The SaaS market in Europe is growing with a compound annual growth rate of 25%. It’s expected to continue to grow at that rate till 2023. And, it’s only getting started – it hasn’t even hit maturity yet. All this makes Europe a prime target for SaaS businesses eying global expansion.

With an untapped potential for SaaS businesses to scale and flourish, the European SaaS market is up for grabs.

Provided, you’re able to tackle and slay the unique set of localization challenges it brings to the table.

Unlike the US (a unified market, a single set of regulations, and a common language), Europe is anything but consolidated.

Varying SaaS penetration rates. A wide variety of payment method preferences including direct debits, cards, and location-specific e-wallets. 24 different language barriers. And last but not least, a plethora of compliance regulations, invoicing regulations, and security norms.

The European SaaS market is a tough (but rewarding) nut to crack.

- How do you stay on top of EU-VAT and other regulations?

- How do you handle varying payment preferences and price sensitivities?

- How do you go about breaking down language barriers?

In essence, aren’t we asking ourselves – how do you localize your way into capturing the European hearts?

This post exists to answer all these questions, and more.

If you’d rather watch/listen to Vikram (Director of Marketing at Chargebee) and Timmy Nielsen (Product Marketing Manager at GoCardless) talking about the same in our webinar, here’s the video recording of that:

Test waters before expanding into Europe

First things first: is that European country even worth expanding into?

Here are the top four factors you’d need to evaluate before you consider investing time and resources in a particular region while taking your SaaS global:

- Size of the market: If you are selling to small and medium-sized businesses, does this geography have a significant number of businesses belonging to your market?

- Language proficiency: How proficient are the locals in your primary language? If a majority of the region is already fluent and/or comfortable with your native tongue, there might not be a need for you to actually go in and localize for that particular area.

- Existing user base: What is the current adoption in the region? This is kind of a tricky point. You might really have a low adoption rate in a particular region because of the lack of localization or it might be low despite having really good localization in place because the market just isn’t good enough. So a useful proxy for you would be to see what the average adoption rate across your market is. If your competitors have been able to establish fairground within a particular region or geography, that might be an interesting area for you to get.

- Existing synergies: How do the existing partners, resellers, and the rest of the ecosystem work together? How can they lend into making your localization efforts easier?

Dropbox – Follow the users

Dropbox started out with an adoption rate across the UK, Norway, Sweden, Denmark, Finland, and other European countries, that’s similar to the rates in Australia, New Zealand, Canada, and other English-speaking nations.

But as they were penetrating France, Germany, and southern Europe, they began facing difficulties with user adoption, and that’s when they started doubling down on their localization efforts.

The main takeaway here is that Dropbox didn’t commence with their localization efforts before they penetrated the market.

❝Dropbox waited until they had about 30 to 40% user adoption across these regions, and then followed their users to go all in and dominate each of these markets, instead of creating the growth from scratch.

The four-step framework for international expansion of your SaaS

Once you’ve decided to take the leap, here’s a four-step expansion framework for your SaaS business to go about localizing for a particular market in Europe – the pricing, the language(s), the payment preferences, and finally, the local compliance regulations:

1. Pricing Localization

When you want to localize your pricing, you have two broad options:

- You can either take the cosmetic localization route, where you continue to charge customers in your base currency but simply have an exchange rate slapped on top of that. So at the interface level, you’ll show them pricing options in their currency, but at rates that are standardized across the globe.

