You’ve probably heard (or found out the hard way) how much more expensive it is to acquire a new customer than to retain an existing one. You’re also aware that churn is among the critical metrics for profitability, and customer retention is crucial to expand the lifetime revenue (LTV) of acquired customers. By some accounts, a 5% increase in customer retention can increase profits by more than 25%.

Sure, a good growth rate can blunt the impact of a high churn rate. But as your SaaS startup grows, even a low churn rate can impede growth substantially.

“As a SaaS company becomes larger, the size of the subscription base becomes large enough that any kind of churn against that base becomes a large number.”

– David Skok, entrepreneur and VC at Matrix Partners

Understanding why customers cancel and what retention strategy works best to stem customer churn, boost expansion revenue, and increase lifetime value is worth understanding. This post walks you through the common reasons for cancellation and steps to ensure your customers stay with your brand.

Top 7 Subscription Cancellation Reasons

Customers cancel their subscriptions for many reasons, from experiential issues and dissatisfaction with the product/service to changing economic situations and even outgrowing a product/service requirement.

Let’s dive into the individual reasons, both from a product/service perspective and a customer-intent perspective below

1. Unaddressed Product Bugs

The most fundamental (and probably the most damaging!) of reasons customers can leave your business are product-level issues. A poorly engineered/hastily released app is frustrating to use. Worse, it can lead to negative consequences for users, like the bugs in an insurance app that caused drivers to have their insurance canceled or lose their no-claims discount.

Having your product described as inferior or weak can be shattering. It calls for an immediate review of product functionality and features. Post product improvements (or a new launch to remove bugs), churned customers can be attempted to re-engage with a win-back campaign.

2. Unmet Value from a Product/service

Every business endeavors to solve a key customer problem adeptly. Yet, with a growing market and evolving customer needs within it, the solution in itself must continue to evolve. Sometimes, this evolution into multiple products/features/plans/options might complicate the initial simplicity a business wants to offer without alerting stakeholders.

Hence, while the product continues to remain intuitive for the ones who built it, customers who aren’t properly hand-held throughout their product journey might have a hard time playing around and having their use-cases met.

It is therefore important not only to have a strong support ecosystem that can nip customer issues in the bud, but also to have an equally strong onboarding workflow that educates customers better on achieving success with your product.

3. Checkout Friction

Since it directly involves a transaction, checkout is one of the most sensitive stages in a customer’s interaction with a business. Longer form-fills, multi-step processes, and latency in transaction follow-throughs not only extend the time a potential customer has, to change their mind, it also projects the ideas of ‘hassle’ and ‘inconvenience’ right before they are about to subscribe to your business.

This is an experiential troubleshooting most businesses must immediately resolve for. Look at providing frictionless checkouts, minimize clicks, and keep your customers reminded of your value proposition as a means of reinforcing confidence.

Related read: 7 checkout page best practices with examples

4. Payment Failures

Payment failures are irksome, especially in a subscription business, since automating your customers’ payments for a periodic consumption of your product/service is kind of the core point of subscriptions.

Churn due to payment failures are also more unfortunate, because it didn’t happen because of an active decision taken by your customers, but because of a more mechanical (read, easily addressable) issue.

Pre-dunning messaging that the customer’s credit card is about to expire and making it as easy and quick as possible for customers to update their card details – are some retention strategies to arrest payment failures (and correspondingly, churn) from happening in these cases.

5. Inability to Downgrade/upgrade/pause

Success requires customer-centricity. Often, it means compromising higher average contract values (ACVs) to provide customers an experience closer to their requirements and budget and keep your customer lifetime value (LTV) intact.

For example – if you were a monthly flower subscription business, and your customer has – for a month or two – planned a vacation out of town, then, not giving them the option to pause their subscription would only mean one of two things – either they pay for two whole months for no material benefit to them (which, let’s agree, is wishful thinking); or – they cancel their subscription with the faintest possibility of never returning(!).

In any case, allowing your customers to scale up or down, in tandem with their needs and expectations from your business is not only critical in retaining them, it is also more humane and empathetic.

6. The Customer is Happy but Doesn’t Need your Service Anymore:

An extension to the previous point – sometimes your customers move beyond your product (or at least, feel like they have) and therefore end up churning. It is what visual communication company Powtoon found itself grappling with. Customers would come for quick one-time video making needs, but as soon as they had their needs met, would leave as quickly as they came.

“We wanted to show customers that Powtoon could meet their needs long-term, but we weren’t reaching customers at the right time or place,” said co-founder Daniel Zaturansky. “We tried email and messaging, but we weren’t cutting through the noise, and our win-backs were low, and our exit survey was elementary.”

Powtoon realized that the key to converting one-time customers into long-term subscribers is educating them better on the value generated. Now, whenever a customer visits their cancel page (hosted in Chargebee Retention), they’re added to a watch-list to analyze further cancel intent for 30 days.

These customers are automatically flagged in Powtoon’s customer support tool, enabling agents to reach out quickly with a personalized offer to stay. This workflow helped them increase their save rate by 63%.

7. A Shrinking Discretionary Wallet Globally

Mounting economic pressure led businesses and customers to cut their wallets short. More businesses are screening their tech stack for shelfware they can offload to save money, while most customers are consciously canceling ‘good to have’ yet discretionary subscriptions.

This means that to retain customers, SaaS softwares and D2C businesses alike, must not only continue to generate greater value, but also exhibit value better. Sending continual communication, identifying ‘at risk’ customers and running personalized retention campaigns around them, even a price discount may convince the customer to continue their patronage.

