Since 2006, Xero automated the problem of high-performance business accounting, amassing 3.5 million subscribers, to become one of the most popular business accounting platforms in the market. It also focused squarely on product intuitives in order to transform, what is essentially a complex problem, into a simple plug-and-play feature for small business owners and accountants around the world.

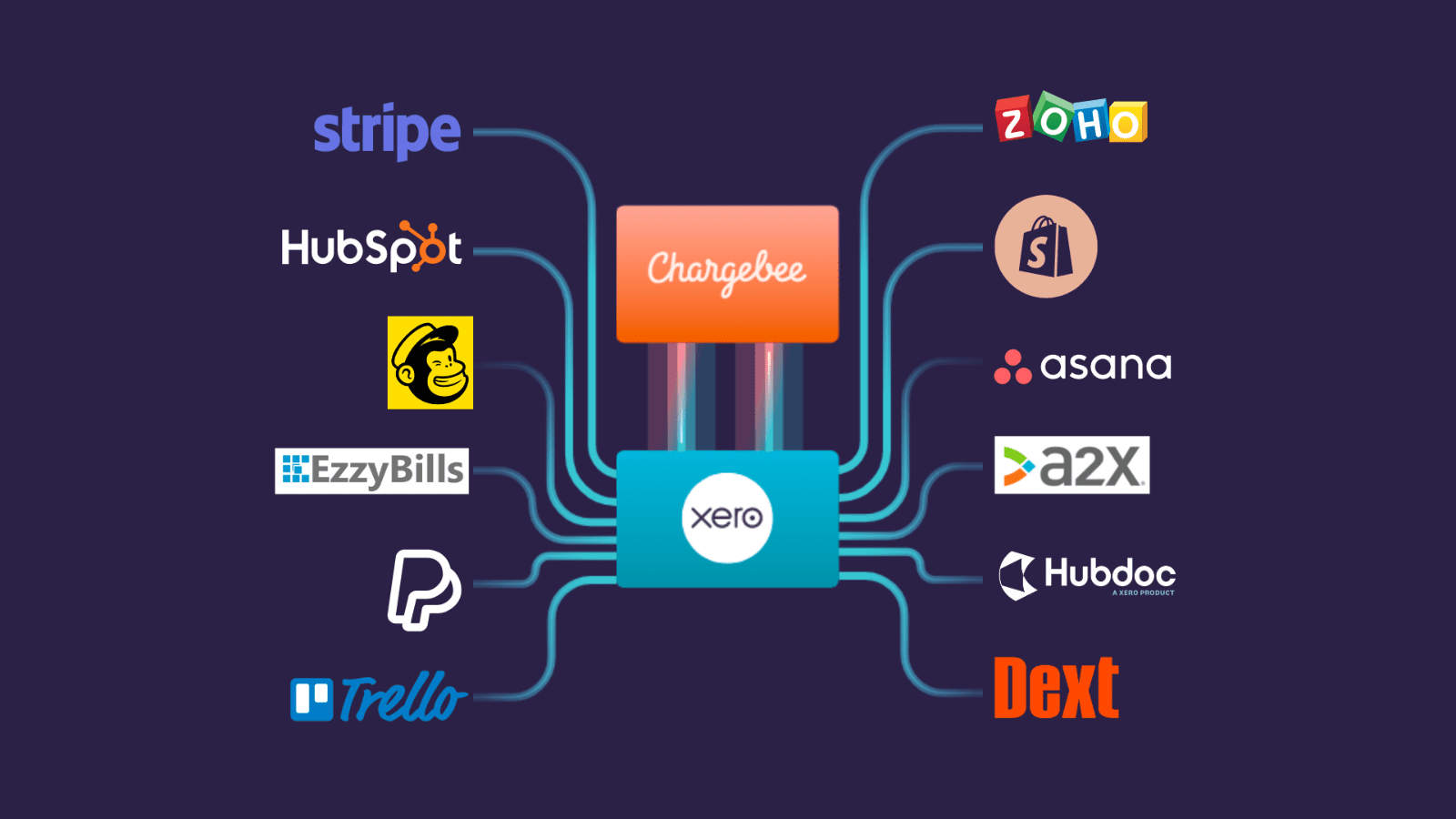

But the real advantage to Xero’s accouting capability, is in how it communicates easily with most of your existing organizational tools, making data sharing across your subscription management, payments, or CRM (and many other) interfaces a walk in the park. This gives every team in the business a clear view into customers transactions – a critical strategic input. This is beyond the native roster of products Xero has in its flywheel to support multiple accounting use-cases within a business.