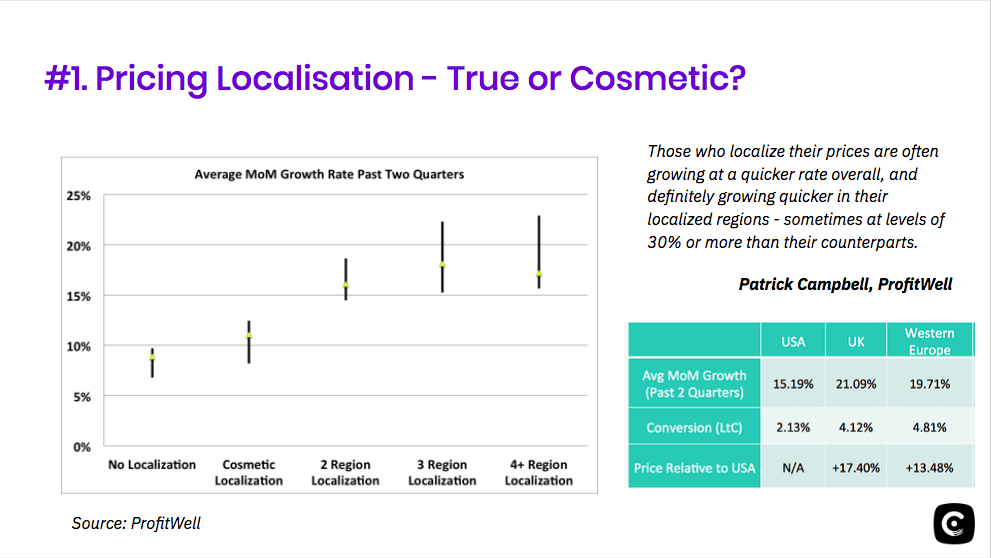

- Or you can opt for a true deep localization, where you bring the price sensitivity of the local region into the picture, and charge customers not just in their local currency, but at a price that matches the sensitivity level of that particular region. A research conducted by ProfitWell shows that companies which have been able to achieve this were able to bring in 30% more revenue than their counterparts.

Evernote – The lost opportunity in localized pricing

In one of their studies, ProfitWell found that Evernote’s customers had wide-ranging willingness to pay, across countries. In Canada for example, people were willing to pay 36% more than their Premium price, for the same product. In the UK, people were willing to pay 98% more and in Denmark, customers were willing to pay a whopping 151% more. By simply accommodating the price sensitivity in their local pricing options, Evernote could’ve realized 1.5x higher ARR, without affecting their active user base.

You need to localize your pricing, because we’re in a globalized world

-Patrick Campbell

2. Language Localization

Most often, you begin by translating the pricing page. After all, that’s where the money lies.

Soon, the other key landing pages on the website follow suit.

And in due course, you hit a roadblock – how long is your customer going to stick with you if their team finds it hard to use your product in a foreign language? Not for long.

You realize that the product needs to be translated as well.

At Chargebee, here’s how we think about language localization when it comes to the product (and everything else linked to it):

- Bake in internationalization and localization support into your SaaS product. Out of the box, the Chargebee app supports six different languages, in addition to which users can add extensible language packs. In other words, the permutations of languages that a user could use in Chargebee is pretty much infinite.

- Strategize localization based on the end user’s preference and proficiency. In a B2B context, you might want to choose your localization and the depth of localization that you offer based on your app user’s proficiencies and preferences. But a good rule of thumb while taking your SaaS international is to always think of your end user first, instead. So within Chargebee, our checkout pages, invoices, and the subscription event emails touch the end user (our customer’s customer) directly, and therefore they end up being our number one localization priority.

- Don’t just translate. Account for the cultural frames of reference, when it comes to phrases. When we were creating our first-ever localization update in German, we made a rookie mistake of literally translating “recurring billing” to German, without taking the contextual nuances into account. And it did backfire by completely distorting what the phrase actually meant.

Survey Monkey – Better late than never

Survey monkey started out in 1999 and up until 2009, about 85% of their business was still in English and English speaking regions. But in 2009, the company recognized the massive opportunity that they’d been leaving on the table and ramped up their internationalization efforts. And in the past 10 years, SurveyMonkey has grown to support 17 languages and accept payments in 20 different currencies. If we have to pick a phrase that encapsulates SurveyMonkey’s approach to localization and how they’ve been able to massively grow their acquisition efforts, it’s better late than never.

3. Payment Localization

In Europe, the payment preferences are so incredibly diverse, that you simply cannot afford to offer one single payment method to all your European customers.

To figure out which payment method works for your business, there are three major dimensions of payments you need to consider (Credit: Timmy Nielsen, Product Marketing Manager, GoCardless):

- Coverage: How much land is covered by the payment method under question? This is a measure of payers who’d opt for the payment method in question, and it ensures that you offer payment methods that are accessible in that region.

- Preference: How is the penetration of the payment method in that country? This is a measure of payers that do choose to use the particular payment method and helps you ensure that you are offering a payment method that the consumers would actually want to use.

- Conversion: How does the payment method impact the cart abandonment rates? This is a measure of payers that complete the payment process using the said method and helps you maximize conversion and in turn, grow your business. For example, offering SOFORT in Germany or iDEAL in the Netherlands as payment options might reflect on improved conversion rates in those countries.

