are some of the options Zoom could have chosen as their primary constraint:

- Number of participants per meeting

- Number of meetings per month

- Features and Functionality

- Meeting Duration

Along with limiting the number of participants per meeting, Zoom’s competitors each limited features and functionality to some extent as well.

This is where Zoom swerved. While they did place some limits on advanced features and participants per meeting, neither was their primary usage constraint. Instead, they capped meeting duration at 40 minutes.

While this might seem to seriously cripple the free plan, Zoom gave away a TON of value in that 40 minutes. Users had access to all core functionality and could host up to 50 participants. In essence, they could use Zoom how they actually would as a paid customer - as long as they kept the meeting under 40 minutes.

The optics of this plan made Zoom look like heroes among the competition.

At the time, Webex was charging $49 per month for up to 25 meeting participants, GoToMeeting was charging $39 per month for up to 25 meeting participants, and even Join.me, LogMeIn’s value-oriented option, was charging $20 per month for up to 50 meeting participants. It’s worth noting that Skype for Business was offering serious value at $5.50 per month, but they faced an uphill battle repositioning Skype as a business solution.

The genius of the 40-minute meeting limit is that eventually, every company needs the ability to run a meeting for longer than 40-minutes. The Zoom team did research and found that the average video-conference meeting is 45 minutes. Putting the free limit right under that enabled them to offer a holistic product experience for free without having to worry about revenue cannibalization.

Epilogue

Needless to say, Zoom’s Freemium strategy worked…

What I find really interesting about this retrospective is that Zoom didn’t totally reinvent the wheel.

They followed industry convention in choosing their approach to free and their Freemium model. Within that model, they looked at what competitors were doing and created an offer that looked too good to be true for prospective customers.

Since we all now know that Zoom had a vastly superior product experience, all they had to do was get a foot in the door, and the rest was history.