To make things easier, Xero readily integrates with over 1000 third-party apps, including accounting tools like Workflow Max, inventory management software like TidyStock, and time tracking apps like MinuteDock.

In this article, we’re going to look at 23 of the most powerful Xero integrations (for various use-cases) and add-ons that will supercharge business operations and save several hours in data entry.

But first, let’s start with the housekeeping.

Xero Integrations vs. Xero Add-Ons — What’s the Difference?

Xero offers two primary (and significantly different) ways to support different use-cases by connecting with other applications:

- Integrations

- Add-ons

Xero add-ons are additional products developed and offered by Xero itself. On the other hand, Xero integrations connect the platform to third-party softwares (like Chargebee, HubSpot, and Shopify).

Now that you understand the difference between Xero add-ons and integrations, let’s look at how you can connect them to your existing software stack.

Connecting apps to your Xero account is simple. Just:

- Log in to Xero on the desktop or mobile app

- Click on your organization’s name, and select App Store

- Browse for the functionality you’re looking for (e.g., purchase order management)

- Choose the app you want to connect and click “Get this app”

- Follow the instructions provided by Xero

23 Xero Integrations and add ons for your business

Chargebee + Xero Integration: Accounting Automation for Subscriptions on Steroids

Ask any subscription business accountant what they think of their accounting books, and all you get is a glare. If managing transactions from millions of customers wasn’t enough, try mid-cycle upgrades/downgrades, cancellation, custom billing logics, refunds on specific items/invoices, pauses and all the bells and whistles that come with it. Subscription proration is not easy, the accounting – is harder.

Chargebee’s integration with Xero brings accountants in subscription business worldwide, a sigh of relief and the time to focus on more strategic output by simplifying accounting, irrespective of their billing labyrinth.

Connecting Chargebee’s subscription billing and revenue management with Xero’s cloud accounting software simplifies data syncing, providing updated accounting data and clear cash flow optics and audit trails through all transactions. Without ever needing to manually transfer or duplicate data between systems.

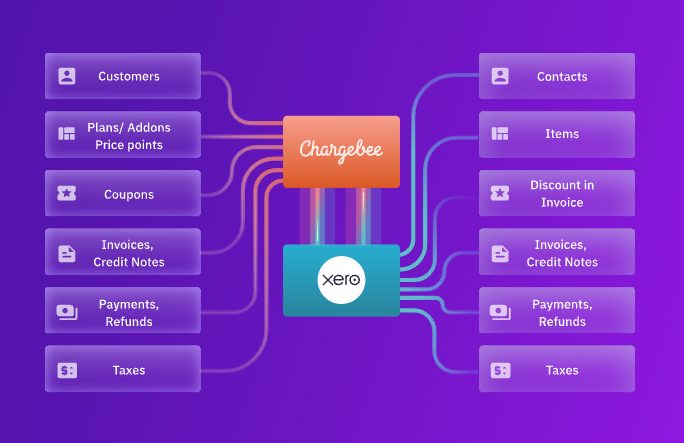

So, how does the Chargebee and Xero integration improve your subscription business workflow?

1. Cloud Accounting on the Go

With Xero and Chargebee connected, you or any authorized users can access up-to-date account data wherever you are, on any device, making it simple to track cash flow, review bank transactions, and monitor accounts payable.

Bank statements will automatically be imported to Xero for easy reconciliation. Payments between Stripe and Xero are automatically reconciled, supported by a Google Chrome extension for one-click reconciliation.

You’ll be able to automatically sync Xero invoices, credit notes, payments, refunds, and taxes (with correct tax rates), eliminating manual work and the possibility of human error.