Other Reasons Why Your Product is No Longer Needed

-

Migration to competition:

Moving to a competitor can happen because of a mixture of any of the aforementioned reasons. However, it is still within your control to provide your existing customers unparalleled experiences. Incentivizing their existing relationship with discounts/coupons or loyalty points can work towards building long-term brand acreage.

-

Sensitivity to price changes:

A ‘price sensitivity and impact’ analysis is important to understand how a pricing change might affect churn. Customers understand that you will have to raise prices at some point. If you provide value commensurate with the increase, they will stick on. Budget-conscious customers will likely unsubscribe but think about whether it’s worth re-engaging them or focusing on pleasing your best customers.

-

Product’s inability to grow with your customers:

Lack of foresight is a common symptom for a dying business. Kodak went from being the commanding force in photography to bankruptcy because it was insistent that customers buy photographic reels by actively resisting the move to digital photography (despite having invented it). Hence, while the product was an initial fan-favorite, customers swiftly moved to competitors Canon and Nikon. To keep your customers with you, it is important to grow with their needs. Capture their pulse continually by collecting timely feedback, look for patterns and solve for the common problems and aspirations from the product.

How to prevent customers from canceling their subscriptions

Newer, more customer-friendly cancel regulations have effectively handled the end of the relationship rope to your customers. Canceling subscriptions is not only more convenient (in just a few clicks), there are also more opportunities to do so since (with mandated cancellation links on every invoice and email).

Businesses today, must therefore, work harder to keep their customers happy and build operational excellence to identify churn intent, resolve unmet needs, and turn around a churn event into a relationship-building opportunity.

While improvements in product/service and customer success are obvious vectors to better retention, setting your cancellation page up to make customers think twice about their decision can keep churn in check.

Let’s go over the fundamentals of customer retention in more detail –

Build Process Efficiency to Minimize Involuntary Churn

As discussed earlier, churn due to payment failures, outdated card-on-file records, or erratic payment gateways are not only irksome, they are also avoidable. Ensuring you have the technology to avoid simple process breakdowns frees you up to actively listen to customers with a real cancel intent, while preventing unnecessary revenue leakage.

Ensure that your subscription tech stack can also effectively retry with alternative payment methods when a payment failure occurs, and if all else fails, can also send customized dunning messages to enable your subscribers to take action.

Your subscription management platform also needs to help you set rules on subscription cancellation if all the aforementioned workaround fails. This gives you the control to determine if a subscription is automatically canceled or set to pause for a time-interval where you’d want to re-engage your defaulted subscriber into updating their payment information.

Subscription management platforms like Chargebee not only natively handle involuntary churn issues, but also provide a seamless dashboard view on 20 KPIs+ reports, in a churn-watch dashboard.

Once you have enabled your system to automatically arrest involuntary churn, you can then focus on customers with an active cancel intent with the steps mentioned below.

Know Why Your Customers Want to Cancel

Before a customer cancels their monthly subscription, they will drop indications that determine their cancel intent – scaled-down product/service usage, visits to the cancellation page, or through direct feedback. It is essential therefore to promote feedback collection and active customers success engagement to proactively identify churn intent and resolve issues. Routine ‘exit surveys’ therefore, don’t do enough. Offering to resolve the issue tells the customer that you’re willing and available to take action on the issue.

What you can do: Chargebee Retention adds a ‘Chat Now’ option to the cancellation page and includes personalization elements that trigger a conversion of intent. It also allows you to A/B test different cancellation pages and messaging, identify the most effective ones, and view the results of your retention experiments.

Exhibit Why Customers Should Stay With You

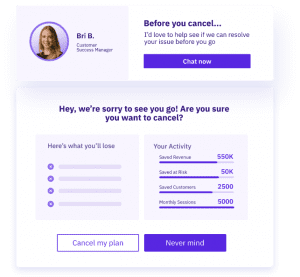

Just like how a fear of missing out works on potential customers, a fear of losing out on your product’s (familiar) benefits can motivate paying customers to postpone or reverse their decision. Your cancel page is also an opportunity to exhibit your benefits and inform your customers what they are likely to lose out on, in case they terminate their subscriptions.

What you can do: With Chargebee Retention, encapsulate the ‘whys’ of choosing your product first on the cancel page itself. Remind customers that they will lose out on key benefits when they unsubscribe and allow them a reconversion button (right beside your cancel button) to indicate a successful churn deflection for your business.

Keep Future Customer Churn in Control.

Saving the customer is a sum of different types of efforts. Not letting your customers walk away from you is the first step. Engaging them and addressing the reason(s) for canceling is the next order of business. You’ll also need to know whether both are working, which is possible with retention performance data.

What you can do: Chargebee Retention presents automated offers depending on cancellation reasons. It also helps to determine the true value of a customer by analyzing LTV, contract value, tenure, upgrades/downgrades, and other variables. Chargebee Retention tells you the truth about your retention performance by tracking customer cancels, deflects, and saves.

Create a plan to keep customers for the long term

Only the likes of Netflix can afford to cancel subscriptions of inactive users and continue profiting unscathed. The vast majority of companies must retain customers to grow sustainably.

The good news is you can save every customer. You have to know how, which is possible if you know why they have canceled, ideally immediately after the fact. With Chargebee, everything you need to stop customers from leaving you are available out of the box. You only need to focus on solving customers’ pain points, which will keep them from churning.

Explore Chargebee Retention right away to plug the leaky bucket of revenue.