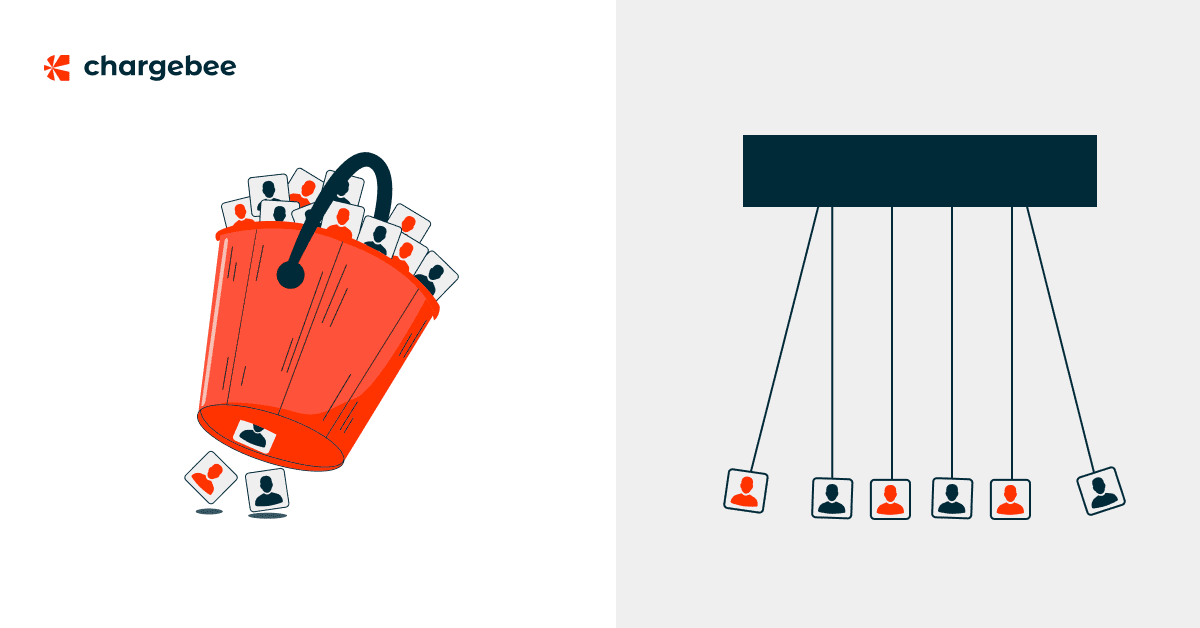

Churn and retention rates might look like two sides of the same coin, but they measure two different aspects of your customer journeys and apply them to other teams.

The churn rate captures the drawdowns of customers that have exited your platform in a particular period (monthly, quarterly, annually) and better indicates the issues nesting within your business. A higher churn rate means more disgruntled customers and, therefore, consistent customer loss for your business over time.

There can be reasons aplenty, including – customer experience, quality of the product, and lack of responsiveness from your customer support team.

On the other hand, the retention rate calculates the number of customers who continued over time and have extended their LTV (lifetime value). Suppose your business has a high retention rate. In that case, it indicates that most of your existing customers remain happy, which means you are more likely to recover CAC (customer acquisition cost) on every inbound customer, making your acquisition strategies more effective.

Both indicators are equally important when gauging how well you are servicing new and existing customers. So, let’s explore what they are, how they impact your business, and the difference between them in further detail-

What is the churn rate, and why is it important?

The churn rate is the percentage of customers who continue using the company’s product or service. This can happen for various reasons, such as a lack of satisfaction with the product or service, unfavorable pricing, poor customer service, and more.

It allows businesses to predict/determine revenue loss over time; hence corrective action to offset it. For example – if we started with 1000 customers, lost 100, and acquired 80 net new customers last quarter, we have effectively lost 20 customers over the previous quarter.