2. Flexible Chart of Account Mapping

Ensure that your transaction, cash flow, and accounting data flows into the right accounting chart. Set up a single account for all line items or use multiple accounts for each, if you want a more granular visibility.

3. Accurate Reporting

Connecting Xero with Chargebee offers a robust financial reporting suite, including detailed summaries of:

- Accounts receivable

- Sales transactions

- Sales tax (data fed from Chargebee)

Since Chargebee funnels invoice/transaction data directly into Xero, filing taxes (for UK, NZ, Australia, and India) can be done from within the Xero app.

The Perfect Xero Integration for Your Subscription Business

Xero and Chargebee work together to make life easy.

With simplified, automated reconciliation, deferred revenue accounting, and robust, flexible charts of account mapping, integrating Chargebee with Xero is a no-brainer.

Learn more about our extensive integration here.

Xero CRM Integrations

The CRM (customer relationship management) platform is often the centerpiece of an organization’s tech stack. It contains all important customer information, including contact details, plan information, and communication records.

Connecting your CRM to Xero is crucial for ensuring both systems are kept updated with current information and for getting invoices to the right people.

HubSpot

The HubSpot integration for (and built by) Xero, offers the ability to create and send invoices directly from within HubSpot (for Australia, New Zealand, and UK users).

The other main benefit is the ability to sync contacts between Xero and HubSpot. Xero uses customer email addresses as the identifier for this, sending data from their end to HubSpot’s side.

This data transfer takes place when you first integrate the platforms but also in real-time as changes are made in Xero.

However, it is important to note that data only flows from Xero into HubSpot and not the other way round. This means changes in HubSpot aren’t reflected in Xero.

HubSpot’s CRM is available on a free plan, though more sophisticated versions of the platform exist for paid subscribers. Sales and marketing hub packages start at $45 per user per month, extending to $1200 per month for Enterprise customers.

Salesforce

Salesforce is the market leader for sales CRMs. It’s a comprehensive and hence feature-intensive product, meaning any integrations will also have to be meticulous.

The Salesforce integration for Xero is built by Breadwinner, a company that specializes specifically in integrating the two tools (as well as other accounting platforms like QuickBooks and NetSuite).

This integration’s primary benefit is bringing secure accounts receivable and payable information from Xero into Salesforce, so those who need it can access this data without having to switch platforms.

This helps sales teams send accurate invoices at pace, reduces mistakes, and makes invoice payment statuses visible across the entire company.

Getting started requires heading to the Salesforce AppExchange and signing up for a free trial. From there, pricing depends on the plan you opt for, though a free version is available if you have fewer than 50 Salesforce users.

Pipedrive

Pipedrive’s Xero integration (built by the former) is relatively new and is focused on the distribution and tracking of sales invoices.

With the Pipedrive integration for Xero, users can:

- Create and send invoices in Pipedrive

- Avoid double work or asking the accounting department to send invoices

- Track invoice payment statuses with ease

Getting started is simple: head to the Pipedrive Marketplace, find the Xero integration, and hit “Install now.”

Zoho

Zoho is a multi-product SaaS business, with many cloud-based platforms focused on sales, marketing, project management, IT, HR, and finance.

Their CRM integration with Xero syncs:

- Products

- Invoices

- Accounts

- Contacts

- Purchase orders

- Payment and reconciliation statuses

It’s a two-way data sync, meaning if you update data in either platform, it will be reflected in both.

This is a paid integration, and costs $50 per month, or $510 a year when paid annually.

Mailchimp

Mailchimp is a suite of marketing tools, including a web page builder, an email marketing platform, and, of course, a CRM.

The Mailchimp integration for Xero is all about contact management. It’s a simple one-way data integration, with changes in Xero being reflected in your Mailchimp customer database.

Again, this isn’t the most useful of integrations for anyone who is more regularly using their CRM to update customer information.

This integration is built by the Xero team and can easily be connected using the Xero interface.

Xero Payments Integrations

Xero is a bookkeeping and accounting platform, meaning if you’re using it, you’re making and receiving payments of some kind. Xero itself is not a payment gateway. However, Xero does integrate with popular payment gateway platforms, such as Stripe and PayPal.