❝Regardless of the payment service providers you use today, you’re going to have to use a different one for other countries,” says Tobaccowala. “This sounds easy enough, but it requires abstracting payments in your app so you can connect to a different PSP later. If you think about it early enough, you can create the abstract layer and avoid rebuilding your entire checkout system. – Selena Tobaccowala, Former CTO, Survey Monkey

4. Compliance Localization

Handling e-Invoicing regulations

We have to hand it to Europe for having e-invoicing regulations that pretty much change year on year within countries. For instance, Italy has its e-invoicing regulations in motion already. Whereas in Germany, it will come into effect in 2020. What makes it even more complicated is that each country has a unique format. And you will have to issue recurring invoices that are compliant with every one of these EU SaaS regulations. For this very reason, choosing the right partners who will scale with you as your SaaS business goes through global expansion becomes critical.

❝If Chargebee hadn’t solved for Italian e-invoicing compliance, we would have had to send the invoices manually. You came and helped, and we are really glad to have you as a business partner for our invoicing platform. – Gabriele Proni, Co-Founder and CTO, Voverc

How does PSD2 impact European SaaS businesses?

With PSD2 in effect from September 14, 2019, the banks’ monopoly on customers’ account information and payment services would no longer exist. PSD2 would lead to a paradigm shift in the way banks function. And thereby impacting the way payment processors and gateways function.

But why should you, as a SaaS business, bother about it?

Though you might not really choose to care about the entire story, there is something that might pique your interest – Secure Customer Authentication!

Subscription businesses will need to have this layer of additional security at the time of transaction. Verifying a transaction needs two of the following authentication methods –

- Something you know (Password, Pin, Sequence)

- Something you own (Mobile phone, Smart Card, token)

- Something you are (Fingerprint, facial feature, Voice patterns)

Solving the EU VAT headache once and for all

What’s the big deal about EU VAT you ask? Well, for starters, you will have to register for VAT in the country you are incorporated in. If you are based out of the EU or if you are selling to multiple countries, you will have to register with VAT MOSS. And then comes VAT number validation, location validation, and the tax rates that change for every country, which have to reflect in your invoices as well.

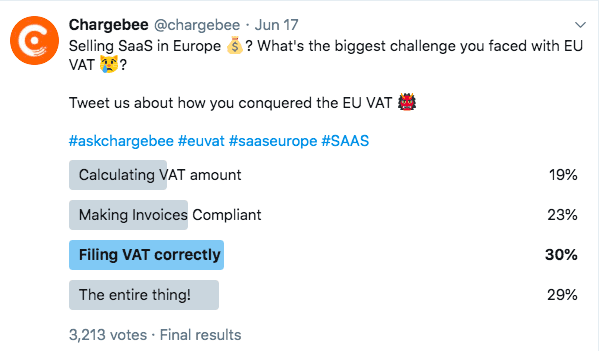

We ran a survey asking SaaS businesses in Europe what their biggest problems were with respect to EU VAT. Of course, the results were expected – 30% said that they face issues with filing VAT correctly, while a close second, was the 29% respondents who had a problem with the entire thing.

If you want to get it solved once and for all, you will need to pick a provider who can actually share this headache of yours.

(Note: With Chargebee jumping in from calculating taxes to giving you an export that you can simply file, a major part of the EU VAT burden is offloaded.)

There are four huge boxes you have to tick to not worry about of EU VAT:

- Registering for EU VAT

- Figuring out how to calculate taxes

- Making invoices tax compliant

- Reporting and filing taxes

If you would like to read more on EU VAT, find our extensive guide on Understanding EU VAT here.

Conclusion

Pipedrive – Product first. Marketing next.

Pipedrive’s approach is complete localization, inside out. And while most SaaS businesses focus predominantly on localizing their marketing web pages, Pipedrive’s expansion strategy has the product, website, billing, and customer support all baked in together into one unit. Right from the get-go, the team built the product in such a way that it had easy and extensive customizability, which, in turn, spared them the trouble of tweaking it to suit each market’s needs.

Partnering with the right process, tools, and products

For SaaS businesses, the European market is ripe for rapid growth and expansion at the moment. And to be able to get a piece of this market pie, you’ll need to pay close attention to the localization of every single aspect of your business. From pricing to the app interface. From landing pages to invoices. From acquisition to payments.

You’ll have to factor in the local language, willingness to pay, price sensitivity, payment preferences, and tax invoicing and security regulations. And to be able to nail all of them right, you’ll first need to have the right arsenal in place – the products, processes, and platforms that enable and empower your European expansion strategy.

Internationalization and localization are bread-and-butter to Chargebee. If you are looking to scale your business in Europe, we’d love to help you out with a personal one-on-one conversation. Head here to book your free slot.