This means that to register the same revenue as last quarter, we need 980 paying customers; this can minimize churn or increase acquisition rates from industry to industry. For example, a high churn rate within a one-time purchase eCommerce business would suggest the business should improve its initial customer experience, loyalty programs, and personalized offers. A high churn rate in SaaS might warrant you to repackage subscription plans, build a flywheel of affiliate products to tackle growing customer needs, or even power your customer success team to handle your customers better.

Understanding the nature of the churn rate in their respective businesses gives companies the edge to implement target strategies to reduce their churn rate.

While churn rate is emblematic of negative customer experiences, it is also a valuable learning resource for companies to identify and fix problems and readjust their value propositions.

Two different types of churn rate(s):

Voluntary churn is the number of people intentionally unsubscribed, and Involuntary churn refers to people forced to unsubscribe. If the churn is voluntary, that suggests several new customers were unhappy with the product or no longer needed it.

Involuntary churn results from a technical issue (such as payment authorization failure) that does not directly reflect a problem with the product or service.

Nonetheless, churn rates can act as an embedded “silent alarm system” that lets your business know something is not working.

While churn is a part of business, there are ways to respond to a high churn rate that you can use to decrease the rate percentage.

- Identify the reasons for customer churn

- Improve customer service

- Offer incentives to retain customers

- Improve product service quality

- Communicate with customers

Calculating churn rate

You find the company’s churn rate by dividing the number of customer cancellations by the initial total number of customers during a period of time.

For example, if a company starts with 1,000 customers and loses 100 of them over a month, the churn rate for that month would be 10%.

What is the retention rate, and why is it important?

The customer retention rate is a metric that measures the percentage of customers who continue to use a company’s product or service over a given period.

It reflects how well your business maintains customer loyalty and satisfaction, making it easier to predict the percentage of customers who may choose to keep using the product, recommend a friend, make repeat purchases, and post positive reviews.

High retention rates can show that your business should:

- Invest less in customer acquisition cost

- Offer incentives to loyal customers

- Personalize their customer experience

- Sharpen their product service development

- Continue building brand loyalty

Calculating retention rate

On the other hand, you can calculate the retention rate by dividing the number of customers retained during a period by the total number of customers at the beginning of that period.

For example, if a company starts with 1,000 customers and retains 900 of them over a month, the retention rate for that month would be 90%.

What is the relationship between churn and retention rate?

Although each is the opposite of the other, churn and retention rates are always read in tandem to understand the complete picture and measure/determine customer loyalty. The metric data from both the churn and retention rates provide a comprehensive picture of how users interact with your website or service.

Since a high churn rate means many customers are leaving a company, it could represent the company’s need for new marketing strategies, customer satisfaction methods, or assistance onboarding. If the churn rate is low and the retention rate is high, that date can lead to another course of action.

Furthermore, customer churn and retention significantly impact a company’s financial health. By improving customer satisfaction and loyalty, businesses can reduce the annual churn rate and increase their customers’ lifetime value.

Simply put, retaining customers directly impacts improving the monthly recurring revenue (MRR). Chargebee shows you how to reduce customer churn so your company can keep the money you brought in.

Catalysis through analysis: Making churn and retention rate monitoring easier

Monitoring churn and retention rates for a subscription business sounds easier than it is. For example – mid-cycle plan changes, multi-tenure contracts, and renewal complications might make tracking the actual impacts of customer loyalty hard to gauge.

To overcome the challenge, businesses need subscription management and retention tools to help them with the tactical and strategic aspects of growing their revenue and also help analyze the outcomes of the changes.

Integrated retention dashboards from Chargebee Retention help businesses not only identify the outcomes of retention experiments on churn rates, retention rates, deflects, and save percentages but also give them a crystal-clear view of cancel reasons, performing offers, and the impact of retained customers on revenue.

This is the secret sauce to finding growth with churn and retention rates. By not treating them as isolated figures but instead using them as roadsigns to dig deeper into your product/service/customer-level problems, you can discover more opportunities to iterate and improve.

Constantly battling a race to profitability with a leaking revenue bucket? Fret not. Let Chargebee Retention help.