Stripe

Stripe is one of the world’s leading payment gateways for accepting credit card payments digitally.

This integration allows Xero users to have their customers pay via:

- Credit card

- Debit card

- Apple Pay

- Google Pay

That means you can invoice within Xero and include a link for customers to enter their credit card details for the payment to be processed through Stripe. Then, these payments are automatically accounted for in Xero, and the invoice is marked as paid!

Xero’s Stripe integration is built by the Xero developer team and can be accessed through the Xero platform.

PayPal

PayPal hardly needs any introductions; it is a popular payment method and payment processor for businesses.

PayPal has a direct integration with Xero, built by PayPal itself.

This integration essentially allows your customers to pay you via PayPal. Once you’ve connected the two platforms, your invoices will now have two options under the “Pay now” menu:

- Pay with credit card

- Pay with PayPal

This is a smart integration for speeding up the payments process, as there are over 325 million active PayPal account holders (meaning your customers will likely already have their details loaded in and ready to go).

Note that when customers pay you via this method, the funds appear in your PayPal account, not your bank account, so you’ll need to transfer that money out if you want to use it outside of PayPal.

Square

Millions of small businesses use Square to accept payments from customers.

Their Xero integration (built by the team at Square) offers a few benefits.

First, it allows businesses to capture payment at the point of sale using Square and directly import this information to Xero. What’s even more impressive is you don’t need a third-party device for this process; you can use your own mobile device!

Secondly, online invoices that you send through Xero will have the option for customers to pay via Square.

Bank reconciliations are simple with the Square and Xero integration, and Square’s fees are automatically accounted for in these transactions, reducing manual rework.

The setup for this integration is a little more complicated than usual, but the two companies have partnered with a third-party integration solution called Amaka, which provides professional accounting software integration services, so they’ll get the two working together nicely for you.

Amaka’s is free of charge, irrespective of how sophisticated the integration between Square and Xero for you, or how many transactions are processed.

Xero Project Management Integrations

Project management platforms (or, more accurately, work management platforms, are a critical part of most companies’ tech stacks.

Integrating your project management software with Xero ensures data is synced across both platforms, making it easier to ensure invoices are paid and projects are completed without delay.

Xero integrations for project management tools are limited, but they do exist.

Asana

Asana is a hugely popular project management platform. Which, however, does not have a native integration with Xero. However, businesses can build a workaround with Zapier.

Zapier is an automation and integration platform, plugging the APIs of two tools together to create a third-party integration. In this case, the two tools are Xero and Asana.

This is not a native integration, so getting things set up is a little more complicated than usual. You’ll pretty much need to set up each aspect you want to automate.

For example, you might want your Asana board to reflect invoices that have been sent via Xero. You’ll need to head into Zapier’s Triggers & Actions settings, choose Invoice Sent as the Trigger, and then define the Action you want to occur in Asana.

This is a little trickier than your typical Xero integration, but it does mean that your connection is entirely custom, and once you’re set-up, you’ll be saving tons of time in manual data entry.

To get started, you’ll need accounts with Xero, Asana, and Zapier. Then, you’ll head into the Zapier interface, authenticate the two apps, and follow the steps provided.

Learn more about integrating Xero with Asana using Zapier here.

Trello

Trello, a kanban board tool by software giant Atlassian, also offers a Xero integration.

However, Trello doesn’t integrate directly with the standard Xero platform, only with Xero Projects, one of Xero’s many power-ups.

In any case, the functionality is simple.

The Xero Projects power-up allows you to track time directly within the Trello app. That means you can measure how long it takes to complete a task and use this to inform accurate invoicing or to manage employee productivity and output.

That’s really all the integration offers, but the good news is that it’s entirely free.

To get started with Xero Projects power-up, head to the Trello power-ups page and click Add Power-Up.

Xero eCommerce Integrations

Xero also offers a number of helpful integrations for those running eCommerce stores on platforms such as Bigcommerce and Shopify.

Some of them are direct integrations with eCommerce website platforms, while others like A2X and Synder are more about revenue management and payments reconciliation.

Shopify

If you’re using Shopify to sell goods online, you can connect your site to Xero using Xero’s self-built Shopify integration.

This integration syncs a daily summary of your Shopify sales to Xero. Unfortunately, it’s not real-time; the summary is only transferred to Xero at the end of each day, meaning Xero is not up-to-date throughout the day.

Now, this is more convenient than manually exporting from Shopify and uploading to Xero, but the lack of real-time data transfer is not ideal, and as such, this integration has garnered quite a few negative reviews from users.

There is no cost for the integration itself, though you will need to have an active Shopify membership.

There’s multiple workarounds, however. Amaka and A2X, both third-party companies, offer solutions to connect Shopify and Xero.

A2X

A2X is a software platform that helps eCommerce business owners automate accounting functions and connect with apps like Xero and Quickbooks.

To get value out of A2X’s offering, you’ll need to be selling on one or more of these platforms:

- Shopify

- Amazon

- Walmart

- eBay

- Etsy

A2X’s integration automatically posts settlement summaries to Xero, mapping income and expenses directly and making reconciliation easy.

Users claim they save up to 20 hours a month through automation using the integration!

Pricing for A2X depends significantly on your platform of choice.

BigCommerce

Xero doesn’t have a direct integration with BigCommerce, but there are a number of third-party suppliers that connect these two platforms.

CarryTheOne is perhaps the most widely used, with a cost of $32 per month. This integration automatically imports orders, inventory, and customer data to Xero directly from BigCommerce.

Other integrated features include invoice payments, credit notes, coupons, discounts, and gift certificates.

Other options for connecting BigCommerce to Xero for payment and order reconciliation include:

- Vextras

- Parex Bridge

- Synder

- Amaka’s granular integration (both free and paid options available)

- ZapERP Inventory (for inventory management)

Xero Bills and Expenses Integrations

Being a bookkeeping and accounting software platform, it’s kind of a no-brainer that Xero would integrate with popular billing and expenses tools.

We’re about to discuss the three most popular Xero bills and expenses integrations, but note that this is not the extent of their offering, and other integrations exist for platforms like:

- Expensify

- Bill.com

- Zoho Expense

- ApprovalMax

- Airwallex

All of these integrations make it simple to automatically sync billing and expense data over to Xero.

EzzyBills

EzzyBills is, at its core, an invoice scanning app.

That means that when you receive a physical invoice or receipt, you can use the EzzyBills mobile app to scan and digitize the document for easy, automated bookkeeping.

The Xero integration allows you to scan invoices in EzzyBills and import them directly to your Xero account.

Uploading digital (i.e., PDF) invoices is just as simple; you just forward the email to your EzzyBills account for automatic upload.

Billing and expense management often require several stages of approval, and EzzyBills accounts for that with customized and completely automated multi-level management approval workflows.

This integration is built by the team at EzzyBills, and is one of Xero’s “Staff Picks,” with 62 five-star ratings on the Xero App Store.

EzzyBills plans start at $69 per month, but there is no cost to use the integration itself.

Hubdoc

Hubdoc is similar to EzzyBills in that it’s a document and data capture platform, allowing you to scan and import important financial documents like invoices and receipts.

Their Xero integration (built by Hubdoc) extracts and publishes this data once you’ve scanned the document using the Hubdoc app.

The big benefit here is the ability to eliminate all that messy paperwork and filing. Once you’ve scanned a document, you’ve got it securely stored in the cloud, and Hubdoc has a strong search and retrieve system, so it’s easy to find documents when you need them.

To connect the two tools, you’ll need to sign in to your Xero workspace, click “Set up Hubdoc,” and then follow the on-screen instructions to authenticate the integration in both apps.

While there is no cost to use the integration itself, Hubdoc costs $12 per month after a 30-day free trial.

Dext

Dext actually has two products:

- Dext Prepare

- Dext Commerce

Both products have integrations with Xero and are built by the Dext team.

Using Dext Prepare, you can scan receipts and invoices and upload data right to Xero. Information is synced with the Xero Chart of Accounts, Purchase Ledger, and Bank Account, making reconciliation simple.

Dext Prepare also integrates with Xero HQ, an activity feed add-on, so you can see all financial activity from both platforms in one location.

Dext Commerce is a little different. It syncs eCommerce data from platforms like Shopify, Stripe, Amazon, eBay, PayPal, Etsy, and Walmart, website builders like Squarespace and Wix, and payment portals like Square.

Even payment data from physical POS terminals are synced to Xero using the Dext Commerce integration.

Other Dext Commerce Xero integration features include:

- An API for integration with other internal business systems

- Syncing of Xero Contacts

- Ability to map products and services, tax rates, tracking categories, and chart of accounts

- Support for multiple tax rates

- Cash basis and Accrual support

Pricing is not publicly available for either product, though the integrations are free and available through the Xero App Store.

Other Xero Integrations

Remember, Xero offers over 1000 integrations with other popular platforms.

We’ve already covered the main categories (billing and expenses, eCommerce, CRM, payment gateways, and project management), but there are plenty of other great integrations to speed up your workflows and automate life in Xero.

Deputy

Deputy is a comprehensive team management platform that offers a variety of features, including:

- Scheduling

- Time tracking

- Employee time clock

- Labor compliance tools

If you’re managing a large team with various schedules, rosters, and wages, Deputy is a powerful tool.

The Deputy integration for Xero is one of the highest-rated on the app store, is built by Deputy, and is one of Xero’s Staff Picks.

The main goal of this integration is to sync employee timesheets to Xero for easy reconciliation and payroll management. For instance, within the Deputy mobile app or Kiosk (a place where employees can use the software to sign in), you simply push the timesheets you’ve collected over to Xero, and you’ll see them there instantly.

Other employee management features, such as leave requests and tracking unpaid and sick leave, are also possible in Deputy, which can then be synced over to Xero.

Pricing for Deputy is based on the number of users (i.e., employees) you have. You’ll pay $4.90 per user per month for full access.

Alternatively, you can choose just one of Deputy’s products (Scheduling or Time & Attendance) depending on your needs and pay just $3.50 per user per month.

Gusto

Gusto is a payroll and employee benefits platform primarily, but it offers a wealth of other features for managing teams, such as:

- Time and attendance tracking

- Hiring and onboarding tools

- Worker compensation enrolment and processing

- Performance review management

Xero and Gusto have a strong partnership; Gusto is Xero’s preferred payroll provider. As such, their integration makes for a seamless experience.

For instance, the Gusto integration for Xero offers a single sign-on feature, meaning you can sign into your Gusto account with your Xero login. You can jump to frequently used Gusto dashboards (like Run Payroll) directly from the Xero interface, and receive payroll alerts with the Xero HQ.

After integrating the two tools and mapping your chart of accounts, your payroll data will be automatically synced from Gusto to Xero, showing up as Bills in the Xero platform.

The integration itself comes at no cost, but you’ll need to pay for Gusto if you’re not already a user. Plans start at $40 per month.

Calxa

Calxa is a financial modeling and automated business insights platform helping non-profits and small businesses better understand their financials without needing a complex understanding of finance.

For example, Calxa can help with budget creation, managing financial KPIs, creating cash flow forecasts, and multiple budget and scenario analyses.

Calxa’s integration extracts data from your Xero account (such as your account structure, tracking categories, and opening balances), providing you the opportunity to prepare helpful visual financial statements and reports, and develop cash flow statements and budgets.

You can create your own reports from scratch or use one of Calxa’s 150+ pre-designed templates to get started quickly.

This integration is built by Calxa itself and is one of the highest-rated connections on the Xero App Store, earning a Xero staff pick award.

Pricing for Calxa starts at $69 per month, depending on the number of users you require.

DEAR Inventory

DEAR Inventory is one of many software tools offered by DEAR, a one-stop platform for ERP (enterprise resource planning), accounting, purchasing, sales, and inventory management.

The Xero integration specifically connects with DEAR Inventory so that any inventory-related processes within DEAR are automatically reflected in your Xero account.

This includes transactions and actions such as:

- Purchases

- Sales

- Manufacturing

These are then reflected in Xero as invoices, bills, and journal entries, ensuring your books match in both software platforms and reducing manual data entry.

Getting started with the DEAR Inventory integration for Xero is easy. Just head to the Integrations section within DEAR, choose Xero, and follow the instructions to sync your two accounts.

This integration is a Xero staff pick with many positive reviews in the Xero App Store and is built by the team at DEAR Inventory.

Expensify

Expensify is a financial tech platform designed to help business owners automate pre-accounting processes like billing, invoices, and expense management. They also offer a business credit card known as the Expensify Card.

They’re the only solution for expense reporting, company card reconciliation, and receipt and mileage tracking recommended by the AICPA (American Institute of Certified Public Accountants). They have a long track record with Xero, with over 450 positive reviews on the Xero App Store.

This is a powerful integration with a two-way sync, meaning data is pushed from either platform to the other to ensure real-time synchronization and up-to-date records in either tool.

As you set up the integration, Expensify pulls the following from Xero:

- Tax rates

- Tracking categories for expenses

- Chart of accounts

Then, as you work in Expensify, finished reports are auto-synced back to Xero.

Expensify also integrates with Xero HQ, the platform for accountants who manage multiple clients, making it simpler to manage tasks like expense reports that are waiting for client approval.

The Expensify integration for Xero is built by their internal team and can be activated within your Expensify account.

Futrli

Futrli is a three-way budgeting, prediction, and reporting platform, owned by Sage, a leader in financial, accounting, HR, and payroll software for small and medium-sized businesses.

Futrli offers three products:

- Futrli Predict

- Futrli Advisor

- Futrli Portfolio

The Predict platform is primarily focused on prediction, looking at future forecasts such as:

- Cash flow

- Profit

- Spending

- Sales

- Due invoices and bills

- Tax

Futrli Advisor is like an AI accountant or financial advisor, providing helpful advice based on your business’s financials (pulled from Xero).

Portfolio is essentially Futrli’s accountant-facing product, designed to help accounting practices manage a portfolio of clients, leveraging predictive insights and AI-powered advice to provide a better service to their clients.

Futrli’s Xero integration here is essentially a data grab to help provide more accurate insights. When you connect the two tools, Futrli pulls information from Xero, such as revenue, expenses, and sales data, to power its predictive analyses.

This integration is built by the Futrli team and can be activated within the Xero interface.

Xero Integration Workaround — Zapier

Xero has over a thousand powerful integrations and add-ons. The thing is, there are thousands of software platforms out there, so it’s impossible for Xero to offer native or out of the box integration with every single one of them.

Plus, some of the integrations are a little limited. So, if you can’t find your favorite platform on the Xero App Store, or you want to build additional functionality into an existing integration, there’s a not-so-secret solution.

Xero integrates with Zapier allowing you to connect any other tool that works with Zapier and build your own custom integration.

Zapier is a custom automation and integration tool that plugs two platforms’ APIs together. Naturally, this is a fairly manual process to set up.

Most of the other Xero integrations we’ve discussed here work pretty seamlessly from the get-go, you just need to authenticate the apps, and you’re working.

Zapier is a little more complicated. First, you’ll need to connect Zapier to your Xero account and to the other software platform you wish to integrate with Xero.

Then, within the Zapier app, you’ll create individual ‘Zaps,’ which essentially follow a formula, “When X happens in platform A, do Y in platform B.”

For instance, “When Invoice is sent in Xero, update Client Card in Asana.”

Once these are set up, everything happens automatically, so you’ll save time in the long run.

Integrations that Make Cloud Accounting Easier

The integrations that Xero offers with other platforms are, on the whole, massive timesavers.

Some are more robust than others, yes. Most, however, eliminate a ton of manual double work, reduce the chance of human error, and make activities like reconciliation simple and rapid.

We’ve built our Xero integration to do just that: make syncing data between Chargebee and Xero simple and seamless.

Check it out today, then book a demo with one of our team to learn how Chargebee can transform your subscription billing processes.